- Defy the herd mentality: These stocks have already priced in the possibility of a recession, presenting a favorable risk-reward balance for those looking to capitalize on the market’s forward-thinking

- Driving Sustainable Innovation: Small and mid-cap companies are spearheading innovation and disruption, one of the 3 key tenets of our multi-thematic DECALIA Sustainable strategy

The current market conditions present a compelling case for increasing Small- and Mid-cap allocation. These stocks have recently underperformed larger peers by a significant margin, potentially indicating that a recession is already priced in. Moreover, their attractive valuation ratios, coupled with their historical tendency to outperform early in the economic cycle after central banks have finished hiking rates, make them an appealing investment opportunity. Note that since the beginning of June, we are starting to see more traction in the small &mid cap space. Below we lay out the arguments to increase allocation to Smid caps in more detail:

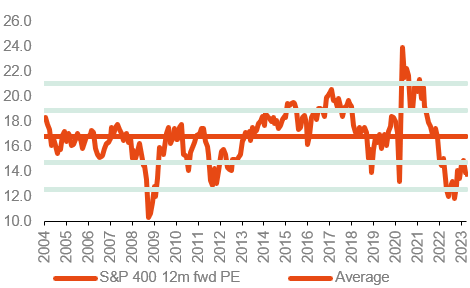

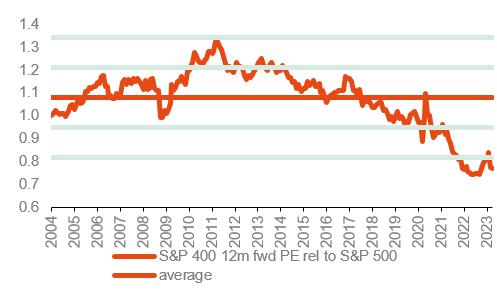

1- Examining the valuation perspective, the S&P 400’s (reference index for midcaps in the US) forward price-to-earnings (PE) ratio stands at 13.2x, near the lows of the past two decades, except for a brief period during the Great Financial Crisis. In relative terms, the valuation picture is even more attractive, with the difference compared to the S&P 500 exceeding two standard deviations. Similar observations can be made for the Russell 2000 (reference index for small caps), which displays an even lower absolute valuation. Considering the historical relationship between the Russell 2000’s 12-month forward PE and subsequent returns, there is potential for double-digit annualized performance ahead.

S&P 400 Midcap 12m fwd valuation

Source: Datastream, PNPP Exane estimates

S&P 400 Midcap 12m fwd valuation relative to S&P 500

Source: Bloomberg, DECALIA, 09/05/2023

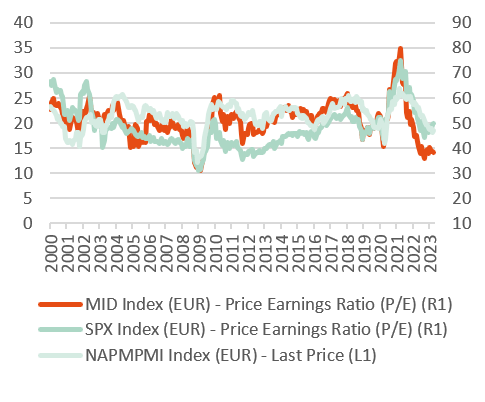

2- Another factor supporting Small- and Mid-cap stocks is their advanced discounting of a recession compared to large caps. When comparing PE levels to the ISM manufacturing index, it becomes apparent that the mid-cap index has experienced more significant declines than the S&P 500. Therefore, increasing Small- and Mid-cap allocation in portfolios appears justified, regardless of whether a recession materializes.

S&P 500 & S&P MidCap 400 P/E & correlation with ISM Manufacturing Index

Source: Bloomberg, DECALIA, 09/05/2023

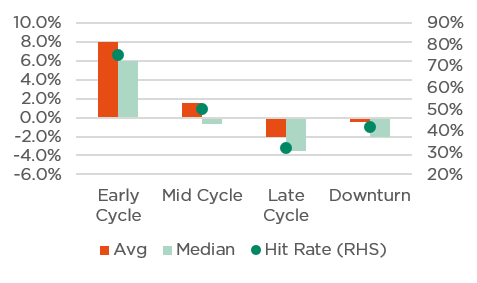

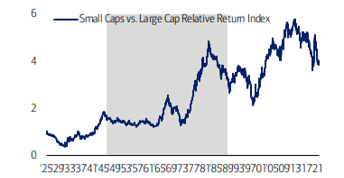

3- The early stage of an economic cycle typically favors Small-cap performance over large caps. Analysing data since 1979, the Russell 2000 has shown an average excess return of 8% relative to the S&P 500 during this phase, with a success rate exceeding 70%. Conversely, it tends to lag by 2-4% during the latter part of the cycle and during an actual downturn.

