In general, seasoned investors are wary when they hear or read somewhere that “this time is different”. Interestingly, there have been plenty of articles in the financial press lately about China turning eventually Japanese. With weakening growth and inflation already nearing 0%, the current 2nd largest world economy seems indeed on the brink of experiencing a Japanese deflation scenario related to the bursting of a housing bubble, excessive debt, an ageing population and an overall loss of confidence of economic agents. There are indeed many striking similarities, but also some dissimilarities obviously between today’s China and Japan in the 90’s. As a result, most of the articles (China is no 1990s Japan – but it could have been, Is China the new Japan?, Is China turning Japanese?,…) conclude that China is somewhat different… Based on the basic investment principle of “hope for the best, prepare for the worst”, here is perhaps a way to hedge against a major balance sheet recession in China.

Let’s be clear since the start: the hedge I suggest here below is an indirect one and with absolutely no guarantee it could work even in the case of China experiencing an adverse Japanese deflation scenario. However, its cost is very small and it makes some, if not much, sense in the current context. The idea isn’t new and it didn’t come from me but from smart investors, including well-known successful hedge fund managers. While I didn’t consider it in the past, as I thought it wasn’t the right timing or the backdrop did not necessitate it, I have now changed my mind thanks to my mentor who, like Robert Redford, whispered this hedge to me…

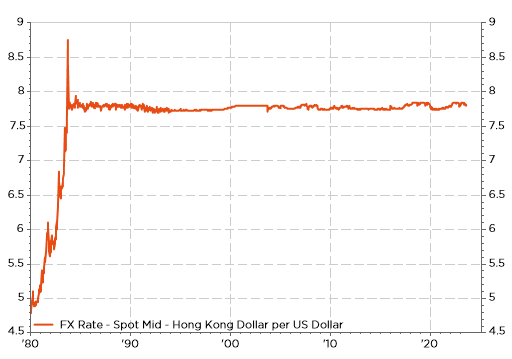

Any guess? It just consists of a call option on HKD against USD (1 year maturity, strike 7.85, to be precise), assuming therefore that the HKD peg won’t resist to the divergence between a resilient, if not currently booming, US economy with higher rates for longer, on one hand; and faltering Chinese growth with increasing deflation risks, on the other hand. The peg of HKD to the USD actually took place 40 years ago in the context of Sino-British negotiation regarding the future of Hong Kong after 1997 and has long been considered as a guarantee of financial stability and prosperity. Does it still make sense today? Can Hong Kong Monetary Authority (HKMA) afford to keep it? What’s about China intentions? Asking these questions is already providing some insights, in my views.

HKD peg: 40 years of stability and prosperity, but can it last forever?

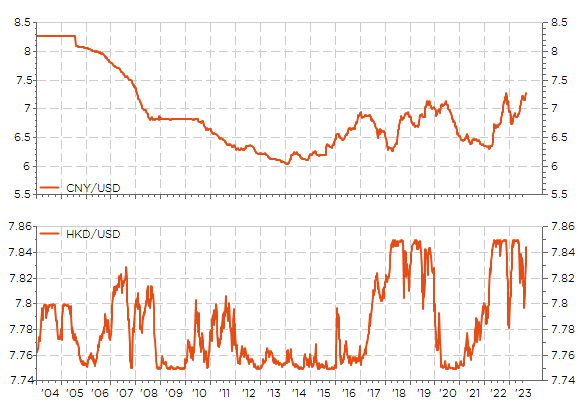

When the Fed started raising interest rates last year, the HKMA followed in lockstep to prevent interest rate arbitrage. As a result, Hong-Kong “imports” the US monetary policy. The peg also has a built-in self-adjusting mechanism that requires the HKMA to buy HKD when it is under persistent downward pressure (and thus also sell HKD when it is under persistent upward pressure) to keep the HKD-USD exchange rate within the convertibility range of HKD 7.75-7.85 per USD, i.e. a very narrow band. The HKMA has thus no specific inflation target, like the Monetary Authority of Singapore for example: it uses the exchange rate as its main monetary policy tool -rather than interest rates- to ensure “indirectly” price stability as well as support sustainable economic growth. As you may guess or see on the graph here below, the HKD tends to trade close to the lower level (7.75) when the CNY is strengthening against the greenback and to the upper limit (7.85) when USD is getting stronger vs. the CNY.

