With the US government shutdown averted (for now), Italy government debt no longer in an imminent danger of a cut to junk at Moody’s (outlook was raised from negative to stable) and the qualification of the Nati (Swiss soccer team) for Euro 2024, I am wondering what could derail global equity markets to end the year on a positive cheering mood.

Clearly not seasonality if you refer to the GS graph here below. Nor the macro backdrop given last week data, which showed a softer US CPI reading and a more resilient than expected retail sales than expected… The perfect opposite of what investors gut feelings were fearing, reinforcing therefore the prevailing Goldilocks narrative. Let’s just hope the Squadra Azzura won’t mess up this fairy tale tonight!

S&P 500 Index Return Seasonality – Santa-Claus is your friend (source: GS)

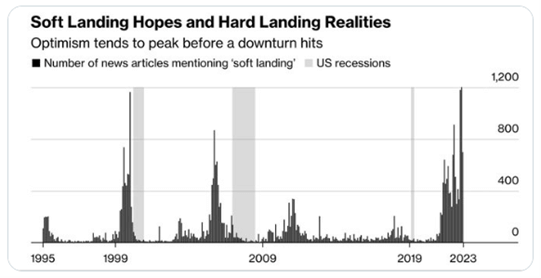

Last week, I went through my economic growth outlook, which could be summed up by “quite resilient global economic growth thanks to solid consumption trend, as well as an improvement on the manufacturing sector, with less divergences than in 2023”. Before to turn on inflation and monetary policy, a last point worth mentioning. Severe recessions don’t warn you in advance by sending you an invitation… And guess what? They always look like a soft landing at the beginning. As a result, recession risk can’t be completely dismissed and fears will thus continue to haunt us from time to time (early signs of recession in every slowing data).

Hard landings don’t give notice (graph found on a Twitter post)

While I don’t expect sizeable surprises on both inflation and monetary policies, here are a few more insights about how things may evolve. While the disinflation cycle will likely continue next year, I believe

- Core inflation will however remain above 2% in most DM, including obviously the US and the Euro Area

- Upside risks on the back of a spike in energy prices or an unexpected reacceleration of global/China growth can’t be completely dismissed -even if the probability is very low- as they may have a bigger or more profound impact on markets, forcing eventually central banks to hike further.

- If I prove wrong and core inflation falls very quickly below 2%, while growth remain resilient, it would be a very favorable Goldilocks regime for markets and thus investors.

- We should not dismiss the cumulative inflation experienced over the last 2 years. I mean, it could be somewhat misleading to look only at the year-over-year rate of inflation when it’s very volatile (but it makes clearly more sense when it’s quite stable around 2%).

As far as monetary policy is concerned, I think

- We may stay in a higher for longer regime for policy rates. The recent rates relief is obviously welcomed but it won’t extend much from here as it’s hard to reconciliate 100bps Fed rates cut next year with resilient growth and sticky core inflation. End of rate hikes doesn’t mean cuts are imminent (just refer to Fed funds rates level and changes in the 90’s… when inflation was not an issue).

- The Fed, as well as ECB, may be forced to maintain a hawkish bias in order to prevent investors to price imminent cuts. Keep in mind what I said above about inflation and also the central banks reputation if they ease too soon and inflation rebounds. In other words, there is an asymmetry today for them as they will rather err on the hawkish side (contrary to the previous decade when deflation was the main risk and central bankers were ultra-dovish)

- The real acid test about central banks credibility, and a key question for markets, is “can they keep on hold despite weaker economic data (assuming sticky inflation)”?

- Financial conditions will also enter into monetary policy calibration: the recent easing in financial conditions gives likely an additional incentive to the Fed to not appear too dovish at its next meeting

The graph here below, from Deutsche Bank, sum it well. It shows at which levels were both US core inflation and US unemployment rate when the Fed has previously begun cutting rates.

Combination of US core CPI & unemployment rate when the Fed has previously begun rate cuts (source: DB)

At first glance, it might seem that we’re not far from the conditions that could justify a Fed’s rate cut. Take a second look and then consider the rate cuts of 2019, 2001 and 2007… They were essentially due to the collapse of the equity and credit markets (i.e. extraordinary sharp tightening of financial conditions leading then to economic pain and/or deflation risks). This means that to see rates cuts next year, we must first observe either a serious financial crisis, or a significant rise in unemployment (deep recession), or the risk of deflation falling further below 2%, or possibly a mix of all these. Either there is still a long way to go before seeing rate cuts or beware what you wish for…

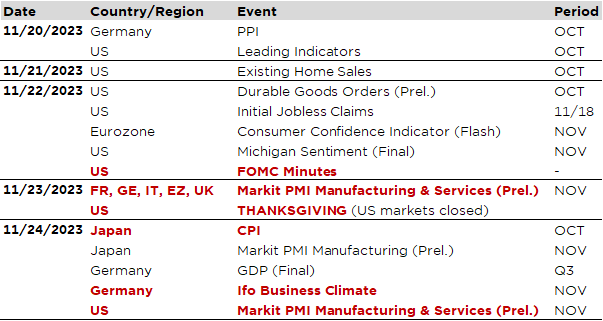

Economic Calendar

For once, markets volatility shouldn’t be much impacted by economic releases this week given the skinny macro agenda over the next few days. The primary culprit is turkeys’ head-cut-party on Thursday, i.e. Thanksgiving, followed then by the Black Friday shopping hysteria, as there won’t be any US economic reports released during these two days, while US markets will be either closed (Thursday) or sleepy (Friday).

As a result, the only noticeable data to watch this week are:

- The global flash PMIs for November on Thursday and Friday (for Japan and the US), which will likely be the main highlight of the week in terms of economic indicators. They will bring some insights about current activity trend in manufacturing and services and, more specifically, whether global manufacturing is somewhat rebounding/bottoming out and if services remain in (slight) expansion overall. As far as Europe is concerned, both services and manufacturing gauges are expected to stay below 50 across the major economies according to the consensus.

- Before that, on Wednesday, we will get the US durable goods orders for October, weekly initial jobless claims (brought forward due to Thanksgiving’s holiday), University of Michigan Consumer Sentiment final print for November and the FOMC minutes. These minutes should move a needle as the US CPI report released last week helped to solidify investors’ expectations that the Fed has now finished hiking (at least in the near future).

- Elsewhere, on Friday, investors will focus on Japan CPI report for October as well as the latest German IFO business survey for November. It’s worth noting that Japan is among the few economies to not have experienced (yet) a meaningful decrease in its annual inflation rate, admittedly starting from a much lower peak than other DM economies. Anyway, inflation excluding both fresh food and energy (called “core-core inflation” in Japan) is expected to tick down to 4.1% in October from 4.2%, while headline inflation should remain around 3%.

Finally, in corporate earnings, the spotlight, and likely the biggest event of the week, will be on Nvidia results tomorrow. Lowe’s, Deere, Medtronic and Baidu will also report this week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.