- In times of crisis, increased exposure to hedge funds can help stabilise portfolios

- Their flexibility and ability to adjust quickly to changing risks are key advantages

- Careful selection is warranted, however, with performances far from uniform

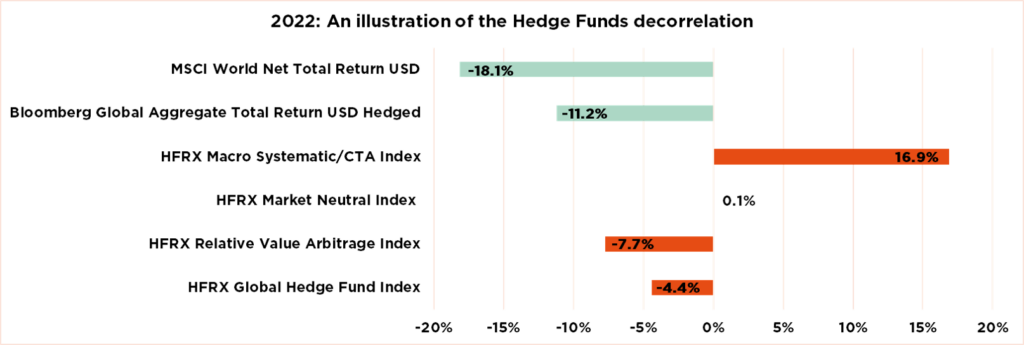

Periods of financial market turmoil test the resilience of traditional portfolios. Hedge fund strategies tend to stand out for their ability to generate positive or stable returns, even when equity and bond markets are correcting in tandem. 2022 proved a striking example, offering valuable lessons for navigating the current trade war environment, triggered by the Trump administration.

Three years ago, the investment world indeed already experienced a “stormy match”. Equity and bond markets, which are usually complementary, simultaneously lost ground. The S&P 500 index plummeted by nearly 20%, while sovereign bonds, supposed to provide a solid defence, recorded one of their worst performances in history.

In this difficult environment, the majority of players – banks, traditional funds as well as retail investors – were destabilised by the extreme volatility. Few managed to stay the course. Some hedge fund strategies, however, were able to limit losses or even generate positive returns. Citadel closed the year up 38.1%, D.E. Shaw up 24.7% and Millennium up 12.4%.

Today, with a new trade war launched by the Trump administration shaking the markets, the match is resuming under pouring rain. Equities are faltering, bonds are losing their solidity and credit is becoming uncertain. The ground is again slippery, with the rules of the game changing at every turn. And once more, hedge funds are emerging as management tools able to adapt fast.

Thanks to flexible investment approaches – whether through long or short positions, or arbitrage between asset classes – they can adjust their strategy in sync with changing risks.

As we expect volatility to persist throughout 2025, with trade tensions remaining high and divergent monetary policies (a wait-and-see approach by the US Federal Reserve, the European Central Bank set to continue to cut rates and the Bank of Japan hiking them), it does seem appropriate for investors to consider broader portfolio diversification, including hedge fund strategies capable of responding to difficult market conditions. A recent Amundi study indeed predicts an increase of such investments, particularly into multi-strategy funds that combine several approaches to maximise stability. More specifically, hedge funds that are focused on arbitrage and macroeconomic trends appear well positioned to take advantage of this highly uncertain financial environment.

But while 2022 may indeed be a textbook case, reminding us that some alternative strategies can offer relative protection against widespread losses in times of crisis, it is important to note that hedge fund performance is mixed. Not all hedge funds were able to take advantage of the extreme conditions in 2022. A rigorous selection process is therefore crucial. If considering such investments, you would be well advised to first contact your advisor, so as to ensure a choice of performing funds, suited to your profile.

