This is my last weekly letter of the year. So, it’s time to step back and look at how I scored on my 10 predictions for 2025. Even if the year isn’t officially over yet, we can already affirm that it has been an incredible eventful and fascinating year on markets (once again!), which have delivered a great vintage for most investors.

Surprisingly or perhaps not, I almost made a home-run this year with my prognosis and divinations… Here below is the recap of each of them, accompanied by the final judgement. For those who want to double-check and/or see the full script, please refer to my letter of January 6th 2025 (Ten surprises for 2025).

- Forget about credit in 2025! Either we remain in a Goldilocks scenario and equities remain the fastest horse of the asset allocation carriage, or economic growth peters out and sovereign bonds outperform.

Almost correct. On the back of a supportive Goldilocks scenario of positive economic growth, ongoing disinflation and monetary policy easing, equities outperformed credit, while sovereign bonds lagged, especially outside the US with EUR govies flat or JGBs significantly down. However, and contrary to all expectations in this context, the star asset of 2025 will have been gold (and Sliver, which is up +140% YTD), while Bitcoin will certainly have earned the prize for the worst Sharpe ratio… Who would have believed it?

- The “Magnificent 7” will no longer lead equity indices (in another positive year) as market participation broadens out.

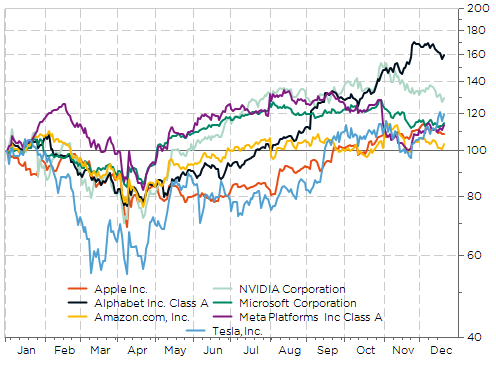

Quite correct. While AI theme remained centerstage to US equities returns and Mag7 stocks drove most of the US market’s returns in 2025, given their still high market’s share, it’s worth noting however that except Alphabet (Google) and Nvidia, the five other stocks didn’t really outperform (outrageously) the S&P500 this year.

Mag7 stock prices YTD performances

- Non-US equities stand to outperform. Trump policies might prove more counterproductive than expected for US stocks, especially if they lead to durably higher US rates and/or a weaker dollar.

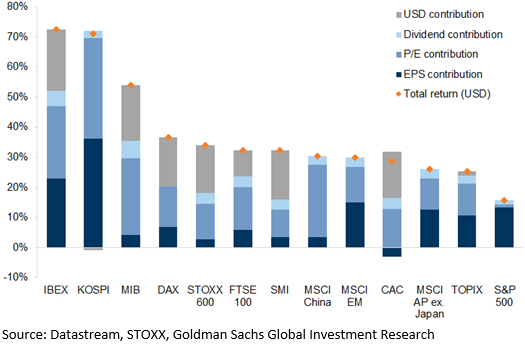

Correct. Nearly all major equity markets have outperformed the US in 2025 in local and in USD terms.

Decomposition of YTD returns (in USD)

- A profound reform of Germany’s debt brake will occur. The new coalition coming out of the February snap elections will have “no other choice”…

Correct. In March 2025, the German Bundestag and Bundesrat approved constitutional changes to effectively relax the country’s long-standing debt brake, allowing much higher borrowing for defence and infrastructure spending. It reflects broad political concern about stagnant growth, underinvestment, and increasing security challenges.

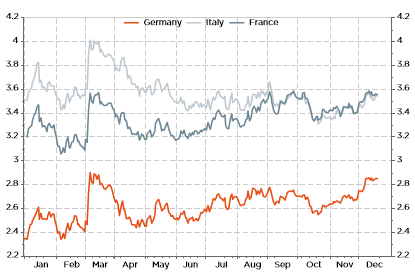

- The French 10-year yield surpasses that of Italy.

