Once again devil was in the details when considering the thrilling outcome of the Super Bowl LVIII with the Kansas City Chiefs stunning the San Francisco 49ers in overtime (25-22). Be reassured (or actually not so much), there are other places where the gap is so wide that even the devil wouldn’t risk an appearance… Such as Italian soccer with the irresistible ascent of Inter and Juventus vs. the unstoppable fall of U.S. Salernitana and Cagliari Calcio in the Serie A ranking. We all know the reasons: it’s about the divide between North and South, the wealthy and the straitened, but we/I still hope for a miraculous catch-up nevertheless. Same story applies obviously to the global equity market, and especially to the US one, with some well-identified (big) winners and many left-behind laggards. Is it rational or just another bubble? And what to do in the meantime: passive or active investment? Like the ways of the Lord, the answers to these questions, seem very subtle and may be wondrous for those who get them right.

This letter has been inspired by the last week Bloomberg’s Points of Return Opinion of John Authers called “Magnificent or Marxist? Passive investing is back on trial”. Should we throw the towel, close our eyes, stop thinking and just follow the money and the crowd by going 100% into passive investment, or is there a more sensible middle way that makes more sense? To ask the question is already answering it, but here are some facts and figures that shape my current considerations.

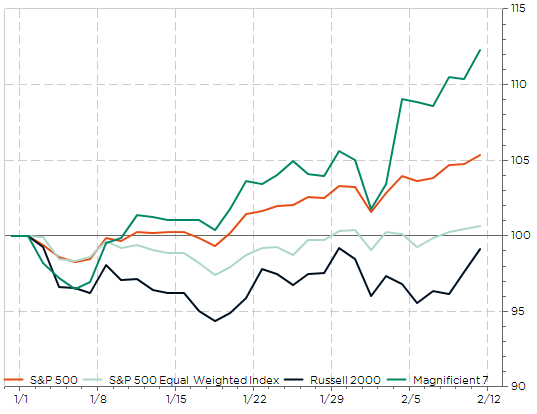

S&P500, S&P500 equal-weight, Russell 2000 and the Mag7: A still growing divide between those who have and those who have not (enough)… exposure to the Magnificent Seven

While the S&P500 equal weight and Russell 2000 (US small and mid-caps) have clearly outperformed the S&P500 and the Mag7 during the end of last year rally (from late October), they are again underperforming. In my views, part of the explanations lies in the macro backdrop narrative: they did very well when consensus view was lower inflation met by plenty of rate cuts in an environment of challenging (but not collapsing growth). However, this market narrative has been somewhat challenged since we entered into this year: activity/growth metrics are surprising again on the upside, unemployment has remained low, wage growth isn’t coming down and CBs are pushing back against early cuts and long rates are thus rebounding. Conclusion: too strong growth (leading to upside risks on inflation and rates) or recession are more favorable (in relative terms) to large caps, growth style and solid balance sheets… such as Mag7.

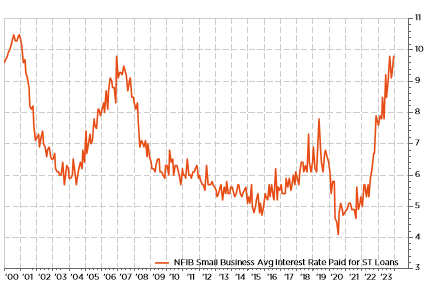

Balance sheets fundamental is becoming a key differentiation performance driver in a context of potentially higher rates for longer from central banks, tight credit spreads and an inverted yield curve. These are all logical expression of surprisingly resilient, and potentially still overheating, economic growth. One the on hand, strong balance sheets companies are not suffering too much from this situation, while the restrictive monetary policy are clearly biting faster and more profoundly the more fragile and indebted small and mid-size companies (SME). Let’s start with the obvious: SME haven’t the same access than large caps to global capital markets for their (re)financing needs. They rely more on (regional) banks and their loans tend to exhibit either shorter maturity and/or floating-rates, on top of higher credit spreads.

NFIB Small Business Avg Interest Rate paid for ST loans: credit getting more expensive for SME

Another current issues for SME, as well as for the Russell 2000, is the challenges faced by US regional banks. Keep in mind that they still make about 14% of the Russell 2000!? According to a Morgan Stanley recent study, about USD 2tn of Commercial Real Estate (CRE) debt matures by the end of 2025 and needs to be refinanced, half of which is on bank balance sheets. “While the top 25 banks have about 30% of this exposure (i.e. $300bn), the rest of the 4’500 smaller US regional banks have the remaining 70% ($700bn). However, as a proportion of the total loan books, the top-25 banks‘ exposure to CRE is only 11% versus 34% for the regional banks…”. Furthermore, as CRE loans by regional banks tend to have a shorter maturity of around 5 years than CMBS conduit (typically 10 years), they are less likely to benefit from significant price appreciation (think about the CRE loans originated in 2019… vs. those launched in 2014). In other words, the CRE challenge for the banking sector is a regional bank issue! Which is also impairing access to capital and credit formation for SMEs. Who said that small is beautiful in the US banking sector!

