- Software, consulting and IT services companies stand as natural facilitators of AI…

- … but are also seeing their current business models undergo major disruption

- Most exposed are seat-based licensing and automatable solutions, making stock selection key

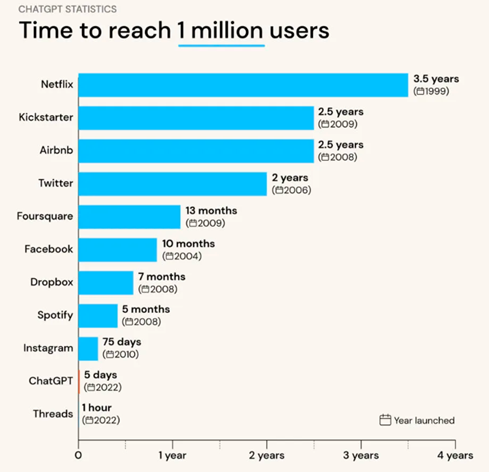

Artificial intelligence (AI) is driving a rapid and profound transformation of business models in the software, consulting and IT services sector. The number of corporate clients recently put forward by OpenAI and Anthropic, one million and 300,000 respectively, reflects an adoption rate far higher than anticipated, fuelling stock market nervousness and weighing on valuation multiples.

The AI ecosystem is advancing in waves. First came the massive investments in physical infrastructure (semiconductors, servers, data centres), then in energy infrastructure – essential to power the entire complex. Hyperscalers form the third link, orchestrating, deploying and monetising the new computing power. Logically, software, consulting and IT services should be the fourth beneficiary, as natural facilitators of AI.

The reality is, however, more nuanced. Rather than just benefiting from the AI adoption cycle, these companies also figure among those most disrupted. The massive deployment of Large Language Models (LLMs) and agentic AI is automating many of the tasks they historically monetised, pressuring their current business models and accelerating the transition to usage-based, outcome-based or data/service-oriented models.

More specifically, seat-based licensing is being undermined, as AI enables corporate clients to reduce their staffing requirements. This is what stock markets fear most for “generalist” software publishers in the areas of productivity, customer relationship management (CRM), support, human resources, etc. That is any software whose value is based on standardised and massively repeated workflows. As regards software development, LLMs make the process simpler, faster and less expensive – thereby lowering barriers to entry and inducing risks of intensified competition and gradual commoditisation. Lastly, AI models are stepping between users and applications. A growing share of activity flows through conversational interfaces or is orchestrated by agents, rather than traditional software. The risk for software publishers is thus that they become features plugged-in to models, losing visibility and control over the end customer.

In the consulting world, companies traditionally operate on a pyramidal model: a broad base of junior consultants perform the majority of low-complexity, labour-intensive tasks, under the supervision of a smaller group of senior consultants and partners at the top. This business model will need rethinking, both in terms of structure and pricing, to focus more on human expertise and AI-facilitator roles.

Readers will have understood that identifying future winners and losers is highly uncertain. Their respective fates will depend on a complex interaction of dynamic and evolving factors, the full impact of which will probably only be measurable beyond 2026. For some well-established players, equity markets may in fact already be pricing in the worst-case scenario. What is certain is that we are currently witnessing a form of natural selection, accelerated by AI. Business models based on user numbers and automatable solutions appear to be the most exposed. Conversely, integrated platforms, proprietary data, regulated workflows and high platform switching costs (particularly in cases where the software/services have been developed specifically for a client) constitute an advantage. As we enter the new year, selectivity will thus be crucial when it comes to investing…

Sandro Occhilupo, Head of Discretionary Portfolio Management

So far, so good

- All quiet on the macro front

- Market trends have remained our friends, despite questions regarding the AI boom

