We’re currently experiencing two impressive runs of remarkable and relentless period of performances. First, the Cagliari Calcio remains on a 3 consecutive unbeaten games streak in Serie A (it won 1-0 against Empoli yesterday), whereas the S&P500 just completed a run of 16 positive weeks out of the last 18 for first time since 1971! I obviously hope both will last as long as possible but, for once and contrary to what you may think, the odds seem to be in favor of the Cagliari as it will play against Salernitana (currently last in the standing), while if the S&P500 run survives this week, it’ll be 17 out of 19 for the first time since 1964… So, place your bets. In the meantime, you will find here below a summary and conclusions of our latest Strategy Meeting held on February 16th, which could be summed up as “never change a winning team”. I suspect Claudio Ranieri (Cagliari’s coach) won’t disagree on that.

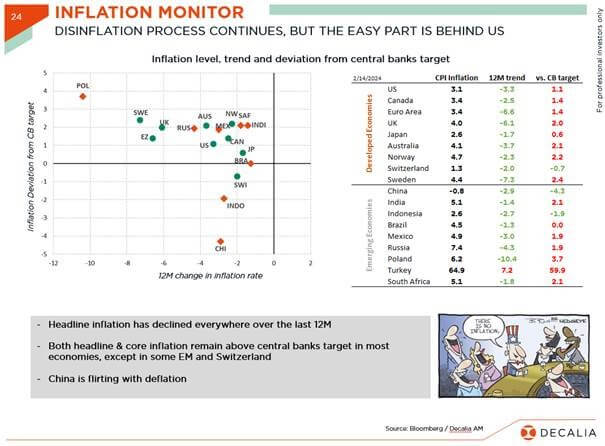

Macro Narrative: Goldilocks Soft Landing Ahead – January’s hotter US data should be taken with a pinch of salt (seasonal adjustments) with the disinflation narrative still largely intact owing to softening wage increases, rising productivity, and falling inflation expectations. Moreover, Fed rate cuts are a matter of when, not if, and the current recovery in global manufacturing momentum should help drive more resilient-than-expected growth, further supporting the outlook for risky assets regardless of revived geopolitical tensions.

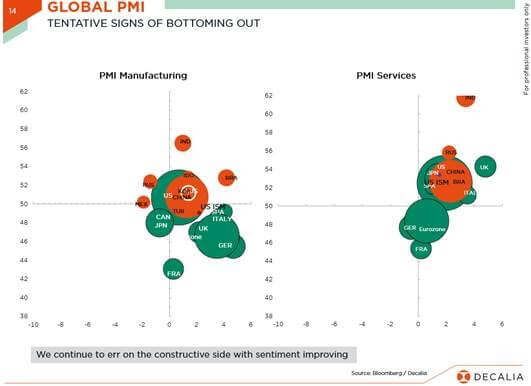

Global PMI: tentative signs of business sentiment bottoming out

Inflation: the last mile is always the longest

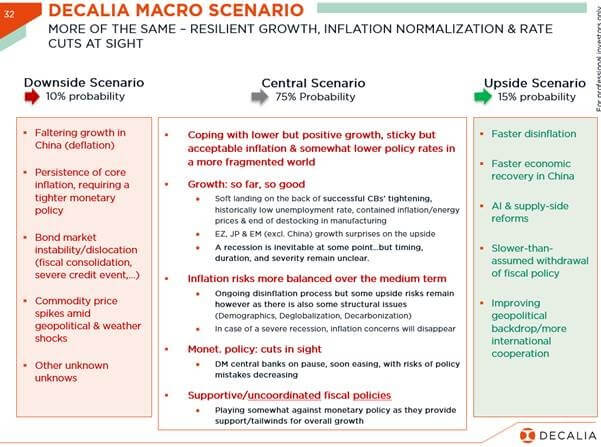

Our Global Macro Scenario: More of the Same with Resilient Growth, Inflation Normalization & Rate Cuts at Sight – Our base case macro scenario remains unchanged: we still foresee a soft landing with slower but positive growth and sticky but acceptable inflation levels leading to more “relaxed” monetary policies as central banks may now envisage rates normalization. Admittedly, latent risks regarding growth and inflation remain in addition to renewed geopolitical tensions and uncertain US presidential election, but the ongoing decrease in inflation definitely reduces the odds of a policy mistake/market accident. That said, among key downside risks, it would be somewhat premature to rule out at this stage a potential disruptive turn to (necessary) fiscal consolidation or a major credit event, which would likely result in slower than expected growth as markets would hit the liquidity brakes.

