DECALIA Market Updates by Fabrizio Quirighetti, CIO and Head of Multi-Asset

- After oscillating in a relatively close range for most of the year, the USD trade weighted index and the DXY (USD dollar index) have experienced a sharp decline so far this month.

- As a result, this recent USD weakness has rekindled both the debate about the structural downtrend of the greenback and concerns about further weakness to come in the near term. To make a long story short: we aren’t so concerned and hereafter are the reasons why.

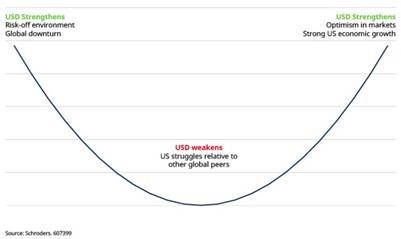

Let’s start first by trying to explain the recent USD depreciation against most major currencies. It is basically due to the dollar smile phenomenon, observed about 20 years ago by Stephen Li Jen: the USD tends to outperform other currencies in two extremely different scenarios: when the US economy is strong (leading to higher US rates) or when the global economy is doing badly and risk appetite is low (‘risk-off’ environment leading to bear equity market / bull bond market).

The dollar smile

In this context, as expectations have recently mounted for a soft-landing scenario (the Fed seems to win its war on inflation without tipping the US economy into a nasty recession), that’s bad news for the world’s reserve currency according to the dollar smile theory. In other words, the US economy is neither experiencing a strong enough expansion nor a deep slump, but just moderate growth with Fed hawkishness peaking. That’s the reasons why some strategists and traders, betting that inflation has now peaked, expect this downtrend is set to continue, especially considering the structural imbalances of the US economy (public debt and current account deficit).

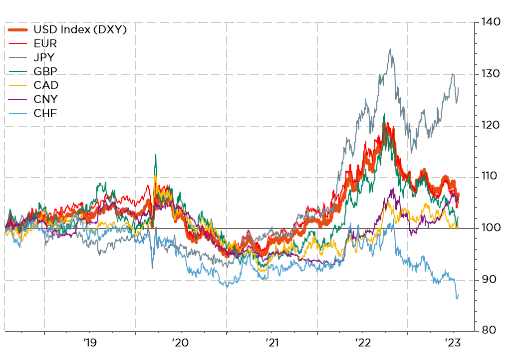

While I don’t rule out a shallow depreciation of US dollar in the second half of this year, I can’t really imagine another collapse or a lasting leg down in the foreseeable future because everything is relative, especially when you compare the pros and the cons of a currency pair… In other words, the USD depreciation means that at least one major currency or a few other DM currencies should appreciate! Assuming you are betting against the USD, or just concerned about its fate, what are the “viable” alternatives as the 2nd best liquid enough reserve currency? You haven’t so many choices between EUR, JPY, GBP, CNY, AUD, CAD or CHF. Basically, only the EUR will qualify. By the way, it represents indeed close to 60% of the USD index (see below the obvious subsequent close correlation between EUR and DXY).

Note for example that you won’t be able to buy any JGBs if you pick the JPY, or the “geopolitical” risks associated with CNY exposure (especially for non-EM private investors / less true for EM central banks), or the small economic weights and thus lack of ample financial markets liquidity related to AUD or CHF.

USD dollar index (DXY) and selected currencies against USD over last 5y (rebased to 100)

While the CNY as well as other EM currencies are not represented in the DXY index, their weightings aren’t negligible in USD trade weighted.

(China accounts for 14.5% and Mexico 13.8% according to latest Fed’s weights).

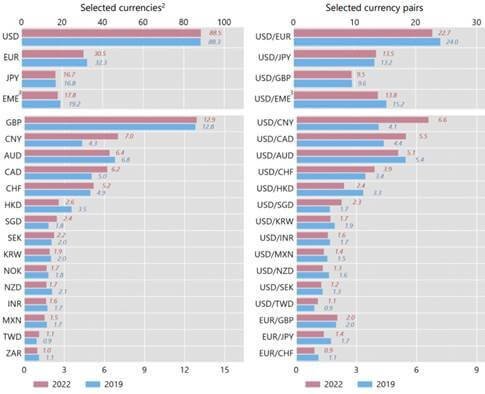

On a global scale, the CNY is now the 5th most traded currency behind USD, EUR, JPY and GBP according to the latest BIS Triennial Central Bank Survey on OTC forex (see below).

