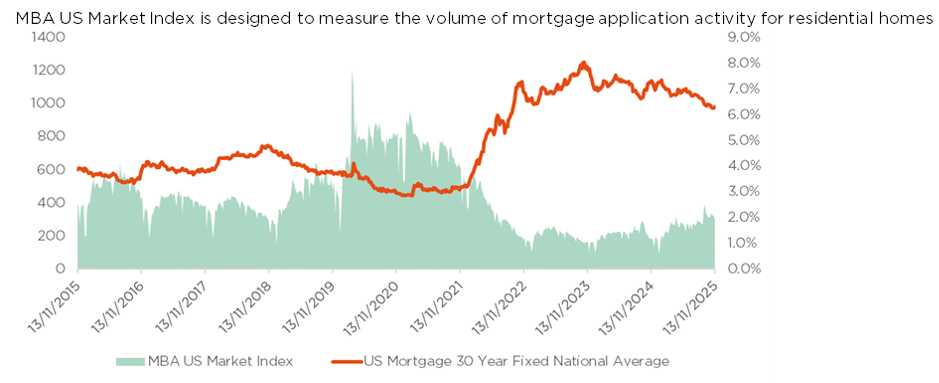

- The pending pivot in US rates is likely to unleash a wave of mortgage debt restructuring

- Providers of analytical assessments will enjoy a fast-rising volume of business…

- … without having to bear any counterparty credit risk

The financial community is witnessing a decisive pivot. The anticipated decline in US benchmark interest rates represents more than just a cost adjustment; it looks set to serve as a powerful catalyst for transaction volumes across consumer debt markets, particularly in the residential mortgage sector. Indeed, a vast pool of borrowers will have a clear financial motivation to restructure their existing debt – a process which, despite being a mere contract modification, requires the same rigorous and instantaneous risk assessment as new mortgage originations.

In the US, costs associated with processing a mortgage, excluding the down payment, are referred to as “closing costs” (sometimes also “settlement costs”). They involve a series of fees and expenses that borrowers must pay in order to finalise a home purchase, and that generally range between 2% and 5% of the total loan amount. Closing costs can be split into six categories.

First is the loan origination fee, a commission charged by the lender for processing the mortgage (typically 0-1.5% of the loan amount). Second is the application fee, a small charge for processing the mortgage application. Third is the underwriting fee, which covers the costs of reviewing the application and granting final approval of the mortgage. Fourth is the credit report fee, aka the cost to obtain a tri-merge report from credit agencies (ca. USD 100 per borrower). Fifth is the appraisal fee, a professional appraisal of the property being necessary to determine its market value and ensure alignment with the purchase price and loan amount. Lastly is the title search fee, associated with the review of the property’s history to confirm there are no liens, mortgages, or other issues that would prevent transfer of ownership.

Within this process, the real profit opportunity lies with the providers of analytical standards, whose revenues exhibit exponential correlation with market activity. Their business model is inherently robust and highly scalable. These entities do not assume the counterparty risk of a default; rather, they monetise the volume of decisions. Revenues are generated on a purely transactional basis: every time a financial institution must underwrite a risk, it procures the necessary analytical output. During a cyclical refinancing boom, the frequency of such inquiries can double or triple rapidly, translating directly into outsized revenue growth for the assessment providers.

Last but not least, the position of these analytical pillars is secured by significant barriers to entry. The confidence, long-standing reliance and regulatory acceptance of their assessment tools, cemented over decades by major financial institutions and government-sponsored entities, constitute a formidable competitive advantage.

As the market prepares for a new cycle of debt restructuring and financial optimisation, discerning investors should focus on the companies supplying the essential tools for this activity. The ability to capitalise on an exponential increase in decision volume – enabled by standardised, indispensable tools deployed at every stage of the credit cycle – arguably represents the most efficient and defensible way to benefit from the shift toward lower interest rates.

