There are 2 important pieces of news this morning. The first one is Oklahoma City Thunder won the NBA championship title for the first time as they defeated the Indiana Pacers in Game 7 of the NBA Finals last night. An impressively tied & undecisive series won by a young but true and mature team… Maybe more than a coincidence or a nod to PSG’s recent triumph. The second one is certainly more important for the markets, especially over the next few days, but the final outcome remains uncertain. The US struck 3 Iranian nuclear sites this week-end, increasing tensions in the region and subsequent market risks in case of a strong retaliation of Iran, which could disrupt oil shipments through the Strait of Hormuz (circa 20% of world’s production). In this worst-off scenario, energy prices may spike above $100 per barrel as the supply/inventories won’t be able to adjust fast enough/compensate for this (temporary) loss. However, a more limited and symbolic retaliation seems the most likely outcome at this stage.

These events add to a long list of signs that the world is changing: the economic, geopolitical, social, demographic and even sporting context is no longer the same as in the previous two decades. Although it’s always difficult to pinpoint the exact tipping point, it seems increasingly clear that the Covid crisis and/or Ukraine invasion by Russia were pivotal moments that will certainly be highlighted by historians in the future. For those who doubt about the recurring and often misleading “this time is different” refrain, here are some striking and sometimes interrelated examples in my view:

- The inexorable ascent of gold… and bitcoin since then, which were trading at around $1’500 per ounce and $10’000 respectively at the beginning of 2020.

- The rise of populism in general, or just the re-election of Trump as US President, which was not even really conceivable a year ago.

- Germany embarking on a massive fiscal expansion over the next decade

- The more fragmented world and the overall new geopolitical order since Putin decided to invade Ukraine, which has been exacerbated further by Trump 2.0 politics towards its commercial partners and security allies.

- The rising concerns about the US fiscal sustainability, which are denting the safe haven status of US Treasuries

- Chinese economy turning Japanese, while long JGBs offer some relatively attractive yield nowadays.

- The AI technology revolution and the subsequent historically elevated equity market concentration.

- The increasing role of passive investment (related also to prior point), algos and US retail investors… which makes life harder for active/fundamentals investors.

- Or some usual US recession warning signals that haven’t worked over the last few years…

I will focus on the last point, which is certainly not the most striking, but is nevertheless symptomatic of these changing times, while being also more under my primary competence as I started my professional career as a market economist at the beginning of 2000. I will just go through three well-known economic indicators, which seem to signal that the business cycle has changed or something has been broken: the US ISM mfg index, the Conference Board US leading economic index (LEI) and the US yield curve.

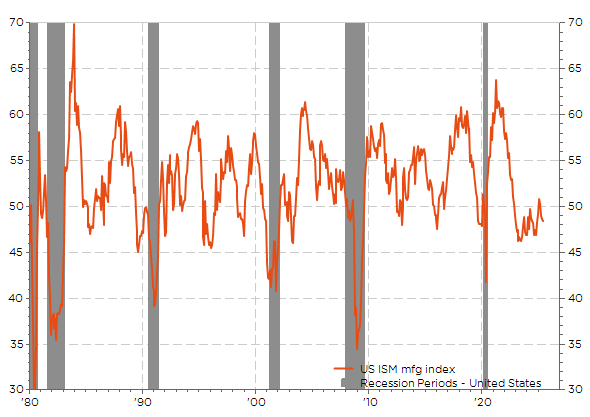

US ISM manufacturing index since 1980

The US ISM manufacturing index, which was known as NAPM (National Association of Purchasing Managers) previously, has been almost continuously below 50 since November 2022… While economists and strategists consider that a reading below 50 points to weak or lower growth ahead (the recession threshold was empirically below 45), we have to admit that it wasn’t really the case this time as growth even surprised on the upside the most optimistic expectations since 2023. Among the reasons often cited, there are the diminished importance of manufacturing production in the overall GDP (services sector is clearly dominating it) and the disruptions and the subsequent signal disturbances caused by the Covid.

