By Quirien Lemey, Co-Lead PM for DECALIA Sustainable Society strategy

- Concern 1: Have valuations gone too far?

- Concern 2: Does the usage of debt creates a dangerous environment?

- Concern 3: MAG7 Capex: Magnificent vision or magnificent madness?

- Concern 4: Are AI circular deals eroding trust?

- Concern 5: The Big “AI” Short: Is Michael Burry right?

- Concern 6: Customer Concentration: Is it a structural risk?

- Concern 7: Is the “AI has no value” thesis credible?

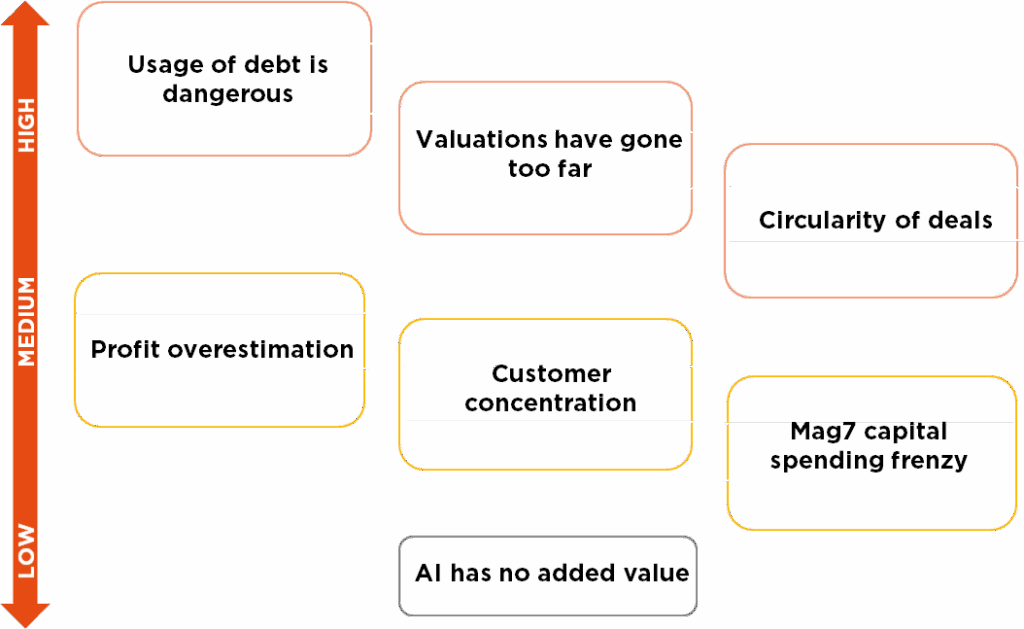

We have seen the market increasingly worry about a potential AI bubble, and hence seen some violent moves in the past few weeks. Even stellar results from Nvidia, their largest and cleanest beat in a while, didn’t change the narrative. Moreover, more than half of the magnificent 7 are actually underperforming this year, which emphasizes the need for a solid stock picking approach. We dissect the bear case in seven parts and provide our take. We believe the market has certainly identified some valid concerns, but we also argue that one needs to put these concerns into context, which we try to provide. As can be seen below, we have ranked these concerns from high to low risk.

The 7 Magnificent worries on AI

Ranking from High to Low risk

- Valuations have gone too far

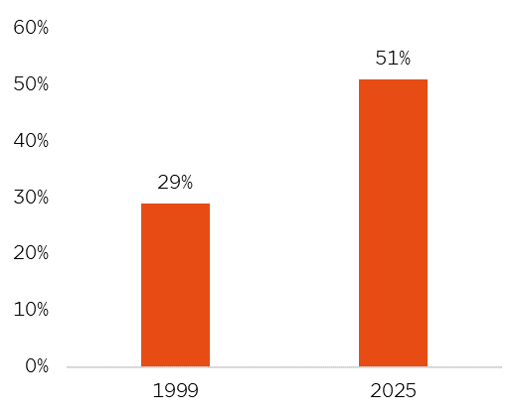

Although some stocks have skyrocketed, we believe valuations are still within reasonable ranges. Many strategists, macro economists (not ours!) and market commentators like to point to this (see Figure 2 below) or similar charts to caution investors that we might be in for a big pullback, arguing the S&P 500 is at valuations only achieved in the dotcom bubble and the COVID craziness.