Early Cycle typically best phase for small vs large caps, with small typically lagging large in Downturns

Average and median relative performance of small vs large caps during the four phases of our US Regime Indicator

Note: Base on Russell indices from 1979-present: source of historical returns prior to 1979; CRSP, Center for Research in Security Prices. Graduate School of Business, The University of Chicago, Used with permission. All rights reserved www.crsp.uchicago.edu Performance has been calculated by BofA US Equity & Quant Strategy.

Source: Bloomberg CRSP, BofA US Equity Quant Strategy

4- Moreover, Small-cap earnings tend to rebound swiftly from their trough during early cycle episodes. In the past, it took the Russell 2000 an average of 1.42 years to return to its prior peak, with three-quarters of the recovery achieved within the first year. Even during full-fledged recessions, although the complete earnings recovery took longer (1.87 years), the bounce in the first year was particularly robust.

5- Considering the specificities of the current cycle, characterized by sticky inflation and rapid monetary tightening, historical data supports Small caps once again. Not only did they outperform during the inflationary period of the 1970s, but their returns in the 12 months following the last Fed rate hike were also strongest at that time.

Small caps outperformed during the inflationary period of the 1970s and during the full protectionist Cold War period (in grey) Small caps vs. large cap relative performance (1926-9/30/22)

Source of historical returns: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago. Used with permission. All rights reserved.

Source: CRSP, The University of Chicago: BofA US Equity & Quant Strategy

In conclusion, to generate alpha and follow the path of future opportunities, it is crucial to increase Small- and Mid-cap exposure. As ice hockey legend Wayne Gretzky wisely said, one should go where the puck is going, not where it has been. Therefore, the time to increase Small- and Mid-cap allocation is now, given the favourable market conditions and the potential for strong performance in the foreseeable future.

Small and Mid-Cap Stocks: One of the 3 USP’s of our multi-thematic strategy

Small and mid-cap stocks are at the forefront of driving innovation and spearheading the transition towards a future Society. These companies, often characterized by their agility and entrepreneurial spirit, are playing a vital role in reshaping industries and creating sustainable solutions to cope with the current and future challenges of our society.

By investing in small and mid-cap stocks, investors have the opportunity to support and benefit from the innovative and disruptive power of these companies, as they shape a more sustainable and resilient future. Although the AI tectonic shift is associated with bigger cap companies such as Nvdia or more indirectly ServiceNow, there are also smaller cap companies that will participate in the AI revolution.

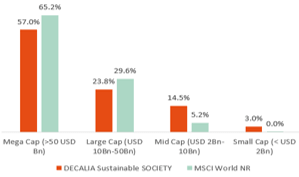

It is not surprising, then, that the multi-thematic strategy has a significant overweight in these smaller companies. As of end of May, the fund has an exposure of 18% with a market capitalization below $10bn and up to 33% with a market capitalization below $25bn. The allocation to small & mid-caps should increase in the coming months.

Market Cap Breakdown

Source DECALIA – Data as of 31/05/23

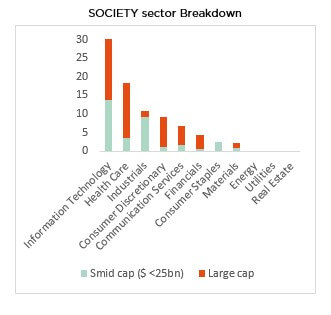

The allocation to small and mid-cap stocks in the fund is well diversified across sectors, indicating a lack of sector bias. Noteworthy, Industrials has the highest proportion of Small & midcaps exposure, and reflects a relatively high exposure to this cohort in the O²&Ecology theme.

This approach offers significant benefits in terms of portfolio diversification.

Conclusion

The current market environment presents an interesting and positive asymmetrical set-up for increasing small- and mid-cap allocation. The potential benefits of this allocation strategy are evident in several key factors.

The possibility of a recession has already been discounted, as evidenced by the underperformance of small- and mid-cap stocks compared to larger peers. This indicates that the market has already priced in the potential economic downturn, reducing the downside risk for these stocks.

Historical data demonstrates the strong historical outperformance of small- and mid-cap stocks early in the economic cycle. Markets tend to anticipate economic trends approximately six months in advance, and the current positioning suggests that these stocks are poised for potential outperformance as the cycle progresses.

Overall, the inclusion of small- and mid-cap companies in the multi-thematic strategy provides exposure to a wide range of sectors, while also capturing the potential of innovative companies that are driving solutions for a more sustainable and circular future. These companies combine attractive growth prospects with valuations on par with the average of the market, making them well-suited for long-term investment strategies.

About DECALIA’s multi-thematic strategy

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

From left to right: Alexander Roose, Head of Equities

Quirien Lemey, Senior Portfolio Manager

Jonathan Graas, Senior Portfolio Manager

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.