US growth is slowing, while inflation is rising. Despite the rosy US Q2 GDP print, the growth details weren’t so great when excluding the extraordinary distortions due to the tariffs’ saga: final domestic demand (i.e. consumption expenditures and capex) is running at about 1.5% a.r. in the first half of this year vs. a quite stable and consistent 3% over the previous 2 years. Furthermore, real personal consumption hasn’t grown at all since the beginning of the year as illustrated by the following two graphs.

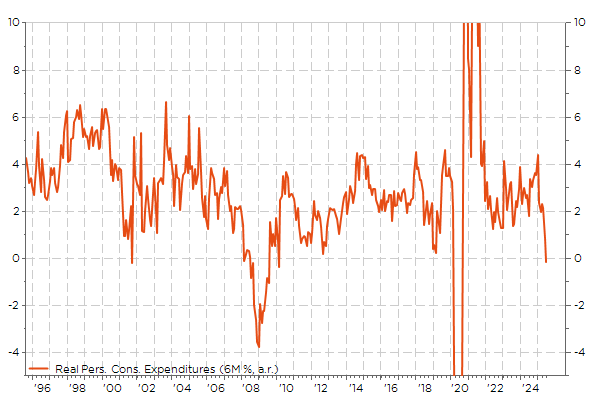

US real personal consumption expenditures, 6M% change, a.r.

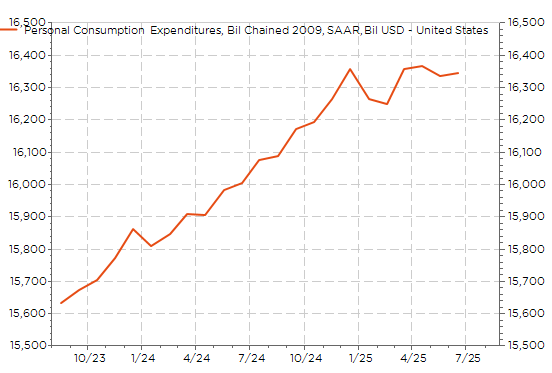

The sharp slowdown in consumption growth is quite impressive over the last 6 months… but this is somewhat misleading, as we are comparing the peak of real consumption at the end of last year with a sideways’ consumption trend since the beginning of 2025 (see graph below). So, it is very clear that consumption growth momentum has faded and that the “landing” phase is thus now finally taking place. Whether it will be soft or hard is still too early to say, but if the Fed manages to lower rates in September, the probability of a soft-landing increases. Unfortunately, the opposite is also true.

Real PCE (in $bn of 2009, real) over the last 2y

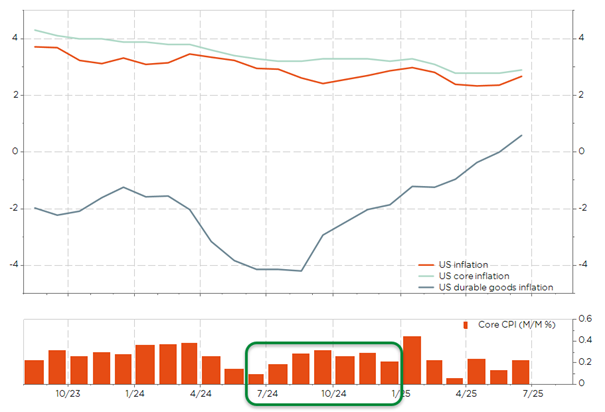

That’s why the next two monthly US CPI reports, this Thursday and on September 11th, will be key for the Fed, but also for financial markets overall. Core goods prices are expected to show an uptick reflecting import tariffs at some point, but the extent and timing remain unclear at this stage. For sure, Fed members, including Chair Powell, recently emphasized the somewhat temporary impact of these tariffs on inflation (you may look at Japanese annual inflation in the years when Japan government increased the VAT). However, the 12-month trend is moving in the wrong direction from the Fed’s 2% inflation target in the meantime, helped also by unfavorable base effect (July, August and September 2024 monthly CPI increases were 0.1%, 0.2% and 0.2%, respectively). As a result, US prices are expected rising closer to a 3% annual pace and eventually higher, while the economy’s growth trend has already slowed below 2%.

US annual inflation gauges and monthly CPI: mind the bas effect!

So, that may be something like stagflation-lite but in fact it looks like we are at a crossroads, with several potential economic scenarios for the next 6-12 months. Should inflation come as anticipated or higher than expected, it could drastically lessen the Fed’s leeway to cut rate at next month’s policy meeting by mid-September… while there is currently a 90% probability on a 25bps rate cut. An above-consensus CPI report could also spark a selloff in Treasuries with ripple effects on the stock market given its lofty valuations, as well as on the USD, which will likely regain some color. In other words, too much inflation will paradoxically increase the odds of a recession as the Fed will perhaps be then unable to accommodate financial conditions.

