While Cagliari Calcio is already slowly sinking into the lower reaches of Serie A following its last minute 0-1 honorable defeat against Napoli this weekend, another negative trend is currently causing me much more concern as a bond portfolio manager. This is, of course, the deterioration in French public finances, highlighted by the political instability that has now persisted for over a year, but also by the improvement in the credit quality of the past laggards, namely Italy (credit rating raised to BBB+ by S&P in June), Portugal (raised this weekend to A+) or Spain (rated A and experiencing strong economic growth). Unlike Cagliari, which still has plenty of time and opportunities to ‘simply’ avoid relegation, time is currently working against France, while the solutions for avoiding a debt crisis in a more or less distant future are becoming increasingly slim. Here is a brief (non-exhaustive) overview of the main reasons why I believe there is cause for concerns, as well as some precautions to take with bond portfolios.

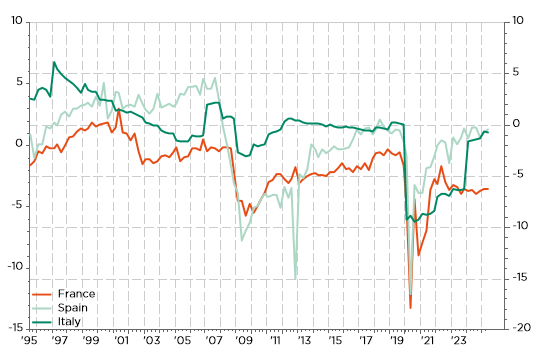

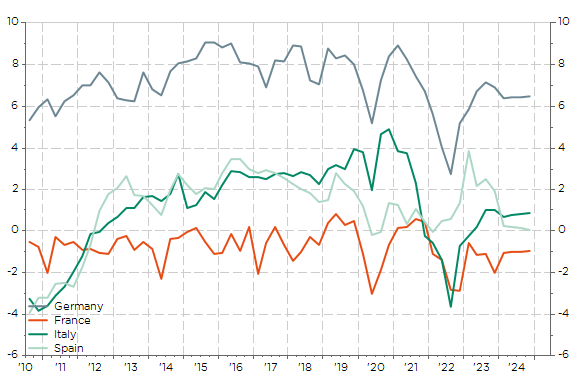

Firstly, France’s inability to balance its accounts for more than twenty years, with an almost structural deficit in its primary balance, while other eurozone countries, such as Italy and Spain, now have a healthier budgetary trajectory than France.

Government primary balance as a %GDP

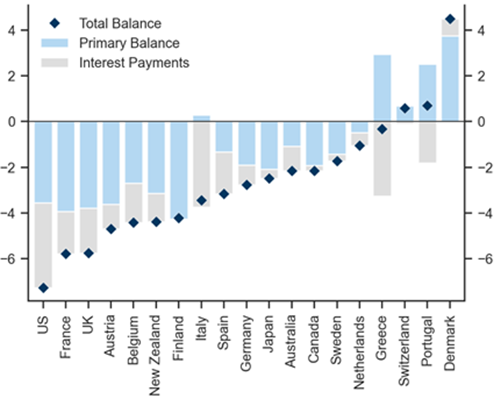

Government Deficit in 2024 as a % GDP with a breakdown between the primary balance and interest payments

Source: Goldman Sachs

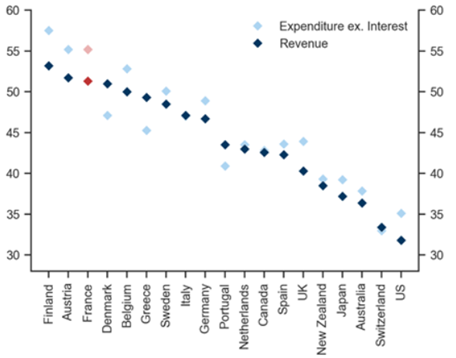

Unfortunately, it is not possible to stabilize public debt without a primary balance surplus. Admittedly, some developed countries are not doing much better than France, such as the United States, but they at least have the advantage of stronger economic growth for the time being and/or the option, albeit an unpopular one, of raising taxes in the long term (see government revenues and expenditures graph here below).

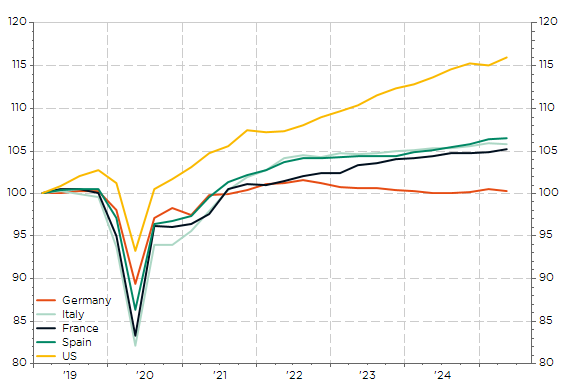

French GDP growth fading and underperforming peripherals

Not only is French growth slowing down, but it is also dependent on… debt. This therefore implies an optimal pace of deficit reduction carefully balancing the positive impact on debt of moving too slow (preserving tax revenues) and the negative impact on growth of going too fast. Execution risks are thus high, especially in case of an unexpected economic shock.

