Welcome to December (at the end of the week)! A month often associated with a sense of warmth and joy as people around the world come together to celebrate various holidays and festivities… on top of this year of the recent successes of Italy with its credit outlook raised from negative to stable by Moody’s, the qualification of its Squadra Azzura for the Euro 2024 or its Tennis Davis Cup Title won yesterday.

So, it’s really time for being grateful! For investors too on the back essentially of a more benign inflation backdrop lately made of easing labor market, softening wages growth and lower energy prices, which has led to a volatility crush in both bonds and equities that we haven’t seen for almost two years. The winter season has thus brought a magical atmosphere not only on streets adorned in festive lights, but also on the financial markets, which seem to have regained some calm around cozy fires and the sweet aroma of Goldilocks’ treats filling the air. What could go wrong? You and I have still one month to think about the many risks and few opportunities that lie ahead next year. In the meantime, let’s enjoy the Christmas Ride and please find a summary of our tactical views and positioning here below.

- Macro Narrative: Make some noise for Santa’s Goldisocks – Soft landing scenario is now consensus with recent market-friendly economic data of resilient growth (solid US consumption, end of de-stocking in Europe, and government support in China), further disinflation trends, and central banks now clearly on hold. Meanwhile, latest geopolitical concerns have largely taken a backseat, driving bonds yields lower again and providing an early relief Christmas gift for investors.

- Our Global Scenario: More of the same next year, with less divergences but persistent risks – Our base case macro scenario still foresees a marked economic slowdown with lower inflation (but above central banks’ targets) leading to hawkish “hold” monetary policies. The recovery in Services is now almost complete but a large part of the slowdown is the result of tighter monetary policy required to bring inflation down. The latter is indeed starting to bite though the transmission is uneven across countries, industries and corporates. The good news is that developed labor markets remain healthy and inflation has declined with historically low unemployment rates and rising real disposable income helping to support activity but also acting as a floor for inflation…

Hence, with no major correction for risky assets driving valuation back to more attractive levels and forcing central banks to adopt a more dovish stance expected yet, we anticipate a continuation of the tug of war between higher for longer rates regime headwinds on the one hand and unusually resilient growth & sticky inflation on the other… until something might break. Finally, while some of the excess pessimism on both growth and inflation has dissipated, latent risks persist (energy prices, China’s deflation scenario, growing debt supply and subsequent distress risks, monetary policy mistake or deepening geo-political fragmentation among others).

- Equity Valuation: Take a look under the hood – Looking beneath expensive global, and especially AI-powered US, equity indexes surface still reveals attractive pockets of value in our view. Both peaking rates and more upbeat earnings outlook support today’s controversial lower risk premia with relative valuation opportunities in Europe, Energy, and most Small & Mid-caps in particular.

- Earnings Momentum: Q3 reporting season was just fine – Despite a well-flagged slowdown in growth, latest corporate results have again been speaking for themselves (mixed top-line trends but better margins) with still no signs of any imminent earnings depression. Consensus expectations for flat global earnings growth this year and a +10% rebound in 2024 thus remain valid, in our view.

- Sentiment & Positioning: Still Hot N Cold – While most technical signals have been flipping from Bearish to Bullish and vice-versa in recent months, we are back to square one (Neutral) today. However, market stress indicators have now eased somewhat and investors’ (still below historical average) equity portfolio exposure provides room for upside, even after this summer’s re-risking.

- Fixed Income Valuation: Fair-value overall but cash remains king – The long end of most DM sovereign curves now seem fairly valued to us but we continue to favor the short end (including cash instruments) as (1) the yield curve may remain inverted for longer in a higher rates policy regime and (2) we still doubt about Govies’ duration buffer potential in a scenario of sticky inflation, “hawkish hold” monetary policies, government debt (over-)supply and milder recession (positive correlation with equities). As far as credit is concerned, we see only few pockets of value, mainly in hybrid/subordinated bonds or in 1-5y IG European corporate bonds with a buy & hold approach. Therefore, we still recommend to act selectively with an overall “up quality” stance, staying away from most fragile segments or issuers.

- Alternatives – Beware of Tighter Financial Conditions – The impact of higher rates on specific asset valuation and/or expected IRR will likely take more time than previously anticipated. In this context, we still favor a selective approach to private debt strategies (i.e. looking for a decent yield pick-up along with downside protection) and Direct Investments with reputable and well-known partners.

- Commodities/Gold: More of the same – We expect the tug of war between cyclical downside risks and favorable long-term structural trends (e.g. climatic & energy transition, lack of investments, geopolitics, …) to continue in the foreseeable future with no clear winner in sight. Gold prices may overreact to potential dovish or hawkish surprises from the Fed and, to a lesser extent, to any further deterioration in the fiscal trajectory (US elections next year).

- Forex: A bumpy USD depreciation journey – This not the first time this year that USD has experienced some weakness on the back of softer inflation data and subsequent US rates peak expectations. However, the US is not alone in this disinflation process and despite some growth convergence expected in 2024, the USD will likely still offer the highest yields and economic growth among developed markets.

