It hasn’t really been a love affair on markets since the release of the US CPI on the Saint-Valentine’s day, which was then followed by stronger than expected activity indicators. As we were suspecting last week, better than expected US activity data have pushed long rates higher, while sticky inflation has forced some investment banks strategists, such as DB or CS for example, to revise their terminal rates forecasts higher and/or removing their Fed’s pivot call for this year, exerting therefore more upward pressures on the short end of the curve. More interestingly, the narrative has now evolved from immaculate disinflation & soft landing to higher (terminal) rates & no landing… until something breaks unfortunately.

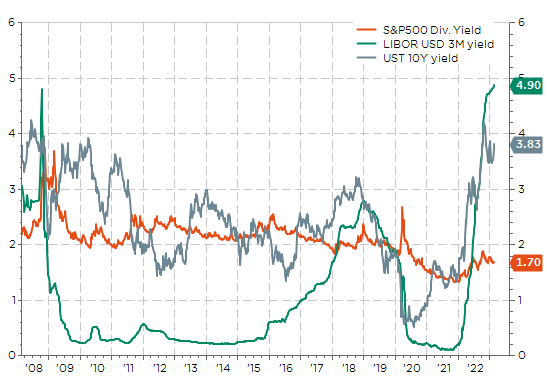

In the meantime, we are likely stuck in the middle for most financial assets such as rates, credit, equity markets and currencies… until something breaks. Equities valuation, especially in the US, is capped by higher rates, while earnings growth will be lackluster at best on the back of modest sales growth and ongoing profit margin compression. Looking forward, downside risks for risk assets still remain in the scenario where the Fed is somewhat forced to kill growth to tame inflation. Same could be said for rates: while the current backdrop of stickier inflation, higher terminal rates and more resilient than expected growth is exerting upward pressures on rates, long rates will then fall if the story ends sadly with a recession in the 2nd half of this year. In this challenging context, there is a strong case building to move from TINA (There Is No Alternative) to TATA (T-Bills Is The Alternative). T-Bills are yielding 5% now and, like cash instruments, they offer a “priceless” call option on every asset class with no expiration date & no strike price (Warren Buffet). So, it could be considered as a good-yielding shelter, without volatility, while waiting for uncertainties and clouds to dissipate. And the higher the equities/credit go, the more investors (at least the less greedy) will be tempted to take shelter with such a yield.

US cash, bonds & equities yield: from TINA to TATA in this challenging context

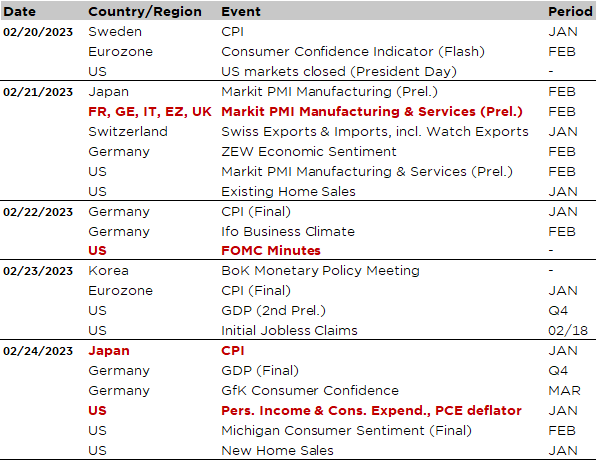

Economic calendar

In this context of no-landing and higher terminal rates, the US personal consumption expenditures and income report (Friday), which includes the PCE deflator, and the global flash PMIs (tomorrow) will be the key data releases to watch for this week as investors try to grasp how sticky and resilient are inflation and growth respectively.

The core PCE inflation is expected to confirm the near-term inflation pressures with a gain in between +0.4%and +0.5% MoM in January, breaking a 3-months streak of improving data as the YoY will rebound towards 5% (it was 4.4% in December vs. 5.2% in September). It’s worth noting that while core CPI continued to moderate in January, the trimmed mean and median CPI gauges rose the most since September, with the median annual inflation rate reaching actually its highest level in the 40y history of calculation. Furthermore, much of the weakness in headline CPI was driven by components that don’t impact PCE calculations, while January PPI inflation surprised on the upside, including a pickup in health care, air fares, and financial services, all categories that pass through directly into… PCE estimates. That’s why consensus is already pricing a quite significant increase in PCE deflator for January.

The release of flash PMIs for key economies tomorrow may confirm investors’ increasingly optimistic near-term growth outlook. Actually, US will likely be more in focus as both its services and manufacturing PMIs are lagging behind the trend’s improvement dynamic seen in Europe and China lately and which is expected to continue (at least in the near term) on the back of lower energy prices and China’s reopening. Aside from the preliminary PMI indices, other business confidence indicators will be released in Germany, including the ZEW and IFO surveys (tomorrow and Wednesday).

We will also get the latest Fed minutes (Wednesday evening), but they should not move much the needle given there has already been a decent amount of hawkish Fed speak over the prior week, while recent data have largely supported the Fed’s hawkish baseline, leading markets to price in a policy path closer to the December dot plot. At minima, these minutes will confirm once more that the Fed won’t risk to not tighten enough… More interestingly, the January CPI will also be due in Japan on Friday morning: core CPI excl. fresh food is expected to increase to 4.3% yoy (vs. +4.0% in December). Inflation still grinding higher, JPY weakening again, global rates resuming their upward trend and an incoming change at the head of the BoJ… something is surely brewing there.

Staying in Asia, G20 finance and central bank chiefs meet in India this week (Feb 22-25) at the first-year anniversary of Russia’s invasion of Ukraine to discuss rising debt troubles among developing countries, the regulation of cryptocurrencies and the global slowdown. More related to Friday’s one-year anniversary of Russia invading Ukraine, US President Biden will be in Poland from today to Wednesday, pledging continued financial and political support for Ukraine and the entire NATO alliance.

Finally, this week’s Q4 earnings releases include key US retailers (Walmart, Home Depot, TJX, eBay), major miners (BHP, Rio Tinto, Anglo American) and China’s tech giants (Baidu, Alibaba) among others (see a larger but non-exhaustive list at the end). With more than 400 of S&P500 firms having already released results, the earnings season is now gently winding down.

Non-exhaustive list of major Q4-22 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.