- Sustainable aviation fuel could pave the way to much lower aviation emissions by 2050

- Derived from a variety of feedstocks, SAF can also be integrated into existing systems

- But with such potential also come major challenges…

Beneath the majestic sweep of an airplane’s wings lies a world of contradictions. For the excitement of discovering new destinations often also entails guilt about the carbon footprint that such travel leaves. What if we could ease this conflict and find a way to balance our desire to fly with that of taking care of the environment? The answer may lie behind these three letters: SAF – for sustainable aviation fuel. An acronym that stands to play a big part in changing the airplane industry and protecting our planet.

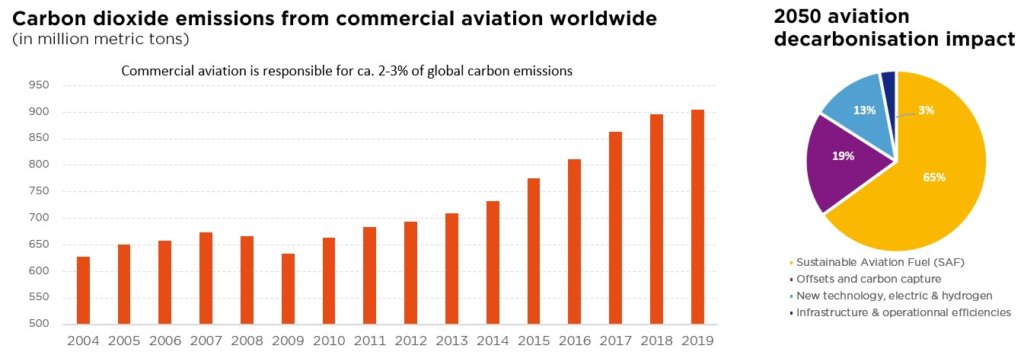

The aviation sector, responsible for a little over 2% of global emissions, is grappling with the complexities of becoming greener. In 2019, aviation emissions aggregated 1GtCO2e, primarily from burning kerosene. The sector’s reliance on fossil fuels, lack of viable alternatives and heavy infrastructure make a reduction challenging. Its emissions should be viewed in the context of aligning with the Paris Agreement, as projected growth could lead to a 6.4% share of the Paris budget by 2050 (source: Credit Suisse). Aviation also produces warming agents beyond CO2, such as nitrous oxides and contrail-forming substances.

Sustainable aviation fuel (SAF) is emerging as a commercially viable solution. It can be derived from various sources, including waste fats, oils, greases, municipal solid waste, agricultural and forestry residues, and non-food crops grown on marginal land. Alternatively, SAF can be produced synthetically by capturing carbon directly from the atmosphere. It is considered sustainable because its feedstocks do not compete with food crops, require minimal extra resources like water or land clearing, and avoid negative environmental impacts such as deforestation or biodiversity loss. Unlike fossil fuels that release previously trapped carbon into the atmosphere, SAF recycles CO2 absorbed by the biomass (feedstock) during its lifespan and potentially reduces emissions by up to 80%.

The advantage of SAF being a “drop-in” fuel allows for seamless integration into existing aviation systems without safety concerns. In 2021, the International Air Transport Association (IATA) passed a resolution committing its ca. 300 airlines to a 2050 net-zero target. To get there, several measures will be needed, including new technologies and operational efficiency improvements. However, the main means to reduce aviation emissions will be to swap conventional jet kerosene for SAF. Indeed, fully replacing aviation fuel with SAF could reduce emissions by 65% by 2050.

National policies are driving SAF adoption. EU mandatory SAF blending rates are to be escalated from 2% in 2025 to 70% in 2050. The US stimulates SAF supply via tax credits, aiming for annual domestic production of 3 billion gallons by 2030, climbing to 35 billion gallons – or 100% of domestic aviation fuel demand – by 2050. Airlines have responded by setting their own SAF targets, with 5% of the market committed by 2030. The most ambitious companies being Emirates, Qantas, and Air France – KLM.

Recognising the promising growth prospects of a SAF future, numerous corporations, including refiners, industrial gas companies and oil majors, are directing investments towards this endeavour. Notably, Neste, the global leader in renewable diesel within the automotive and truck sector, is swiftly positioning itself to spearhead the expansion of SAF.

However great the potential, one need also be aware of the formidable challenges involved in ensuring an ample supply of SAF for the airline industry. Capital investment requirements will be significant and a reliable feedstock stream will need to be sourced, all the while facing the unpredictability of commodity price fluctuations. Not to mention a potential short-term risk of SAF oversupply!

Written by Jonathan Graas, Senior Portfolio Manager

Goldilocks-lite now, what else… thereafter?

