- The SEC’s authorisation of ETFs has, on paper, legitimised bitcoin in the eyes of some investors

- Regulation is also evolving, making it easier for institutions to get involved in digital assets

- Blockchain technology is thus gaining ground in the world of finance

When our Investment Insights last covered Bitcoin, exactly one year ago, it was trading at around USD 63,000 after a bout of volatility triggered by the halving event. Since then, it has entered a period of relative stabilization, leading some market participants to revisit its potential role in global finance. While certain developments suggest growing interest from institutions and policymakers, Bitcoin remains a volatile and polarizing asset, with unresolved questions about its long-term place in financial markets.

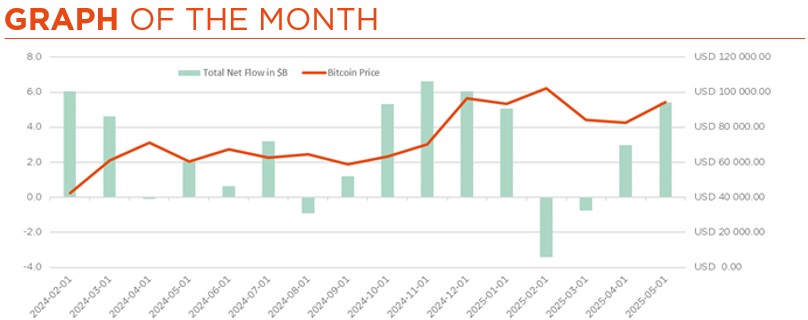

The SEC’s approval of spot Bitcoin ETFs in January 2024 was definitely a turning point. It marked Bitcoin’s entry into regulated financial products, making it easier for institutional investors to get involved. However, the availability of ETFs does not necessarily signal a fundamental shift in Bitcoin’s risk profile, which remains vulnerable to price volatility, liquidity limitations, and concerns about market manipulation.

Bitcoin is increasingly being framed by advocates as a hedge against monetary instability and inflation—a form of “digital gold”. Long-term holding trends and corporate treasury allocations are often cited to support this view. Critics, however, argue that Bitcoin’s correlation with risk assets during times of market stress undermines this narrative.

In March 2025, President Donald Trump signed an executive order establishing a modest national strategic Bitcoin reserve. The order outlined three objectives: providing protection against inflation, strengthening digital sovereignty, and responding to competing blockchain initiatives from other global powers. Nevertheless, this strategic reserve, while symbolically significant, marking a major policy pivot, is small in scale relative to traditional reserves held by central banks or to the Federal Reserve’s balance sheet, raising questions about its practical impact. This has sparked debate about the evolving role of digital assets in national economic policy.

On the regulatory front, significant developments are taking place globally. In the US, the SEC has launched a public consultation on digital asset frameworks and a bipartisan stablecoin bill is progressing in Congress. In the European Union, MiCA regulation is being phased in, creating a harmonised legal environment for crypto assets across member states. And in Asia, Hong Kong is positioning itself as a regulated crypto hub, even though China continues to enforce strict controls. This evolving regulatory clarity is enabling institutions to engage with digital assets more responsibly and at greater scale.

Traditional financial giants are thus increasingly exploring blockchain technology within their line of business. HSBC for instance launched “Orion,” a tokenised bond platform that could support digital sterling issuance. JPMorgan, meanwhile, has conducted its first on-chain settlement of tokenised US Treasuries using Chainlink. Visa, Mastercard, and Stripe now support stablecoin transactions, helping integrate crypto into everyday payments. These developments highlight a growing interest in exploring blockchain applications within traditional finance.

And while Bitcoin remains the anchor of the crypto world, other protocols like Ethereum and Solana provide the infrastructure for decentralised applications, tokenised finance and smart contracts. Stablecoins and tokenisation in fact represent the fastest-growing institutional use cases, with players such as BlackRock and UBS investing heavily.

In summary, the role of Bitcoin and other digital assets is evolving, driven by institutional activity. Technological innovation and evolving regulation suggest these trends warrant close monitoring as the industry matures. However, the long-term integration of these assets into financial systems remains uncertain and continues to face heightened regulatory scrutiny.

