For once, the title of my editorial has nothing to do with Cagliari’s incredible victory over Roma last week or the supernatural goal scored against Atlanta yesterday… but rather with what is happening on the US repo market and the concerns this seems to be raising within the Fed. As widely expected, the Fed cut its target rate by 25bps for a 3rd consecutive time, to 3.5%-3.75%, last Wednesday evening. Apart some dissensions among Fed members, which may be considered as healthy given the challenging time with “inflation still somewhat elevated” and a weakening labor market in an unusual low-fire low-hire context, there weren’t really any surprises. Jay Powell delivered a master class neutral rate cut (or at least not more “hawkish” than expected), playing it out well and juggling perfectly with both hawkish and dovish elements.

However, there was something that sounded weird at the end of his press conference when he spoke about the implementation of monetary policy and said that “the Committee judged that reserve balances have declined to ample levels”, and thus announced just right after “the Committee decided to initiate purchases of shorter-term Treasury securities (mainly T-Bills) for the sole purpose of maintaining an ample supply of reserves over time”. We already went through this episode back in the Autumn 2019, when Fed reversed the QT in force between October 2017 and August 2019 by injecting $60bn/month into market through T-Bills purchases. Furthermore, why “ample” cannot be large enough? Like the agents Fox Mulder and Dana Scully, I investigated further. And what I found is both interesting and potentially frightening…

In trying to understand these plumbing issues and the reason(s) why the Fed will have to buy T-Bills again, I reread the latest Grant Interest Rate Observer (published on December 5th, so a week before last Wednesday’s Fed meeting), which discusses the period from September to October 2019, when the repo rate skyrocketed/diverged from the Fed rate. In hindsight, the analogies/parallels are troubling…

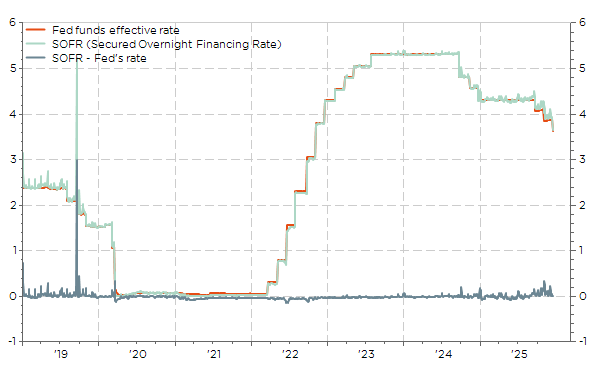

First, there are currently signs of liquidity stress in the repo market as the SOFR rate has been recently above the Fed’s fund target, as well as effective, rate as it was also the case back in 2019 and forced the Fed to intervene by injected liquidity into the market.

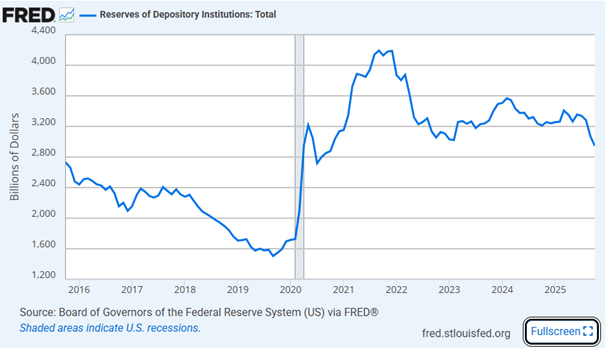

Then, looking at the reserves of depository institutions, we may also see that these reserves have declined recently from about $3.3tn this summer to less than $3tn in October. Same downward trend happened in 2018-2019… The difference is that, at that time, these reserves were about half current levels while there were negligible pre-GFC crisis, read close to zero (or around $50bn to be more precise, i.e. 60x lower than today !?).

Reserves of Depositary Institutions: Ample, abundant or otherwise?

Source: https://fred.stlouisfed.org/series/TOTRESNS

So, why these reserves must now be so large, or ample enough, to ensure the effective transmission of monetary policy? Jay Powell gave us some insights during the press conference (“such increases in our securities holdings ensure that the federal funds rate remains within its target range, and are necessary because the growth of the economy leads to rising demand over time for our liabilities, including currency and reserves”) and the Q&A session, following a question of Claire Jones from the FT on this topic (page 13 of the transcript here), but the least we can say is that he wasn’t really crystal-clear: the economy is growing, as well as the banking system, thus these reserves, as well as the Fed’s “balance sheet needs to grow” to keep it constant in proportion to that. On top of that there will be the “tax day” on April 15th (get some front-loading reserves high enough to go through this tax period). But he didn’t speak directly about increasing fast government debt or he didn’t explain why all these reasons, which seem to make sense, weren’t valid before 2008 -when these reserves were kept at the same levels for many years…