Forex market turnover by currency and currency pairs

Source: BIS Triennial Central Bank Survey, October 2022

Daily averages in April, as a % of total turnover: as 2 currencies are involved in each transaction, the sum of shares in individual currencies total 200%

Are the EUR and/or the CNY on the cusp to take over the USD as a global reserve currency? Let me doubt so about it that I feel relax enough to bet the full house that it won’t happen this year. For sure, the reserve currency status of the USD is eroding (it started with the creation of the EUR at the turn of the XXI century) but it’s a long, slow, gradual and non-linear process with potential setbacks on this long journey.

When assessing the “relative benefits” of other currencies over the next few months, the macro backdrop and especially the growth prospects of the US relative to the rest of world is thus crucial to the US dollar relative performance. Right now, it seems that if the US is eventually experiencing a soft landing, but the euro area is much closer to a stagnation (at best) or a recession, while China recovery growth is already petering out. Therefore, economic surprises have been positive in the US lately (basically not as bad as expected), while they have turned quite negative in both Euro Zone and China. Actually, the US is outperforming all other major economies on this gauge… So, growth prospects should not be a major drag for the greenback. In relative terms.

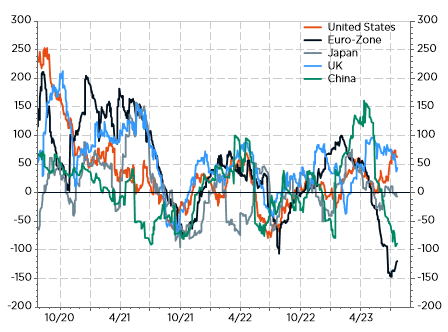

Citi Economic Surprise Index for selected economies

Another key driver of currencies is monetary policy. Same story as the one here above: while the Fed may be close to the peak, I doubt investors will price further hawkishness from other DM central banks such as the ECB or the BoE. At the opposite, ECB hawkishness may become less dogmatic as growth disappoints, disinflation process extends (helped also by recent € strength / end of sustained weakness) and ECB QT eventually impacts negatively liquidity conditions in the euro area (i.e. hindering monetary policy transmission).

For the same reasons, I suspect we also have already seen BoE peak’s hawkishness pricing in rates futures markets and I will rather bet on a downward trend on the “Quid” (i.e. GBP) now, rather than a further fall of the greenback. The Japanese Yen is the only currency that could be sustained by a (significant) divergence in monetary policy path in the next 6-12 months if the BoJ tweaks its Yield Curve Control policy this week (see below our economic calendar), leaving the door open for further tightening -even if slow and gradual- in the next few months. If BoJ doesn’t move this week, they will likely stay pat until October, accumulating more evidences that Japan economy is really out of deflation risks.

In other words, other major central banks are also close to the peak hawkishness (they could be one or maximum 2 meetings away from the Fed assuming this week we see the peak in US target rates). So, there aren’t many divergences between them are they are generally becoming less committed about the need of additional hikes.

It would be thus illusory at this stage to expect the Fed to cut because US inflation landing zone will remain above Fed’s target and US growth is probably more resilient than elsewhere, while other central banks remain definitively hawkish (except obviously for BoJ as it is far behind). Note for example that the RBA, BoC, Norges Bank as well as BoE -to a lesser extent so far- have already started to sound less hawkish on the back of the risks associated with their respective housing market (overvalued prices, household leverage and short-term maturity mortgages refinancing).

To sum up, the disinflation and resilient growth mix has been a favorable support for most financial assets and an overall negative for the dollar, but the lack of broad improvement elsewhere make it difficult to foresee a sustained USD weakness going forward. For sure, the dollar has been, and is still overvalued, but you need a strong enough (relative) trigger to push it back towards its fair value. Just look at the Swiss Franc! And concerning the US economy structural imbalances we are all well aware, the other economies aren’t in a much better seat. Just ask to the Brits! In this context, the USD still appears the least bad choice in an ugly contest.

It’s definitively all relative.

CIO, Head of Multi-Asset

Fabrizio Quirighetti and his team supervise $1bn fixed income allocation for DECALIA. Before joining DECALIA, he worked for more than 17 years at Syz Asset Management. He was CIO and Head of Multi-Asset and managed various Fixed Income strategies.

Before that, he spent six years working as a teaching assistant in the Econometrics department at the University of Geneva. Fabrizio Quirighetti holds a Master’s degree in applied econometrics from the University of Geneva.

From 2014 to 2020, he was an external member of the Tactical Allocation Committee of Compenswiss, the AHV/IV/EO social security fund manager.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.