- The market’s dovish reaction to last week Fed’s meeting seems premature to us. What if the current monetary policy may not be restrictive enough to tame inflationary pressures?

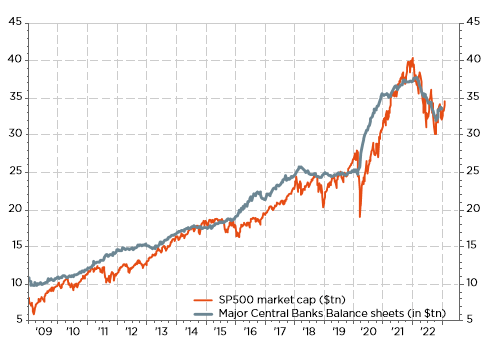

- There has been a surprising and almost unnoticed development recently: global central banks’ balance sheets have ballooned again

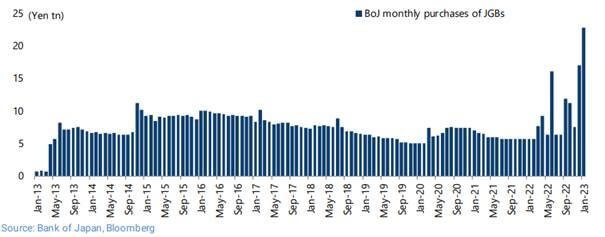

- The major culprits: a weakening greenback and, above all, the BoJ, which as bought the equivalent of more than $600bn of JGBs since the YCC tweak on 20 December.

- So, the current global monetary policy backdrop may not be restrictive enough… with China, and indirectly the BoJ, playing against the Fed and ECB

- Markets have experienced a repeat of 2022 so far… in the opposite direction

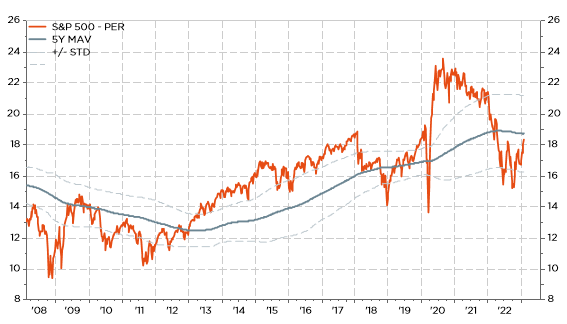

- Unfortunately, valuations remain stretched on (US) equities, negative revisions in S&P500 sales and earnings continue, and there are now better opportunities outside the US equity markets nowadays

- US equity upside seems limited: trees don’t grow to the sky, especially when liquidity tends to dry

As expected, Fed and ECB hiked last week their respective target rate by +25bps to 4.50-4.75% and by +50bps to 2.50%, while France beats Italy in the 6 Nations tournament (rugby) yesterday but it wasn’t as smooth and easy for the “coqs bleus”. Despite the still hawkish message they delivered and their overall cautiousness about claiming victory on inflation too early, investors have continued partying (or screaming cocorico) on the back of an “immaculate disinflation” that would open the door, if it proved right, to a more supportive goldilocks environment. So, no fumble yet and quite the opposite with bulls still raging ahead for the time being. I suspect investors have liked the facts that central banks have confirmed that “the disinflationary process has started” and, as a result, they will seemingly become more data-dependent after March. Moreover, they think inflation is tamed and central banks will thus be able to, or will have to, cut rates before year-end. My concern is what if inflation doesn’t behave in this good way because of a rebound in energy prices and/or, more worrying, wages growth doesn’t slow enough…

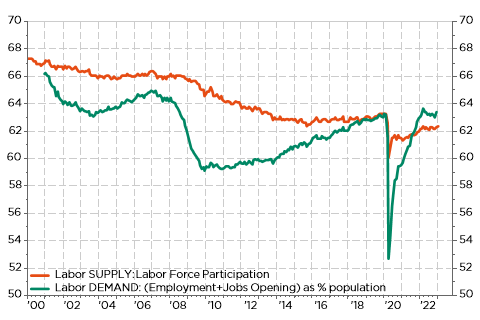

Given the surprisingly strong latest US jobs report and other labor market indicators released last week (weekly initial jobless claims still declining, jobs opening rebounding, quits rate still elevated,…). I am surprised that very few investors are seriously considering that the current monetary policy may not be restrictive enough… especially looking at the way how the Fed monitors its progress. So far, it has achieved to slow economic growth below, but what’s about the easing in labor market and especially the wages growth back towards 3%? We aren’t yet there.

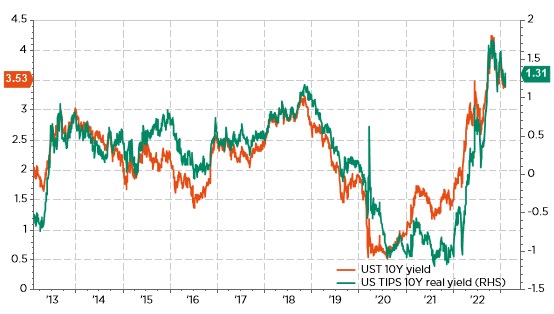

So, I still don’t believe in this “immaculate disinflation” fairy tale, remaining rather on the “hawkish hold” camp and thus concerned by the current absurdly low levels, in my view, of long rates. Like Doubting Thomas, I would prefer to see evidences that the Fed’s job is done before partying. Obviously, it may then eventually be too late as markets always anticipate, but there are pitfalls and false starts sometimes too. As a result, I continue to fear that risks remain tilted on the upside for (long) rates due to sticky inflationary pressures for both cyclical and structural reasons. On top of a still tight labor market in both the US & Euro Area, the ongoing structural energy crisis/transition and a more fragmented world, the fiscal policy and the recent easing in financial conditions are counterproductive, playing against the monetary policy objective and thus delaying the necessary demand destruction to tame inflationary pressures.