CNY/USD and HKD/USD over the last 20 years

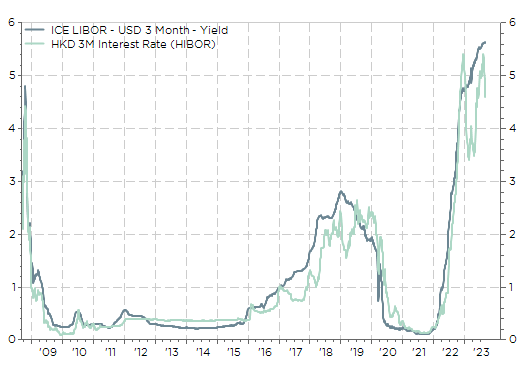

Moreover, interest rate arbitrage can still arise because the banks in Hong Kong do not necessarily follow exactly the HKMA’s interest rate decision (see below the graph of the USD 3M Libor and HKD 3M Hibor) as market’s interest rates also depend on interbank liquidity. Interestingly, banks in Hong-Kong are somewhat lagging their US counterparts in raising interest rates since the end of last year (as it was also the case back in between 2016 and 2019). Apparently, it means that there is still ample liquidity in Hong Kong nowadays. Perhaps, it’s just due to Chinese wealthy households and small companies, who likely prefer holding/buying/diversifying into HKD, which is pegged to the USD, rather than keeping all their savings in a depreciating CNY. According to my understanding, Chinese individuals can’t buy more than the equivalent of $50’000 in foreign currencies, but there is no limit on HKD… Nevertheless, the current interest rates’ differential between USD and HKD encourages carry trade, which put downward pressure on the HKD exchange rate triggering the HKMA’s automatic buying of HKD, which happens every time the HKD-USD rate spread widens (as it was also the case between 2016 and 2019).

USD 3M Libor and HKD 3M Hibor: very close but not always the same

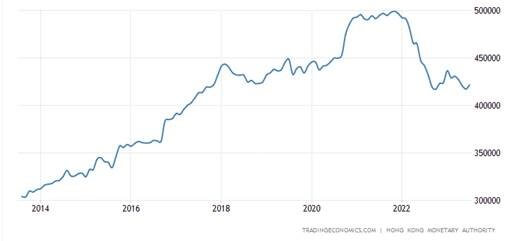

As a result, HKMA foreign exchange reserves have declined since the end of 2021. While they represented $500bn at that time, they are now standing at $421.6 bn in July 2023 (or circa 115% of GDP, over five times the currency in circulation or about 40% of HKD M3). So, there are still large fx reserves but as the great Wayne Gretzky would say you should “skate to where the puck is going to be, not where it is or has been”.

Hong Kong Foreign Exchange Reserves (in $ mio)

In other words, looking at Hong-Kong current economic indicators, which look logically more like China than the US (with overall feeble GDP growth since the protests in 2019 and two severe recessions since then, falling housing prices, inflation below 2%, lack of confidence from economic agents, less inflows of non-Chinese capital, a steep decline of inbound travelers & wealthy foreigners’ residence since 2019, etc…), these forex reserves should continue to decline. Or Hong-Kong banks may be forced at some point -by the authority eventually- to rise the interest rates at higher levels (at least equal to US Libor or even higher), which may not be suited to the current Hong-Kong economic backdrop if it persists. For sure, the US and China (or Hong-Kong) business cycles have never been perfectly synchronized or worked in lockstep, but over the time the divergences weren’t so large and/or lasting. Furthermore, as the time goes on, Hong-Kong gets more and more integrated to the Chinese economy.

How long can the HKD peg last is anyone’s guess, but it won’t certainly last forever as it is making less and less economic as well as political sense, potentially also exacerbating economic and financial instability for both Hong-Kong and China in certain circumstances. While I really hope that China won’t be the new Japan and you may rightly doubt about an imminent break of the HKD peg, beware that … this time it could really be different !

