With no major economic data coming out of the US due to the ongoing US government shutdown, the earnings season kicking off this week takes on particular importance in these circumstances. What can we expect and what should we be watching for?

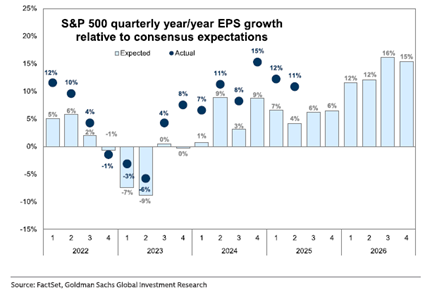

- There is a strong chance that expectations will once again be exceeded, given that the bar of consensus expectations is low again (6% yoy US EPS growth forecasted for the third quarter). Analysts are certainly too pessimistic about nominal revenue growth, with a slowdown from 6% yoy in Q2 to 4% in Q3, even though macro figures and (nominal) GDP growth remained solid last quarter. In addition, they also foresee a sharp deceleration in EPS growth for the tech sector in general, from 30% yoy in Q1 and Q2 to… 15% in Q3. Given the weight of this sector in the index (>30%), a less marked slowdown in its earnings growth should also translate into positive surprises at the overall level.

The consensus expects S&P500 earnings grew 6% yoy in Q3-2025

- That said, earnings growth will slow in Q3 compared to previous quarters (+11% yoy in Q2) as there will be less tailwind due to the dollar weakness (which remained relatively stable in Q3), but mainly because of … tariffs, which certainly shaved off about 1% given the figures of tariffs collected so far (circa $90bn last quarter or +30% vs. Q2). In addition, some bottom-up idiosyncratic boosts, which occurred in Q2, will not be repeated in Q3. All in all, EPS growth will likely be around very high single digits (let’s say 9%).

- Finally, the focus will be on AI capex sustainability too obviously. We will see if mega-cap tech companies will reaffirm their intentions to spend and if there are some tangible signs of revenues growth (at some point down on the road) to justify this spending. In this context, it will also be interesting what non-IT companies have to say about implementing AI in their business and the related expected impact on their revenues and/or costs. Also linked to the AI spend phenomena, the circularity issue, which have recently raised some eyebrows and red flags about the sustainability of this dynamic due to the troubling parallel with Cisco and Nortel during the TMT bubble, will also be in focus. For the time being, it is big money for sure -in USD terms- but it remains reasonable (read manageable) as a % of Nvidia total’s size, according to the majority of analysts covering this sector.

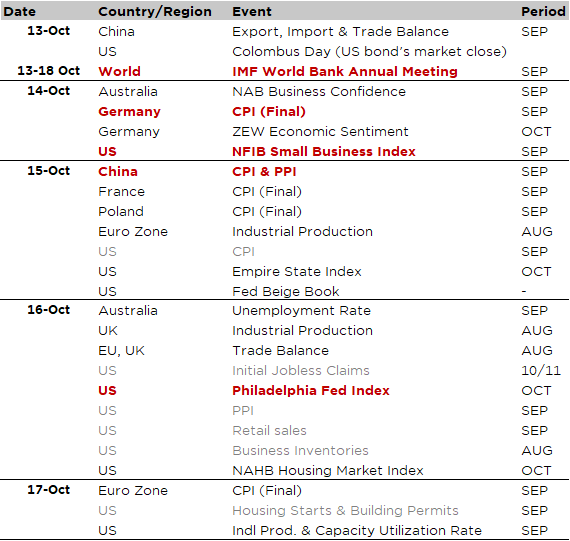

Economic Calendar

Without a resolution about the budget dispute between Republicans and Democrats, the US government shutdown will enter its third week and will continue to be in focus, with several US economic data releases still disrupted, likely delaying the releases of this week data on inflation (would have been the most important), retail sales, housing starts, and jobless claims. But after Friday’s big selloff due to a re-escalation in trade tensions between US and China as President Trump imposed higher tariffs on China (an additional 100% tariff on Chinese goods!?) to punish it from tightening rare earths exports, investors will also be watching closely for the latest trade policy developments… again. The NFIB small business optimism survey (Tuesday) and the NAHB homebuilder confidence -expect a rebound as mortgage rates fell over the last few week-, as well as the regional manufacturing indices such as Philadelphia Fed (Thursday) -good indicators of the October ISM- and the industrial production (Friday) are still scheduled. Finally, the Fed will release its Beige Book on Wednesday, while several Fed members are expected to deliver remarks, including Fed Chair Jerome Powell at the IMF – World Bank meetings (see below).

Elsewhere, we will get the CPI data for September in China (Wednesday) and the final reading for the whole Euro Area on Friday, while The German ZEW survey will be released Tuesday. This morning, Chinese trade data were reassuring as exports came better than expected (+8.3% yoy in September, up from +4.4% the prior month), while imports grew 7.5% y/y last month, the fastest pace since May 2024 and well above expectations too. While this resilience underscores the ability of Chinese exporters to cope with US tariffs (so far at least), the latest re-escalation in tensions with the US still poses some downside risks.

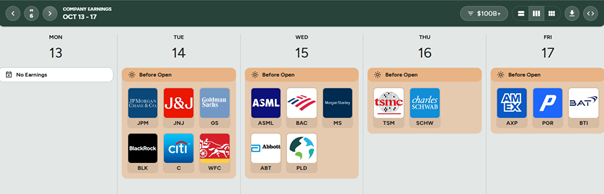

Note also the World Bank and IMF Annual Meetings from today until Saturday: the latest World Economic Outlook from the IMF is due on Tuesday, whereas appearances and speeches by central bankers at various events over the week include Fed Chair Powell, BoE Governor Bailey or ECB President Lagarde among others. Finally, the Q3 US earnings season will kick off on Tuesday with the releases of several major US financial firms in the following days too, including JPM, Wells Fargo, GS, Citigroup, MS, BofA and Amex, … but not only as TSMC, J&J, Samsung or BAT will also report this week.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-08-04

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.