Nowadays, economists and investors spend considerable time tracking inflation, debating purchasing power, and worrying about affordability. These three concepts are deeply connected, frequently confused, and, much like football tactics, widely discussed with varying levels of genuine understanding.

In the US, where economic data releases can move markets more reliably than Cagliari Calcio games generate excitement, distinguishing among these forces is essential to interpreting both consumer behavior and assets valuation.

Inflation: The League-Wide Cost of Playing the Game

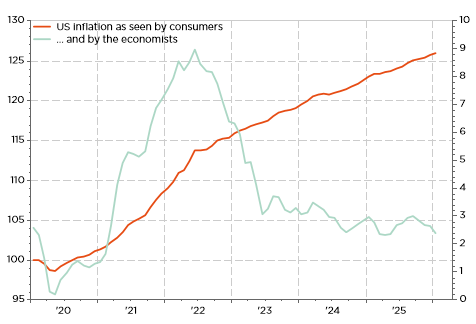

Inflation measures the broad increase in prices across goods and services. In the U.S., it is most commonly tracked through the Consumer Price Index (CPI), which captures the cost of a standardized basket of everyday expenses (housing, food, transportation, healthcare, and other staples of American financial existence). Inflation is macroeconomic, structural, and… largely indifferent to personal circumstances. Think about it! A standardized basket of goods and services for an average household in an ever-expanding universe of goods and services (am I the only one who feels lost in front some store shelves because of the infinite choices?) and ever-widening income gaps. No wonder, then, that no one recognizes themselves in these inflation figures. Anyway, let’s get back to our topic. When inflation rises, the cost of living increases across the economy, reducing the real value of your income, future cash flows or fixed-income streams. From a portfolio perspective, inflation acts as a slow but persistent dilution of returns. Nominal performances (or wages) can remain strong while real returns (or income) quietly underwhelm. The economic equivalent of dominating possession statistics while trailing on the scoreboard.

So, while the economists, Fed members and investors may eventually read a more presentable 2.5% inflation figure for January, the average wallet continues to feel the pain of a cumulated 25% increase so far over the last 6 years. In the meantime, both headline and core annual inflation are still running above 2%. Same story for alternative gauges: they all seems to have settle above 2%.

It’s the (cumulated) inflation stupid!

As a result, investors and consumers focus intensely on inflation not because rising prices are inherently destabilizing (except when inflation reaches really some absurd levels), but because inflation shapes their purchasing power, the monetary policy and interest rates (the fundamental gravity force of assets valuation).

Purchasing Power: The real strength of your income and capital

Purchasing power reflects what money can actually acquire. It is inflation’s practical consequence and, arguably, the central objective of long-term investing. Accumulating capital is useful only to the extent that the capital maintains or expands its ability to purchase meaningful goods and services over time.

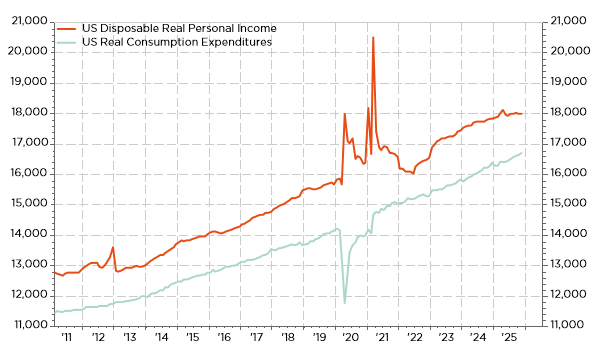

Purchasing power depends on the interplay between wage growth, asset returns, taxes and inflation. When portfolio returns and income growth outpace inflation, purchasing power expands. When inflation runs ahead of both, wealth may grow nominally while declining in real terms (a scenario that investors often discover only when attempting to fund retirement, college tuition, or housing upgrades that appear to have undergone their own independent bull markets). Taxes too play a role in purchasing power: lower them and you may get more firepower -at least in the short term-. During the covid period, most US households received several rounds of stimulus checks from the federal government, totalling up to about $3’200 per eligible adult.

US real disposable income and spending: fiscal policies matter too!

Affordability: Where Macroeconomics Becomes Personal

Affordability translates macroeconomic trends into household-level decision-making, including their “tastes and desires”. It reflects whether consumers can realistically purchase major assets or services given prevailing income levels, borrowing costs, and price dynamics.

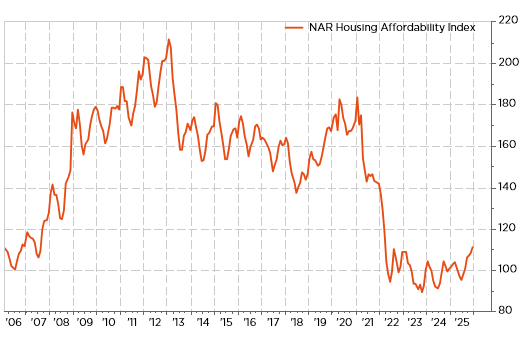

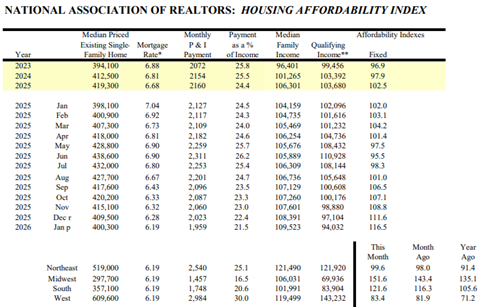

The US housing market offers a particularly clear illustration. Even as inflation moderates, elevated mortgage rates combined with structurally high home prices have materially reduced affordability. The result is a dynamic where inflation headlines may appear reassuring while housing accessibility continues to deteriorate… a reminder that affordability responds to multiple variables, not simply price trajectories!