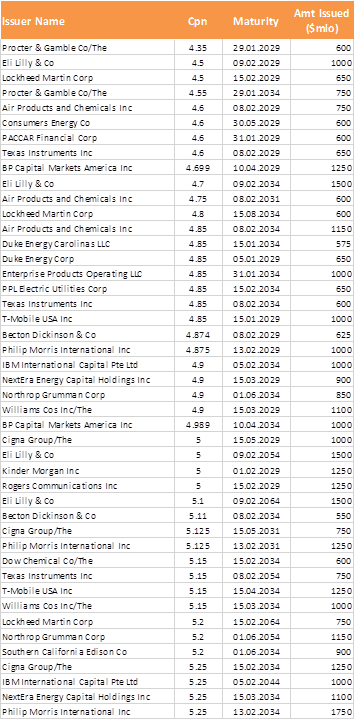

At the opposite, big caps have rushed to the credit market since the beginning of the year with more than $200bn new issuances in January in the US alone on the back of some anticipation of the maturity wall coming next year and the uncertain environment they may face pre and post-US elections, but also due mainly to very favorable conditions (sharp rates rally at the end of last year, credit spreads tightening especially on the long-end of the curve with such low levels not seen since the mid-90s). So, it has been a fairly active month on the primary market, above normal considering the average of past January, driven essentially by non-financial corporates. No wonder many big caps seized the opportunity to (re)finance at attractive conditions, courtesy also of the yield curve inversion. Since the beginning of the year, more than $50bn of USD denominated bonds of non-financial corporates with a maturity > 5 years have been issued with a coupon below current cash rate (i.e. 5.25%). See the list here below. Assuming these companies have some cash, they are currently better-off keeping it indeed… or asking the debt market for more now in a scenario of longer shorter rates for longer leading potentially to a recession (widening credit spreads) later, or if inflation spikes again.

List of corporates non-financial new issuances YTD with at least 5y maturity and a coupon < 5.25% (cash rates)

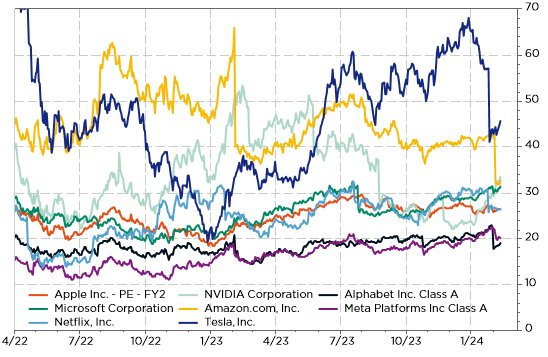

Last consideration before to conclude with some pragmatic advices on how to position within US equities: the Magnificent Seven are strong and profitable companies with a well-embedded competitive position but what’s about their valuations. Some may argue it looks more and more like the dot-com era or it is just unsustainable. As far as the current forward P/E are concerned, it doesn’t seem so unreasonable or bubbly overall. However, they aren’t equal: Tesla valuation is clearly questionable to say the least (especially if you consider it as an auto maker!), while Meta and Alphabet could be deemed as cheap considering their superior growth prospects (their valuations already integrate some challenges they face in the advertising sector).

The “Magnificent Seven” forward PE (price / next year expected earnings): not all equal!

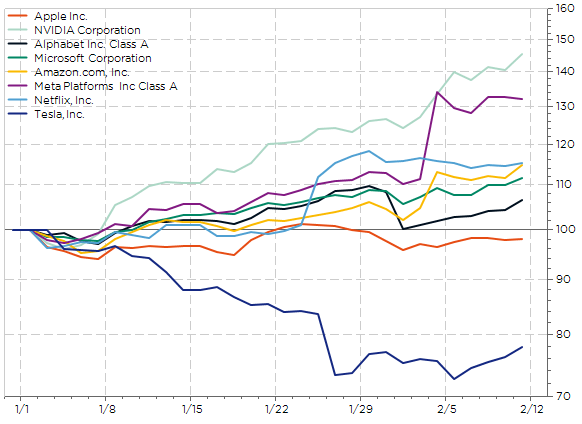

What has recently changed however is the investors perception about the supposed uniformity of this group: did you notice the divergent trajectories in the Magnificents YTD performances? For those who have seen the movie (“Les Sept Mercenaires” in French) and remember it, there are only 3 who actually survived at the end… So, we may sooner or later speak about the Gifted Six-Pack, the Fabulous Five, then the Fantastic Four, eventually the Magic Three, the Incredibles 2 at some point or perhaps just the Special One at the end.

