“Prediction is very difficult, especially if it’s about the future…”. Like every year at the same time, I have indeed to admit it as I look back at my own predictions made at the very beginning of each year. So, it’s now time to see how I scored on my 10 predictions for 2023 (even it the year isn’t completely over yet). For those who want to double-check and/or see the full script, please refer to my weekly letters of January 9th (here) and 16th 2023 (here).

- No hard landing this year: global growth will prove more resilient than expected

CORRECT even if China’s reopening petered out much faster than expected and Chinese growth proved a drag on sentiment all over the year, while Europe also disappointed. However, I foresaw quite well the strength of the US consumer (strong labor market, pick up in real disposable income, still some savings cushion) and US manufacturing activity sustained by “industrial policy”.

- US and EU annual inflation rates won’t fall back to central banks’ targets and they will re-accelerate in H2.

Partly correct and partly wrong: both headline and core inflation rates have remained above central banks’ target in most DM (except Switzerland), but the disinflation process accelerated in H2 on the back of falling energy prices and slower economic growth outside the US (see above)

- Forget about Fed’s pivot: there won’t be any Fed‘s rate cuts this year.

CORRECT. Fortunately, it didn’t prove too disruptive for the markets thanks to the ongoing disinflation process and very recent renewed hopes of a Fed’s pivot soon. Note that I somewhat smelled some form of “dysfunctional bond markets at some point this Summer” on the back of the US debt ceiling / soaring government debt net supply

- US 10 rate will end the year above 4%.

CORRECT. We are currently just below this level (3.9%) but the idea of US 10y rate level surprising on the upside this year was a prescient and useful call for managing fixed income portfolios this year

- Within US assets: credit, cash, bonds and equities markets will all end the year with low single digit total returns of less than 6%.

WRONG. While I was right to not be overly pessimistic in forecasting positive returns across the board, I completely missed out the AI story, which has led to the 7 magnificent massive and extraordinary out-performance, as well as the ongoing disinflation story in H2 (see above). Note that I got the S&P500 trajectory path right “falling again at some point this Summer, the S&P500 will finally end the year on a strong note…”

- Energy/commodity story -especially in the base metals space- has more to run…

WRONG. While structural factors haven’t changed much, business cycle outside the US hasn’t proved supportive enough this year. In addition, US energy production has surprised on the upside, weather temperatures haven’t been so low this winter in the North Hemisphere and supply disruptions related to the war in Ukraine have been mainly resolved within Europe.

- EM finally find time in the sun. Emerging markets may indeed outperform DM both in terms of macro backdrop and equity markets performances

Partly correct… or partly wrong, depending if you exclude or include China. Excluding China, the rest of EM scored well in terms of macro performances (resilient and somewhat better than expected growth overall, inflation under control and no major accident) and equity returns if you compare them to Europe and US equity excluding the magnificent seven.

- USD will remain quite strong overall versus other DM currencies this year.

CORRECT. On the back of stronger than expected US growth, no Fed’s rate cuts this year and the lack of credible “better” alternative as of world reserve currency, the greenback didn’t experience the depreciation trend that most forex pundits were predicting

- The German 10y rate will break and remain above 3%.

WRONG. Disappointing growth, warmer weather temperatures, lower energy prices and, as a result, a sharp decline in inflation lately pushed German 10y rate way back to 2%… while it was close to 3% at the beginning of October.

- Value should outperform growth style again this year and, as a result, US equities markets may underperform global equities markets.

WRONG. Again. 2023 was a strong year for US stocks, and especially growth stocks, on the back of an unexpectedly strong economy, the AI craze, and lately the prospect of interest-rate cuts in the 2024. In Europe, the good run of luxury stocks (lee true lately) as well as the home run of Novo Nordisk also played in favor of growth style, but it was more mixed outside the US as European (as well as Japanese) banks outperformed their respective national indices for a 3rd and 2nd year in a row respectively. Energy and overall material stocks performance was a drag within value style.

Final results: 4 correct predictions, 4 wrong ones and 2 undecisive. At the end, while it was far from the perfect copy, my 10 previsions for 2023 weren’t completely mistaken and some were even good (I mean useful) calls who helped me to navigate these extra-ordinary markets this year. I really hope that the correct ones helped you too, whereas you obviously forgot or skipped the wrong ones. Compared to my soccer prognosis, my honor & self-esteem come out “relatively” preserved once again. Just enough to repeat this exercise next month!

That was my last letter of the year, which will then return on 8 January 2024 with my first 5 surprises for 2024. The next five will land in your email box the following week. In the meantime, you will also find a bonus economic calendar covering the holiday’s weeks of Christmas and the New Year’s Eve at the end of this letter. Last but not the least, I wish you all the best for a Merry Xmas and a Happy New Year…!

