•Novo Nordisk’s “SELECT” study released ground-breaking results last week.

•The study demonstrated that Wegovy, a GLP-1 anti-obesity drug, reduces severe cardiovascular risk by 20% for non-diabetic obese patients.

•This was seen as a best-case scenario, boosting confidence in Novo and Eli Lilly in particular as it paves the way for public and private payer coverage, unlocking a potential $100bn+ market.

Remember the first piece of our Wellness series “Turning the tide: the promise of anti-obesity drugs” published last June. We previously highlighted that a new category of anti-obesity drugs has been in the limelight since Elon Musk admitted to using Novo Nordisk’s Wegovy. We saw that obesity was one of the main causes for type 2 diabetes, unlike type 1 diabetes which is linked to genetic factors, type 2 diabetes is closely linked to lifestyle. We mentioned that patients taking GLP-1 medication against type 2 diabetes, were inclined to lose a substantial amount of weight. Hence, this form of therapy began to be employed as a remedy for the obesity epidemic. Nonetheless, it became evident that despite the substantial potential of the market, there remained considerable intricacies in financing, namely insurance coverage, such a medical breakthrough. Here is the newest information on the subject.

As a reminder, the key to unlocking the market lies in persuading both public payers (Medicare and Medicaid) and private insurers (MCOs such as UnitedHealth) that a cost-benefit analysis justifies the prescription of these medications for obese individuals who are not diabetic.

That’s why the news of the “SELECT” study published by Novo Nordisk had the effect of a bombshell. It revealed that their drug Wegovy, a GLP-1 anti-obesity medicine, not only is highly effective in inducing weight loss but also has a strongly positive effect on reducing cardiac incidents.

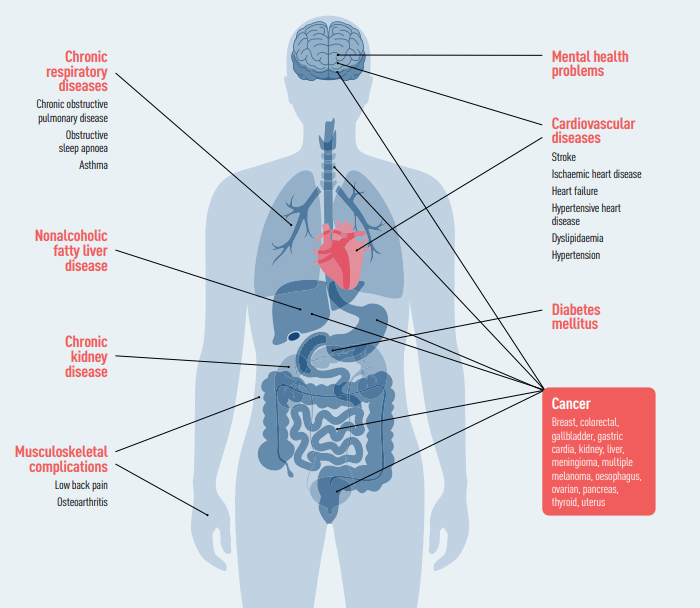

Medical conditions associated with obesity

To be more precise, it was already established that GLP-1 drugs had many benefits, as they reduced cardiovascular risk for diabetic patients to up to 26%. Nevertheless, the study revealed that their main drug decreased the risk of severe cardio vascular incident, namely heart attacks or strokes, by 20% also for non-diabetic obese patients.

In addition, to blood sugar regulation, GLP-1 drugs offer many cardiovascular benefits. Mainly, they induce significant weight losses, reduce blood pressure and decrease lipid levels. It is too premature to confirm with absolutely certainty; however, if the benefits extend beyond those interlaced to the simple effect of weight loss, then it is quite safe to state that the drugs’ additional value would be substantially higher.

This is why pharmaceutical companies like Novo or Eli Lilly are investing heavily into conducting outcome trials, to firmly establish the effectiveness of GLP-1 medication in treating a wide spectrum of medical conditions.

