- Farewell Credit Suisse… The most fragile economic agents are always at risk when monetary policy is tightened, especially when it is so rapid and important in its scope and speed.

- Today, banks are well capitalized, highly profitable and repurchasing stocks so far… A very different backdrop than 2008-2009.

- The first consequence may be an overall higher cost of capital/funding costs for banks on the back of an expected selloff in banks’ AT1 following the write-down of CS subordinated debt.

- The consequences on the overall economic prospects will now obviously depend on the magnitude of these scares/wounds and the time needed to heal them

- As far as monetary policy is concerned, an “hawkish hold” pause seems now more appropriate under the current circumstances

Among Credit Suisse most valuable assets as of today

What are the lessons to be learned and consequences from SVB fallout and CS debacle? I won’t be long today as there are still a lot of uncertainties in the air (i.e. I probably don’t know much more than you) and I have also to navigate through the storm by taking good care of portfolios/funds. I just hope this email will may help you to not overreact or eventually comfort your own opinions.

For the lessons, nothing really new unfortunately… It will eventually lead to a new updated edition of a classic must-read book for investors: “Manias, Panics, and Crashes: A History of Financial Crises” from Charles Kindelberger & Robert Aliber. The most fragile economic agents are always at risk when monetary policy is tightened, especially when it is so rapid and important in its scope and speed. The rapid normalization of financial conditions in an environment of slowing growth always entails risks of varying degrees to financial stability, sending shockwaves and stressing the overall financial markets. But, banks or financial institutions aren’t always the main culprit or the eye of the storm as excess risk taking, debt mismanagement or overall weak fundamentals may also apply to governments (remember the Tequila crisis, Russian debt default or Greece) or companies (Worldcom). In this context, the next few hours and days will be key to assess if the tones of regulation and firewalls surrounding the banking sector will shield it well from this new crisis confidence.

I think so when I look at the capital ratio and liquidity buffer of large European banks. In aggregate the picture is pretty good and healthy according to GS analysts, with every big EU bank meeting the liquidity requirements under stress test scenarios, having quite stable funding and an average 400bps buffer in CET1 (capital ratio of 15% vs 11% required), which represents circa €200bn. If large European banks would crystalize their current mark-to-markets losses on their balance sheets, the impact on the average capital ratio will be circa 30bps. Today, banks are well capitalized, highly profitable and repurchasing stocks so far… A very different backdrop than 2008-2009. It seemed to be confirmed by the relatively muted reaction of senior debt bonds’ prices, which have been quite well insulated so far from the tumultuous environment. It’s also worth mentioning that Credit Suisse was an outlier as it was experiencing a unique situation within the banking sector: it was loss-making and had to issue capital in both 2021 and 2022, while the significant outflows it has experienced since the end of last year was atrophying fast its earnings power.

In the meantime, the first consequence may be an overall higher cost of capital/funding costs for banks on the back of an expected selloff in banks’ additional tier 1 bonds (AT1) following the write-down of CS $17bn of subordinated debt. Investors may indeed reassess the risks of these instruments as CS AT1 bonds have been wiped out, while equity has kept some value (even if marginal). This may lead to months of uncertainty for these securities, which represent circa $260bn of notional. That’s probably why major central banks, in a coordinated manner, announced last night that they would enhance dollar swap lines, thereby helping to keep credit flowing through the economy. The consequences on the overall economic prospects will now obviously depend on the magnitude of these scares/wounds and the time needed to heal them. Fear is unfortunately a non-rational self-fulfilling sentiment and things may get worse before they turn better.

As far as monetary policy is concerned, major central banks face now a difficult tradeoff between inflation credibility and financial stability. If investors and markets calm down somewhat until Wednesday, the Fed may proceed with a 25bps hike this week with a more macro data and financial conditions-dependent path thereafter instead of being only focused on inflation. But an “hawkish hold” pause makes likely more sense in the current uncertain and challenging environment for financial stability and therefore both the growth and inflation prospects. A pause will indeed allow the Fed to assess the negative impulse to growth (how big and lasting will it be) without abandoning its medium-term objective to bring inflation back to 2%. Adopting a wait-and-see posture until they know the answer, instead of doing more harms, which may then be beyond repair, seems thus more appropriate. In other words, the cost of waiting until the next meeting is relatively low as the Fed may then resume, even faster if needed, its hiking cycle. At this stage, it has become hard anyway to be confident about anything… including the path of monetary policy. Let’s just try to keep also in mind that in every crisis lies the seed of opportunity. Easier said than done I concede (again!) when you navigate the storm without the necessary hindsight.

Next week’s letter will be dedicated to asset allocation and portfolio positioning, i.e. the conclusions of our strategy meeting committee that will take place this week, with some of our answers to what does this mean pragmatically for the portfolios management.

