Right now, there are two things that are shining brightly, continuing to climb to new heights, leaving us wondering how far they can go: gold, of course, which has just experienced its strongest weekly increase (+8.5%) since 2008, reaching a new record high of over $5,000 an ounce… and Cagliari Calcio, which has just secured its second consecutive victory (2-1 against Fiorentina), propelling itself into the middle of the table, eight points above the dreaded relegation zone. In the short term, the outlook remains favorable for both, as Cagliari will face the second-to-last team in the standings (Verona) next weekend and gold’s rise could very well continue—albeit at a less frenetic pace—in the coming months.

Indeed, I noted in my 10 predictions for 2026 that the next leg higher in gold will likely be driven by private investors,… “as distrust in fiat currencies and US Treasuries grows, households’ allocations to gold should increase further”. I also added that this trend “may be reinforced by a downturn (or at least reduced volatility) in cryptocurrencies with precious metals increasingly attracting speculative capital once drawn to crypto”. So, gold is perhaps becoming the new Bitcoin.

Let’s make a step back a few years ago, when I was asked about the fair value of Bitcoin. “What do I know?” I replied, “I was bearish at $10’000”. However, I suspected that while Bitcoin rising prices were underpinned by the similar drivers that also pushed higher the valuation of most financial assets at this time, namely abnormally low rates, excessive liquidity and overall financial repression and heightened geopolitical uncertainties, cryptocurrencies were more prone than gold or other financial assets to suffer from a bubble and the Dunning-Kruger effect (i.e. and overconfidence bias to make it simple). Today, at $5’000 per ounce, I remain bullish on gold and I will try to convince you that the barbaric relic valuation isn’t so foolish.

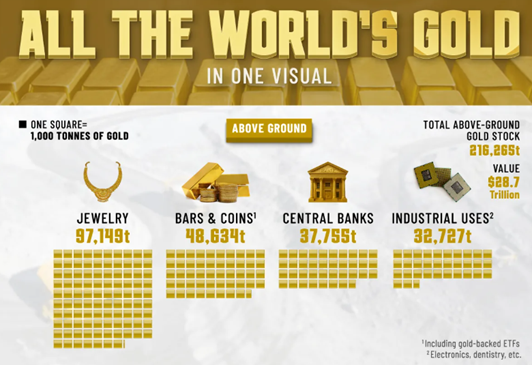

First, let’s explore the topic of the supply. Compared to the Bitcoin, gold doesn’t benefit from a limited supply stricto sensu as its production (or supply) increases by about 1-2% per annum. Or about 3’000 tons per year considering that the total amount of gold excavated to date represents approximatively 220’000 tons. However, this rate of growth remains well below the rate of nominal GDP (6-7% per year over the past 30 years) or just the debt in system (the net fixed income supply is forecasted to increase by $4.6tn this year, vs. a gold production of about $15bn at the current prices). Keep also in mind that you can’t really use Bitcoin for jewelry purposes… yet (maybe one day, mothers will receive a Bitcoin necklace instead of pasta’s one as a Mother’s day gift), neither for industrial usages, while I haven’t seen or heard many central banks -if you exclude El Salvador- adopting it for their forex reserves or as an asset in their balance sheets. So, it you take the total excavated gold so far, here is the current breakdown.

Total excavated gold breakdown by usage (in tons)

Source: VisualCapitalist.com

Just note that, adjusted to the current gold price, the total value represents now $34.5 trillion ($28.7 tn was the few days or weeks ago estimates) and thus the pool of gold “available” for investment purposes is worth about 4-5 times less (let’s assume 4 and thus less than $10tn) as it just represents 20-25% of the total gold available. But how much are worth the total marketable debt or the global listed equity shares? Both are about the same size, in excess of $160tn for debt and somewhat below $150tn for global equity markets -excluding private markets in both cases. So, I don’t find it shockingly foolish that gold -as a financial asset- represents less than 5% of the total value of debt or about 3% of global financial markets.

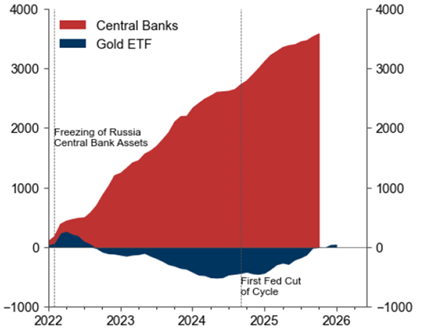

The graph here below also shows that the strong or “excess” demand in gold seen over the last 4 years has been mainly driven by central banks demand, especially those from EM economies, managing large pool of fx reserves (DM central banks have rather tended to sit on their current gold holdings), while households demand for investment purposes -at least through physical backed gold ETFs- has only started to pick up, at a moderate pace since the end of 2024. As a result, there could be further additional gold demand, from private investors, in the coming months. Add now speculative flows, thrill seekers and casino enthusiasts and you easily experience a booming demand that rapidly exceed the “limited” supply in the short term.

Cumulative Gold Demand since 2022 (in tonnes)

For so long, cryptos aficionados have pointed to the many similarities and few advantages of Bitcoin over gold. Strangers Things: the world is turning upside-down thanks to Trump essentially but also according to their latest price trajectories, which seem to say the opposite: Bitcoin is exactly like gold except when it isn’t!

