Last week, I shared with you my first 5 out of 10 predictions that could shape financial markets and portfolio returns this year. As we enter 2024 -and as a reminder-, our central macro scenario may be summed up as “more of the same – but better” …

With resilient growth, inflation normalization & rate cuts in sight. I also remind you that some of these predictions may be considered as consensual, other are provocative, many of them won’t happen, while others seem obvious but I still consider worth to keep them in mind. There aren’t really “surprises” but more educated guesses, which are sometimes linked or bind together to lead to a consistent scenario. Here is a quick reminder of the first five, followed then by the last five.

- Global growth will prove again more resilient than expected, with positive surprises from Europe, Japan and EM economies (excluding China)

- The main economic disappointment will come from China as it falls into a Japanese-like deflation scenario

- US and EU annual inflation rates won’t fall back below central banks’ targets by year-end

- The Fed will commit a policy mistake either by cutting too soon or too late (it has no other choices!)

- The bulk of the rally in long bonds is behind us (i.e. long rates won’t fall much further)

- Neither Trump, nor Biden will be the next US President… Pure gut feelings but we have to admit that many unknown unknows could happen over the next 10 months campaign, suffice also to remember that Obama or Biden were both obscure outsiders at this time of the year back in 2009 and 2020 respectively, while Trump score at the latest elections were finally much higher than expected. Anyway, volatility related to the uncertainties of these US elections will certainly increase from the end of the summer and should then come down after the results. More of less quickly as this US presidential election won’t only impact the overall markets at a “macro” level but also be key for specific sectors as its outcome will influence AI regulation, energy, trade & budget/tax policy

- Fiscal sustainability to come back at the forefront of investors’ concerns. That could be especially true in a context of resilient growth, central banks cutting rates later or less quickly than expected, with real yields staying in positive territory and another unexpected increase in funding needs. Anyway, given expectations about the fiscal policy path of major DM economies, the reluctance of central banks to embark on renewed massive QE and the subsequent rising government debt net supply, the risks remain latent and may thus pop up at any time in the future.

- Within the fixed income universe, the performances of the main bond’s buckets (govies, IG credit, HY and EM) will be quite similar in the area of mid-single digits returns in 2024. In other words, I don’t expect significant changes in rates (likely somewhat lower) or credit spreads (somewhat wider), with most of the performances coming basically from the coupons. Obviously, there will be some rates and credit spreads volatility over the year, related to the other points here above or below, with the final outcome depending essentially of the interactions between growth trend, inflation trajectory and monetary policy responses. In a scenario of (deep) recession, where bad news will become again bad news, long term govies should obviously outperform. At the opposite, resilient growth and hawkish hold stance from central banks should favor short term HY, with a large pinch of cautiousness given the wall of debt that will get closer as we move towards the end of 2024.

- Correlations between bonds and equities will remain positive this year, especially if economic growth doesn’t peter out. In this context, it will be inflation and monetary policy, read interest rates that will remain in the driving seat. In our base case scenario, we thus expect equities to deliver about 10% returns coming essentially from earnings growth, with valuations staying around the current levels. high single digits, low double. However, depending on the disinflation progress, it could be really supportive for equites, and to a lesser extent for bonds, if inflation falls quickly below central banks targets (faster than our forecasts), opening the doors for a rapid easing in monetary policies. Potentially leading to some form of equities bubble (see our point 4). Unfortunately, the opposite is also true… Note finally that in case of (deep) recession, the balanced portfolio will regain some appeal as (long) sovereign bonds should offer a buffer to falling risk asset prices. In this context, correlation will thus turn negative obviously.