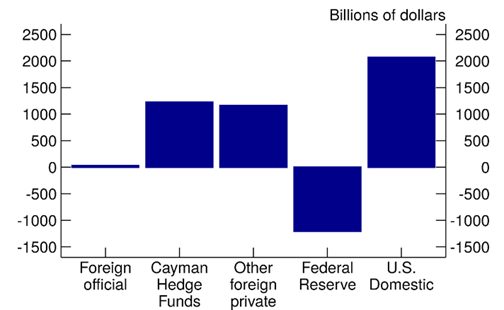

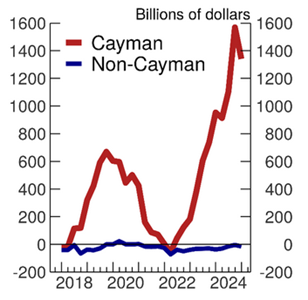

By continuing my week-end readings, I discovered that he did not tell us all the truth… The latest “Greed & Fear” newsletter from Christopher Wood (Jefferies) pointed indeed to a report from the Federal Reserve Board staff on the Treasury bond “basis trade”, dated October 15th (“The Cross-Border Trail of the Treasury Basis Trade”). The main conclusion of this document is that Hedge Funds have increasingly become the marginal buyers of Treasury bills and bonds at a time when the Fed was reducing the size of its balance sheet (by letting them come to maturity without reinvesting the proceeds). The report estimates that Cayman Islands-domiciled funds purchased a net amount of $1.2 trillion over this period, absorbing 37% of net Treasury bill and bond issuance, or “almost as much as all other foreign investors combined.”

Absorption of Net Issuance of UST Notes and Bonds (Jan 2022 – Dec 2024)

The report also concludes that, after adjusting for these holdings of Treasury securities by Cayman Islands entities reported in the Treasury International Capital (TIC) data, Cayman Islands funds are now the largest “foreign” holder of US Treasuries, ahead of China, Japan, and the UK, which were listed as the three largest holders in TIC data as of end of 2024!? The report estimates that investors domiciled in the Cayman Islands held approximately $1.9 trillion in Treasury securities at the end of 2024. By comparison, Japan held $1.06 trillion, the United Kingdom $723 billion, and China $759 billion on the same date.

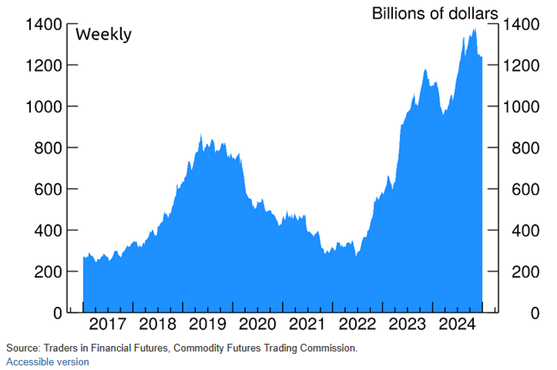

This observation is therefore key given the Treasury’s extreme dependence on short-term financing and the fact that many Cayman Islands-based funds engage in basis trading, which requires significant leverage (shorting UST futures and going long on the Treasury bonds in order to arbitrage price differences). In this regard, the increase in gross short positions on Treasuries held by leveraged funds during this period is illustrated in the chart below, taken from the report. So, HF’s leveraged bets are likely the main culprits behind the lack of liquidity in the repo market.

Leveraged Funds Gross Short Positions in Treasury Futures

Hedge Fund Net Repurchase Agreements Positions, by Country of Domicile

And that’s where I think there’s a connection between all of this: Look at what happened between 2018 and 2019… these positions increased, putting pressure on the repo rate!!! So, it’s not only about growing economy and banking system, it’s about a growingly fast leverage in a context of an overall more fragile US giant debt market -because it is also growing fast in an unhealthy or uncontrolled manner -. In other words, Fed is trying to tame a gigantic monster with feet of clay!

Even more striking and weird are the similarities between what is happening now and back in October 2019, as well as the (same) comparisons between what the officials were/are saying to each other and what they were/are telling the public. Courtesy of the FOMC Insight Engine, you can now send requests and dig into Fed’s archive dating back to 1936… So back in 2019, the Fed held a special conference call on October 4th about how to “sell” the end of QT, renewed purchases of T-Bills… Here some exchanges between Fed members at that time:

- “I do worry that a message of $60 billion a month will be misinterpreted as a return to QE, as it does appear to be comparably scaled. Our communication needs to emphasize that this is about liabilities, not about assets. It’s a reserves-maintenance program, not a balance-sheet expansion. In line with the options presented in the communication, I would just communicate that we will maintain reserves at a minimum level, perhaps consistent with early September, and to do that we will conduct a limited-time technical adjustment as necessary.”

….

- We’ve got to make sure we’ve got a large margin for error, and that’s why I asked about other assessments of what those numbers might be…. So, we need a larger margin for error. I don’t know what that number should be. I’d err on the side of making sure we had plenty. The cost of another failure could be really immense, and I’m not sure how many mulligans we have in our pocket if we don’t get this right next time.

