- (Transitory) growth and inflation reliefs in the US

- Unappealing Market Valuation? Look under the lid!

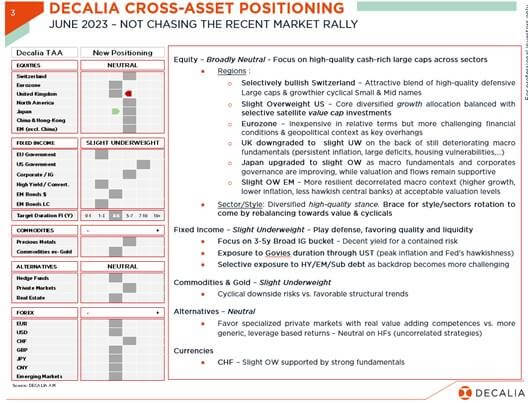

- Not chasing the recent equity market rally but brace for further equity rotations

- Too early to add meaningfully to duration

For my last weekly editorial before I go on vacation, and for a change, you’ll find below the highlights of our latest strategy meeting, which took place last week, as well as a summary of our tactical allocation changes. Like a four-handed musical score, the credit also goes to my colleague Damien Weyermann, CFA, Lead Portfolio Manager of Decalia Dividend Growth Fund & Decalia Swiss Made Certificate, who contributed greatly to the content, the form as well as the overall melody of the text here below.

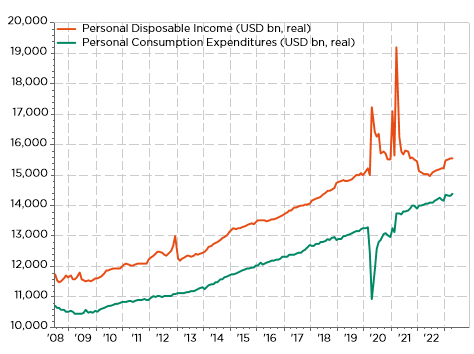

US Macro: Supportive again on the back of (transitory) growth and inflation reliefs – Investors’ seemingly never-ending wall of worry climb may not be over yet but at least it appears that things are moving in the right direction again. At least in the US. More specifically, while latent recession risks remain, the odds of a soft landing scenario have further increased with economic activity proving more resilient than expected (positive surprises driven by strong Services & bottoming Manufacturing along with healthy consumption trends as households are still winding down excess pandemic savings), inflation already past its peak, US banking stress & debt ceiling now stories of the past, Fed nearing peak hawkishness, and labor markets rebalancing smoothly. Actually, we may even argue that the US economy has landed, but it’s however still rolling way too fast… At the opposite, China’s post-reopening recovery is not fully living up to expectations and economic trends across Europe remain mixed and fragile (e.g. disappointing June flash PMI) with near-term inflation likely to remain sticky in specific countries (e.g. UK), but the dreaded global credit crunch is now likely to be postponed until later. In other words, it may paradoxically get better, before it turns (more) sour. This in turn may suggest that we are up for another few rates hikes by major Central Banks but investors have already repriced such a scenario today without significant market volatility, a healthy sign in our view.

US personal disposable income and consumer spending in real terms: US consumption supported by an increase in real disposable income on the back of solid wages growth and declining inflation