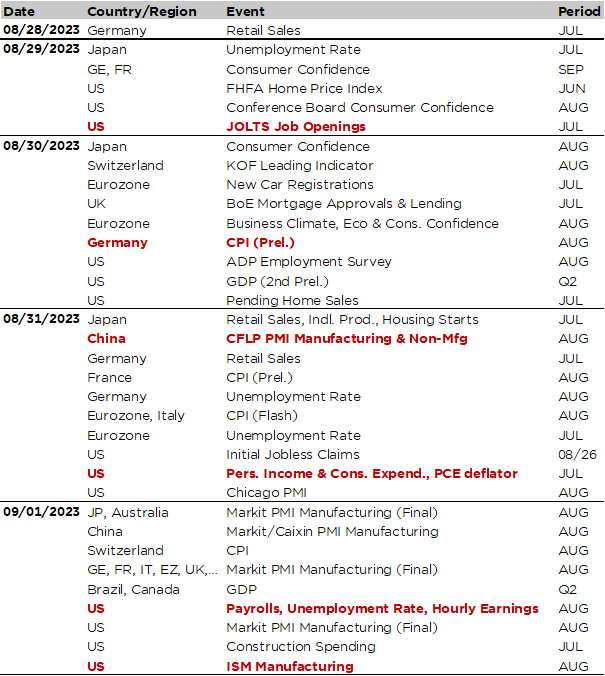

Economic Calendar

It will be a busy back-to-school week for investors over the next few days, with several key economic data releases from all over the world on both growth and inflation, as well as on US labor market more specifically. As usual, this new data set will be scrutinized to gain some insights about the potential next moves of the major central banks when they meet by mid-September (ECB, Fed, BoE and BoJ next meetings will take place in between September 14th and 22nd). As far as companies’ results are concerned, the Q2 earnings season is now definitively winding down with only a few large caps reporting this week (Salesforce, Broadcom, HP, Dell, Crowdstrike, VMware for IT sector; Dollar General, Best Buy, UBS, PetroChina and… some interesting Chinese financial names reporting in the current context such as Agricultural Bank of China, Industrial & Commercial Bank of China and Ping An among others)

In the US, the highlights will be the US jobs report for August on Friday and the July’s PCE inflation print the day before, released in the same time as personal consumption expenditure, real disposable income and saving rate data. US labor market is expected to ease further (i.e. become less tight) as payroll gains should slow to about 160k in August (vs. 190k the prior month), unemployment rate may creep up to 3.6%, while average wages growth is expected to tick down to +0.3% MoM from +0.4% according to the consensus. Before that, we will get tomorrow the US JOLTS Job openings (and quits rate) report for July, the ADP employment survey for August on Wednesday, as well as the weekly initial jobless claims on Thursday. For those old enough -like me-, you should be amazed -if not shocked- when you observe the current still historically quite low level of these initial claims (around 230k) and you remember the rule of thumb that prevailed in the past (labor market improving/deteriorating when initial jobless claims are under/above 400k). According to this extinct gauge, the labor market is still quite far from having really eased enough. To make a long story short, we should continue to observe a “gradual moderation” of the labor market, but not (yet) an outright weakness.

On Thursday, both the headline and core PCE deflator are expected to increase by only +0.2% MoM, similar to June’s prints, leaving the YoY changes basically unchanged at slightly above 3% and 4% respectively. Personal spending and income data should confirm current US consumption’s resilience, with growth of +0.3% MoM in income and +0.7% in spending. Other notable US economic indicators include the US ISM manufacturing index for August on Friday (consensus foresees a small uptick to 47.0 from 46.4, while our proprietary model forecast a more marked rebound above 50…), the Conference Board consumer confidence survey for August and the June home price index on Tuesday and the 2nd estimation of Q2 GDP on Wednesday.

Turning to Europe, the focus will be on inflation with the preliminary readings of German and Euro Area inflation for August on Wednesday and Thursday respectively, and the Swiss CPI on Friday. Euro Area headline and core inflation are seen falling moderately on a yoy basis but remaining nevertheless both above 5%, while headline annual inflation in Switzerland should remain unchanged at… 1.6% in August. Other notable data releases include the unemployment rate in the Euro Area (Thursday), which is expected to stay flat at 6.4% and the final manufacturing PMI indices for August on Friday morning, which are likely to confirm an overall moderation in manufacturing activity, with an especially worrisome pocket of acute weakness in Germany.

To conclude with Asia, all eyes will be on August China PMI indices on Wednesday and Thursday given the current worries about the (more structural) headwinds Chinese economy is facing and the lack of economic policy responses from the government so far. Investors will also focus on Japan as several key indicators, including retail sales, industrial production, housing starts, unemployment rate and consumer confidence are due this week.

Otherwise, holidays are also behind for central bankers as there will be plenty of them speaking throughout the week, bringing perhaps some nuances or just emphasizing -once again- the unsurprising key message from Jackson Hole of “higher for longer rates as long as the fight against inflation hasn’t been won”.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.