Latest US data and some Fed members statements reinforced the current optimistic views made of resilient growth and ongoing disinflation. Consumers income and spending are indeed still expanding, manufacturing activity is holding well according to latest ISM, while the Fed’s favorite inflation gauge, the PCE deflator, decelerated further in October. The headline reading was actually flat month-over-month (+3.0% yoy) and the core one grew +0.2% in October (+3.5% yoy).

In addition, Fed Governor Christopher Waller said last week he was “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%”. More importantly, he added that he could see a point where the Fed might start lowering rates if inflation continues to ease over the next few months. As a result, everything went up again: equities, bonds, credit and gold have therefore continued to surf on this goldilocks wave, while USD offered some resilience as other central banks, especially the ECB, may eventually been even forced to cut rate before on the back of slower/anemic economic growth and inflation decelerating even faster there.

While investors have plenty good reasons to enjoy this Christmas Goldisocks rally gift after a challenging year where pessimistic views prevailed most of the time, from the recession fears to the inflation stickiness to the debt sustainability concerns or the geopolitical uncertainties. It’s like a kind of relief rally: so far so good… we finally made it! Unfortunately, markets have likely run too fast and/or too far. Either because inflation may not yet be completely under control (health insurance is poised to act as a countervailing upward force next year, consumers inflation expectations have continued creeping higher, geopolitics and other structural developments may also push prices higher) or economic growth could really peter out on the back of the lagged effect of tighter monetary policy and overall higher rates hurting severely the most fragile consumers and companies.

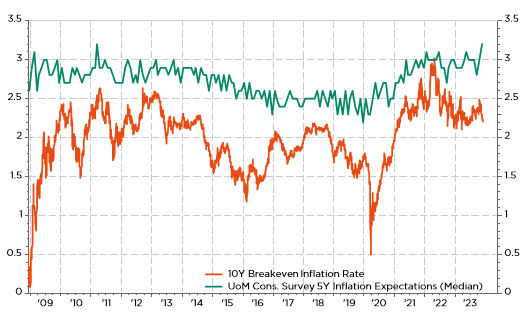

US consumers & investors inflation expectations: Mind the divergence!

Last but not the least, the Fed and Jerome Powell may also act as the Grinch for investors who have already discounted too many rate cuts too soon. The recent easing of financial conditions with both yields and spreads falling rapidly over the last few weeks, the resilience of the US economy and the inflation risks asymmetry in the eye of the (central bankers’) beholder should indeed reduce the emergency of rate cuts. Christmas and 2023 will soon be behind us and, for once, I don’t really need any reliable crystal ball to foresee renewed concerns awaiting us next year. So, let’s enjoy the present calm and the current festivities while they last.

Economic Calendar

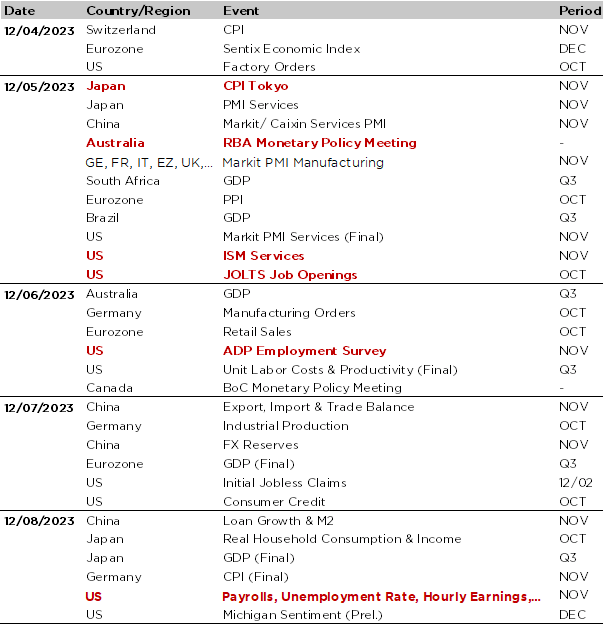

The November US jobs report will be the main highlight of this week ahead of the Fed’s meeting next week (Wednesday 13 December). The consensus expects solid payrolls gains (180k vs. 150k the prior month), easing wages growth (around +0.3% on a monthly basis, consistent with a decline towards 3.5% yoy) and stable unemployment rate (3.9%), which will definitively cement a wait-and-see approach from the Fed. Any significant upside or downside surprise will likely lead to a spike in financial markets volatility as it will challenge the current goldilocks backdrop. Before that, we will already get some insights on the state of the US labor market through the October JOLTS report (jobs openings and the quits rate, closely correlated with wages growth) and the employment subcomponent of the US ISM service tomorrow, as well as the November ADP report on Wednesday and weekly initial jobless claims on Thursday.

Apart from the US labor market, other key US economic releases include the factory orders today, the US ISM services index tomorrow (consensus expects a slight improvement to 52.3 in November from 51.8 the prior month) and the preliminary reading of the University of Michigan consumer sentiment for December. It may be worth to keep an eye on consumers inflation expectations as they seem stickier than the ongoing disinflation observed in official data as they have continued to creep higher recently.

Turning to Europe, the focus will be on Germany with the releases of October factory orders (Wednesday) and industrial production (Thursday). For the whole Euro Area, we will also get the Eurozone Economic Index (today), October retail sales (Wednesday) and the final Q3 GDP print (Thursday). In Asia, the November China PMI services index and loans growth data are due today and Friday respectively in order to assess indirectly domestic consumption trend, whereas the Chinese trade balance will be released on Thursday. As far as Japan is concerned, the Tokyo CPI (tomorrow) will be watched closely ahead of the BoJ next meeting (19 December), as well as the household real consumption and income report for October (Friday).

In the run-up of major central banks meetings, investors will keep an eye on rate decisions from the RBA on Tuesday (consensus expects rates to stay unchanged at 4.35% but some economists point to a 25bps hike) and the BoC on Wednesday (no change expected with policy rates at 5%). While Fed members have now entered a blackout period ahead of their meeting next week, some ECB members, including President Lagarde today, will still give speeches and interviews over the week.

Finally, closer to us, there will be an ICMB Public Conference tomorrow evening in Geneva (Maison de la Paix, 18h30) where Beatrice Weder di Mauro (President CEPR & Professor Geneva Graduate Institute) will present her recent research paper “Still too big to fail? Reforms needs after the demise of Credit Suisse”.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.