- Conditions still smell of Goldilocks but mind the tail risks – on both sides

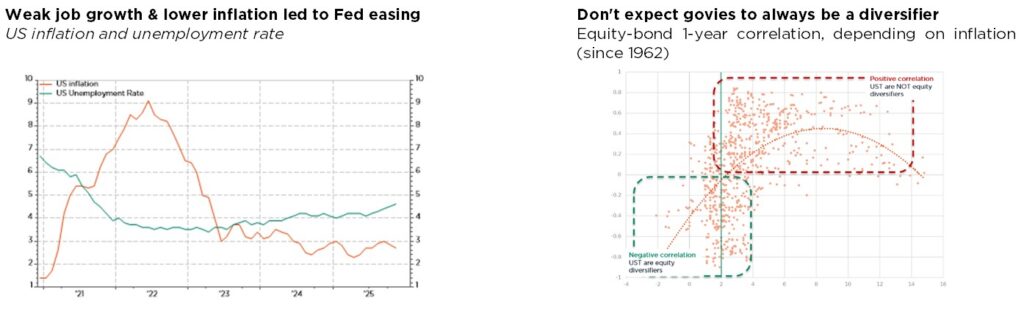

The delayed US economic data releases following the end of the government shutdown did not really move the needle. In fact, they possibly generated more noise than signal, as they were outdated and suffering from technical distortions. Against this backdrop, the Fed cut rates by 25 bp for a third time in 2025 to 3.5%-3.75% due to labour market weakness, while still acknowledging “somewhat elevated inflation pressures”. As a result, the bar is now higher for further cuts over the next few months assuming no major change in the macroeconomic outlook. In the meantime, green shoots are still popping up in the euro area thanks to the German expansionary fiscal plan, whereas current strength in Chinese exports and the industrial sector is offsetting persistent weakness in real estate and domestic demand. As a result, markets continue to benefit from a supportive backdrop: resilient global growth, ongoing disinflation and gradual monetary easing.

The market trends of the past few weeks have thus been quite similar to those experienced year-to-date. Global equity indices moved higher with broad-based participation, supported this time by a catch-up in US small-cap stocks. Financials, IT and cyclical sectors outperformed, while utilities, real estate, healthcare and energy lagged. The debate about AI valuation, monetisation, related financing and eventual overinvestment/indebtedness issues, adoption dynamics and potential winners/losers also continued to shape the market narrative, particularly in the US. In fixed income, sovereign bonds edged lower as long-term rates backed up and yield curves steepened, though credit once again proved more resilient. On the forex market, the US dollar softened further, with the Japanese yen continuing to depreciate too. Finally, gold rebounded above USD 4,400/oz, while energy prices fell to new annual lows.

What can we expect for the coming year? Overall, our macro outlook remains favorable for risky assets. We expect sturdy economic growth, as it may even strengthen slightly across all major regions (tariffs tailwinds fade, US tax cuts and German fiscal boost kick-in, financial conditions remain easy). Inflation is expected to decline, returning back to central bank targets in the 2nd part of 2026, which will enable them to complete their monetary policy normalization. As for fiscal policy, it looks set to remain resolutely supportive. Finally, we also believe the AI boom will continue to provide additional tailwinds through capex and energy-infrastructure investment. In this context, we still assign a low probability to a “natural” recession scenario.

Among the downside risks that are bound to arise unexpectedly along the way are those related to interest rate pressures (persistent inflation or concerns about the sustainability of fiscal trajectories) or, conversely, a sharp slowdown in economic activity and the labor market in particular, as US Fed’s Chairman Jerome Powell also pointed out during the last monetary policy meeting. In this very unusual context, portfolio resilience and the ability of managers to adapt will certainly be more important than usual in order to navigate as smoothly as possible in 2026 murky waters.

As a result, we have made only one change to our asset allocation by upgrading our stance on the US dollar to Slight Under-Weight as we believe it may now be supported by sturdy US growth, the near end of Fed’s easing and a “credible” new Fed’s Chairman to be announced soon. For the rest, we are maintaining an overall neutral stance and a well-balanced equities positioning (across regions, sectors and factors) on the back of a supportive Goldilocks macro backdrop, overall stretched valuations and still elevated geopolitical uncertainties.

Fabrizio Quirighetti, CIO & Head of Multi-Asset

External sources include: LSEG Datastream, Bloomberg, FactSet, Statista.