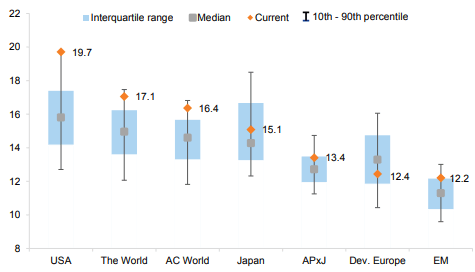

Unappealing Market Valuation? – Look Under The Lid! No doubt, global equity markets, and especially the US, look expensive by almost all metrics today, at least on the surface. Indeed, both fading geopolitical tensions and easing growth concerns along with Central Banks’ near peak hawkishness have driven equity risk premia lower. As a result, global equity index multiples are near historical highs, compressing both earnings & dividend yields, and seriously impairing their relative appeal in today’s more attractive (real) bond & cash yields environment. Admittedly, the recent stabilization in earnings trends has helped investors become more comfortable with such high multiples, now showing lower sensitivity to rippling interest rates, but pushbacks remain. Interestingly however, looking beneath the index surface, equity valuation multiples are not as stretched as they may seem for many sub-segments, sectors, and individual stocks. In particular, excluding the US market, or more specifically the growthier parts of the US market including this year’s AI-powered names, the equity market valuation landscape looks much brighter all of the sudden. As far as the related narrow market breadth pushback is concerned, things are already improving with a broader participation lately, while similar episodes of narrow market breadth in the past have NOT acted as a break on subsequent market performance. As a result, we now expect a gradual non-linear convergence of stocks beneath the index surface in the coming months, combining a relative catch-up for many non-AI names and a relative catch-down for several undue YTD winners, underpinning further equity factor/style/sector market rotations. In other words, we still see attractive pockets of value in equities today but one needs to be nimble & selective.

Equity Regions 10Y Valuation (12M Fwd P/E): Expensive US market distorted by recent FAANMGs returns

Source: Goldman Sachs

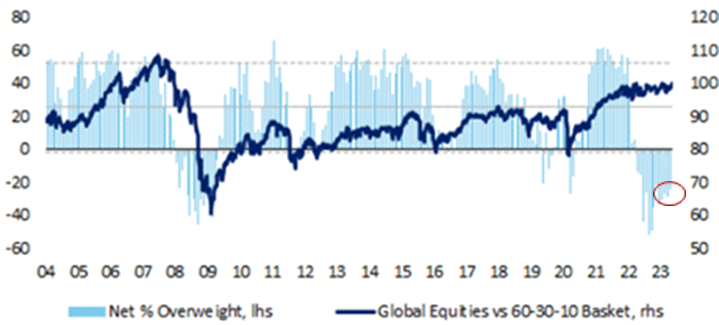

Markets: So, the glass is still half empty but investors are thirsty now – A much better Q1 earnings season than expected, dissipating clouds concerning the growth and inflation in the near-term outlook, as well as the lack of “sell in May & go away” have undoubtedly triggered a FOMO panic attack among investors with most sentiment indicators switching from Bearish to Bullish in just a matter of days. While acknowledging this cash redeployment, we would however caution against reading too much into such volatile signals with History showing these technical alerts can often flash red for a while before providing accurate indications. In the fact, average equity portfolio allocation, according to the latest BofA Merrill Lynch investors survey, have only marginally increased (from deep underweight) in recent weeks suggesting much of today’s revived bullishness may actually be benefiting other asset classes too. As a result, we continue to see limited downside selling risk for global equities with the pain trade still to the upside for most investors.

Portfolio Equity Allocation – Still Historically Low…

Source: BofAML

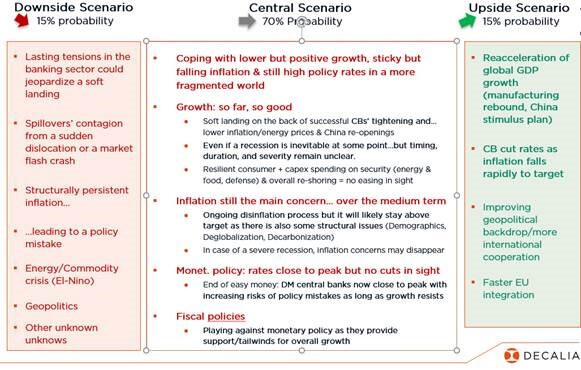

Global scenario: Light at The End of The Tunnel? – Yes, but maybe we are just not there yet. Far from gloom and doom, our macro scenario still foresees a marked slowdown with lower inflation (but remaining above central banks’ target in the foreseeable future) and thus hawkish “hold” monetary policies. Instead of experiencing a major correction soon that could reset risky asset valuations back to more attractive levels and force central banks to adopt a more dovish stance, we rather expect a continuation of the tug of war between restrictive monetary policy headwinds on the one hand and unusually resilient growth and sticky inflation on the other hand … until something breaks. Admittedly, some of the market’s recent overhangs have dissipated but latent risks persist and potentially grow under the surface, still keeping us tactically wary in terms of the overall asset allocation. In particular, we still need to gain more visibility against the current backdrop of uncertain growth/inflation/rates/earnings trends before turning more constructive again.

