- Recent bankruptcies have raised eyebrows about private credit – though the real drama lies elsewhere

- Concerns exist but mainly in commoditised private credit deals

- Private credit still shines with solid gains and lower volatility

The recent bankruptcies of Tricolor and First Brands in the US have cast a cloud on the private credit market, with public remarks from prominent financial world figures, including the metaphoric warning from JPMorgan CEO Jamie Dimon about further losses in this asset class, saying more cockroaches will surface. While private credit clearly carries some risks, it is important to underline the idiosyncratic nature of the difficulties encountered by both bankrupt companies, as well as their primary financing source – broadly syndicated loans and asset-backed securitisation vehicles, not private credit.

The distinction among these can often be unclear, as “private credit” tends to serve as an umbrella term encompassing various types of financing. However, private lenders differ from typical participants in bank loan syndications and securitisation markets. They aim to be the primary lender in bilaterally negotiated deals that follow a thorough due diligence process, benefitting from superior monitoring rights and greater control over enforcement should problems arise – features notably absent in the cases of First Brands and Tricolor.

That said, stories like First Brands highlight genuine areas of concern, such as the loosening of underwriting standards amid intense capital inflows and competition in more commoditised segments, the increasing use of financial engineering, and the prevalence of weaker debt covenants. Fortunately, these challenges are not systemic and can be mitigated through disciplined investment selection.

This is not a new phenomenon. Indeed, as we discussed in our October 2024 note “Evolution in Private Credit’s Golden Age”, the market is becoming increasingly polarised.

On one side stand large-cap players with vast amounts of capital, and strong pressure to deploy it. On the other side are smaller, specialised managers who are better positioned to thrive in evolving market conditions, thanks to a more focused approach and greater agility.

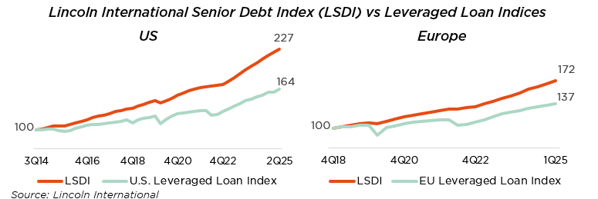

Overall, private credit continues to demonstrate robust performance. Data from Lincoln International’s private debt return indices, when compared to leveraged loan benchmarks, reveal not only superior returns for private credit but also steadily increasing outperformance coupled with lower volatility. Similar patterns emerge from other sources, such as Houlihan Lokey’s indices, which primarily track senior direct lending – the most competitive sector within the market. From our perspective, these positive trends are even more evident in niche, specialised strategies.

Note also that this need for greater selectivity comes right at the time when asset managers – with US presidential support – are pushing to open private investments to retail capital. A poll conducted last month by Pitchbook LCD indicated that three quarters of market participants expect growing retail participation in private credit over the coming years, of which 30% see retail investors as a “major new capital source”. Let us hope that such new entrants into this asset class will be well counselled, helping them steer clear of opaque structures and not succumb to unrealistic yield promises. In this respect, the recent news flow on First Brands and Tricolor might actually prove to have been a timely warning.

Written by Andrea Biscia, CFA, Principal Private Markets

Don’t fight the Fed… and the AI capex boom!

- (Almost) Everything Everywhere up All at Once

- It is hard to be negative on nominal growth while policies are expansionary

- The AI boom has further to run, in our view

Politics and geopolitics have easily filled in the near void left by the lack of hard US economic data: zig-zagging headlines on US-China trade negotiations, French budget deliberations, an easing of the tensions in the Middle-East following the Israel-Hamas ceasefire, the surprising victory and appointment of Sanae Takaichi as Japan’s first woman Prime Minister, and, of course, the ongoing US government shutdown. Most of these events have left investors indifferent or not proven meaningful game changers to date.

Investors seem relaxed about flying blind, as the soft landing (a.k.a. Goldilocks) scenario still dominates and was recently even reinforced by the softer-than-expected September US CPI. Global equity indices have thus continued to post new records over the past weeks, underpinned by resilient global economic activity consistent with the latest IMF outlook, robust earnings growth as confirmed by the strong kick-off to the Q3 earnings season, the ongoing AI boom, still low energy prices and moderating global inflation (even though risks do remain tilted to the upside in the US). Not to mention the return of a “Fed put”, through the US central bank’s risk management easing decisions.

Against this backdrop, risk premia and volatility have remained near the lower end of their historical ranges and long-term global rates have declined somewhat, although concerns regarding the sustainability of sovereign debt trajectories are still present. And while credit experienced some contained cracks, with the emergence of a few “cockroaches”, we are not overly concerned. We consider these to be idiosyncratic events, related to fraud, even if we do recognise that there has been a massive build-up in credit risk/leverage, with spreads at historically tight levels that leave little margin for error should the macro backdrop deteriorate significantly. The US dollar has now stabilised, but this may be the calm before a second stormy downward leg – weighed down by a softening labour market, lower Fed rates and President Trump’s economic policies. Gold prices meanwhile experienced a parabolic surge towards USD 4’400 per ounce, before undergoing a rapid but “healthy” consolidation around the more reasonable – read: less bubbly – USD 4’000 current level (still a 15% gain over a two-month period).

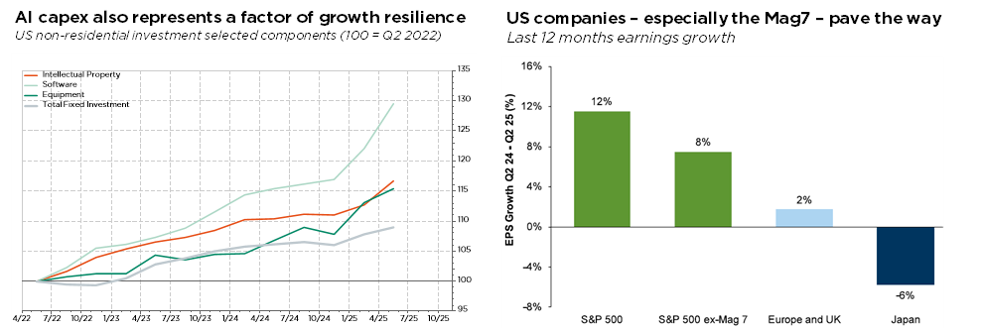

With the Fed now in easing mode and a new fiscal boost soon to come in the US, via the implementation of the One Big Beautiful Bill, we still assign a low probability to a “natural” recession scenario. In our view, only a major financial market crash – due to other factors, such as a spike in rates or a systemic credit event – may precipitate the economy into a severe growth contraction. Furthermore, we believe that the AI boom has more to run, with a direct and positive impact on growth through capex and energy infrastructure investments. In other words, we do not think we are (yet?) in bubble territory. Valuations are not irrational, and these AI investments are mainly financed by IT mega caps cashflows, thus avoiding over-indebtedness. At the same time, investor sentiment and positioning are far from being euphoric or extreme. For sure, market breadth has not really improved but, at the same time, the AI theme is almost absent of the (public) credit market.

We do acknowledge that today’s apparent overconfidence in a seemingly endless Goldilocks loop, combined with lofty valuations, leaves little cushion to absorb major disappointments in earnings, negative inflation surprises, unexpected rate shocks, or currency debasement risks. But recent history has also shown us that financial markets can easily climb such a wall of worry, especially if our supportive base case scenario proves correct.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, Goldman Sachs, Lincoln International.