Since President Trump continues to act like a sheriff in order to restore law and order in the economic and financial markets, let’s look at the impact of his decisions and measures through the lens of my favorite Western film.

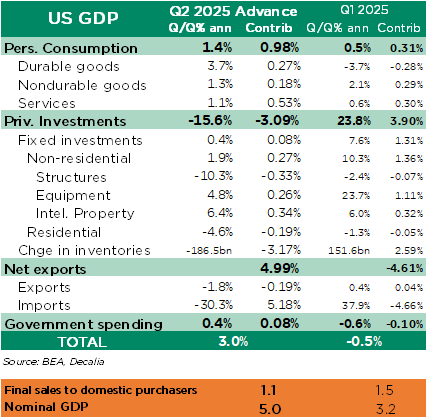

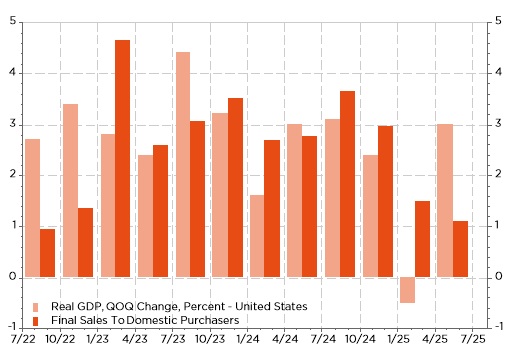

First quarter US GDP growth headline was poor (-0.5%), but the details were not so bad. Lat week, the headline US GDP Q2 print came above expectations (3.0% vs. 2.6% expected) but the details aren’t as rosy as suggested by this strong print. The culprit of these distortions remains the same however: the front loading of US imports and the stockpiling in Q1, ahead of the US trade tariffs announcement, and the subsequent collapse of US imports and inventories depletion in Q2. Excluding these extraordinary distortions, i.e. focusing only on final domestic demand (i.e. consumption expenditures and capex), this report remains perfectly in line with our soft-landing scenario, with the US economy slowing but going so far as suggested also by the “final sales to domestic purchasers”, which give a better idea of the underlying domestic growth trend.

US Q2 2025 GDP advance estimates breakdown and comparisons with Q1

US GDP and final sales to domestic purchasers, Q/Q % a.r.

Bottom line, first half 2025 GDP growth is running around 1.5% annualized. That’s in line with our baseline for this year. The GDP release also contained hints that inflation remains somewhat sticky, implying that core PCE deflator (the Fed’s preferred gauge) accelerated to a 2.8% in June (it was 2.6% as recently as April). So, this GDP report suggests that Fed current monetary policy seems appropriate in the sense that there is no urgency to lower rates, with all due respect to the sheriff President Trump.

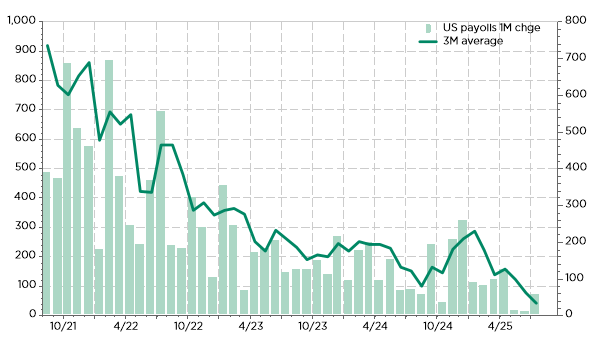

Let’s now move to the bad US jobs report of last Friday. Payrolls growth totaled 73k for the month, below the estimates for gains around 100k. But the ugly part was the previous months downward revisions: June and May totals were revised sharply lower, down a combined 258k from previously announced levels. As a result, the 3-months job average is now just 35k (compared to about 150k according to last month data -prior to the revisions-). Optically, it seems terrible.

US 1M payrolls change and 3M average: optically terrible

However, we should keep in mind that

- The US unemployment rate hasn’t moved much higher (yet?) as it rose from 4.1% to 4.2% a level similar to exactly one year ago when most investors were freaking out about a recession coming soon…

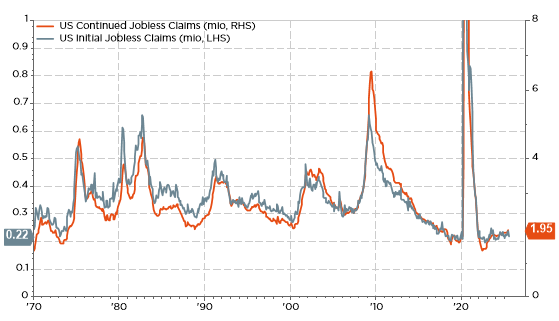

- Weekly initial jobless claims, as well as total contains claims, remain both at historically low levels suggesting that while the US economy is perhaps not creating many “new” jobs, companies aren’t really sacking lot of workers either. And wages aren’t falling… as the average hourly earnings have accelerated to 3.9% yoy in July (vs. 3.7% in June).

