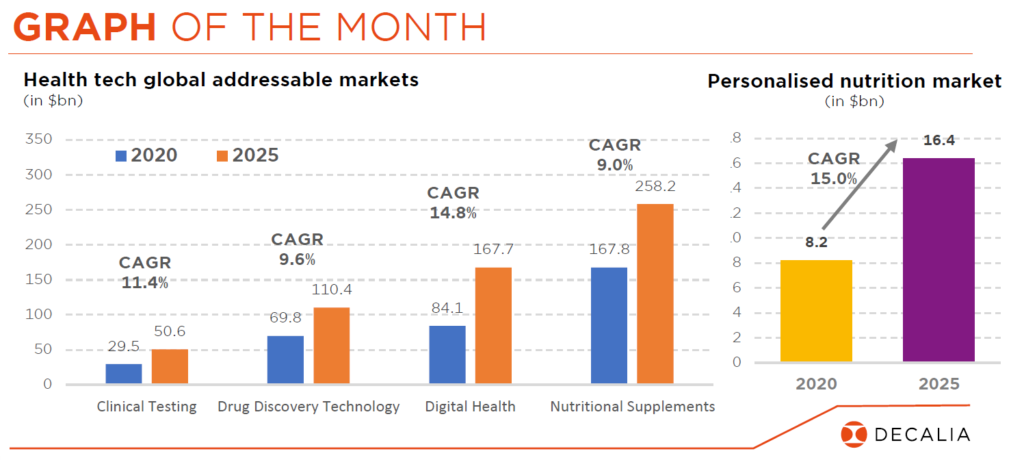

- Personalised food is no longer a premium (and somewhat arcane) niche market

- Technological progress, as well as greater health awareness, is driving growth

- Picking winners in this burgeoning industry is no easy task though

As 2022 sets in, no doubt that many of the new year resolutions being taken have to do with a healthier lifestyle – and not just to shake off those extra holiday season kilos! The Covid pandemic has put a renewed spotlight on the importance of one’s diet to overall health, even as scientific and technological advances are bringing personalised nutrition solutions to the masses.

When it comes to dieting, there is no magical formula. However (in)famous, the various “one size fits all” regimes that have been touted over the years fail to acknowledge a key fact: each body reacts differently to a given food intake, depending on eating/sleeping/exercise patterns and – as is increasingly being understood – the 100 trillion microbes that colonise its gut (otherwise known as the microbiome). In the wake of 2015 landmark work by Israeli researchers, who developed an artificial intelligence-based algorithm able to predict an individual’s response to food, the number of companies offering bespoke nutritional advice has exploded.

The personalisation of food or dietary supplement offerings involves, first, expanding the criteria upon which they are based. Demographics being the simplest, complemented by responses to individual questionnaires, potentially also by blood/urine/hair testing and – in the most advanced form – by genetic/microbiome analysis. The other axis pertains to the actual solution that is proposed: a personalised combination of mass-manufactured products or – taking it to the next level – products that are specifically-designed for a given individual.

Interest is particularly strong among the Millennial and Gen X cohorts (although Babyboomers are also fast catching on) and in countries where consumers are more comfortable sharing personal data with private companies. Interestingly, according to a 2021 Euromonitor study, this means China, India and the US, with Western Europe lagging somewhat.

From an investment perspective, as indeed that of a consumer, the challenge is to distinguish promises from what can actually be delivered today. With scientists stressing that much has yet to be deciphered, notably when it comes to the influence of the diet on the microbiome, and certain segments of the personalised food business (e.g. direct-to- consumer laboratory tests and dietary supplements) still insufficiently regulated, picking long-term winners is no easy task. At this point in time, we would tend to focus on « enablers », meaning companies of the likes of DSM, Kerry Group or Ajinomoto that develop fermentation-based nutritional ingredients, rather than “end distributors”.

Ultimately, the ambition of the more than 425 businesses already active in this space, including plenty of startups, is no less than to do away with some of the great diseases of our times – alongside promoting food that is friendlier for the environment. In effect, we are seeing a convergence of the health and consumer sectors, which incidentally probably explains why Nestlé’s current CEO is a pharmaceutical veteran. Or why Abbott is increasingly incorporating whey proteins into its senior nutrition products to fend off osteoporosis.

Speaking of great diseases, some specialists predict that antimicrobial resistance will be the leading cause of mortality by 2050. Gut health thus stands to become ever more important, and with it the need for a better – more personalised – diet.