DECALIA Macro Scenario for the next 3-6M

Tactical positioning: not chasing the recent equity market rally – On the one hand, many of the market’s earlier overhangs have being removed in recent months (e.g. severe economic recession, earnings depression, US debt ceiling), while several equity indexes have broken key technical resistance levels, calling for further upside from here. On the other hand, the aforementioned concentrated nature of this year’s market rally along with unappealing valuation multiples and somewhat stretched near-term sentiment indicators still call for caution today. Admittedly, we have progressively become more constructive in our outlook for equities since the start of 2023, but we still need to gain more visibility against the current backdrop of uncertain growth/inflation/earnings trends before turning resolutely more positive. Hence, we retain our broadly Neutral Equity stance for now.

Equity Reshuffling – Brace For Further Rotations! – Considering both latest macro events and market developments, we have carried out several changes to our tactical equity positioning in June. We downgrade our UK stance, and more specifically the domestic segment, to Slight Underweight, reflecting a lasting deterioration in the nation’s economic (sticky high inflation & current account cliff) and political backdrop leading to further rate hikes by the BoE. Meanwhile, we upgrade Japan equities to Slight Overweight as the market should benefit from its current “Goldilocks” monetary policy (with contained inflation suggesting no immediate change to the BoJ’s accommodative stance), improved economic growth perspectives, inflecting (foreign… as well as domestic) capital flows, an attractive valuation framework, and improving corporate governance (TSE reform). Elsewhere, we keep our Slight Overweight stance on China equities but would consider reducing on any potential stimulus-led rebound in the near term. At a more granular level, we now tilt our factor allocation more in favor of Value (Slight Overweight). Anyway, with the dispersion of macro outcomes still remarkably large implying divergence among equity styles, regions, sectors, and ultimately stocks, we continue to favor a balanced all-terrain approach and advocate for a well-diversified high-quality equity allocation & selection at this stage of the business cycle.

Fixed Income – Too early to add meaningfully to duration – While government bond’s duration may help to mitigate equity losses related to an earnings recession, we doubt about their buffer benefits in our scenario of sticky inflation, hawkish hold monetary policy stance and not so severe recession in the foreseeable future. Other hedging ways, such as put spreads on equity indices, may be more efficient. As a result, within fixed income, we still prefer cash instruments and the short end of the curve (over long-term bonds) given the current steep yield inversion and sticky inflation. That said, we like US Treasury duration over other sovereign bonds as they will likely prove the best safe haven if nominal growth peters out ultimately. Finally, we prefer Corporates over Sovereigns in Europe as valuations remain cheaper than in the US and continue to target the upper end of the credit spectrum.

No change elsewhere – we keep our Slight Overweight on Gold and our Slight Underweight on other materials. Both are facing cyclical downside risks (higher real rates for gold and recession for energy and industrial metals), but they are also benefiting from supportive structural trends on the back of an overall lack of investment to meet an increasing demand related to geopolitics (de-globalization and gradual de-dollarization), persistent inflation as well as the energy transition. Finally, in currencies, we now see a lack of direction for the major currencies in the next few months as we remain in a scenario of low but positive global growth without significant divergences in monetary policy trends. In this context, the Swiss franc remains our preferred currency, supported by still-rock solid structural fundamentals, lower inflation, resilient growth and SNB’s pragmatic approach.

Please note again this weekly letter (and his author) are taking a few weeks off. Normal service will resume from July 24th.