As mentioned above, France can’t really increase the taxes as France already has one of the largest government revenues among developed economies, suggesting little room for further increases. So, the only way is to reduce spending, which by the way tend to be more successful in sustainably contain the deficit.

Tax me if you can: government revenues and expenditures (excl. interest) as % GDP in 2024

Source: Goldman Sachs

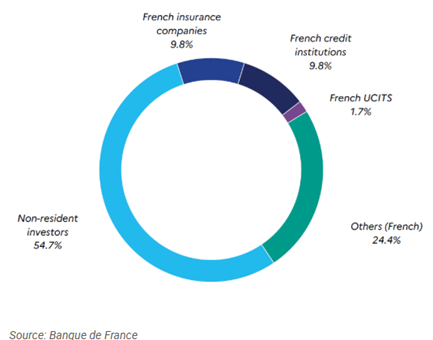

The perilous adjustment required by this increasingly precarious fiscal situation is made even more complicated by another factor: French debt is increasingly held abroad. This is easy to guess, since the current account balance, which roughly and indirectly represents the surplus or deficit in savings at the national level (government, households and businesses), is chronically in the red in France. It is worth noting once again the difference with Italy, whose government debt is now largely absorbed internally, particularly by households directly through subscriptions to certain new issues reserved for them on a priority basis with marginally more favorable terms.

The main French growing export: national debt. Current account balance as % GDP

French government debt by group of holders as of Q1-2025

In this context, political instability therefore acts as an amplifier, focused on the outside world, for France’s budgetary issues. As this fiscal cliffhanger looms, I deem prudent to not have direct exposure to long French sovereign bonds (for those who want to avoid headache by having to pick a single country, favor European Union bonds), limit or reduce exposure to French financial issuers (banks and insurers) -especially subordinated debt or bonds with maturities above 5y, reassess also exposure to French companies with direct ties to the government or just highly dependent of the French budget, particularly those with weak balance sheet fundamentals. It’s not too late to act because France sovereign debt spreads, as well as overall credit spreads, have remained tight so far, but, as the Sage of Omaha (Warren Buffet) will tell you: “when the tide goes out do you [really] discover who’s been swimming naked”.

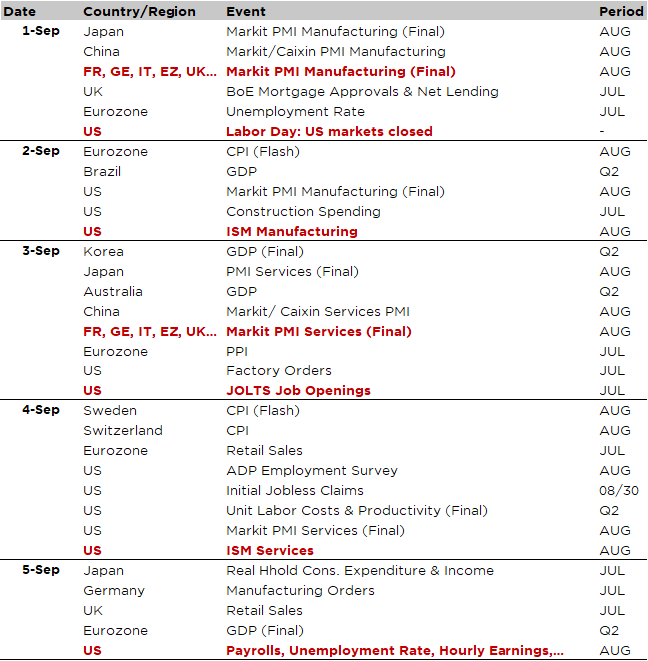

Economic calendar

Welcome to September! It will be a busy week in terms of macroeconomic data for the back-to-school season that coincides with the last and decisive sprint to year-end. We will get the August final PMIs for the major economies across the world (manufacturing indices on Monday and services indices on Wednesday), the US ISM indices (Tuesday and Thursday, as today is a bank holiday in the United States for Labor Day holiday), and the eagerly awaited US job report (Friday), which could influence the Fed’s decision and Jay Powell’s tone at its next meeting on 17 September, depending on the direction and scale of any surprises on this front.

As regards this US jobs report, the consensus forecasts currently 75’000 new jobs’ creation in August (with estimates ranging from 0 to 115k), an unemployment rate rising to 4.3% from 4.2% in July, and wages up by +0.3% MoM (+3.8% yoy). If this proves to be correct, it wouldn’t move much the needle regarding the Fed’s upcoming decision, as everything remains possible and will depend even more on the inflation figures published on 10 and 11 September (PPI and CPI). Until Friday, we will also have a few other labor market indicators to tide us over: the employment components of the ISM indices (Tuesday and Thursday), JOLTS job openings (Wednesday), weekly unemployment claims and the ADP survey (Thursday).

At the micro level, the earnings season is coming to an end. The main corporate results feature Salesforce (Wednesday) and Broadcom (Thursday).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.