Written by Alexander Roose, Head of Equities, Co-Lead PM of DECALIA Sustainable SOCIETY

• Investors took heart that Omicron is contagious but less severe than prior strains

• The macro backdrop, relative valuation, sentiment & positioning remain supportive

• That said, the next market upleg will not be a walk in the park

2021 ended as it began… with Covid-19 hitting the headlines and equity markets climbing. As we suspected, the Omicron variant has not been a game changer – unlike the vaccine – with investors taking heart from growing evidence that it is contagious but less severe than prior strains. Provided one has been vaccinated during the last twelve months.

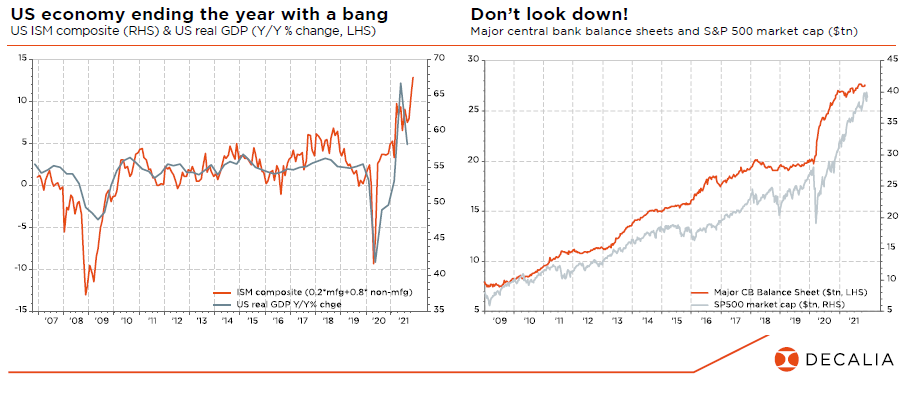

As we enter 2022, our central macro scenario remains broadly unchanged. For sure, the return to normalcy has proved bumpier and lengthier than expected a year ago, but we are still headed in the right direction. And the global picture of above- trend growth, high but falling inflation and accommodative – albeit less easy – monetary policy remains supportive overall for equities & real assets vs. fixed income & cash. The same can be said of valuations, with equities still the cheapest house in a very expensive street of liquid financial assets.

As a result, our stance today is the same as a year ago, i.e. modestly bullish on global equities and clearly underweight bonds. We did turn temporarily more cautious last summer, but then re-risked portfolios in October after a bumpy ride. In effect, notwithstanding the rapid spread of Omicron, our positive investment thesis is intact. We still believe that the future path of real rates will be the key driver of bond, credit and equity markets (as well as factor/style rotations) going forward. The next market upleg will be no walk in the park though, with volatility set to increase again as the economic recovery matures, inflation proves stickier than in the past and monetary policy support gradually fades. Put differently, the “Fed put” has not disappeared, just been set lower.

With valuation multiples off recent highs and both bearish investor sentiment and lighter equity positioning more supportive, we expect a continuation of the recent buy-the-dip market forces, combined with resilient economic trends, positive earnings momentum, easing supply chain disruptions and still-low interest rates, to more than offset temporary “emotional” fears arising from a well-telegraphed Fed tightening and delayed US Build Back Better stimulus package.

At the portfolio level, this means that we continue to argue for a high-quality balanced “all-terrain” equity positioning, in terms of both sectors and styles. Over the past year, we have complemented our core equity portfolio allocation with selective satellite regional assets so as to recalibrate sector and style biases, to reach a more cyclical and less “growthy” stance. While our long-term structural preference still goes to more resilient higher quality diversified growth markets, such as the US and Switzerland, China offers some tactical opportunities given the improved valuations and more favourable macro backdrop.

In fixed income, we still recommend a barbell strategy on rates, especially on the USD curve. Consistent with our constructive view on risky assets, we keep a slight overweight on the HY segment and EM debt, where we continue to favour actively managed investments (selectivity remaining key).

Elsewhere, we stick to our neutral view on gold and a slight overweight of other commodities. We are also still tactically cautious on EUR vs. USD, while remaining at ease with the CNY and AUD. Finally, it is worth mentioning that the CHF, supported by strong structural fundamentals, remains our favourite pick within an overall underweight of defensive currencies.

Written by Fabrizio Quirighetti, CIO, Head of multi- asset and fixed income strategies