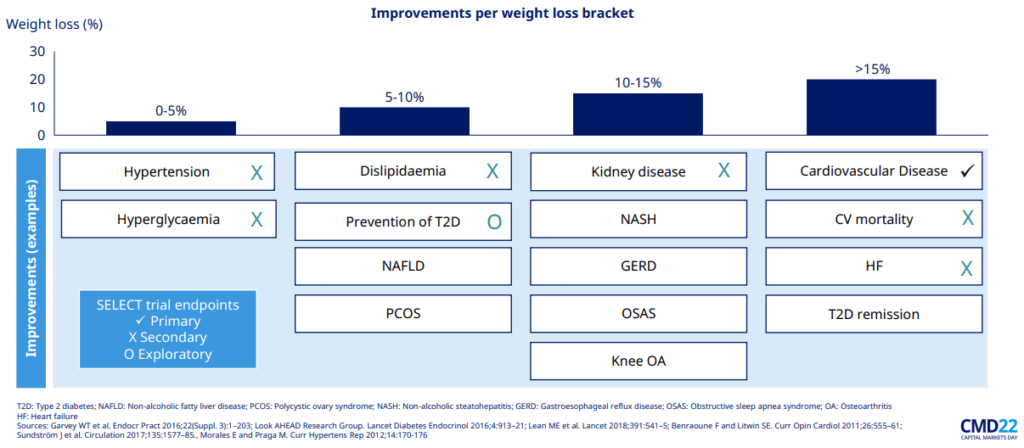

Improvements per weight loss bracket

Such studies are important to demonstrate the potential for cost savings in healthcare systems, with obesity currently representing an annual burden of nearly USD 173 billion for the US healthcare system alone. The favourable results from the SELECT trial are thus essential as they will increase pressure on the US government to expand reimbursement coverage for those treatments, which would be especially beneficial for Medicare, the state insurance plan for the elderly. It is expected that if coverage by Medicare is accepted, private health insurers would follow, which will create a surge in the number of patients treated.

It is key to understand that pharmaceuticals differ from conventional consumer products since they are predominantly covered by insurance, whether private or public. The pivotal factor is the cost-benefit analysis, as the GLP-1 drug family must demonstrate that its substantial cost (currently around $10,000 per patient annually) would be offset by even greater savings. This is precisely why the impact of the SELECT trial outcomes reverberated so strongly. Hence, our optimistic standpoint is based not solely on the technology per se, but also on the firm belief that it will become politically infeasible to withhold extensive reimbursement options, as around 42% of Americans are medically classified as obese.

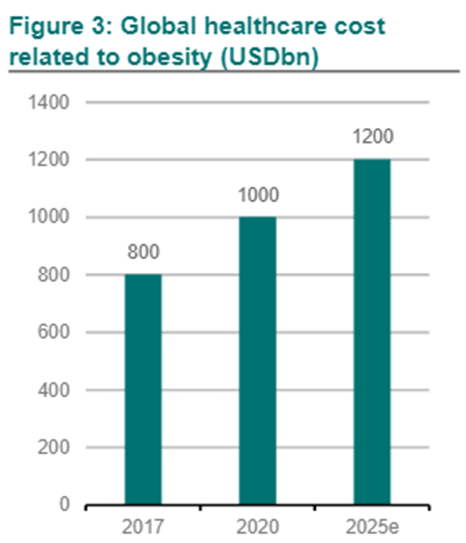

In the present the story is still very US centric, but the issue being a global one, the market opportunity is significant worldwide.

In terms of market implications, we can see clear winners to such things happening. Firstly GLP-1 leaders, like Novo Nordisk or Eli Lilly but also a few challengers like Zealand Pharma, a small Danish biotechnology company. The most likely losers would be bariatric surgery names, cardiology names and orthopaedics, however the silver lining for these companies is that the new medication would also open new markets as some of procedures cannot be performed on severely obese patients. Lastly potential losers would be food and beverages companies, as GLP-1 substantially decrease the patients’ calorie intake.

Finally, a significant risk for GLP-1 drug developers revolves around the ability to swiftly scale up the supply chain, as the demand for these drugs surpasses the initial projections. This underscores the need for both internal capacity expansion, but also external partnerships.

As a result, Contract Development and Manufacturing Organizations (CDMOs) that engage in the production of the active ingredient and its filling in primary packaging (including auto and pen-injectors) stand to benefit due to GLP-1 drug developers’ limited internal capacity. Likewise, bioprocessing vendors, such as Danaher and Thermo Fischer, that sell equipment used in drug manufacturing, are also set to gain from this drug class pent-up demand.

To conclude, we remain convinced that the pharmaceutical industry will play a pivotal role in combatting the obesity epidemic. The market potential, as projected by industry analysts, still stands within the $50-75 billion range by 2030. This figure has already risen substantially since our initial discussions, yet it still falls short of the true potential which, in our perspective, will substantially surpass $100 billion. We remain committed to our long term holdings in both Eli Lilly and Novo Nordisk, (that also holds shares in Zealand Pharma). While the valuation of these stocks may look stretched in the short term, our steadfast long-term conviction remains unshaken.

Global healthcare cost related to obesity (USDbn)

Roberto Magnatantini, CFA

Senior Portfolio Manager

Iana Perova,

Equity Analyst

About DECALIA’s strategies:

- DECALIA Silver Generation is a thematic strategy investing into companies that will structurally benefit from the longevity trend. The strategy intends to capture opportunities across the full spectrum of the longevity value chain: Consumption plays, Healthspan plays and Transformational companies.

- DECALIA Sustainable SOCIETY is a multi-thematic strategy investing in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well-being, Tech Med, Young Generation) that will shape tomorrow’s SOCIETY. The Elder & Well-being & Tech Med themes currently represent 22% of the fund.

- Both strategies are managed by an experienced investment team.

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.

Copyright © 2023 by DECALIA SA. All rights reserved. This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from DECALIA SA. This material is intended for informational purposes only and should not be construed as an offer or solicitation for the purchase or sale of any financial instrument, or as a contractual document. The information provided herein is not intended to constitute legal, tax, or accounting advice and may not be suitable for all investors. The market valuations, terms, and calculations contained herein are estimates only and are subject to change without notice. The information provided is believed to be reliable; however DECALIA SA does not guarantee its completeness or accuracy. Past performance is not an indication of future results.