- A proper financial crisis has likely been averted but has left the economy with some scars

- Small businesses are the real lifeblood of the labor market

- There isn’t much optimism currently among small businesses

- The banking stress has accelerated the tightening in credit standards and the slowdown in loan growth for small businesses. In turn, they are now planning to slow down hiring and capex.

- More credit tightening means less monetary policy tightening: I now expect the Fed to pause after a last 25bps hike to 5%-5.25% next month.

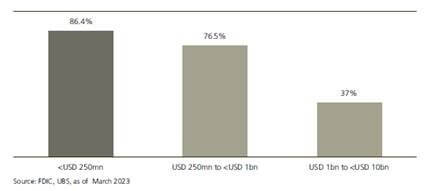

There are several signs that the most acute part of the US banking turmoil may be behind us: markets have rebounded, the VIX is back to its lowest level since January 2022 (17.1), the amount of bank lending from the Fed emergency lending facilities has declined, US bank deposits are increasing again after weeks of outflows and both banks debt & equities have recovered to some extent the losses experienced one month ago… As a result, the Bloomberg’s index of US financial conditions has now almost completely erased the tightening seen last month and investors are pricing now an 80% probability of a Fed’s hike at its next meeting on May 3rd. While a proper financial crisis has likely been averted (at least for the time being), this ongoing “manageable” banking stress will accelerate the tightening in credit standards and slowdown in loan growth that was already underway. That’s especially true for small and mid-size companies, which are far more reliant on (regional) banks loans, than large multi-national companies who can easily tap the global bond/equity markets to finance their business/expansion -at a cheaper costs-.

US small banks play a big role to small businesses

% banks by size that make “largely all” of their commercial & industrial (C&I) loans to small business

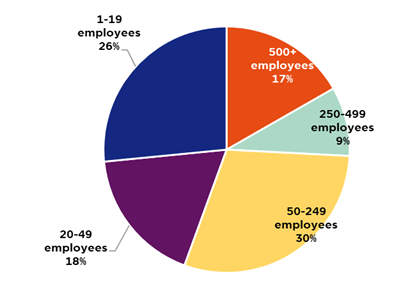

Given the importance of the small businesses to the domestic economy, the latest data from the National Federation of Independent Business (NFIB) survey of small businesses may be full of insights for both investors and policy makers. Let’s take the US labor market, companies with less than 250 people account for circa 75% of all private jobs in the US according to the latest ADP National Employment Report!? So, newspaper headlines about big companies firing or hiring thousands of people should always be taken with a pinch of salt in the prospects of inferring the overall health of the labor market… Another lesson could be to devote perhaps as much time and analysis on this NFIB index as we usually spend on US ISM indices as the former is certainly much more related to the domestic economy, while the latter are more influenced by the global economy and financial conditions.

Small businesses are the real lifeblood of the labor market

ADP National Employment Report: breakdown of 127’454’000 US private jobs by establishment size as of March 2023

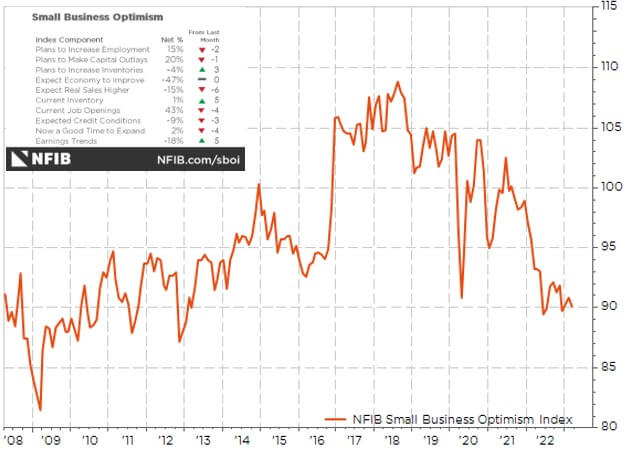

So, looking at the latest NFIB optimism index, which was released last Tuesday, the key take-away is… there isn’t much optimism currently as the index fell to 90.1, close to its lowest level of the last 10 years (worth mentioning that small businesses optimism reached its paroxysm during Trump’s presidency and it experienced the same kind of surge when Reagan became President in the early 80’s)

NFIB small business optimism index

Actually, there isn’t much optimism!