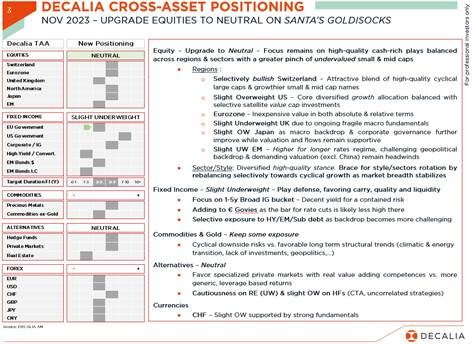

- Tactical positioning: Equities Upgraded to Neutral – We adopt a more constructive view as peaking rates & bond yields streak a key inflection point providing a near-term window of opportunity for equities. Today’s more benign macro backdrop is undeniably supportive but we still need to gain further visibility on next year’s trends before turning resolutely more bullish. Though leaving our regional preferences unchanged with a focus on higher quality markets, we recommend to add a pinch of undervalued small-mid caps, keeping an overall focus on cash-rich plays well balanced across regions & sectors. In fixed income, we stick to our slight underweight stance as we still prefer cash vs. bonds. That said, we are adding to Euro Zone Sovereign bonds (from Underweight to slight Underweight) as the bar for ECB rate cuts (and lower yields overall) is probably not as high in the region (weaker growth, inflation falling more rapidly and debt sustainability issues) as in the US.

- The Bottom-line: Enjoy the Christmas ride – While likely to be a(nother) bumpy one, the finish “gift” should be worth it. Assuming a soft landing scenario for the global economy and the removal of earlier macro overhangs, the start to 2024 is now looking more promising for both equity and fixed income investors. That said, we continue to favor a diversified all-terrain approach to portfolio construction at this stage.

Economic Calendar

The week ahead will be dominated by both growth dynamics (US ISM manufacturing index, US personal income & expenditure, China’s PMIs, EZ Business Climate Indicator and unemployment rate or Canada & Switzerland Q3 GDP among others) and inflation trajectory (flash CPI reports for November in Germany and Euro Zone, US PCE deflator), while central bank speakers include ECB President Lagarde (today), BoE Governor Bailey (Wednesday) and Fed Chair Powell (Friday).

In the US, the main highlights will be the personal income and spending report for October (Thursday), which also includes the saving rate as well as the PCE deflator (Fed’s preferred inflation gauge) and the US ISM manufacturing index from November (Friday). Personal income and spending are expected to have moderated somewhat in October (consensus points to +0.2% monthly gain on both) after a roaring period. Ahead of the next Fed meeting (13 December), the headline and core PCE may cement further expectations of “no more hikes” if the consensus proves right with slight monthly gains of +0.1% and +0.2% for headline and core PCE respectively, which will bring down yoy changes to 3.1% in October from 3.4%, and to 3.5% from 3.7% the prior month for core PCE. For the ISM manufacturing index, our model forecasts a rebound to 49.9 in November (compared to 47.7 for the consensus median estimates) from the last observed level of 46.7 in October. Otherwise, we will also get some housing data (new home sales today, home prices tomorrow and pending home sales on Thursday), the Conference Board consumer confidence for November (tomorrow) with more colors, below the headline surface, on how market labor situation is perceived by people, their willingness to spend in the next few months as well as their expectations about inflation.

Turning to Europe, the most important releases will be the flash CPI reports in Germany (Wednesday) and for the whole Euro Area the next day, which will likely influence the tone of the ECB’s next meeting on December 14. The consensus expects further moderation with both headline and core annual inflation rate declining to 2.7% (2.9% in October) and 3.9% (4.2%) respectively in November. On top of the inflation prints across key economies in Europe, we will also get the same day their unemployment rate for October. Before that, we will get the Euro Zone Business Climate Indicator (Wednesday), while the final manufacturing PMIs will be released on Friday.

Moving on to Asia, the main highlight will be the Chinese PMI indices for November on Thursday as well as the Caixin manufacturing gauge due Friday after the October prints came below expectations. Bloomberg current consensus estimates suggest little change, pointing to a stabilization-slight improvement. In Japan, the focus will be on unemployment rate for October and the final reading of the manufacturing PMI gauge (on Friday) as well as the industrial production the day before (Thursday).

On the international scene, note that OECD’s updated economic outlook will be released on Wednesday, while the OPEC+ is set to meet on Thursday, after the original meeting (planned for today) was postponed due to disagreements among its members. As you may guess, the main focus is on lowering members’ oil production quotas due to the decreasing prices of oil barrels since September. However, it remains uncertain how the cuts will be distributed among the members and how they will be implemented in 2024. So far, Saudi Arabia has borne most of the burden.

Finally, in corporate earnings, the most notable reports this week include Salesforce, Intuit, RBC, Prosus, Alimentation Couche-Tard, Dell, Crowdstrike and Snowflake.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.