Written by Armando Beninati, Portfolio Manager

Markets can continue to climb the wall of worry

- Macroeconomic fog, AI doubts & market bumps

- Greater market volatility is not necessarily a bad thing

- Being bearish on nominal growth is hard when economic policies are expansionary

The end of the US government shutdown triggered a flood of delayed data releases, but with little real insight: the figures are outdated, incomplete, and the publication calendar has been thrown off. As a result, visibility is unlikely to improve before mid-December, after the Fed’s December 10 meeting. Meanwhile, unexpectedly hawkish comments from Fed officials have shifted the odds of a December rate cut from “almost certain” to essentially a coin toss.

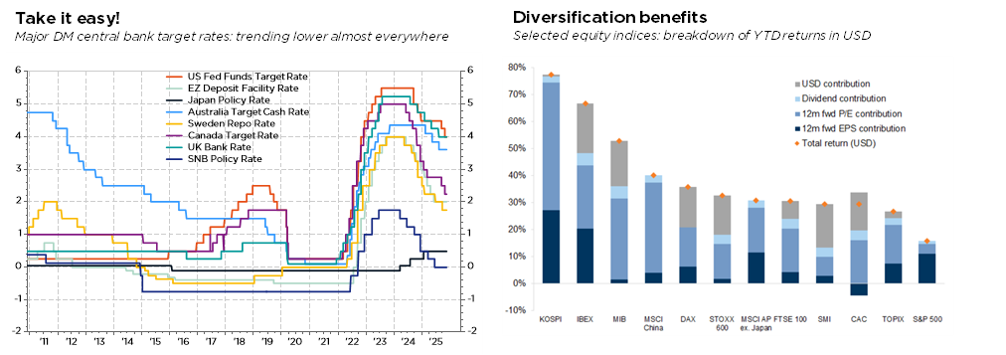

Despite the uncertainties surrounding the Fed’s upcoming decision, US monetary policy is still clearly in easing mode, supported by a gradual deterioration of the labour market, while inflation has so far remained broadly in line with expectations (with no evidence of second-round tariff effects). Moreover, US growth continues to benefit from substantial fiscal support. Note that this combination of accommodative monetary policy and increased government spending also applies to China, Germany or Japan. We also see the AI boom as providing additional tailwinds through capex and energy-infrastructure investment, while US banking deregulation should inject additional liquidity into both the economy and financial markets. In this context, we still assign a low probability to a “natural” recession scenario for the foreseeable future. In our view, only a major financial market crash – driven by factors such as a sharp spike in rates or a credit market dislocation – could truly tip the economy into contraction.

In the meantime, earnings have proved solid (+12% YoY for the S&P 500, +9% for the median company), yet market performance has been flat since mid-October, with increased volatility. Questions regarding AI monetisation, concerns about US private credit and renewed IT bubble talk have generated healthy volatility. We still see no bubble at this stage: the extraordinary performance of mega-cap tech stocks is not irrational, but underpinned by exceptional earnings growth, and valuations remain far from exuberant. In other words, fundamentals are broadly supportive. There are undoubtedly some excesses and pockets of overvaluation, but today’s doubts, debates and concerns are actually helping keep the market in check and should thus be viewed as part of a healthy consolidation. In fact, investor sentiment is anything but euphoric. Importantly also, this year’s strong returns are not confined to the US or the tech sector, especially when measured in USD terms.

As a result, we remain broadly neutral and in wait-and-see mode, staying constructively invested but cautiously diversified. Our balanced stance and well-diversified allocation reflect a prudent approach given the wide range of potential tail-risk outcomes. This positioning should help portfolios deliver better risk-adjusted returns by smoothing inevitable market bumps and sector rotations, while maintaining enough flexibility to adapt as conditions evolve. For example, high-quality, long-duration bonds and defensive stocks should offer protection in the event of a tech downturn, whereas equities – especially value segments – and commodities would be better positioned in a more acute or persistent inflationary environment.

Diversification therefore remains a cornerstone of our current allocation: within equities (across regions, sectors, styles and market caps), within fixed income (across geographies, maturities, sectors and credit risks), and through gold exposure, which we continue to prefer to longer duration in the absence of a severe recession. Finally, we may continue to implement tactical hedges on an opportunistic basis.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Morgan Stanley, Mortgage Bankers Association.