Equity: Magnificently Bullish, What Else? – Despite a well-flagged economic slowdown and fading pricing tailwinds, both resilient margins and easing destocking trends still support earnings consensus estimates of a close to 10% rebound this year, driving healthy equity upside as rich valuation multiples offer only little leeway. For sure, global equity markets may seem expensive by (almost) all metrics today, but looking beneath elevated, especially AI-powered US, indexes surfaces still reveals attractive pockets of value among non-Magnificent stocks. While a significant re-rating of multiples higher appears unlikely in the near term, a further pullback in bond yields combined with an improving earnings backdrop & sentiment should continue to lend support to current low risk premia. Admittedly, equity sentiment & positioning have evolved from a strong tailwind to a modest headwind: investors have indeed largely re-risked portfolios in recent months, enthusiastically embracing the crowded Magnificent Seven (or Magnetizing Five since the start of the year) and pulling most sentiment indicators temporarily into overbought territory as a result. Still, portfolios’ current equity allocations are only close to average historical levels, leaving plenty of room for further upside. Hence, we maintain our constructive view on the asset class for the first half of 2024 with an increasing contribution from non-Magnificent stocks throughout the year.

Fixed Income: Be Patient as Carry is your Friend – Just as we suspected entering 2024, most under-valuation opportunities within the fixed income universe have virtually vanished with the Fast & Furious relief rally in rates (and credit spreads) seen in the last two months of last year. Since then, investors have repriced central banks’ rate cuts trajectory in a more reasonable way (i.e. consistent with our global macro scenario depicted here above). As such, fixed income performances have proven disappointing so far this year – at least compared to some unreasonable expectations – but we still expect positive single digit returns through year-end, once evidence of disinflation resumes and/or growth softens. Meanwhile, the embedded carry should protect investors against the misfortunes experienced by the asset class in 2022, especially investments with contained duration risks. In the current context, we view bonds as fairly valued across the board and thus recommend a neutral/benchmarked positioning overall with our earlier preference for cash now been dashed by upcoming central banks rate cuts. Importantly, we still favor a selective approach in the HY/EM segment, staying away from most fragile issuers.

Commodities/Gold: Real Assets Still Matter – As inflation is expected to gradually ease back to major Central Banks’ targets, the commodities hedging/decorrelation purpose has logically lost some of its appeal, especially in a context of slower global growth. However, they may still offer some values in specific, out of consensus, scenarios such as in the case of stubbornly high inflation with growth proving once again more resilient than expected. Furthermore, Gold may also benefit from lower global real rates and a somewhat weaker greenback in a still challenging geopolitical context along with structural tailwinds (US fiscal trajectory, constrained supply, de-dollarization trend & FX reserves diversification). Hence, our current tactical allocation to this segment, favoring Gold over other Commodities.

Forex: It all Depends on Monetary Policy Trajectories Now – Over the past 12-18 months, movements in forex markets have been primarily driven by the expectations (and facts) regarding monetary policies. As we don’t expect major divergences or time lags among major Central Banks in the upcoming global monetary easing process, we don’t see either strong trends across currencies reflecting our rather limited convictions at this stage. With the exception of the JPY maybe, which should stop faltering and appreciate when the BoJ raises rates back into positive territory and put an official end to the Yield Curve Control (likely before June). One should however bear in mind that the US is not alone in this disinflation process and that other major central banks will certainly move in lockstep with the USD still likely to offer the highest yields and economic growth among developed markets topping some US exceptionalism (AI and broader technology sector). As a result, the USD shouldn’t depreciate much this year, in our view, while the EUR and JPY may recover underpinned by the “less dovish” stances of their respective monetary policies (i.e. given lower domestic inflation levels, both the Fed and SNB should be among the first to cut rates).

Tactical positioning: Do the Right Thing, Do Nothing… – After upgrading our Equity stance from slight underweight to slight overweight it two steps during the last quarter of 2023, we stick to our constructive view for 2024. Though likely to prove bumpy along the way, both today’s more benign macro backdrop and improved near-term visibility support a further re-rating for equities, in our view. That is why we also added some “cheap” tactical protections at the end of last year to own the upside potential though with a lower risk profile. Same could be said for fixed income: we gradually upgraded our stance from Underweight to Neutral in the last quarter while also raising our duration target closer to neutral/benchmark levels, i.e. 5-7 years. Here too, volatility has been high recently but should be largely compensated by the attractive carry on the short end of the curve and the overall downward trend in rates. Finally, we are keeping our slight overweight stance on Gold and underweight allocation to other Commodities.