SPX Index

Price Earnings Ratio (P/E)

However, we believe this view misses a few very important nuances:

• When looking at historical valuations, one should always consider the changing composition of the index. As during the dotcom bubble, a small number of companies make up a large share of the index. Today, however, these are among the biggest cash-generating machines in the world with very few, if any, leverage (see our point on debt below). If anything, today they have also shown to be some of the most defensive companies out there, enduring even the COVID pandemic, the most severe global recession since the Great Depression. If anything, these companies deserve to trade at a premium. Moreover, the FCF yield for the median large cap stock is almost three times higher today than it was in 2000. In short, the operational efficiency, strong profitability and robust FCF generation are all characteristics of a higher-quality index.

Top 10 S&P 500 Weights

Median Operating Margin

• On the Mag 7 and AI companies specifically, any valuation should always incorporate or reflect growth prospects. When looking at PEG ratios, for example, things are a lot less frothy than first meets the eye.

• Morgan Stanley notes that the Mag 7 now account for ~35% of the S&P 500—fuelling frequent comparisons to 1999/2000. But back then, the top 7 names made up just 21% of the index and 12% of net income. Today’s Mag 7 deliver roughly 31% of total earnings. So, while the concentration is higher, the earnings justification is also much stronger. Moreover, whether desirable or not, we should not disregard the possibility that the Mag 7 will only become stronger and bigger in the future…

• Consensus has declared AI to be in a ‘bubble’… but the “value” investors at Berkshire Hathaway recently initiated a $4.5B position in GOOGL and now own three of the seven Mags (GOOGL, AAPL, AMZN). We wouldn’t put too much importance on Softbank selling its Nvidia stake either, as they confirmed that the sale was simply driven by funding needs for other commitments (and they missed out on most of the rise of Nvidia in the past years).

• Interestingly, NVIDIA, the bellwether of AI, is actually cheaper than the market on forward looking estimates…

In summary, although we argue that valuation arguments needs to be put into context, it should be clear that at any valuation level the market can experience significant drawdowns for a multitude of reasons, related to AI or not.

2. The usage of debt creates a dangerous environment

The (almost extreme) fears the market is showing when big tech is taking on debt should also be nuanced.

During the dotcom buildout, corporate debt was the main funding source and leverage rose sharply (and the fed was hiking rates!). The major players then, like WorldCom and Lucent, were BBB/BB rated and lacked cash reserves. Today’s AI buildout is mostly done by companies with the extraordinarily strong balance sheets. Just three companies (AMZN, GOOGL, MSFT) could raise one trillion dollars today in debt and still stay below a 2x leverage ratio. Let alone there are many more companies and governments ready to invest big time, and let alone the use of the enormous FCF generated coming years by these companies.

We are old enough to remember that the market sounded the alarm bells when the market cap of Apple reached $0.5bn almost 15 years ago, crying out the law of large numbers. This stock couldn’t work. Fast forward today, they have a market cap over $4tr. It seems the market is spellbound by the magnitude of market caps, investments and commitments, and is having a hard time to put these massive numbers into context.

Moreover, the capex cycle is being led by some of the most creditworthy companies in history. Microsoft holds a AAA rating (higher than the US government), while Alphabet and Meta are rated AA across agencies. Amazon carries AA ratings from two agencies and a single-A from one, and Oracle, though a relative outlier, remains mid-BBB, still within investment-grade territory (for now).

That being said, there are valid concerns we need to be cognizant of.