Gold has a very simple advantage over Bitcoin: it actually exists. You can touch it, hold it, drop it on your foot (painfully real), and store it without needing Wi-Fi, passwords, updates, or a nervous breakdown when the network is down. Gold has been around for thousands of years: it survived empires, wars, plagues, and fashion disasters. Bitcoin, on the other hand, showed up in 2009 and already feels like it might already need a rebrand. Gold is timeless. Kings wore it, banks hoard it, jewelers adore it, and industries depend on it. It doesn’t care about trends, influencers, or tweets. It doesn’t need electricity to exist, and it never disappears because you forgot a password. You don’t “lose” gold in a software glitch. You either have it… or someone stole it the old-fashioned way. Bitcoin is innovative: a brilliant piece of technology built on blockchain, promising programmed scarcity and potential financial freedom. But let’s be honest: it still feels a bit like a digital fashion statement. Very exciting, very modern, and very dependent on electricity, the internet, and collective belief. Gold doesn’t ask for belief. Gold just sits there, shiny, indestructible, and quietly confident, like it has been for millennia.

In short: Gold is security, history, and stability. Bitcoin is innovation, potential, and a bold experiment. One is a store of value, the other a store of hope. In the current highly uncertain and unchartered geopolitical context, hope is clearly in high demand and short supply, but this structural imbalance translates rather into a lower price of hope – contrary to what economic theory would suggest, and a rising price tag for timeless and proven store of value.

Funny facts: did you know that the total excavated gold so far (i.e. 220’000 tones) could be stored in just two Olympic size swimming pools (50m in length, 25m in width and 3m of depth). As 1 kg of gold has a volume of 51.8 cm3, you could eventually put 625kg of gold -worth $100bn- in your Easyjet cabin luggage. Unfortunately, you will likely endure 3 major issues: you won’t be able to lift your suitcase, which will largely exceed both the maximum authorized weight of 15kg and the maximum value amount you can cross a border with. However, you could also easily hide a few pounds at the bottom of your suitcase and still have plenty of place for a toothbrush, some underwear and clothes.

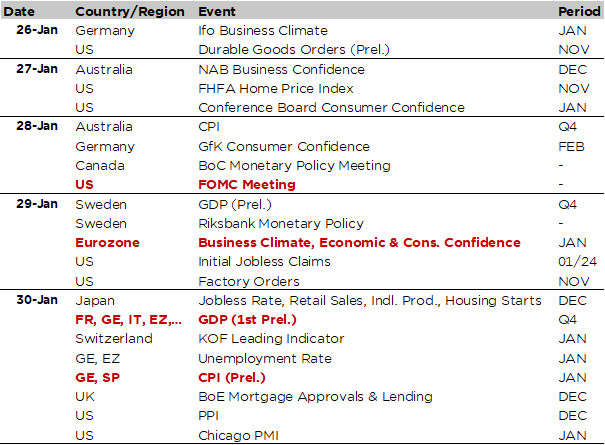

Economic Calendar

This week, the focus will likely be on the Fed’s decision (Wednesday), even though it will certainly be a non-event as it will keep rates on hold at 3.5%-3.75% as unanimously expected. The much-awaited nomination of the next Fed Chairman (it now seems that the new favorite is the unexpected-till-recently challenger Rick Rieder…), as well as any Trump’s tweet or trick challenging the independence of the US central bank, could be far more important for markets than the incoming FOMC meeting. Staying with monetary policy, central banks in Canada (Wednesday) and Sweden (Thursday) will also meet and very likely keep rates unchanged at 1.75% and 2.25% respectively.

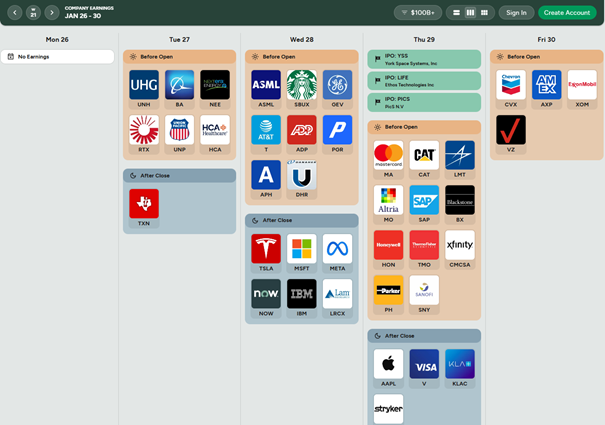

Moving to economic data, the highlights will be found in Europe for ounce with the preliminary Q4 GDP for the major Euro Area economies and January CPI prints for Germany and Spain, all released on Friday. A timely check-up on growth and inflation dynamics for the Euro Area, which may either confirm the goldilocks tendency (good to better growth prospects and benign inflationary pressures) or not in case of disappointing data. In the US, we will get the durable goods orders for November (Monday), the Conference Board’s consumer confidence for January (Tuesday) and December PPI (Friday). In Asia, several key Japanese data will be released on Friday morning, including the December jobless rate, retail sales and industrial production among many others. Note also that the Lower House election campaign that will begin on Tuesday ahead of the 8 February vote. Finally, rounding out with corporate results, the earnings season will shift into high gear next week with Tech earnings around the corner. Apple, Meta, Microsoft and Tesla are indeed set to report in between Wednesday and Thursday. It will be a key event as these 4 names represent 16% of the S&P500 market cap and Tech has wobbling lately with several Mag7 trailing behind the broader market. In addition, some other big US caps will also report, such as Visa & Mastercard, Altria, Stryker, AT&T or Starbucks among others, on the same days, while in Europe, we will get the earnings from the two largest tech companies (ASML & SAP), LVMH or Roche. The focus will also be on defence firms (RTX, Northrop Grumman and Lockheed Martin), as well as on the energy sector on Friday as Exxon and Chevron will report.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2026-01-26

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.