The Bottom-line: We Would Rather Be In Than Out (of the Market) – 2024 is likely to be another eventful year for global equities, having to navigate an economic slowdown (at some point), further high bond yields, revived geopolitical uncertainties, the fate of China, a US presidential election, commercial real estate woes, and still widely underappreciated side-effects of the ongoing AI revolution. In this context, we believe investors’ journey is unlikely to prove peaceful but still see healthy upside potential for the braver in the coming months. Keep the faith & stay in!

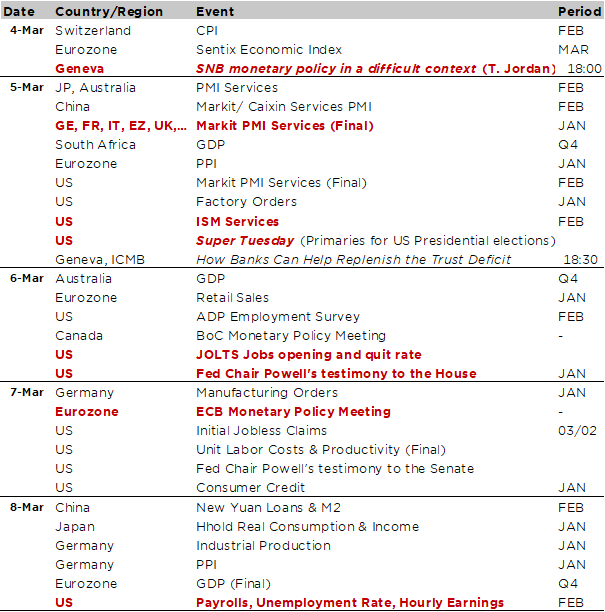

Economic Calendar

March is getting off to a madly busiest start for investors with the US jobs report on Friday among the key highlights of the week. The consensus expects change in payrolls to moderate to about +200k from +353k in January, with hourly earnings slowing to +0.2% last month (vs. +0.6% in January) and the unemployment rate staying at 3.7%. Before that, investors will also pay attention to the ADP and JOLTS reports, especially the quit rate, which is highly correlated with wages growth, as well as the employment subcomponent of the US ISM services index.

In the meantime, over this busy first week of March Madness, there won’t be much time for a siesta as we will also get, as soon as tomorrow, the final PMI services for February across the major economies, including the US ISM services; Fed Chair Powell’s testimonies to the House Financial Services Committee and the Senate Banking Committee on Wednesday and Thursday; and the ECB monetary policy meeting on Thursday. While rate will indubitably remain on hold (deposit facility rate at 4%), economists will seize the opportunity of this meeting to collect any updated insights about the timing and extent around the much-desired rate cuts.

Speaking about monetary policy, the Bank of Canada (BoC) will also meet on Wednesday and is widely expected to stand pat with policy rate staying at 5%, while BoJ’s Governor Ueda will deliver a speech tomorrow.

In addition, on the political side, we will also go through the “Super Tuesday” in the US (i.e. the day when the greatest number of US states hold primary elections: actually 16 states and territories will be holding primary elections tomorrow). So, these results will be a strong indicator of the likely eventual presidential nominee of each party… if there are still some doubts about it. That comes ahead of the State of the Union address by President Biden on Thursday. Over in China, the focus will be on the National Party Congress, where 2024 growth target and fiscal stance will be announced, and any potential additional announcements or policy to lift out its property sector, and subsequently its economy and markets, out of the doldrums.

Europe’s biggest economy will be in focus too with Germany factory orders and industrial production on Thursday and Friday, while we will also get Eurozone Sentix Economic Index, PPI and retail sales before that. In corporate earnings, we’re now at the end of the Q4 reporting season at least in the US, with just about 10 S&P500 members left to report. The US large cap to keep an eye are Broadcom and Target.

Last but not the least, note that there will be two conferences in Geneva over the next 2 days:

- A conference of Thomas J. Jordan, Chairman of the Governing Board of the Swiss National Bank (SNB) today at 6:00 pm at the Aula du Collège Calvin: “The SNB’s monetary policy in a difficult environment”. Conference organized by the Fondation Genève Place Financière (FGPF), the Institut National Genevois (INGE) and the Association des Stratégistes d’Investissement de Genève (ISAG). This event is reserved for members of the organizing companies and students of the UNIGE Faculty of Economics.

- A conference of José Viñals (Chairman of Standard Chartered) at the Maison de la Paix (Geneva Graduate Institute) tomorrow at 6:30 pm: A World in Transition: How Banks Can Help Replenish the Trust Deficit. Public conference organized by the International Center for Monetary and Banking Studies (ICMB), free entrance.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.