- Within the forex markets, the HKD peg will break. With China turning Japanese (faltering economic growth, inflation already nearing 0%, the bursting of a housing bubble, excessive debt, ageing population and an overall loss of confidence within the private sector), the 40 years history of HKD peg to the USD will be challenged further by the ongoing divergences between US and China trends on growth (resilient vs. faltering), inflation (sticky vs. deflation risks) and real rates (positive vs. negative highly needed), as well as geopolitical considerations. Does this peg still make sense today? Can the Hong Kong Monetary Authority afford to keep it? Especially as it is exacerbating economic and financial instability in certain circumstances? What’s about China final intentions about Hong-Kong? Asking these questions is already providing some insights, in my views… As far as the major crosses are concerned, I expect the USD and the CHF won’t depreciate much despite the EUR and JPY will regain some color on the back of the relative stance of their respective monetary policies (read the Fed and SNB will appear more dovish or less hawkish than the ECB and BoJ, as they will be among the first to cut rates).

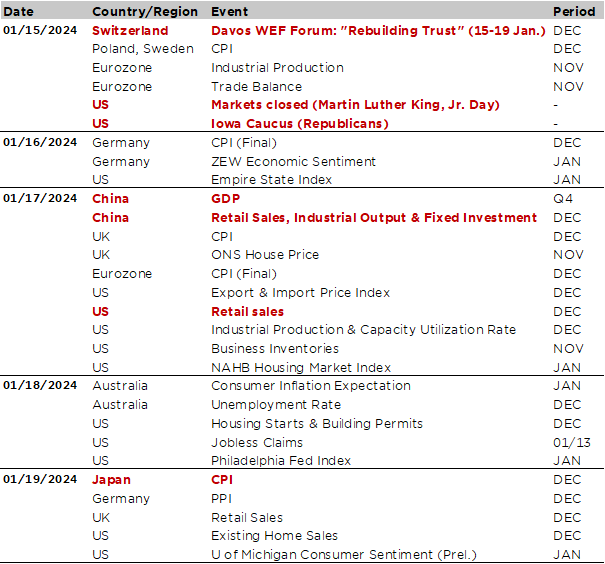

Economic Calendar

For once, political events will be on the center stage this week with investors gauging the consequences of the Taiwanese elections on its overall relations with China (Lai Ching-Te of the incumbent DPP won the presidential election. He was referred as a “troublemaker” and “separatist” by Bejing’s officials ahead of the election), the Iowa Caucus for the US Republican camp tonight (first nominating contest for this year’s US Presidential election where we will get the first indications about support from Trump’s candidature) and the World Economic Forum’s annual meeting beginning today at Davos. The common denominator for these 3 events is likely “freezing cold”… In addition, investors will also continue to closely monitor developments in the Middle East/Yemen as oil prices are back above $80 per barrel.

Starting from Switzerland, Volodymyr Zelensky, Emmanuel Macron, Anthony Blinken, Li Qiang (Chinese premier), Isaac Herzog (Israel President) or Javier Milei (Argentina’s President) are among the top politicians who will attend the WEF this week, joining the 2’800 other happy-few experts, business leaders, civil society leaders, entrepreneurs, social and youth representatives, as well as news outlets, from all over the world. For your info, this year’s title is “Rebuilding Trusts” divided in 4 key themes: Achieving Security and Cooperation in a Fractured World, Creating Growth and Jobs for a New Era, Artificial Intelligence as a Driving Force for the Economy and Society, A Long-Term Strategy for Climate, Nature and Energy

Moving into the world economy sphere, investors will take the pulse of the US consumer through the December retail sales report on Wednesday (a solid +0.4% MoM gain is expected) and the University of Michigan consumer sentiment preliminary reading for January (Friday), assess the improvements, or not, of the China economy with the releases on Wednesday of the Q4-2023 GDP growth figure (+1.0% QoQ and + 5.2% YoY expected) and latest key economic activity data for December related to retail sales, industrial output and business investment.

We will also get the December CPI reports from the UK (Wednesday) and Japan (Friday), which may influence the stance, if not the decisions, of the respective central bank’s meetings at the end of this month. Other notable economic reports include German ZEW Economic Sentiment (tomorrow), US industrial production and NAHB Housing Market Index (Wednesday), US jobless claims, housing starts and Philadelphia Fed Index (Thursday). Note that US markets will be closed today (Martin Luther King Day).