Written by Rayan Benmabrouk (Trader) & Christophe Reuter (Junior Portfolio Manager)

Moving back towards the soft-landing narrative

- Relief rally on the back of Trump’s decision to pause tariffs and a strong earnings season

- Beware of a US rate backup above a certain level… especially when due to bad reasons

- Diversification is a key requirement to navigate through these unchartered waters

Since President Trump softened his stance on tariffs, risk-on markets have experienced a sharp rally, while global long rates backed up to pre-“Liberation Day” levels. This V-shaped recovery has also been supported by resilient activity data (mitigating imminent recession concerns), better-than-expected Q1 earnings (with still impressive reports from the technology sector overall) and the poor sentiment/light positioning that prevailed after the downturn.

The greenback is alone is not having fully recovered from the punch it received, still weighed down by uncertainties surrounding the US growth, inflation, policy and public debt trajectories, as well as, more generally, the role of the US in a more multipolar world.So far, so good then in terms of overall market performance, although there is little room for complacency as no real significant concrete trade deals have yet been concluded, especially with China or Europe. The clock thus continues to tick, with the three-month delay expiring in July for some countries and August for China.

Consistent with recent market developments, we upped the odds of our base case macro scenario somewhat (steady-positive growth, sticky but acceptable inflation and gradual rate normalisation in a more divided world), at the expense of the downside scenario. We nonetheless still consider a US recession, triggered by hazardous Trump policies, as the major risk for global markets. Nor can we rule out temporary inflation scares, public deficit concerns leading to a bond market dislocation, or, on a more favourable note for the rest of the world, a global growth reacceleration driven by European and Chinese fiscal impulse towards the end of the year. We also continue to believe that the US economy itself will be the main victim of Trump tariffs. Prospects for the rest of the world would also darken, but to a lesser degree, while the inflationary impact would be relatively muted. Finally, it remains possible that the Trump administration backtracks further, again kicking certain tariffs down the road or “stealing” some good deals in exchange for lower tariffs – as has apparently been the case in the Middle East.

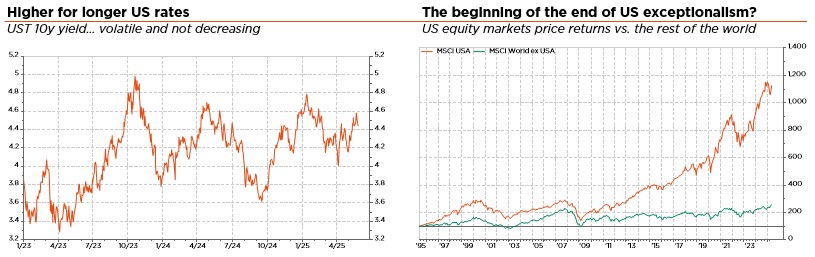

At the portfolio level, we are adopting a more cautious stance on USD-denominated bonds, and especially on US long Treasuries – downgraded from slight overweight to slight underweight. The very recent rise in long yields is likely the number one threat for global markets, because of the debt sustainability concerns it reflects. Anyhow, this move is in line with our latest allocation changes (downgrading both the USD and US equities to slight underweight), which could be summed up as diversifying out of the US. With US assets remaining more expensive than their global peers, and given the more challenging times they may face due to Trump policies, they are clearly at risk of underperformance and outflows (capital repatriation or redeployment by international investors). Particularly following several years of US exceptionalism that worked as a magnet for the European and Asian savings glut.

Speaking about diversification, we continue to view it as a key portfolio requirement in order to navigate through these unchartered and rather murky waters. Diversification between asset classes, with gold (still preferred to government bond duration so long as a severe recession is not in the cards) or CHF exposure as broad safe havens in various risk-off scenarios, but, more importantly, also within equities (regions, sectors, company sizes or styles) and bonds (sovereign, credit, curve picking or positioning among others). As a result, we are maintaining an overall neutral stance on both equities and fixed income. Such a balanced positioning and well-diversified allocation reflects our cautiousness on assessing the wide range of potential outcomes. Overall, it should allow portfolios to benefit from expected positive, but contained, returns in most asset classes over the next few months, while mitigating the bumps and maintaining sufficient flexibility to adapt to evolving conditions during the journey. That said, from time to time, we may opportunistically continue to add “cheap” tactical protections to retain the projected upside potential albeit with a lower risk profile.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, CoinMarketCap.com