On the private side, things are different. OpenAI is the posterchild, but that group encompassed hundreds of start-ups. Here we have seen valuations soar without much revenues, let alone profits, to show for. The use of debt is much more widespread and inherently there’s a lack of transparency. It is therefore hard to estimate any fallout or systemic damage should this collapse. In the case of OpenAI specifically, we know they publicly stated they plan to spend about $1.4 trillion in the next 8 years. These commitments are probably the biggest concern the market has today. We believe many of these commitments are aspirational, i.e. they can scale investments up or down depending on how demand and financing evolves. However, due to the lack of true transparency, we cannot be certain. Do note, this company has become a top 10 software company in terms of revenue just 3 years after they launched their product, something we have never seen before. As long as they continue on that trajectory, we’re convinced funding will remain available.

3. The Mag7’s capital spending spree borders on magnificent madness

Related to the point above, the market has concerns the hyperscalers are just spending irrationally and at one point there will be overcapacity. On the one hand, we believe this spending by hyperscalers is completely rational. As many of them have said, the risk of not doing it is far greater than the risk of doing it.

We agree with this statement.

If this capex spending would prove to be exuberant, then any overcapacity will just get filled in the months or years after. Long before the rise of generative AI, both data generation and the resulting need for cloud storage and compute were already on a steep upward trajectory, and we see no reason why this should not continue, even without Gen AI.

Moreover, some commentators argue in this case the hyperscalers would be the stocks that get hit the most. We argue this might not be the case as a cessation of this capex would cause FCF and the corresponding FCF yield of these companies to surge big time and dampen any downward stock pressures. That being said, we do believe that, if these companies have a structurally higher capex intensity, they should theoretically see a derating. This can, however, be partially offset by a higher revenue profile and even higher barriers to entry.

Another point to consider is that the lack of available power and the enormous complexity of these huge AI clusters might actually be a counterweight to the notion of a massive and rapid overspent.

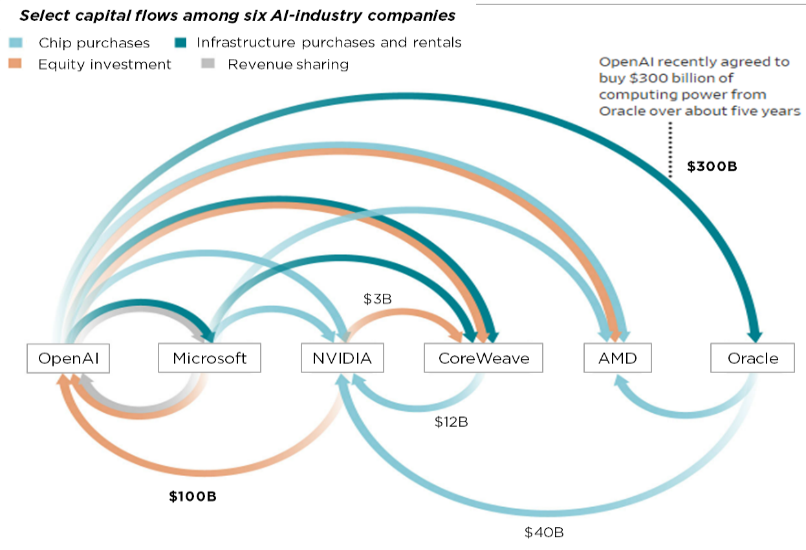

4. Circularity of deals

There has been a rise in the so-called circular deals (see figure 4). Let’s be very clear: we prefer not to see these kinds of deals, as it only increases suspicion and mistrust in the AI investment cycle.