Written by François Botta, Senior Portfolio Manager

Everything Everywhere All At Once: a US production

- Downside scenario risks have increased amidst a very uncertain and challenging context

- The “tariff” effects: Melania, I shrunk the expected equity returns

- Recession still not expected, but valuations are not cheap enough to add exposure

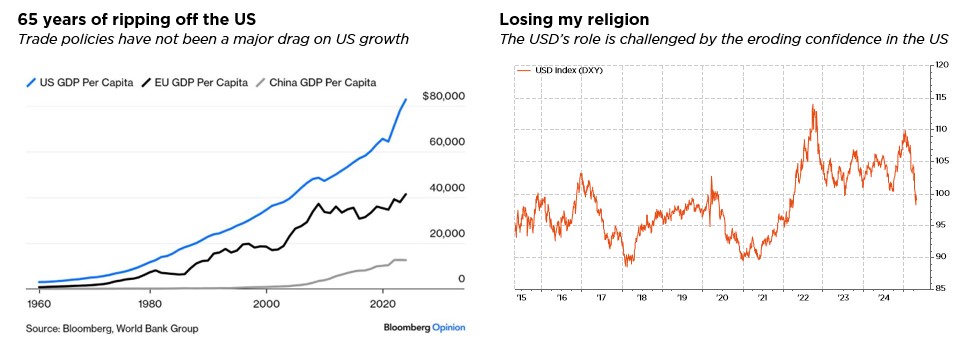

The markets have experienced considerable turmoil since Donald Trump announced reciprocal tariffs on April 2. Not only did the global equity index drop sharply (before recouping a large part of its losses), but interest rates, exchange rates, commodities and credit also proved highly volatile, reflecting the uncertainty in which all operators have been immersed since that infamous “Liberation Day”. The three-month suspension has helped dust settle but does not really move the needle: it provides some hope by extending the uncertainties. In any event, this episode may be seen as a turning point in the global economic order, with a major crisis of confidence regarding the US in general. This applies to trade, finance and geopolitics, raising the risk premium on all US assets.

While our base case macro scenario remains unchanged (positive growth, sticky but acceptable inflation and a gradual normalisation of rates in a fragmented world), we did lower its odds given the very uncertain and challenging backdrop. As a result, downside scenario risks have increased, while the odds of an upside macro scenario have also shrunk. Assuming the announced tariffs do come into effect, they would represent circa 15-20% of the value of US imports (compared to 2.5% as of the end of 2024) – a level not seen during the past century.

In this context, the swift escalation of trade tensions and extremely high levels of policy uncertainty would mainly affect economic growth and inflation in the US, ironically, with an estimated impact, as things stand, of ca. -1.0% to -1.5% and +1.0% to +1.5% respectively. The rest of the world would also see its growth prospects darken, but to a lesser extent (between -0.3% and -0.5% for partners such as China and Europe), while the inflationary impact would be relatively muted. A global recession should thus be avoided, although nothing is guaranteed. Indeed, an escalation into a full-blown trade war cannot be ruled out, especially with China also showing its muscles. And there are a multitude of collateral and often self-fulfilling effects, whose impacts on corporate earnings are difficult to assess. Ultimately, it is also possible that the Trump administration backtracks, further postponing some tariffs or “stealing some deals” in exchange for lower tariffs.

The impact of this saga on equity markets has been multifold: higher volatility and a de-rating, especially in the US, because of the greater uncertainty, alongside deflated earnings growth expectations across the board due to mounting recession risks, which led to a cleaner positioning as sentiment turned sharply bearish. Obviously, US markets have been in the eye of the storm given their more elevated valuations and the higher potential damage they may incur from Trump policies. However, we see the global equity outlook as still supported by a constructive macro backdrop, since we are – for now – not forecasting a recession. Unfortunately, valuations are not supportive, or cheap, enough to add some risk at this very uncertain stage. In other terms, some cautiousness is now warranted, with Trump tariffs having shrunk equities’ near-term expected returns.

At the portfolio level, we are maintaining a neutral stance on equity and fixed income. Our current balanced positioning and well-diversified allocation reflects our cautiousness on assessing the wide range of potential outcomes. It should allow portfolios to benefit from expected positive, but contained, returns in most asset classes in the near term, mitigating the bumps, while maintaining sufficient flexibility to adapt to evolving conditions along the journey. That said, in an opportunistic manner, we may continue to embark some “cheap” tactical protections.

Otherwise, the main change to our allocation grid was the fine-tuning of our equity positioning, with a downgrade of US stance to neutral/slight underweight (vs. slight overweight previously) as we believe that most of the recent developments are weighing mainly on US risk premiums. US equities, but also the USD (downgraded last month to a slight underweight) and US Treasuries, are clearly at risk of outflows either for repatriation or for redeployment. That is especially true after several years of US exceptionalism, that worked as a piggy bank magnet for the European and Asian savings glut.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies

External sources include: LSEG Datastream, Bloomberg, FactSet, World Bank.