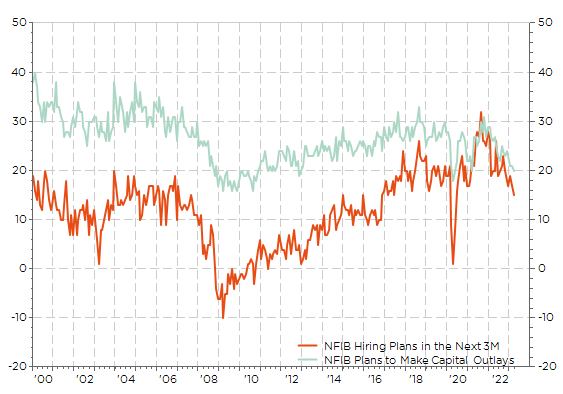

As a result, small and mid-size companies are now planning to slow down hiring and capex with just 15% expecting to create new jobs in the next 3M and 20% planning to make capital outlays in the next 3-6M, both trending down for the last 12-18 months.

NFIB hiring and capex plansSlowing down is the trend

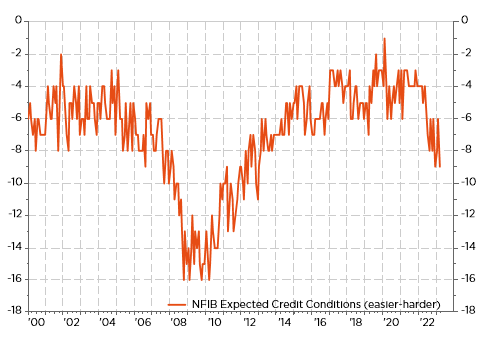

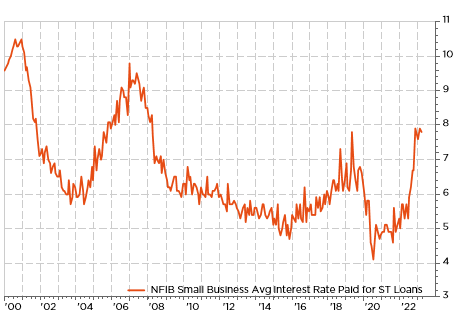

On top of a less sanguine sentiment towards their proper and overall economic growth prospects, small companies are facing tighter credit conditions as loans are more difficult to get and becoming more expensive. As said at the beginning, the ongoing stress experienced by US regional banks has accelerated the tightening in credit standards and the slowdown in loan growth for small businesses. In turn, the latter are now planning to slow down hiring and capex.

NFIB credit conditions and avg interest rate paid for short term loans by small businesses

Harder to get and getting more and more expensive

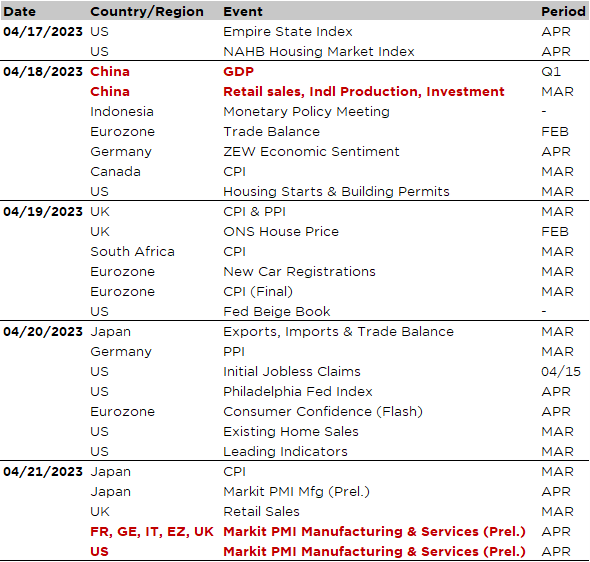

Economic calendar

While there aren’t major economic data releases this week, there will be nevertheless many interesting ones to keep an eye on, starting with the China’s Q1 GDP growth tomorrow, as well as industrial production, retail sales and fixed investment data for March. It will give the first indications about the strength of Chinese economy recovery following its reopening at the very end of last year. Investors will focus particularly on consumption and property investments. The consensus expects yoy GDP growth of circa 4%, while the recent IMF projects 5.2% for the whole 2023. Recent data were rather upbeat with exports surging, property sales & prices finally picking up, consumer confidence rebounding and loans growth/credit impulse remaining solid, but the year is still long and the path remains full of pitfalls.