- Goldilocks-lite economy (lower inflation without tipping into recession): as good as it gets?

- Supportive Q2 results & improved stock market breadth vs. valuation and complacency

- Light at the end of the tunnel? Yes, but another tunnel may lie ahead before year end

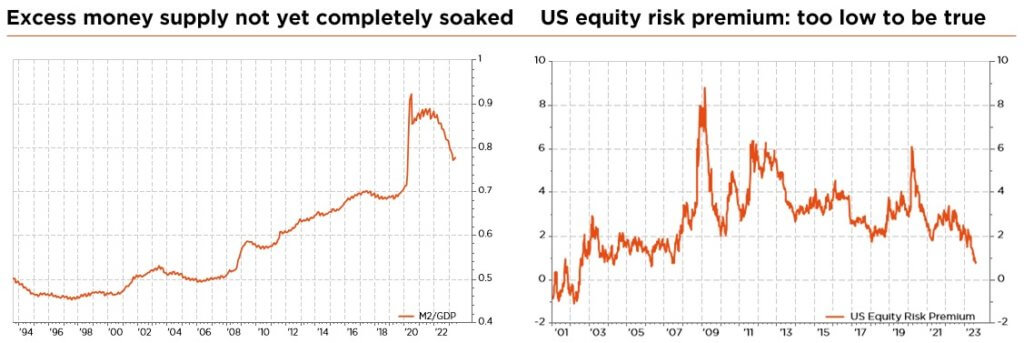

So far this year, global economies, central banks and financial markets have all been walking a remarkably fine line between inflation, growth and policy rates, increasing the odds of a soft landing. Activity is proving more resilient than expected, disinflation is well underway, destocking trends have peaked, the rate hiking cycle is close to an end, and labour markets are rebalancing smoothly. Admittedly, China’s post-reopening recovery is not living up to expectations and European economic trends remain mixed, but a severe near-term recession can be ruled out in our view. Also, monetary tightening has yet to bite into growth; only the recent years’ excess money supply has been depleted so far, postponing a potential credit crunch. To sum up, the investment backdrop has resolutely improved, leaving less room for positive surprises.

Although Q2 reports showed no sign of the predicated great earnings depression (with revisions actually turning positive for most markets), equities still proved choppier lately as most major indexes took a break to digest early year gains. This consolidation was achieved on the back of improving market breadth, a healthy development consistent with our prior expectation of a gradual non-linear convergence of stocks beneath the index surface, suggesting further market rotations in the coming months.

On the gloomier side, stock markets globally, and especially in the US, still look expensive according to most metrics, which seriously impairs their relative appeal in today’s higher (real) yields environment. Indeed, current equity multiples leave little room for error – even though some attractive pockets of value can still be found in selective high-quality names across Europe, Japan, financials, energy, as well as the small- and mid-caps segment. Moreover, market sentiment indicators have recently switched from bearish to bullish, with the latest industry-wide asset allocation data suggesting that investors have been following suit, i.e. have meaningfully increased their equity exposure. In other words, the previous low equity positioning tailwind, limiting downside selling risk, is no longer a valid argument.

With this year’s global equity rally starting to show signs of exhaustion at levels that already price in a Goldilocks-lite macro scenario, we see little room for error and limited scope for new catalysts in the near term, prompting us to downgrade our equity stance from neutral to slight underweight. Admittedly, many of the market’s earlier overhangs have been removed in recent months. But with both bullish sentiment indicators and less supportive equity positioning adding to already unappealing index valuation multiples and revived China ripple effects concerns, we believe the market is now ripe for a pause. In particular, we still need to gain greater visibility on growth and inflation trends before positively embracing next year’s promising earnings perspectives.

While government bond duration may help mitigate possible equity losses related to an earnings recession, we still doubt its buffer potential for the foreseeable future, in our scenario of sticky inflation, “hawkish hold” monetary policies and milder recession. Nonetheless, with long rates having continued to edge up over the summer, reaching highs since 2008, we now see them as fairly valued and have thus decided to add back some duration in a “risk-adjusted carry” context for balanced portfolios (all the while remaining slightly underweight given more appealing higher and uncorrelated cash returns).

The bottom-line? After this year’s rollercoaster start and significant rotation reversals in equities, bonds, forex or commodities, we expect further bumpiness in the near term. 2024 may prove smoother, but with the current dispersion of macro outcomes still remarkably large, we continue to favour a balanced all-terrain approach to portfolio construction and advocate a well-diversified high-quality allocation and selection this year.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: Refinitiv Datastream, Bloomberg, FactSet, IATA, Statista