- Payrolls “air pockets” aren’t unusual as you can observe on the graph here above, especially as this report contains some well-known estimation’s errors (seasonal adjustments or other statistical models when data is lacking such as the birth-death model for estimating new businesses creation or closures). In this context, total non-farm payrolls represent 160 million, while the BLS points out that the confidence interval for the payroll number is plus or minus 136k, i.e. less than 0.1% of total payrolls!?

Weekly initial jobless claims and total continued claims

So, I think that this report should be taken with a pinch of salt. It is certainly bad enough to put a September Fed rate cut in play, but it isn’t so ugly after all.

Same could be said about the Trump’s tariffs announcements on August 1st deadline… except perhaps for Swiss goods’ exporters to the US that will be hit, or rather whacked, by a 39% tariffs rate. But wait a minute, because beyond the shocking news headlines, the striking unfairness and the many subsequent complains, it is perhaps not as ugly as it seems. I mean for example that pharma, which represent the bulk of Swiss exports to the US (circa $20bn), don’t know yet what’s in store for them and are thus still exempt for the time being. In the same vein, big food companies aren’t really concerned as they produce locally (think about Nestle), except obviously for “smaller Swiss” cheese and wine producers: in total, swiss food exports to the US represent less than $1bn… Peanuts compared to the $15bn of precious metals transiting from Swiss to the US (but who will feel sorry for them?) or the $4-5bn worth of Swiss watches and precision instruments exported last year to the US. Clearly an issue for them, but I am quite convinced that the most concerned Swiss exporters will adapt and adjust over time -as usual-, while the Swiss economy (GDP > $900bn) will definitively survive to this unfair, sad and shocking Trump’s decision. Anyway, that was an unexpected but great diversion from the SNB interim results, released the day before: the Swiss National Bank reported a loss of CHF 15.3bn for the first half of 2025 but who cares now about this ugly outcome?

Especially when you compare the extent of this loss with the figures here above for Swiss good exports, the total assets in the AVS-AHV Compensation Fund (CHF 46.1bn as of end of 2024) or just the ongoing lively political discussion about its future funding or this year budget deficit. And to really hit where it hurts: what about the main culprit of this loss? Ironically, the largest detractor was the SNB’s position in… US Treasuries, which represent approximatively 25% of SNB foreign currency investments (excluding gold), or a quite ugly -according to me- and certainly huge investment of close to $200bn!? Who can say and do worse?

Economic Calendar

As the incoming week will be quiet in terms of macroeconomic data releases, Trump’s tariffs “trick-or-treat” announcements will likely continue to be the main theme at least through Thursday (August 7th) when the new US tariffs are set to take effect. However, investors will also focus on the services PMI indices, as well as on the US ISM services -especially the employment subcomponent-, that will be released on Tuesday after the disappointing US jobs report of last Friday, which have led to raising recession concerns and Fed’s rate cuts odds as soon as September. In this context, Thursday’s initial jobless claims weekly report may also matter. Note that there is still one job report (beginning of September) and two CPI reports (mid-August and September) before the next Fed’s meeting on September 16th, while the Jackson Hole Economic Symposium will be held on August 21-23. This year’s theme is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy« .

Otherwise, the focus will be also on the Fed with several members speeches and interviews (will they regret to not have cut last week?) and the possible appointment of a new board member by President Trump after the resignation of Fed Governor Adriana Kugler on Friday has created an opportunity for President Trump to appoint a new board member. This individual could potentially be the successor to Chair Powell or, at the very least, represent another dovish voter.

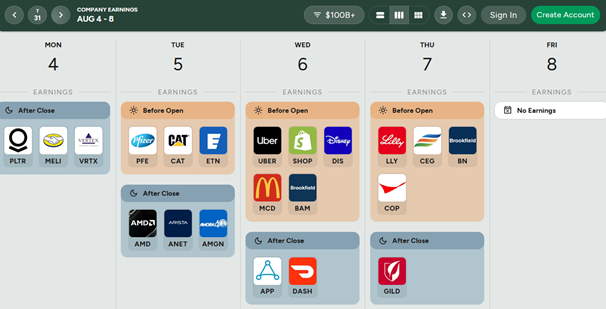

Another notable event will be the still open and uncertain BoE decision on Thursday: will it cut rates or not and who will vote for what? Finally, the earnings season will continue in full swing with many blue chips active in a number of different sectors due to report in the next few days (see below).

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-08-04

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.