After a week’s vacation, I’m back at the office. Although quite a lot has happened in recent days, including the US government shutdown, the strong rebound in the pharmaceutical sector (big sentiment relief after the deal between Pfizer and US administration), the resignation of the French prime minister, and the unexpected victory of a woman at the head of the Japanese government, nothing has really changed. Equity markets are hitting new highs, with AI still the uncontested leader, as is gold, which is breaking record after record, while credit continues to outperform duration. This ultimately inspires me to paraphrase the famous quote from Visconti’s film The Leopard: “If we want everything to melt up, we have to keep messing things up.”

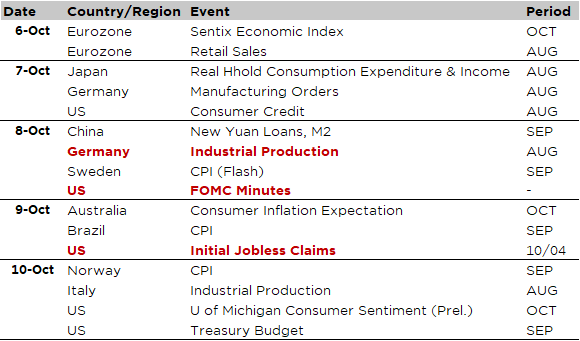

Economic Calendar

We will experience a quiet week in terms of economic data releases, thanks mainly to the ongoing US government shutdown, which will remain itself a key theme for markets this week and eventually a growing one if it last beyond. Staying with politics, France and Japan will also share the spotlight after the resignation of French Prime Minister Sebastien Lecornu and the surprising victory of Sanae Takaichi as the elected leader of the ruling Liberal Democratic Party, positioning her to become Japan’s first female prime minister (parliament vote expected on 15 October) as these political developments may have lasting impact on their respective economic policies and therefore on their currency, rate and equity market.

Given the lack of official US economic data releases, investors will mainly focus on the latest FOMC meeting minutes (Wednesday) and the several Fed members public appearances (including S. Miran & J. Powell) over the next few days in order to get some fresh insights about US target rates trajectories and overall monetary policy stance beyond October as another 25bps rate cut by the end of this month seems a done deal. Otherwise, we will also get the University of Michigan US consumer sentiment (Friday), a few inflation’s prints in the Nordic countries and Brazil (Thursday) and the factory orders and industrial production in Germany (Tuesday and Wednesday).

Note finally that the official Q3 earning season will kick-off next week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.