Much like Cagliari Calcio, firmly stuck in the same league position, global markets also seem determined to go nowhere fast. This weekend’s Cagliari–Genoa match was the perfect metaphor for global markets: indecisive, breathless, and full of twists, yet ultimately going… nowhere. Nothing collapses, nothing soars, everything drifts in a macro fog where everyone seems to be waiting for someone else to make the first move.

Macro: Persistent Fog and a Hesitant Fed – The end of the U.S. government shutdown triggered a flood of delayed data releases, but with little real insight: the numbers are outdated, incomplete, and the publication calendar has been thrown off. As a result, visibility is unlikely to improve before mid-December, after the Fed’s December 10 meeting. Meanwhile, unexpectedly hawkish comments from Fed officials have shifted the odds of a December rate cut from “almost certain” to essentially a coin toss.

Markets: Strong Earnings, Rising Volatility, but No Euphoria – Earnings have been solid (+12% YoY for the S&P 500, +9% for the median), yet markets have been flat since mid-October, with the VIX back above 20. Questions around AI monetization, concerns about U.S. private credit, and renewed bubble talk have driven healthy volatility. We still see no bubble at this stage: mega-cap tech strength is underpinned by exceptional earnings growth, and valuations remain far from extreme.

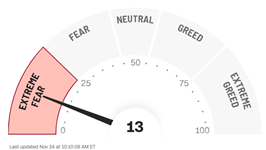

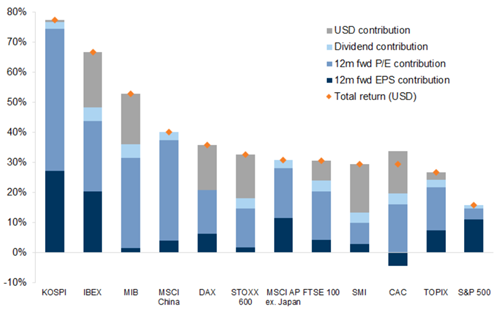

Global Sentiment: Cautious Investors and Broader Global Leadership – Investor sentiment is anything but euphoric. And importantly, this year’s strength is not confined to the U.S.: most non-U.S. markets have outperformed in USD terms. Performance has broadened both geographically and across factors, with value and small caps leading in Europe.

Sentiment – CNN Fear & Greed Index

Decomposition of selected YTD indices returns in USD

Source: Morgan Stanley

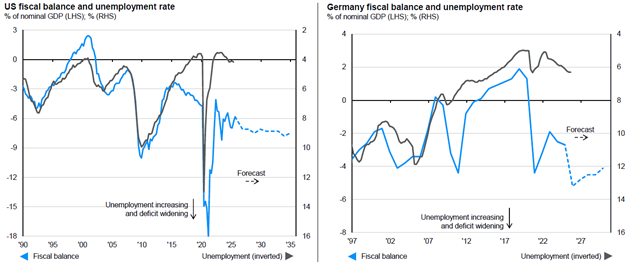

Global Macro: Hard to Be Bearish on Nominal Growth – Monetary policy remains in easing territory, inflation trends are behaving, and fiscal policy is heavily expansionary. The AI boom is adding further support through capex and energy-infrastructure investment. In this environment, a “natural” recession looks unlikely; only a major financial shock or credit-market dislocation could derail global growth.

Unprecedented ‘peacetime’ fiscal stimulus

Source: JP Morgan

Thin Cushion, but Markets Can Still Climb the Wall of Worry – Extreme concentration, high valuations, a Pavlovian buy-the-dip reflex, and a seemingly endless Goldilocks narrative all reduce the market’s buffer against earnings disappointments, inflation surprises, rate shocks, or currency risks. But recent history shows that markets can continue climbing the wall of worry – especially if our supportive base-case scenario plays out.

And just as markets have shown an uncanny ability to climb the wall of worry despite doubts, volatility, and structural challenges, Cagliari, too, can fight through uncertainty and stay in Serie A. The team may wobble, scare its supporters, and flirt with danger — but it keeps finding a way to hang on, game after game, twist after twist. In markets as in football, resilience often matters more than perfection. And for now, both look capable of staying in the game.

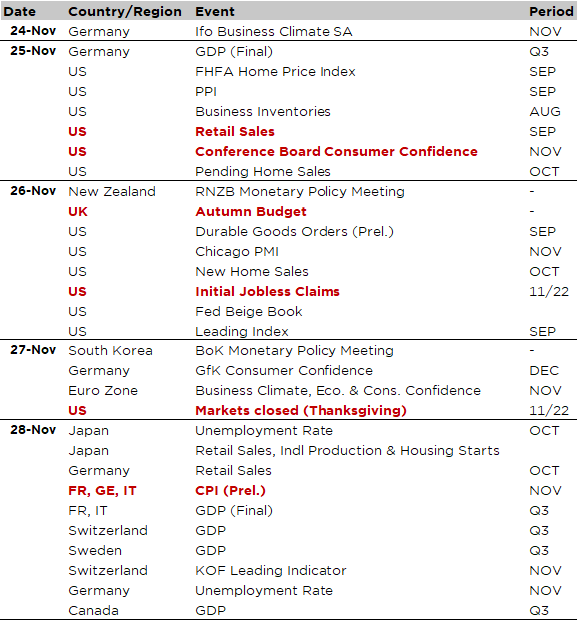

Economic Calendar

December is coming… even faster than you think on financial markets as US markets will be closed on Thursday for Thanksgiving and open just half-day on Friday -with limited activity and therefore certainly low volumes-. Otherwise, the focus will continue to be on the delayed US economic data releases, which will be compressed into the first three days, including the September retail sales (Tuesday), PPI (Tuesday) and the durable goods orders (Wednesday) reports, as well as on the few up-to-date indicators such as the November consumer confidence survey from the Conference Board (Tuesday), the jobless claims and the Fed Beige Book (Wednesday).

Meanwhile, while Americans will digest their turkey by going shopping on Friday, we will get several October economic data for Japan (unemployment rate, retail sales, industrial production and housing starts), the November flash CPI for Germany, France and Italy, as well as the Q3 GDP reports for Switzerland, Sweden and Canada. The German IFO is due on Monday.

Elsewhere, the RBNZ next monetary policy meeting will take place on Wednesday. A 25bps rate cut to 2.25% is widely expected. In the UK, the main event will be the Autumn Budget unveiled on the same day by Chancellor Reeves, who is facing a big challenge: delivering a credible fiscal consolidation (circa £30bn in savings) through a well-balanced mix of tax rises and spending cuts… without jeopardizing the fate of her and Prime Minister Keir Starmer’s careers. Assuming the UK budget is more growth-contractionary than taxes-inflationary, it may help to force the BOE’s members hands towards an easier stance with a rate cut as soon as its December 18th meeting. Moving to geopolitics, we will keep an eye on the diplomatic moving parts related to the US ultimatum to Ukraine, set for before Thanksgiving on Thursday, to accept a 28-points peace plan agreed with Russia… Finally, the earnings season is now winding down, but there are still a few companies results to keep an eye such as Alibaba and Meituan in China, or Dell and HP in the US.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.