US NAR Housing Affordability Index: there have been large swings over the last 20y

Housing affordability depends also about… location

For investors, affordability matters because it drives consumption behavior, which in turn drives corporate revenues and economic momentum. Consumers do not spend based solely on price trends; they spend based on whether their financial “reality” allows them to, but also assuming they have the willingness to!

Investment Implications: Watching the Right Scoreboard

Markets frequently overemphasize headline inflation while underappreciating how inflation interacts with wages, credit availability, and asset prices. Moderate inflation can coexist with strong economic performance if income growth and asset appreciation support purchasing power. Conversely, low inflation environments can still produce affordability stress if borrowing costs remain elevated or asset prices rise faster than earnings. Put more simply: inflation determines how expensive the game becomes, purchasing power determines how strong your squad is, and affordability determines whether you stay in the league… a bit like trying to keep Cagliari Calcio competitive season after season. Portfolio construction, therefore, should prioritize real return generation and diversification across asset classes that historically preserve or enhance purchasing power during varying inflation regimes.

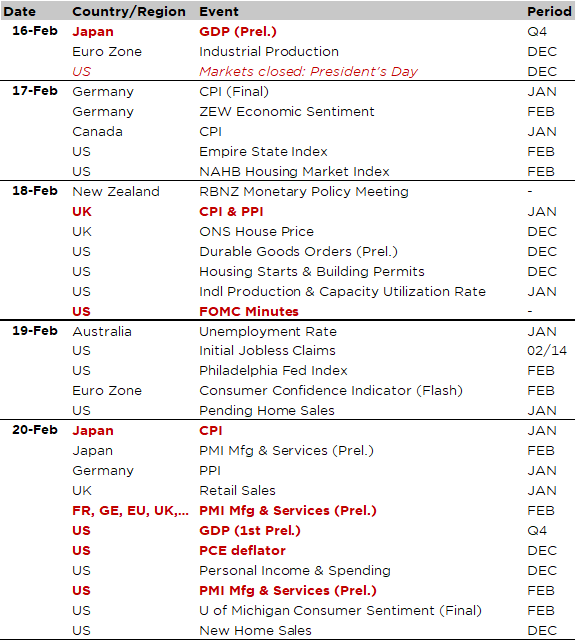

Economic calendar

Economic activity and inflation will be in the spotlight this week as we will get the Q4 GDP prints for both Japan (Monday) and the US (Friday), the global flash PMIs on Friday, as well as CPI numbers for January in Canada (Tuesday), UK (Wednesday) and Japan, on top of the US PCE deflator (Friday). Finally, we will also get the US durable goods orders, the US housing starts, the US industrial production, as well as the FOMC minutes, all due on Wednesday.

However, most of the markets’ actions related to US economic data will take place on Friday with the releases of the Q4 GDP, the January PCE deflator -along with the personal consumption expenditures, income and savings rate- and the preliminary manufacturing and services PMI indices for February. The consensus expects GDP growth to have slowed from 4.4% a.r. in Q3 to 2.8% during the last quarter of 2025, whereas both the headline and core PCE deflator MoM growth is foreseen at +0.3%, implying YoY percentage change of 2.8% and 2.9%, respectively. For the personal income and consumption, economists forecast solid gains of +0.3% and +0.4%. Note that US markets will be closed on Monday for the President’s Day holiday.

Global investors will also pay attention to the global flash PMIs due Friday as a health check on economic activity sentiment across the globe. In UK, the spotlight will be on inflation (Wednesday) as BoE target rate downward trajectory remains uncertain (headline inflation is expected to drop to 3.0% vs. 3.4% in December, with services inflation still well above 4%). Inflation will also be in focus in Japan (Friday), where the headline national inflation is expected to fall to 1.5% from 2.1% in December, while the core-core CPI inflation (i.e. excluding fresh food and energy) should prove stickier, closer to 3.0% (2.7% expected). The Japan Q4 2025 GDP was released this morning: a disappointing muted rebound in real activity (+0.1% Q/Q gain after a -0.7% drop), while nominal growth has remained more resilient (+0.6% Q/Q after 0% in Q3). Note however that the major drag to real GDP came from inventories, which decreased, whereas consumption, investments and net exports didn’t detract to overall GDP growth.

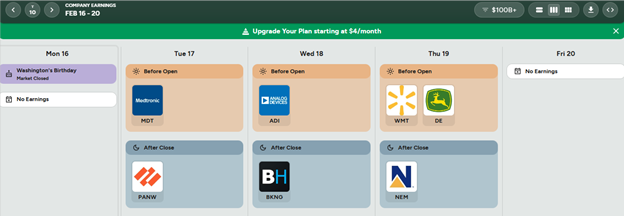

Wrapping up with the earnings season, which is now winding down across the Atlantic, the key reports will feature Walmart, Palo Alto Networks and Deer. In Europe, the focus will be on consumers staples (Nestle and Danone) and miners (BHP, Glencore, Rio Tinto and Anglo American).

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2026-02-16

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.