….

- So, I agree with the objectives as stated of returning to a sustainable level of ample reserves, and I think the other objective I would have in assessing these options is erring on the side of preempting volatility in the future versus reacting to it.

Do you copy? We are six years later with double reserves ($1.5tn have been added since 2019) and the Fed hasn’t yet really mastered this plumbing issue! Furthermore, it isn’t totally transparent, trying to playing it down or hiding something it doesn’t fully understand/control itself. Somewhat frightening, isn’t it? Between the lines, the Fed’s imperative may be to suppress the (excess) volatility of interest rates, to provide liquidity (in whatever volumes are necessary) to promote “smooth market functioning” in the cause of financing the public debt… while HF’s are jeopardizing this gigantic market with massive leverage bet!

A recipe for a potential financial disaster or perhaps even worse… Preemptively, in case of excessive, unexpected volatility, or worse still, a dislocation in US Treasuries market, the Fed may be forced to step in again and enforce more formal financial repression policies through Yield Curve Control (à la BoJ) to avoid a real disaster. It seems to me that Fed genuinely fears this scenario, even more than the usual risks on his dual mandate. The bottom-line pragmatic investment conclusions are straightforward: stay away or underweight US long term treasuries (or at least be cautious), stay long gold and short USD.

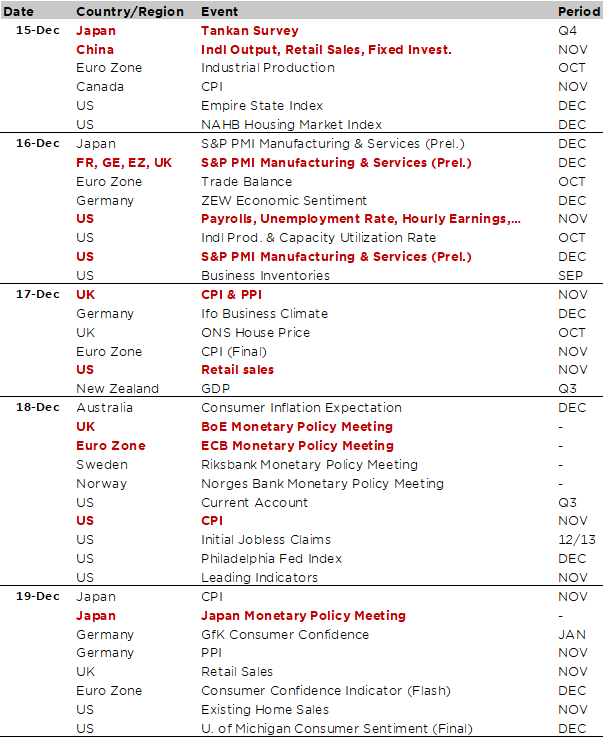

Economic Calendar

It ain’t over till it’s over… Just one week to go before some welcomed days off while enjoying and celebrating the end of the year festivities, but no time to rest yet as there will be several important economic data releases this week, as well as major central bank meetings, including the ECB, the BoE and the BoJ.

Starting with economic data, the focus will be on the delayed US jobs and inflation prints, with both releases subject to data quality/technical report issues (also underlined by Fed Chairman Powell last Wednesday during the Fed’s press conference). The US jobs report for November (and an incomplete release for October) will be published on Tuesday. The consensus expects payrolls dropped by -60k in October and then rose +50k in November, with the November unemployment rate coming in at 4.5% and average wages growth up +0.3% MoM (3.6% YoY). The November CPI print will follow on Thursday: monthly changes will not be produced due to the government shutdown… so most of the focus will be on year-over-year growth rates, with consensus foreseeing both the headline and core rates roughly stable around 3%.

Other notable economic data release will be the global flash PMI prints for December on Tuesday, the October US retail sales (Tuesday), or the consumer prices inflation in Canada (Monday, foreseen ticking up to 2.3%), in the UK (Thursday, expected to come down a notch just below 3.5%) and in Japan (Friday, still running around 3%). Finally, we got this morning the November economic activity indicators in China and the BoJ’s quarterly Tankan survey of business for December. Chinese data point (again) to a broad-based weakness in domestic activity with fixed investment, industrial output and retail sales all coming below expectations and declining/decelerating from prior month readings. The only bright spot remains export. In Japan, the Tankan survey was overall better than expected, especially business sentiment among from small manufacturing companies.

Central banks will be another major theme for investors this week, with the decisions from the ECB (expected to stay put at 2%), the BoE (-25bps rate cut to 3.75% widely expected), Riksbank (stable at 1.75%) and Norges Bank (on hold at 4%) in Europe are all due Thursday, followed by the Bank of Japan on Friday (+25bps rate hike to 0.75% expected).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.