AI-Industry – Circularity of deals

Select capital flows among six AI-Industry companies

That being said, most of these deals are vague in details and many are not irretractable. Many of these commitments have a wording in the range of “we will invest up to 100bn…”, this can also be 1bn… Moreover, in the grand scheme of things, for now the exact investments are still pretty small. Again, putting these deals into context is important. For example, Nvidia made $3.7B strategic investments in Q3 and $4.7B YTD (7% and 3% of revenue), a small slice of ~$1T of annual global private capital. Nvidia currently has $50bn net cash (up from $8bn 5 years ago) and consensus expects them the generate $150bn in cash next year (up from $4bn 5 years ago). We honestly do not mind putting some of that cash to work and taking stakes in the most prominent AI firms.

5. The Big AI short. Burry’s case on profit overestimation

Michael Burry spearheaded speculation that tech giants are artificially boosting earnings through changes in accounting practices—specifically, by extending depreciation schedules on AI chips. When a company lengthens the depreciation period for its assets, annual depreciation expenses decline, which in turn inflates net income. Given that depreciation represents a significant portion of operating costs, such adjustments could create an upward bias in reported earnings. This skepticism is warranted as most hyperscalers moved the useful life of AI chips from 3 years to 6 years. However, there are several data points that argue the useful life has gone up significantly. First of all, the vast majority of all AI datacenter capacity built out in the past few years was new capacity. Consequently, given the older datacenters are still running, we naturally assume even the older pre-Gen-AI chips are still running. Secondly, Coreweave explicitly said they “recontracted existing capacity” on older-generation GPUs at a price “within 5% of the original agreement”. Lastly, Nvidia argued that older-generation GPUs remain valuable and in use many years after release. In particular, CFO Colette Kress noted that “six-year-old Ampere GPUs” are still available in the cloud and “fully utilized today.” To conclude, this is a risk worth monitoring but we don’t see it as worrisome today.

6. Customer concentration risk

The customer concentration risk is real and we share this worry. Given the enormous size of the capex, and the fact that it’s being carried out by a handful of names, results in customer concentration risk for most, if not almost all, names across the value chain. From the smallest companies to the largest company in the world (Nvidia), losing one of these clients can cause significant downside to the numbers. That said, in the tech world, we’ve seen this before. The rise of Apple and the iPhone gave rise to a similar phenomenon. Still today Apple remains the biggest, and very dominant client for most of their supply chain. For example, even after the spectacular rise of Nvidia, Apple is still the biggest client for TSMC. Our point is customer concentration risk is real and here to stay. It’s the natural result of the rising dominance of big tech in last decade. It’s is our job to monitor and deal with this on an individual company basis.

7. AI has no value

If you still believe in this bear argument, time stopped for you 3 years ago. It’s 2025 — catch up.

Conclusion

To conclude, if not individually, all these worries combined have contributed to a significant market wide concern of an AI bubble. We definitely acknowledge there are clear risks, and many are correlated to each other. Our main concern goes back to the private funding, OpenAI in particular, and related, its importance to many companies in the AI supply chain. Moreover, it’s just a fact that capex growth will slow and will eventually decline at which point the whole capex space might be under pressure. It should also be clear that we don’t even need an AI bubble burst for AI stocks to decline significantly. The macro, rate expectations and external factors can easily influence valuations heavily as well. Lastly, the market is clearly separating winners from losers, even within the Mag7. Smaller cap companies have also started to perform. This environment mandates a clear stock picking approach. In our fund, we adopt a diversified strategy, avoiding extreme valuations (e.g. no Palantir), high debt levels (we sold Oracle for this reason) and companies facing declining margins (no Meta). Finally, within our AI exposure (and any other exposure in our fund), we also invest in a number of SMID caps, many still undiscovered, less expensive and less correlated to the Mag7.

About the Author

Quirien Lemey, CFA

Senior Portfolio Manager

About DECALIA Sustainable SOCIETY strategy

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well-being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

Highlights

- Joined DECALIA in 2021

- 11 years at Degroof Petercam AM, first as a global technology analyst and Lead PM for several multi-thematic and sustainable funds.

- Ranked 7th best PM in Europe by Citywire in 2021

- CFA Charter holder

- Launched in 2021 with Alexander DECALIA Sustainable SOCIETY strategy