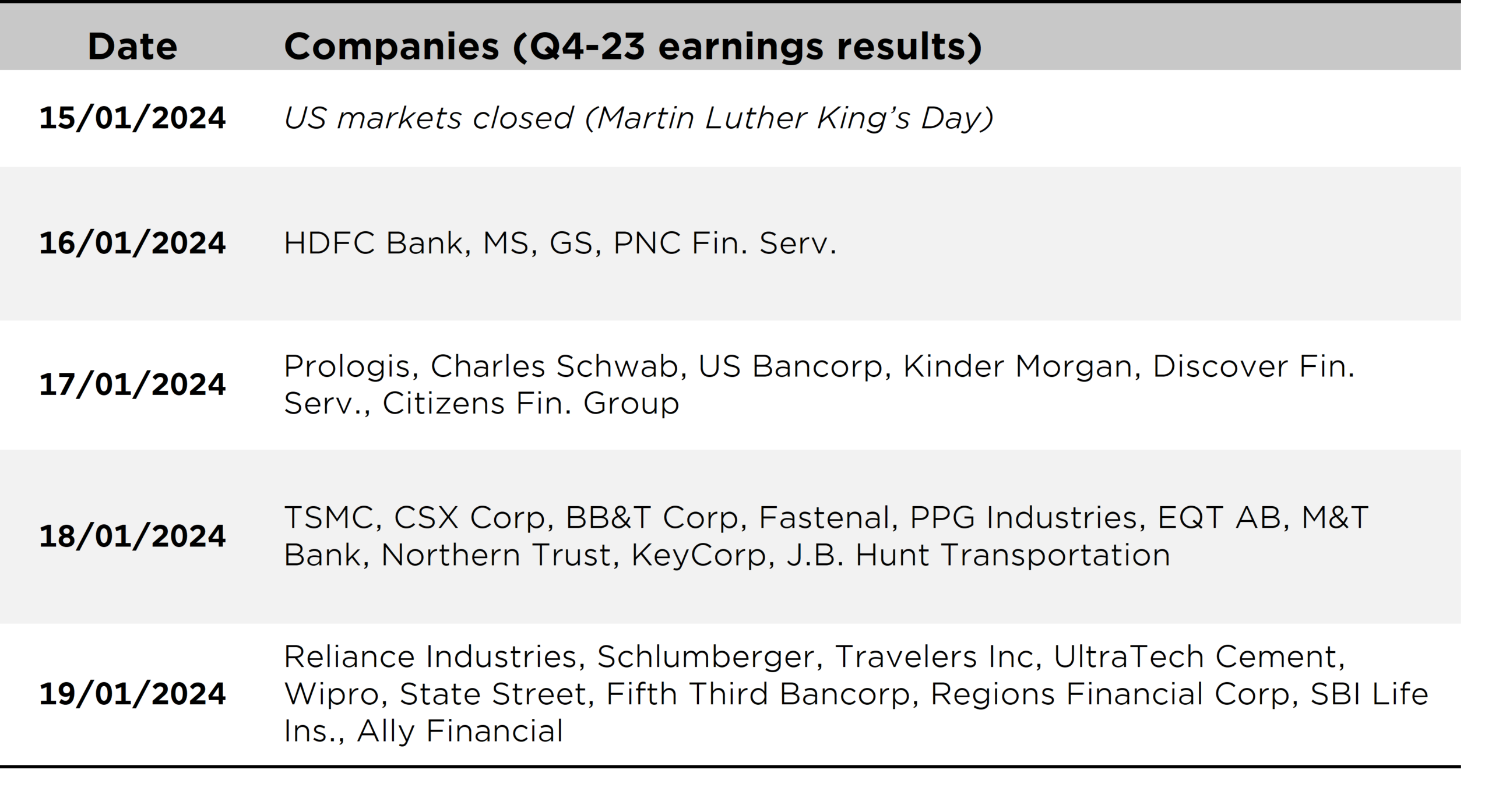

Finally, concluding with the earnings season, financials will stay in the spotlight this week with results from GS, MS or Charles Schwab among others. Outside the financials universe, other notable earnings reports include TSMC, Schlumberger and Prologis. A non-exhaustive list of major earnings releases over the week is available at the end of this letter.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.