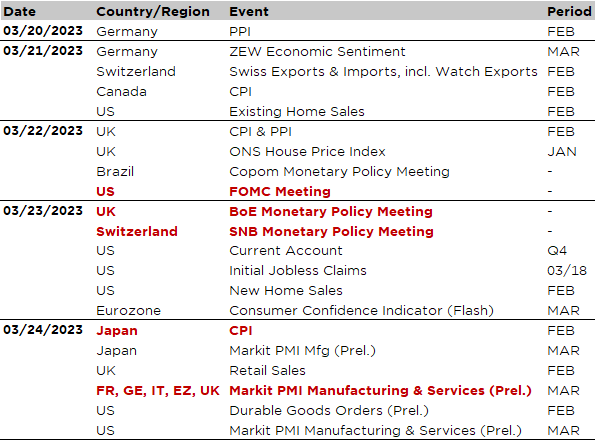

Economic calendar

Spring is coming… let’s hope. In the meantime, as we move from one busy and extraordinary week to another one, the FOMC meeting on Wednesday will be the key highlight of the week on top of the confidence crisis surrounding -once again unfortunately- the global banking sector. Investors nervousness since the failure of SVB, which has led to wild swings and tumultuous trends in markets, before crossing the Atlantic to break through Europe and to Credit Suisse in particular, is now morphing into an acute financial stress with tightening credit conditions as a certain consequence. Will it be quickly resolved with calm & reason prevailing over somewhat unfounded fear & panic? Hard to say obviously even if it seems that today’s banking crisis is likely more “easily manageable” than the 2008 GFC.

As a result, the Fed faces now a difficult tradeoff between inflation credibility and financial stability. If investors and markets calm down somewhat until Wednesday, the Fed may proceed with a 25bps hike with a more macro data and financial conditions-dependent path thereafter instead of being only focused on inflation. A “hawkish hold” pause makes also some sense in the current more uncertain and challenging environment for both the growth and inflation prospects. A pause will allow the Fed to assess the negative impulse to growth (how big and lasting will it be) without abandoning its medium-term objective to bring inflation back to 2%. Adopting a wait-and-see posture until they know the answer, instead of doing more harms, which may then be beyond repair, seems thus more appropriate. In other words, the cost of waiting until the next meeting is relatively low as the Fed may then resume, even faster if needed, its hiking cycle. The FOMC may thus pause its hiking cycle for now, but eventually uses the dot plot, its summary of economic projections (SEP) and the press conference to indicate that further rate hikes are likely going forward once/if the dust settles from SVB fallout, CS takeover and their subsequent domino’s contagion in the banking system through higher financing costs. At this stage, it has become hard anyway to be confident about the path of monetary policy. Jerome Powell will thus walk on eggshell during his press conference, which will be closely scrutinized for what he has to say about the current situation.

Following the Fed decision on Wednesday evening, it will then be the turn of the SNB and the BoE on Thursday late morning to decide about their respective target rate. The SNB will certainly be in the spotlight of the whole financial world this week. Not so much about its target rate decision, but as you may guess about the tragic end of CS and the prospects of UBS and overall Swiss banking system. The probability of a 75bps rate hike by the SNB, as initially expected, has been wiped out given recent events… especially as the CHF may appreciates further if the financial turmoil intensifies. And a too hawkish stance won’t get Swiss banks financing cheaper or easier! As a result, a 50bps rate hike to 1.5% by the SNB seems more appropriate even if Swiss inflation unexpectedly accelerated to 3.4% last month and may remain above 2% until the end of the year. Here too that’s a medium term objective not an immediate one. By the way, 1.5% is the rate at which the Swiss National Bank and Swiss Confederation will lend liquidity if needed to the new UBS-CS entity. As far as the BoE is concerned, a 25bps hike to 4.25% is expected but with some split dissident votes (2-3 members will vote either for a 50bps move or no move at all), which makes it thus a close call. In this regard, the February UK CPI report that will be released tomorrow may tip the balance to a more or less hawkish stance (headline inflation is forecasted to remain flat at 10.1%, while core inflation should rise to 6.0% from 5.8%).

Other noteworthy economic data releases include:

- US weekly initial and continuing jobless claims on Thursday to assess “real time” US labor market trend

- The flash March PMI indices across the major economies on Friday. It will be interesting to see if the recent improvement in both global services and manufacturing sectors extends, pauses or even reverses in some economies, with the US likely the most at risk of a reversal in the near term on the back of the sharp tightening financial conditions lately. The jury is out as far as the European economies are concerned, while China and Japan may logically be unaffected/less impacted at this stage by the recent financial stress

- Japan February CPI on Friday. Recent government subsidies for energy (gas and electricity) are expected to weigh on the yoy annual inflation, which should thus fall to 3.3% from 4.3% in January according to the consensus. However, excluding both food and energy, core inflation may tick up to 3.4% from 3.2%.

This marketing document is issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund’s prospectus, regulations, key Investor Information Document annual and semi-annual reports may be relied upon as fund the basis for investment decisions. You should read the Prospectus and the Key Investor Information Document (KIID) for each fund in which you want to invest. These documents are available on www.decalia.com or at FundPartner Solutions (Europe) S.A.,15 Avenue J.F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments. Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional. Past performance is neither guarantee nor a reliable indicator of future results. This marketing material is not intended to be a substitute for the fund’s full documentation or for any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.