Correct. It’s not only about the government debt level compared to nominal GDP, but also the trajectory, the nominal growth outlook, the political backdrop (compare the current unusual political stability in Italy vs. instability in France), as well as how and who is the financing the deficit (foreign or domestic savings) or the government taxes and spending rates parameters,… So, assessing sovereign debt sustainability is a complex and ever-moving matter.

German Bund, Italy BTP & France OAT 10y rate

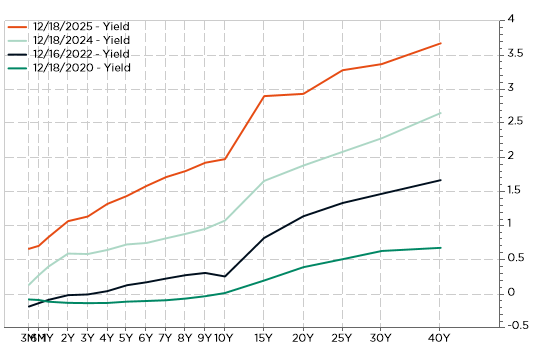

- The Japanese yield curve will undergo a bull flattening, with global growth slowing as the year proceeds (especially outside the US), Japanese wage growth finally disappointing but the BoJ having nonetheless already hiked rates at least twice. This will be in stark contrast with most other sovereign bond curves, which will tend to steepen as shorter rates fall more than long rates.

Completely Wrong for JGBs… and somewhat right for the other curves (which get steeper thanks essentially to the decline in short term rates). That was undoubtedly, by far, my biggest miss this year as instead of a “bull flattening”, the JGB’s yield curve experienced a further significant “bear steepening” in 2025… Even the recent BoJ interest rate hike didn’t reverse this trend. But what’s about next year? And what could happen if global growth peters out?

JGB’s yield curve at different points in time

- The UK economy will face stagflation with GDP growth slowing materially (close to 0% vs. IMF and OECD 2025 expectations of 1.1% and 1.5% respectively), persistently above-3% inflation (or at least higher than in any other G7 economy) and renewed debt sustainability concerns, leading to overall downward pressures on the cable. As a result, the BoE will cut its easing cycle short.

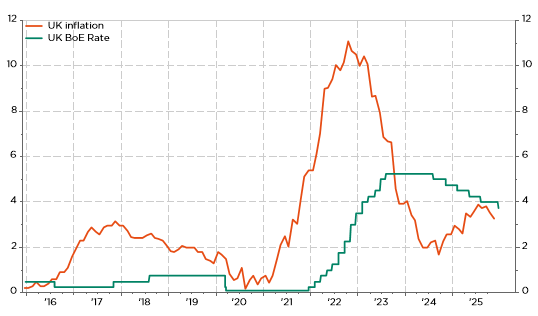

Quite wrong… While I foresaw rather well the UK inflation trajectory, which accelerated from 2.5% to 3.8% over the summer before receding lately to 3.2% (remaining therefore the highest among G7 economies), I proved wrong on UK growth, which remained more resilient than expected on the back of a supportive labor market -despite some cracks lately-, as well as on the BoE easing cycle as it went on even if in a hesitant manner.

UK inflation & BoE target rate

- Oil prices to collapse below $50 per barrel as the war in Ukraine ends, tensions in the Middle East recede, global growth slows down and Trump policies push US oil/shale gas production higher.

Almost correct. Oil prices fell indeed this year, with both WTI and Brent around $60/bbl nowadays, but not really for the reasons I mentioned here above. Anyway, this decline in energy prices was very welcomed for investors as it reinforced the Goldilocks backdrop (less inflationary pressures and better growth outlook as it gives some additional purchasing power to consumer and help improve companies’ margins). That was especially true for the Euro economy, once you convert energy prices in EUR, as it likely provided a significant growth tailwind, which offset more or less tariffs’ headwind, also facilitating ECB monetary easing.

- Trump tariff policies lead to a full-blown trade war, causing major FX moves.