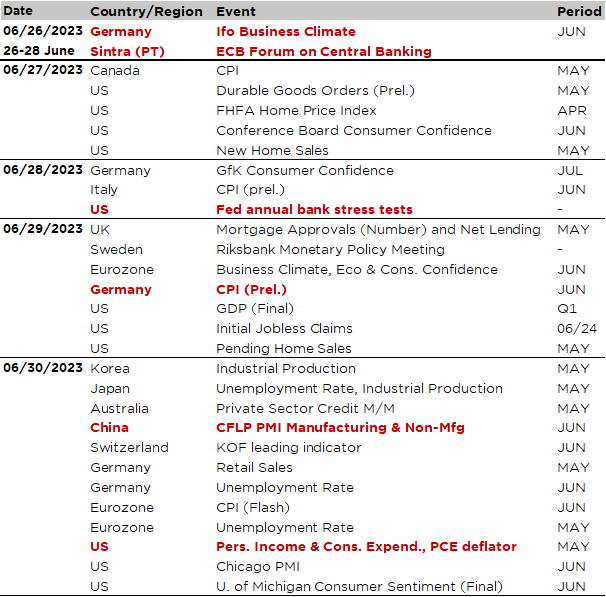

Economic Calendar

Investors will certainly scratch their heads about what to do about the latest developments in Russia. Except a marginal and temporary increase in (European) risk premium, some downward pressures on long rates and a pinch of risk-of sentiment, it seems difficult at this stage to assess the exact consequences of this political instability on the global markets given the uncertain and volatile situation in Russia. So, I suspect that it will be rather “business as usual” for global investors as long as there aren’t any new game changers elements obviously.

After the stubbornly elevated inflationary pressures in the UK (CPI surprised once again on the upside) and the subsequent 50bps hike to 5.0% by the BoE last week, as well as the unexpected hawkish move by the Norges Bank (+0.5% to 3.75%) and then the somewhat hawkish stance of the SNB, which delivered a +25bps hike as expected but signaled that further hikes were likely, the focus will likely remain on inflation and monetary policy this week. In this context, the ECB Forum on Central Banking in Sintra, the Eurozone June flash CPI releases (for Italy on Wednesday, Germany on Thursday and the whole Euro Area on Friday) as well as the May US PCE deflator on Friday will thus be the key highlights of the next few days.

Let’s start with the US. While the headline PCE deflator is likely to confirm the gradual disinflation (largely due to the energy prices decline over the last 12 months), the core PCE inflation should remain sticky, well above the Fed’s 2% target. Indeed, the core PCE inflation is expected to increase +0.4% MoM in May (same pace as the prior month), which will therefore lead to a YoY core inflation remaining virtually unchanged at 4.7%, the same level than 9 months ago (August 2022). As far as headline inflation is concerned, the MoM change is expected to be about flat, meaning a decline below 4%, from 4.4% the prior month, for the annual YoY reading. Along with the PCE deflator release on Friday, we will also get the personal spending and income data, as well as the saving rate for May. Income and consumption are expected to post modest increase after the strong gains observed in April. Other notable US economic releases include durable goods orders (May preliminary reading) and Conference Board June consumer confidence tomorrow, weekly initial jobless claims on Thursday and the June Chicago PMI on Friday.

Other CPI releases will also be released this week such as in Canada tomorrow (May reading) but more importantly in Europe with the first hints flash readings about this month. Italy will kick off on Wednesday, Germany’s figure is due on Thursday, while the June CPI flash reading for the whole Euro Area will be released on Friday. The final data will be published in about 2 weeks and they will be the last inflation readings ahead of the July 27th ECB meeting.

From inflation to monetary policy, the link is quite straightforward. As a result, central bankers will also be in the spotlight, particularly in Europe where the ECB Forum on central Banking will take place again in Sintra this year. The theme is “Macroeconomic stabilisation in a volatile inflation environment”. It will feature plenty of high-profile speakers, including the heads of the Fed, the ECB, the BoJ and the BoE, all together at some point on a Policy Panel on Wednesday at 14:30… Just have a look at the full agenda here and you will get a quick and easy sense of our monetary stewards current concerns and questionings (Structural change in energy markets and implications for inflation, Unconventional fiscal policy in times of high inflation, Monetary policy in the face of multiple supply shocks, etc…). The Swedish Riksbank will then meet on Thursday and is expected to increase its target rate to 3.75% from 3.5%.

In Asia, China June PMI indices, as well as and some key economic data for Japan in May (retail sales, unemployment rate, industrial production, Tokyo CPI and housing starts), will be released at the end of the week. Turning back to Europe, keep also an eye on the Germany IFO index this morning after the disappointing flash PMI for June in the major Euro economies released last Friday, which have raised at least some eyebrows, at worst recession odds with both manufacturing and services indices falling more than expected. Finally, note also that the Fed will release the results of its annual bank stress tests on Wednesday. They will likely draw investors’ attention following the regional banking turmoil experienced this spring as well as lingering concerns over exposure to commercial real estate and the broader risks related to deposit dynamics, higher interest rates and slowing economy (i.e. rising NPLs and defaults rates).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.