- Lack of conviction for investors, while markets are already priced close to perfection

- Beware of sleepy waters as it’s now time for a shakeup given the vast array of incoming key data and central banks meetings

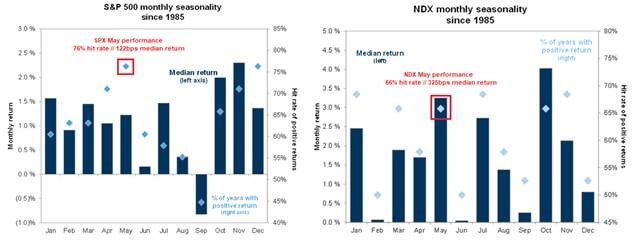

- Especially as the month of May is coming…

- So, I am preparing us for the worse, while hoping for the best… and covering my rear.

Markets have gone nowhere over the last few days, with equity indices, long rates and major forex crosses experiencing contained daily variations and an overall sideways trading after a strong start of the year for both equity and bond investors. That’s certainly a symptom of a lack of conviction among them about what comes next for the economy, the inflation, the monetary policy and, obviously, the markets. Especially as markets are now somewhat priced for a goldilocks scenario of growth slowing just enough to bring down inflation and lead to less restrictive monetary policies.

Unfortunately, you can’t usually eat your cake and have it… So, beware of sleepy or calm markets! The battle between falling earnings and interest rates level will certainly continue as long as we don’t get a clearer picture (read more convictions). In this context, the timing and interplay between inflation, real rates, and economic slowdown is set to remain the key driver for markets and this process could suddenly bring a lot of volatility when investors will assess with more precision the earnings level and the right valuation to apply to it. In the meantime, markets (and investors) are somewhat “stuck in the middle” between recession concerns and higher for longer rates. For those who are as impatient as me, I have good and bad news…

The good news is that we will certainly get some important insights and thus more clarity soon, the bad news is it could get messy. In other words, it’s now Bruce Buffer’s tiiiiime for a high kick shakeup! I had actually a nightmare last night as I dreamed investors were knocked out by a continuous string of badly hurting data and events next week with

- The US ISM manufacturing index (Monday May 1st) plunging below 45.0

- The ISM services disappointing (Wednesday May 3rd) by falling below 50 in April, while the consensus expects a small increase to 52.0 from 51.2 the prior month

- The Fed meeting cementing a hawkish hold stance after a last 25bps hike to 5.0%-5.25% in the evening of Wednesday May 3rd, while markets are still pricing 2 rates cuts in the second half of this year and economic growth starts petering out… like the straw that broke the camel’s back

- A negative earnings surprise and/or worrying guidance from Apple, which is the largest market cap in the S&P500 (7.2% to be precise), the following day (Thursday May 4th).

- A too hawkish Lagarde during ECB press conference on Thursday May 4th afternoon

- an ugly US jobs report on Friday 5th May with a negative payrolls’ print, downward revisions to prior months data and sticky wages growth in order to conclude a potential apocalyptic week.

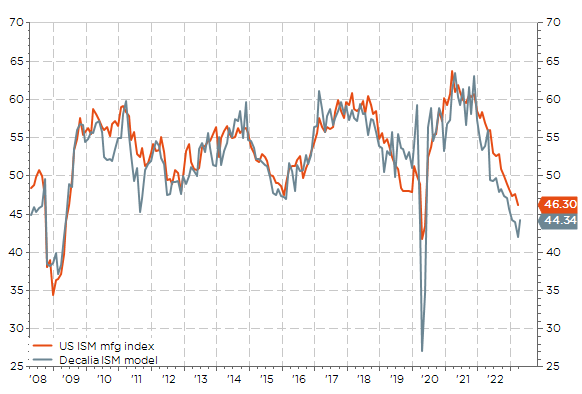

DECALIA model continues to point to a lower US ISM manufacturing index

Here are the key takeaways:

- Lack of conviction for investors, while markets are already priced close to perfection

- Beware of sleepy waters as it’s now time for a shakeup given the vast array of incoming key data and central banks meetings

- Especially as the month of May is coming…

- So, I am preparing us for the worse, while hoping for the best… and covering my rear.

