Welcome to June! Looking back, I hope you didn’t sell in May -or at least not at the very beginning of last month as the US S&P500 index just experienced its best month of May since… 1990. The 2 main reasons behind the surprising sharp rebound of risk-on assets have been (1) a much better than expected earnings season with US earnings growth up +13% yoy (vs. +7% expected) led -once again- by an impressive set of results of most Mag7 stocks and, above all, (2) the TACO effect, an acronym recently coined by a FT journalist to describe the Trump trade (Trump Always Chicken Out) as the US President and his administration do not have a very high tolerance for market and economic pressure. The recent twist and turns in Trump’s tweets concerning Jerome Powell or China and European tariffs levels and deadlines seem indeed to confirm this “adage”. As a result, recession concerns have receded over the last few weeks as the tariffs threat has been delayed and eventually sweetened.

Meanwhile, the markets have already move forward to the next matter, which is the One Big Beautiful Bill. The Tax Foundation estimates that this bill, if enacted, will increase budget deficits by an average of 1.4% of GDP per year over the next decade. Moreover, the debt sustainability worries have now come back in the forefront as there are growing doubt about the funding plan of these fiscal largesse in a context where the DOGE government savings hopes have already faded away (Elon Musk had to back down), while reciprocal tariffs revenues will be much smaller than expected if they remain just a threat. This means the US may run budget deficits in excess of 7% of GDP for the foreseeable future! Not exactly what foreign bond’s investors are looking for as it dents US Treasuries safe haven properties.

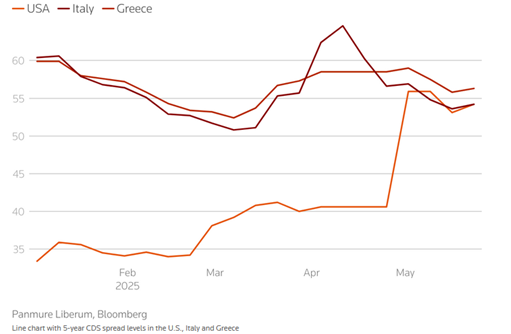

It’s not Greece, but it’s not Great

US default risk: 5-yer CDS spread in bps

The more optimistic investors may rightly point that the US will be able to sustain this debt overload either by increasing taxes at some point (or reforming its social security system) or just by experiencing much higher (nominal) growth. Not really a win-win situation as increasing taxes will slow down growth, while higher (nominal) growth will also mean higher for longer rates. If not, it would mean financial repression that should be detrimental to the greenback. And if growth reaccelerates at the beginning of next year, on the back of the current Big Beautiful Bill proposal with fiscal largesse frontloaded in H1-2026, the Fed will perhaps have to consider some unwelcomed tightening. In other words, Trump and his administration, as well as (foreign) investors, will sooner or later come to the conclusions that you can have your TACO and eat it forever.

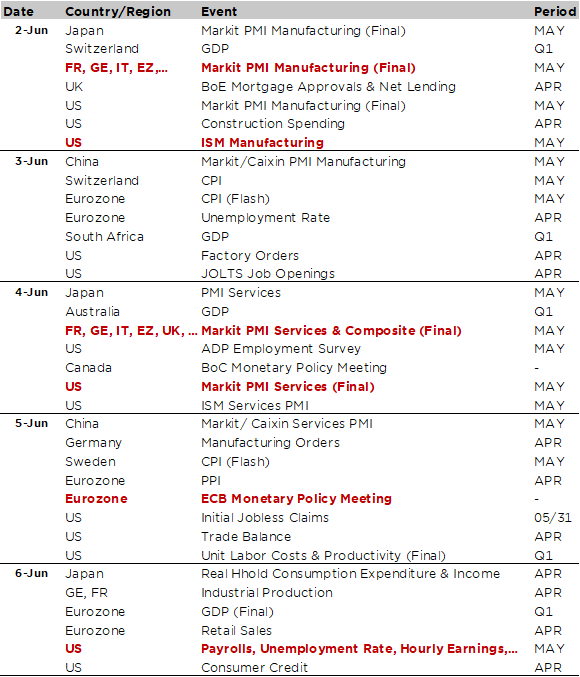

Economic calendar

Welcome to June! A busy week in terms of economic data awaits us, with the releases of the final global PMI indices and US ISM figures on Monday (manufacturing) and Wednesday (services), the ECB monetary policy meeting on Thursday (a 25bps cut to 2% of the key deposit facility rate is expected) and the US jobs report on Friday to round out the week (the consensus is expecting +130k net new jobs last month vs. +177k in April, a stable unemployment rate at 4.2% and wages up +0.3% MoM in May).

Investors will be closing watching these data to assess if…

- Economic growth in Europe continues to show some resilience as it has tended to surprise on the upside so far this year (to be honest, expectations were very low too), with manufacturing PMIs bottoming out and services PMIs remaining close or above 50.

- US economic activity is not showing further signs of fatigue, on the back of the erratic policies of the Trump administration and higher for longer rates, through the length of the US ISM indices releases, but above all, the jobs report, which could tip the balance towards a more accommodating stance from the Fed going forward in case of disappointment.

- The ECB continues to stimulate this embryonic growth in the eurozone by cutting rates once again, thus validating the decline in inflationary pressures, also supported lately by the strength of the euro (vs. the USD) and the fall in energy prices, leading overall to a more goldilocks/friendly environment for euro denominated assets. This would be the 8th ECB’s rate cut -over the last 9 meetings- since June 2024 (NB: the deposit rate was at 4% one year ago).

Other notable releases due this week include the US trade balance for April on Thursday (a big decline of US trade deficit is in the cards, reversing most of the Q1 surge due to the imports boost ahead of tariffs announcement); the US JOLTS jobs openings and ADP employment survey, on Tuesday and Wednesday, like preliminary teasers for the Friday US jobs report; or the Swiss May CPI print tomorrow, as well as the Bank of Canada Monetary policy meeting on Wednesday. Finally, the earnings season is now coming to an end but investors will keep an eye on the following Q1 corporate results earnings: Broadcom, Crowdstrike and HPE in tech as well as Dollar General and Dollar Tree in the retail sector.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.