Speaking about easing, financial conditions and central banks, there has been a surprising and almost unnoticed development over the last few weeks: global central banks’ balance sheets have ballooned again despite most major central banks ongoing quantitative tightening for two reasons. First, as the USD got weaker since last October, ECB, BoJ or BoE assets value have risen in $ terms. Then, not all central banks are actually reducing the size of their balance sheets… The BoJ has indeed bought more than JPY 50 trillion of JGBs since the Yield Curve Control adjustment on 20 December. That’s the equivalent of more than $600bn, or more than 10% of Japan’s GDP!? In a global G7 central bank context, the BoJ balance sheet expansion in USD terms has thus exceeded the balance sheet contractions since the start of December of the Fed, the ECB and the Bank of England, which have declined by a combined $357bn according to calculus from Jefferies (Christopher Wood, “Greed&Fear” of February 2nd).

BoJ monthly purchases of JGBs

In other words, global liquidity has perhaps improved recently despite rate hikes and ongoing QT, which has likely helped to support risk sentiment, contributed to ease overall financial conditions, push long rates lower and propel equity up. So, we come back to my initial doubt: the current global monetary policy backdrop may not be restrictive enough… with China, and indirectly the BoJ, playing against the Fed and ECB by potentially magnifying inflationary pressures! Note also that the drawing down of funds from the Treasury general account has offset to some extent (at least so far) the Fed’s balance sheet reduction.

Major central banks balance sheets (Fed + ECB + BoJ + China) & US S&P500 market cap (both in $tn)

US 10y nominal and real rates have dropped recently

US S&P500 P/E current ratio: back to pre-pandemic level

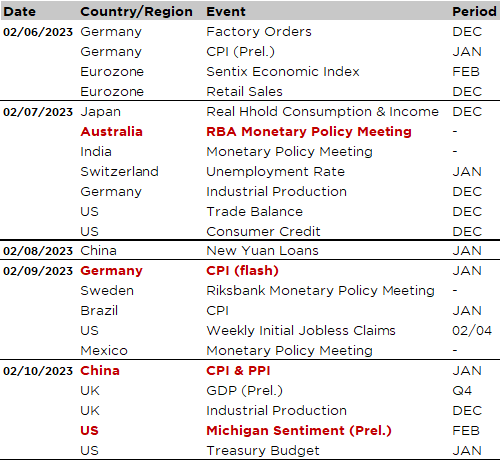

Economic calendar

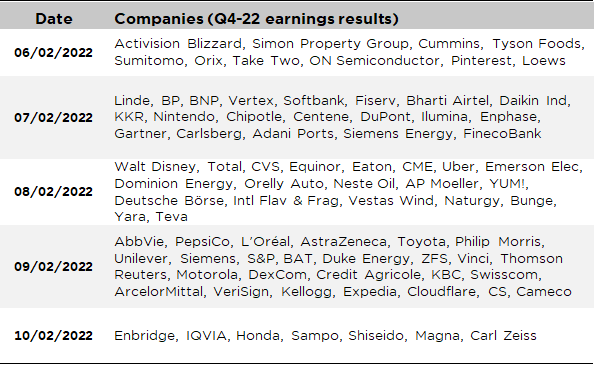

After the busy rollercoaster week we just experienced, the next few days macro agenda would likely seem quiet and light. As a result, the focus will be primarily on Q4 earnings releases and central bankers’ speeches/interviews, including Fed Chair Powell (tomorrow) and BoE Governor Bailey. As far as earnings results are concerned, Activision, Disney, Uber, AbbVie, PepsiCo and PayPal will be among the key ones for the large cap index this week. It’s worth mentioning that about half of S&P500 companies already reported. Outside the US, we will get the results of European big oil heavyweights such as BP, Total and Equinor, on top of those of Linde, BNP, l’Oreal and Siemens, as well as Toyota and Softbank in Japan, among the largest cap. See our non-exhaustive list at the end of this letter.

The few noticeable economic data & events include:

- The RBA monetary policy meeting tomorrow: a +25bps hike to 3.35% is expected but the statement may provide some hawkish elements on the back of China’s reopening and a higher than expected Q4 CPI reading released recently

- The German January flash CPI report on Thursday, which was delayed due to technical issues (it was due last week)…

- China CPI data on Friday: upside surprises can’t be ruled out going forward but it is not for the time being with consensus expecting annual inflation rising from 1.8% to 2.2% in China last month

- UK Q4 GDP on Friday: consensus expects a small decline, implying that the UK was in recession in H2 2022. However, given the recent resilience of data, there is a chance that 4Q GDP is closer to zero and the recession is delayed to 1H 2023.

- February preliminary reading of University of Michigan Consumer Sentiment, still on Friday: lower energy prices, a solid jobs markets, declining mortgage rates, an outperforming stock market and better news on inflation should continue to drive modest improvement.

Non-exhaustive list of major Q4-22 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.