When this letter will hit your screen, I will be in Turin… waiting impatiently for the official return of Cagliari Calcio in Italian Serie A with its first season’s game at 18h30 at Torino’s Olympic Stadium. At this stage, I can still dream about glorious victories and a more than honorable ranking by end of the season. In other words, I am excited like an innocent kid with high expectations, which haven’t yet been dashed by the harsh reality of the game’s field. Speaking about wishful thinking and disappointments, investors have also had their own experiments this year, especially with the two largest economies. One is remaining too hot, while the other seems getting colder. In this context, it may be wiser to just look and invest elsewhere in the meantime.

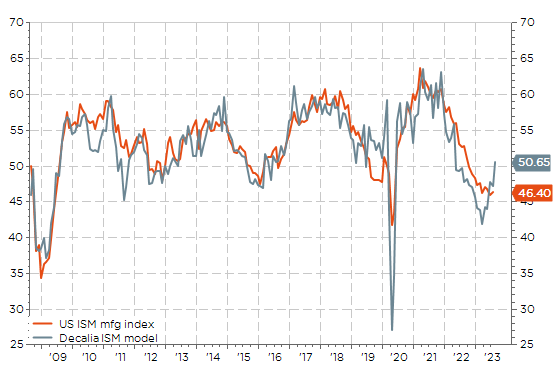

According to the latest US regional manufacturing indices, our ISM model forecasts a rebound above 50 in August from 47.8 forecasted and 46.9 observed the prior month. In the details, it was somewhat a yo-yo between the 2 regional components of our model this month with an unexpected surge of the Philadelphia Fed (+12 vs. -10 expected and -13 in July), while the Empire manufacturing came well below expectations, pointing to a sharp slowdown in manufacturing activity (-19 in August July vs. -1 expected and +1 the prior month). Given (1) the limited weighting or importance of manufacturing activity in the New York area and (2) the better than expected industrial production figures for July released last week (+1.0% vs. +0.3% expected, with capacity utilization rate rising to 79.3% from 78.6%), our ISM model seems to confirm a bottoming out of the manufacturing sector during the summer (destocking cycle is behind us, supportive fiscal policies remain in place, resilient consumer demand, re-shoring trend,… )

Honey, I Boosted the manufacturing sector!

Our ISM model forecasts a reading above 50 for this month

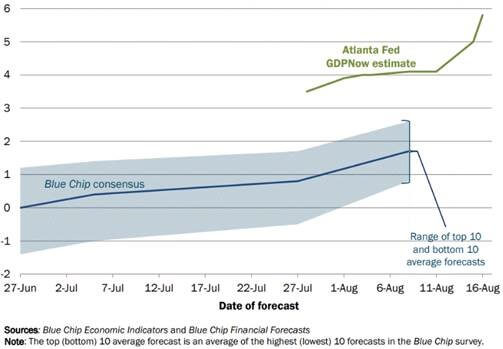

Moreover, overall US economic data continue to surprise on the upside to such an extent that the Q3-2023 real GDP growth forecasted by the Atlanta Fed GDPNow model spiked recently to… 5.8% (annualized rate)!? As a result, these upbeat US data are now filtering into a narrative of still more hawkish Fed than currently priced in, which in turn caps overall market gains on the back of a higher real yield penalizing essentially the growthier and most expensive part of the US market.

Evolution of the Atlanta Fed GDPNow real Q3-2023 estimate (quarterly % chge a.r.)

In other words, we are experiencing another powerful sectors’ rotation… which could eventually become larger if China also announces a “true” fiscal stimulus plan at some point. In the meantime, the strength and resilience of the US economy is even more striking when compared the current Chinese economy woes. China’s post-reopening recovery is clearly not living up to expectations. The 2nd world largest economy (worth circa $18tn) is decelerating, consumers are downbeat, exports are struggling, property developers are on cusp of default, prices are falling and more than 20% of young people are out of work. It smells like a Japanese-deflation scenario. And the timid 10bps cut of the 1-year Loan Prime Rate (LPR) won’t be enough to revive credit demand. With the PBOC unlikely to embrace much larger rates cuts, hopes for a stimulus-led turnaround in economic activity largely depend now on the prospect of greater fiscal support.

How long can this divergence continue? Will the US catch down, or the rest of the world, led by a spectacular Chinese rebound, catch up? The jury is still out and it’s becoming a headache for equity investors to choose between a US market supported by superior EPS growth but stretched valuations on one hand, or dirty cheap Chinese equity on the back of deflation’s risks and geopolitical concerns on the other hand. In this context, it may be wiser to just look and invest elsewhere such as Switzerland or Japan.