The global flash PMI indices for April across the major economies are also among the key economic indicators due this week (on Friday) as investors assess the recession risks. Consensus estimates for the manufacturing’s gauge are pointing to readings staying below 50, while for services, they should remain in expansionary territory (i.e. > 50) even if some indicators may experience a slight decline. Speaking about manufacturing PMI signaling a contraction, the Empire manufacturing (today) and the Philadelphia Fed (on Thursday) readings for April will also be out this week and they will provide fresh inputs for our US ISM model. Last month, it forecasted a reading of 42.0, while the US ISM fell “only” to 46.3. Keep in mind that April US ISM indices will be the last major data points before the next Fed meeting on May 3rd… Readings surprising on the downside and thus well below 50 may restrain the last Fed’s hawkish intentions.

Staying in the US and still gauging recession risks, the Fed will release its Beige Book on Wednesday. It will likely be scrutinized to see if it contains any signs of a potential credit crunch, lingering stress or knock-on effects to the broader economy arising from the recent banking turmoil. Note that the previous Beige Book was released at the beginning of March, just before the SVB fallout. Other US economic data releases include the NAHB index for April (today), March housing starts and building permits (tomorrow) and weekly initial jobless claims (Thursday), which are finally increasing -from a very low level in historic comparison-

Elsewhere, investors will also keep an eye on UK and Japan CPI March readings that will be out on Wednesday and Friday respectively. They are both expected to show signs of moderation from still uncomfortably -not to say unacceptably- high level in the UK (10.4%) vs. easily manageable – despite still historically elevated one- in Japan (3.3%). In Europe, the German ZEW April survey will be released tomorrow, together with trade balance data for the Eurozone. Finally, we will get the German PPI for March and the Euro Area consumer confidence for April will on Thursday.

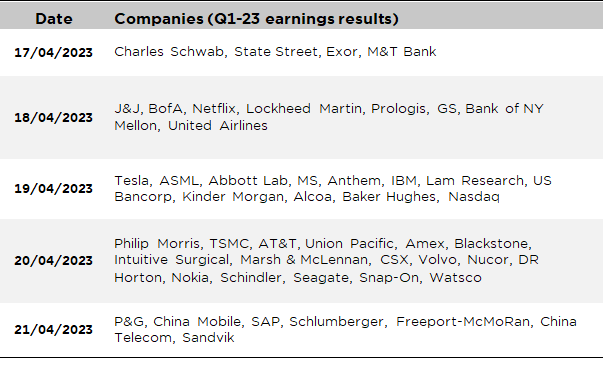

Earnings season will ramp up this week with reports from large US banks (BofA, GS and MS), along with an array of regional ones, which could be in the spotlight given the recent events related to SVB fallout, semiconductor firms (TSMC, ASML and Lam Research) and some energy & materials (Alcoa, Kinder Morgan, Schlumberger and Freeport-McMoRan). Other noticeable earnings releases include Tesla, Netflix, IBM, J&J, Lockheed Martin, AT&T, Philip Morris and P&G. Consensus expects yoy US earnings growth to decline further to -7%. With such a low bar, there shouldn’t be too many disappointments but guidance will likely be the key performance driver. A non-exhaustive list of this week major earning releases is available here below.

This marketing document is issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund’s prospectus, regulations, key Investor Information Document annual and semi-annual reports may be relied upon as fund the basis for investment decisions. You should read the Prospectus and the Key Investor Information Document (KIID) for each fund in which you want to invest. These documents are available on www.decalia.com or at FundPartner Solutions (Europe) S.A.,15 Avenue J.F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments. Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional. Past performance is neither guarantee nor a reliable indicator of future results. This marketing material is not intended to be a substitute for the fund’s full documentation or for any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.