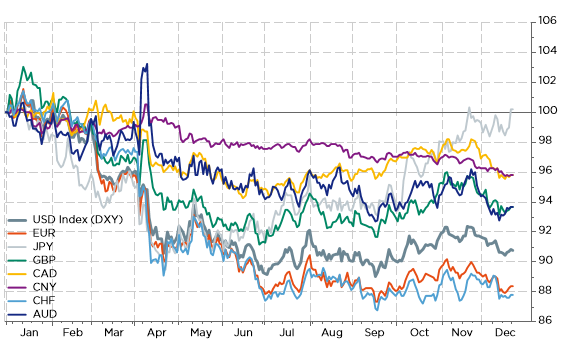

Half correct. In the sense that even if Trump tariffs haven’t led (yet or finally?) to a full-blown global trade war, there has been a major FX move with the greenback experiencing one of the most brutal depreciation in the last few decades.

US dollar against major DM currencies (rebased to 100)

- China falls into a Japan-like deflation scenario

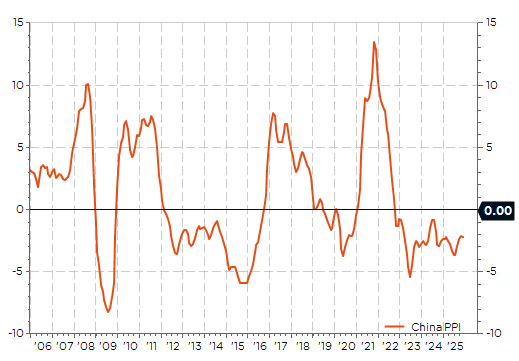

Half correct. While the Chinese economy has continued growing at about 4-5% in real terms, it is still suffering from “involution”. That’s a term used by locals to describe the intense price competition spurred by excess production as producer prices have registered YoY declines for 38 consecutive months (-2.2% in November). As a result, the Chinese 10y sovereign bond’s yield stands now below the JGB 10y one (1.84% vs 2.07%)…

China PPI (Y/Y %): Fruits of “Involution”

Final results: hard to say precisely but, at the end, I think my 10 predictions for this year were rather prescient, especially as most of them helped me to navigate these once-again extra-ordinary markets. I really hope that the correct ones helped you too, whereas you obviously were smart enough or more prescient than me to skip the wrong ones. Compared to the results and ranking of Cagliari Calcio, my honor & self-esteem come out preserved enough to repeat the exercise for next year!

That was indeed my last letter of the year, which will then return on 12 January 2026 with my 10 surprises for 2026. In the meantime, I would like to thank you warmly for your support, interest and interactions, and I wish you a well-deserved and restful end of the year break with your family and friends.

Merry Christmas and a All the Best for a Happy and Healthy New Year. See you in 2026 for another ride on the markets!

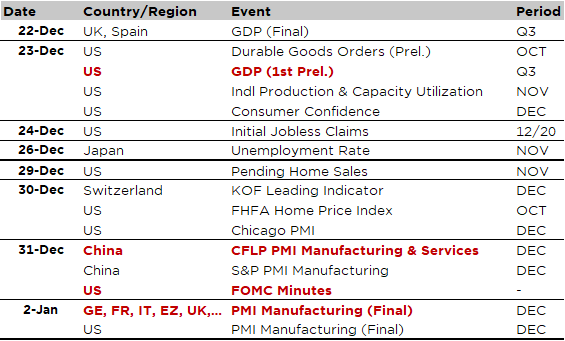

Economic calendar

During the incoming holiday-shortened and quiet fortnight, most key economic data releases will be released this Tuesday with the government-shutdown delayed US Q3 GDP (expected at 3.2% a.r.), durable goods orders for October, November industrial production and the Conference Board consumer confidence. We will also get the China PMI indices and the latest FOMC minutes for New Year’s Eve, and then the final readings of global PMI manufacturing on Friday 2nd January 2026.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.