To sum up, the economic backdrop remains supportive for the time being, consistent with the soft-landing narrative, but is expected to become more fragile going forward. Recession, inflation, both or neither… Place your bets! On our side, in a pragmatic way, we remain in wait-and-see mode, still dancing as the music goes on (i.e. the soft-landing consensual scenario holds) while keeping a close eye on the exit door by using tactical protections to retain the projected upside potential, but with a lower risk profile.

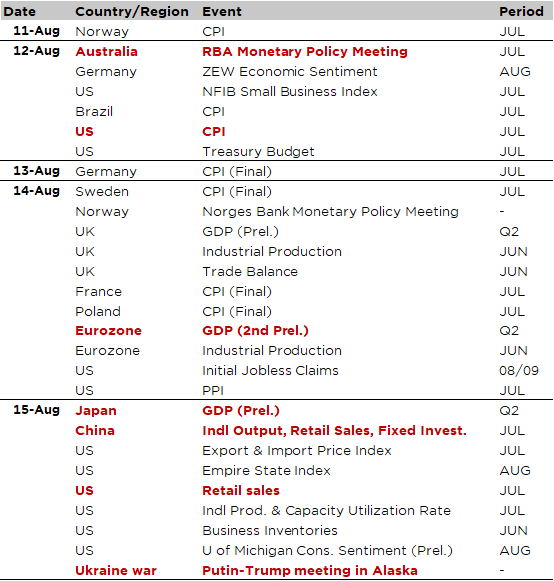

Economic Calendar

Quite a bit of interesting data and events this week. While the focus will likely stay on tariff developments ahead of the August 12 deadline for a pause in US tariffs for China exports, we will also get the US inflation report (Tuesday) as well as July retail sales (Friday), to see whether the impact of tariffs is starting to show up—or not—in US prices and/or consumption. The consensus expects a monthly increase of +0.2% for headline CPI and +0.3% for core CPI, which would push annual rates slightly up to 2.8% and 3.0% respectively (due to an unfavorable base effect over the next 2–3 months). Moreover, these figures feed directly into the Fed’s reaction function, with investors perhaps a bit too quick to take for granted a Fed rate cut as soon as September. In fact, there will still be one more job report and another CPI, plus the Jackson Hole Economic Symposium – which should be a non-event this year- before the next Fed meeting, which will include a Summary of Economy Projections and the famous dot plot, scheduled on September 17th.

Speaking of monetary policy, the Reserve Bank of Australia meets tomorrow morning. A 25bps rate cut to 3.60% is almost unanimously expected by economists following the latest inflation figures (lower than expected and now within the central bank’s target range), while another 25bps easing before year-end remains well in the cards. The Norges Bank will also meet on Thursday.

Elsewhere, we’ll have the first estimate of Japan’s GDP (Friday morning) and UK GDP (Thursday), as well as the second estimate of Eurozone GDP growth for Q2 (still on Thursday). German growth should be revised from 0% to -0.1% (industrial production “collapsed” again in June)—a backlash from the boost due to front-loaded exports to the US earlier in the year—but nothing worrying at this stage (investment and consumption have shown some signs of life in recent months). On Friday, the focus will shift to both China and US July retail sales and industrial production reports. While modest to moderate monthly growth is expected in the US with retail sales up +0.5% and industrial production flattish, economists foresee another set of not so great and thus disappointing Chinese data as both industrial production and retail sales annual growth are anticipated to slow.

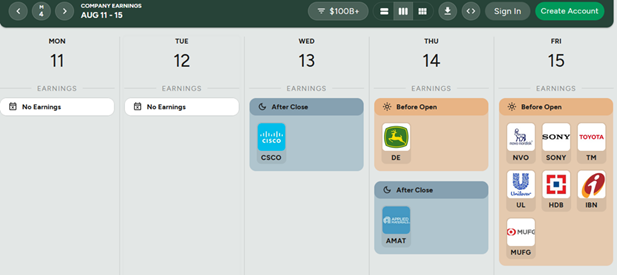

Otherwise, earnings season will start to ease in intensity (Nvidia still to come at the end of the month). We’ll see Deere, Cisco, and Applied Materials in the US; and, later in the week, Toyota, Sony, MUFG in Japan; Tencent and JD.com in China; or Unilever and Novo, among others, in Europe. Finally, Putin should meet Trump in Alaska on Friday to speak about a potential ceasefire in Ukraine… if he shows up.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-08-11

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.