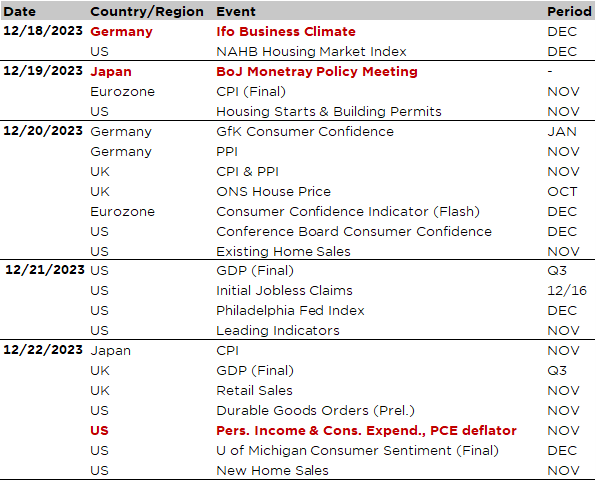

Economic Calendar

Here we go for the final sprint of another incredible year on financial markets. Following last week Jerome Powell’s dovish gift to (already) excited investors, the main highlight of the week will likely be the US personal income and expenditures data for November on Friday, which includes also the PCE deflator, as well as the saving rate. In the current goldilocks context of resilient growth, clear signs of disinflation and monetary policy response tilting now on the dovish side of the Force, another evidence of “lower” inflation will broaden confidence in disinflation and help markets to end the year on a bullish note and perhaps a new record high for the S&P500. Actually, we are just 2% away from it: 4766.2 reached on 31/12/2021… While the core PCE deflator was still running at 3.5% yoy in October, it may fall indeed further closer to 3.0% before year-end as it has averaged less than 3% a.r. over the last 6M (a pace more in line with Fed’s price stability objective). It will be also worth keeping an eye on consumers spending and income data to gauge growth dynamics in Q4.

Speaking about inflation, we will also get some figures for the UK and Japan with the release of November CPI on Wednesday and Friday respectively. BoE seems reluctant to ease too soon on the back of the stickiest/structural inflation issue among DM, while the BoJ still hesitates to exit from its dovish cavern after multi-decades of structural deflation. As a result, all eyes will be on the BoJ tomorrow early morning with the jury still out… Will the BoJ keep its current monetary policy stance or finally decide to end its negative interest rate policy? While expectations about a move this week have faded away in recent days, they are still well alive for its next meeting on 23 January. Then, the door may close quickly if the Fed, followed by other central banks, start to ease as soon and as fast as currently anticipated (5-6 times in 2024 starting from March). Anyway, forget about a sequence of hikes from the BoJ as it will likely lead to a sharp counterproductive appreciation of the JPY. It’s more like an official abandon of the Yield Curve Control and a symbolic move out of negative interest rate policy. Will BoJ will brave enough this week, next month… or still not yet? Place your bets!

Other notable economic data releases include the German IFO index this morning (desperately seeking a bottoming out of the sick man of Europe), US consumer confidence from the Conference Board on Wednesday, US durable goods orders on Friday, as wells as a number of US housing market gauges over the week (housing starts & building permits, existing and new home sales).

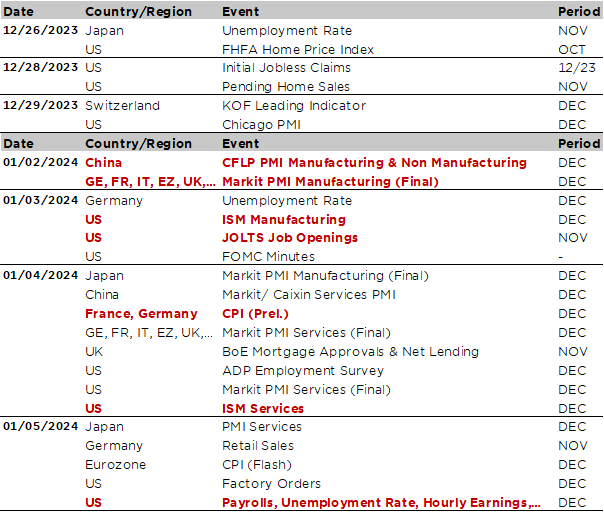

The week between Christmas and New Year’s Eve should be smooth, quiet and thus easy as far as economic data releases are concerned. However, the year 2024 will start with a bang with the releases of the final December PMI indices across major economies on Tuesday 2 January (manufacturing) and Thursday 4 (services), US ISM indices on the same days, US JOLTS report (job openings and quit rate) on Wednesday 3, Germany and Euro Area flash CPI for December and, last but not the least, the US job report on Friday 5 January.

So, stay tuned… and see you next year. All the best!

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.