Swiss equities offer an attractive blend of high-quality defensive large caps & growthier cyclical small & mid cap names, while Japanese equity is currently benefitting from improving macro backdrop and corporates’ governance, while valuation and flows remain supportive. For both Switzerland and Japan, economic growth is just right, inflation is not really an issue, higher rates to more “normal” levels are welcomed overall -especially for their banking sector which suffered from negative interest rates-, and the risks of monetary policy becoming voluntary too restrictive remain limited as a result. Both the SNB and BoJ will continue to act slowly and gradually, with the former avoiding as much as possible to experience further appreciation of the Swiss Franc, while the later will probably need to act again before year-end, with a proper rate increase, to avoid more JPY weakening. Interestingly, Japan may finally get out -at least symbolically- of 30 years of deflation’s spiral, just at the same time that China may fall into it. In economy and in the markets, it’s not unusual to see yesterday’s losers becoming tomorrow’s winners. Let’s hope it also applies to soccer and more specifically to Cagliari Calcio.

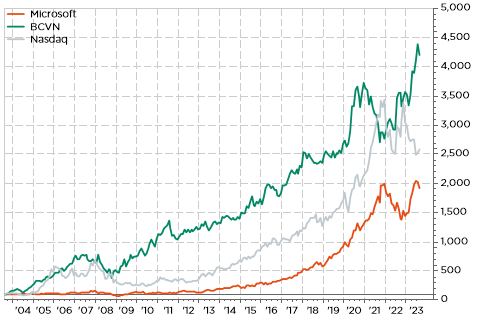

«Reviens Léon Hans-Peter, j’ai les même à la maison !»

BCVN (in $) vs. MSFT & NASDAQ total return

Economic Calendar

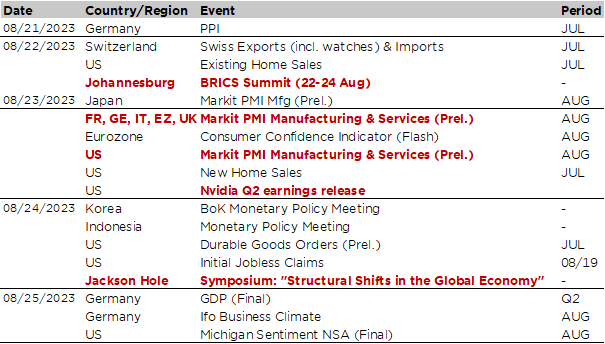

The Jackson Hole annual Economic Symposium, starting on Thursday (and running until Saturday), will undoubtedly be the key highlight of this week. The theme this year is “Structural Shifts in the Global Economy”. The happy-few academics and the world central bankers’ gratin will thus discuss about strong demand and constrained supply, which have pushed up inflation up in DM economies. In this context, they will examine the consequences of extraordinary policy actions taken during the pandemics, as well as the tectonic shifts in both monetary and fiscal policies we are experiencing. A few papers and thoughts about energy transition and AI impact on growth, inflation and subsequent macro policies will likely also emerge during the discussions. Jerome Powell and his peers will walk a fine line between optimism and caution in assessing their inflation fight. They won’t commit about specific near-term actions but give us rather a kind of medium-long term visions and an outline plan. My best guesses about the take-away conclusions are the following: growth will tend to be (structurally) slower, inflation will tend to be (structurally) higher, with policy rates likely higher for longer… especially if fiscal policies continue to remain too loose in order to compensate for higher costs overall (energy, food, security). With AI as the wildcard that could save us through significant productivity gains. Obviously, investors will try to read across to assess more precisely the Fed (and other major central banks) function reaction, and especially to gain insights about the next meeting’s decisions (the next ECB, Fed, BoE and BoJ meetings will take place in between September 14th and 22nd). Keep in mind we will see another round of labor market indicators and inflation data for all of them before that… as they are now clearly data dependent, except for the BoJ.

Before that you will have time to warm-up with “gentle” economic data releases, including the global flash PMI prints for August and US July new home sales (both on Wednesday), US durable goods orders for July (Thursday), as well as the Q2 results of the AI-darling Nvidia on Wednesday.

As far as the global PMI indices are concerned, investors will look…

- whether the weakening momentum in global services activity continues

- for a confirmation -or not- about the recent strength of US economy as data have continued to surprise on the upside lately (Atlanta Fed GDPNow for Q3 has recently spiked to 5.8%)

- developments in China and in Europe: is activity weakening further (German PMI manufacturing was below 40 last month) or is it bottoming out? Speaking about gauging German manufacturing activity trend, the IFO index for August will be release on Friday. Bear in mind however that sentiment indicators have clearly underperformed hard data since the end of pandemics.

Otherwise, in geopolitics, the BRICS summit will take place in Johannesburg from Tuesday 22 to Thursday 24 August. Likely an interesting meeting, with perhaps some important decisions or major guidelines within concluding remarks, given the current economic & geopolitics woes of both China and Russia. Finally, earnings season is now coming to an end: except Nvidia’s report on Wednesday, results are also due from BHP, Analog Devices, Marvell, Snowflake or Lowe’s among the most prominent this week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.