The “Magnificent Seven” YTD performance trajectories

On the one hand, some Mag7 may thus leave this group, move into the background, by underperforming the broader market and thus join it. On the other hand, if we are right about the resilience of the US, the ongoing disinflation process (perhaps bumpier and longer than expected a few weeks ago) and that there will be rate cuts at some point, there should by a catch-up for the S&P493 and the market rally breadth will broaden (watch out, the S&P500 gains could be limited/restrained by this market rotation).

So, what to do? Just adopt a mix of 3 components with their respective weights depending on your own macro views, your stock-picking skills and overall convictions: (1) some passive investment through S&P500 ETF or futures, (2) complemented by selective stock picking of large 493 caps, while also introducing an overall OW, neutral, or UW bias towards the Mag7 you like, you don’t have strong views, you dislike respectively, with a (3) final layer of an actively managed dedicated US small caps funds as it seems easier to separate the grain from the chaff in this field (you will find plenty of active fund managers in this area who have outperformed their benchmarks). These are certainly the right ingredients and the best recipe to keep in mind for tackling the US equity market puzzle in the months ahead. Provided, of course, that the right balance is struck.

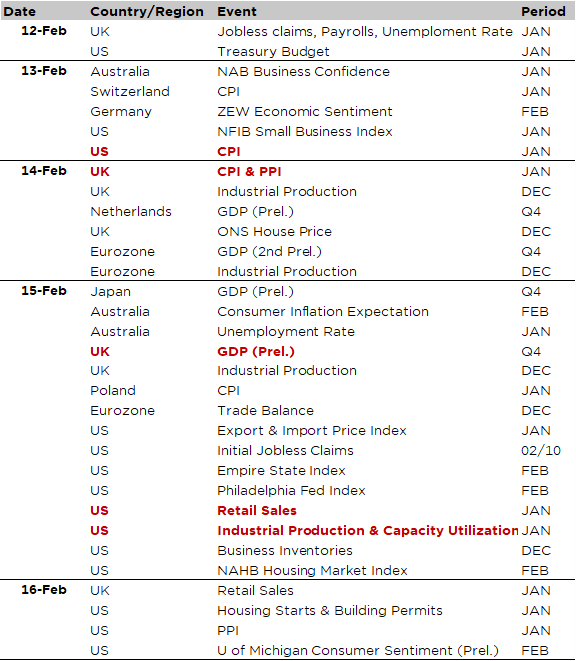

Economic Calendar

The US & the UK will steal the show this week as far as economic data releases are concerned. Starting with Uncle Sam, all eyes will be on the January inflation report tomorrow – as investors are still guestimating when the Fed will start cutting rate (odds tend now towards May or June)- and then move to retail sales and industrial production on Thursday. Coming back on this side of the Atlantic, to Prince Charles Kingdom, investors will know more about the health and trend’s developments of the UK economy thanks to a quite extensive check-up over the week including labor market today, inflation and industrial production on Wednesday, Q4-2023 GDP growth on Thursday (the preliminary print may eventually suggest a slight technical recession in H2-2023) and retail sales on Friday.

Elsewhere, growth preliminary figures for Q4-2023 are also due in Japan on Thursday (+0.3% expected), while we will get ZEW survey for Germany on Tuesday and the 2nd estimate of Q4 GDP in Eurozone on Wednesday.

Turning back to the US CPI January report (tomorrow), the consensus expects the headline and core indices to increase +0.2% and +0.3% MoM respectively, leading to declines in annual changes to +2.9% for headline inflation (from +3.4% in December) & +3.7% for core one (from +3.9% the prior month). For the UK CPI, both headline and core inflation will likely remain somewhat higher (above 4% and 5% respectively) and thus quite uncomfortable for the BoE as illustrated by the current dissension among its voters. Another important area of focus will be the strength of the US consumer, with key releases including retail sales on Thursday and the University of Michigan consumer survey on Friday. Other notable US economic releases due this week include the NFIB Small Business index tomorrow, the regional manufacturing surveys (Empire & Philadelphia Fed) and the NAHB Housing market index on Thursday, as well as the housing starts and building permits on Friday.

Finally, the earnings season goes on with several consumer-related companies such as Coca-Cola, Kraft Heinz, Stellantis, Heineken or Airbnb reporting their Q4-2023 results. Other notable results this week include Cisco, Sony, Shopify and Applied Materials in Technology sector, or ENI, Swiss Re, Airbus, Schneider Electric or Sika, among many others, in Europe.

Non-exhaustive list of 2023-Q4 major earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.