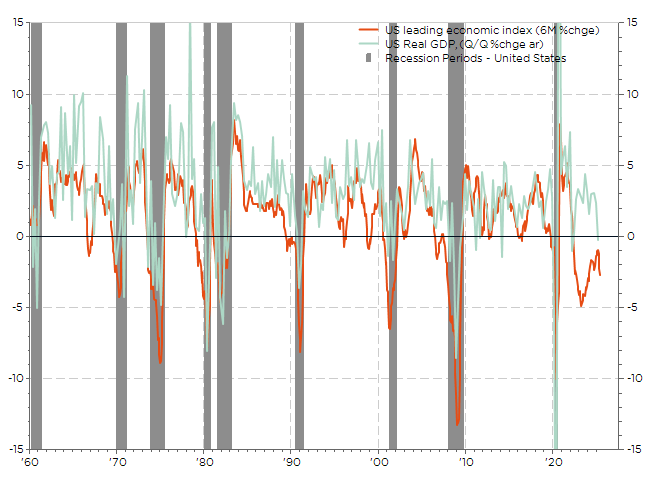

However, moving to the next one, the Conference Board US LEI, the results haven’t been more successfully recently despite it aggregates 10 key economic indicators (each selected “scientifically” through econometric modelling for its ability to forecast future economic activity – typically 3 to 6 months ahead).

The Conference Board US leading economic index and US real GDP Q/Q %chge a.r.

Here too, this indicator pointed to sub growth, if not a recession when it reached -5% in April 2023… Note that the recent disappointing US GDP figure (slightly negative in Q1) was essentially due to the trade tariffs disturbances as US companies imported massively before Liberation day and will now likely be reversed with a strong GDP rebound in Q2 (as US imports have collapsed since April).

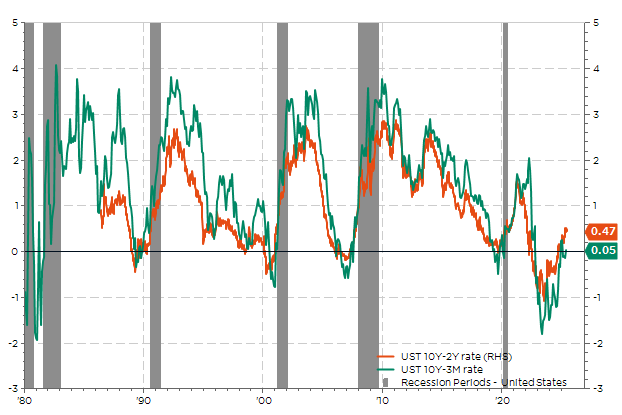

Last but not the least, the US yield curve slope (the difference between US 10y and 2y, or 3M rates) that many economists and strategists spoke about when it inverted at the end of 2022, but which everyone seems to have forgotten since it returned into positive territory. In my opinion, the inverted yield curve was just signaling lower nominal growth -not necessarily a recession- compared to the extraordinary strong rebound that followed the no less extraordinary collapse of economic activity during the Covid. For sure, the next recession always lie ahead but many of us have been puzzled by this apparent disconnection between this indicator and the resilient US economy so far. Note also that some structural inflation risk premium and fiscal concerns filtering into the long end of the curve may obviously continue to perturb the signal.

US yield curve slope (10y-2y & 10y-3M rates)

My conclusions are twofold. The first one is to underline and stress how quickly things can unravel if fear and uncertainty replace trust and stability with nowadays example about US politics impacting US Treasuries or the greenback. The second one is about the next recession as I fear that when people are too much crying wolf, you may end up not believing it. Please note this weekly letter (and his author) are taking a few days off in July. Normal service will resume from July 28th.

. In the meantime, I already wish you a great summer time.

Economic calendar

While developments in the Middle-East will continue to be front and center for markets (a NATO summit will be held in the Hague on Tuesday and Wednesday), the focus will also be on some economic data releases such as the global flash PMIs for June today and the US PCE core deflator (the Fed’s preferred inflation gauge) on Friday, along with consumer spending, disposable income and savings rate for May. The Bloomberg consensus forecasts both US headline and core PCE deflators to grow +0.1% in May -like in April-, without bringing down the YoY annual rate (expected at +2.3% and +2.6% respectively in May), while moderate MoM gains (+0.2%) are foreseen for both the US personal consumption and income.

Other notable economic data releases include the German Ifo survey (tomorrow) and the Euro Area business sentiment indicators (Friday) for June, as well as the US durable goods orders for May and the US jobless claims on Thursday. Finally, we will also get the June CPI preliminary reading for France on Friday.

After the recent decisions from most major central banks over the last 2 weeks, monetary policy’s topic will also remain in the air with Fed’s Chair Powell’s testimonies to Congress on Tuesday and Wednesday, while ECB’s President Lagarde speaks today in the EU Parliament, and BoE’s Governor Bailey testifies at a House of Lords on Tuesday. Finally, in China, the National People’s Congress will hold its Standing Committee this week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.