Markets have gone nowhere over the last few days, with equity indices, long rates and major forex crosses experiencing contained daily variations and an overall sideways trading after a strong start of the year for both equity and bond investors. That’s certainly a symptom of a lack of conviction among them about what comes next for the economy, the inflation, the monetary policy and, obviously, the markets. Especially as markets are now somewhat priced for a goldilocks scenario of growth slowing just enough to bring down inflation and lead to less restrictive monetary policies.

Unfortunately, you can’t usually eat your cake and have it… So, beware of sleepy or calm markets! The battle between falling earnings and interest rates level will certainly continue as long as we don’t get a clearer picture (read more convictions). In this context, the timing and interplay between inflation, real rates, and economic slowdown is set to remain the key driver for markets and this process could suddenly bring a lot of volatility when investors will assess with more precision the earnings level and the right valuation to apply to it. In the meantime, markets (and investors) are somewhat “stuck in the middle” between recession concerns and higher for longer rates. For those who are as impatient as me, I have good and bad news…

The good news is that we will certainly get some important insights and thus more clarity soon, the bad news is it could get messy. In other words, it’s now Bruce Buffer’s tiiiiime for a high kick shakeup! I had actually a nightmare last night as I dreamed investors were knocked out by a continuous string of badly hurting data and events next week with

- The US ISM manufacturing index (Monday May 1st) plunging below 45.0

- The ISM services disappointing (Wednesday May 3rd) by falling below 50 in April, while the consensus expects a small increase to 52.0 from 51.2 the prior month

- The Fed meeting cementing a hawkish hold stance after a last 25bps hike to 5.0%-5.25% in the evening of Wednesday May 3rd, while markets are still pricing 2 rates cuts in the second half of this year and economic growth starts petering out… like the straw that broke the camel’s back

- A negative earnings surprise and/or worrying guidance from Apple, which is the largest market cap in the S&P500 (7.2% to be precise), the following day (Thursday May 4th).

- A too hawkish Lagarde during ECB press conference on Thursday May 4th afternoon

- an ugly US jobs report on Friday 5th May with a negative payrolls’ print, downward revisions to prior months data and sticky wages growth in order to conclude a potential apocalyptic week.

DECALIA model continues to point to a lower US ISM manufacturing index

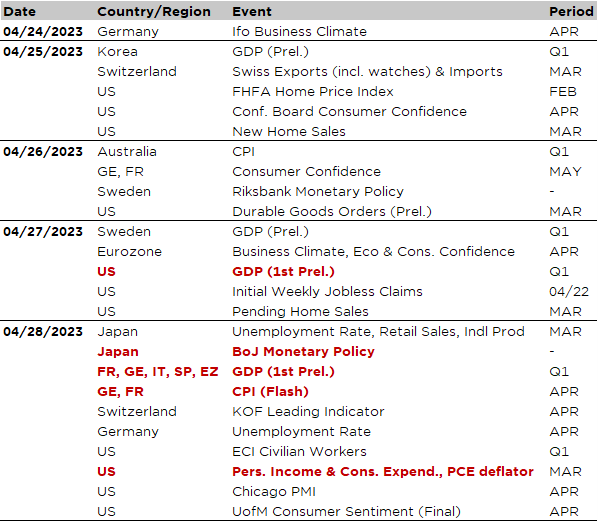

Economic calendar

It’s an interpret-all-you-can buffet for investors this week as far as the data releases’ menu is concerned. From economic growth with the first estimates of Q1 GDP for the US (Thursday) and European economies (Friday), to inflation prints with Euro Area April flash estimates and US PCE deflator for March on Friday, companies’ earnings running full steam (42% of SP500 market cap reporting this week) or central bank’s meetings (the first BoJ meeting with Kazuo Ueda as governor on Friday). Beware of the indigestion starving investors as next week will be as packed including Fed and ECB meetings on top of PMI indices around the world, US ISM and a vast array of earning releases again.

In the US, Q1-GDP is expected to decelerate to around 2% a.r., down from 2.6% in Q4-2022. More important than the headline, which is often heavily impacted by net trade and inventories contributions, investors will thus also focus on consumer spending, business investment and overall domestic demand figures. In this context, the Conference Board US consumer confidence survey for April (released tomorrow) and durable goods orders data, especially excluding transportation and defense (on Wednesday), will bring more timely insights about the current trend. Anyway, after a more solid than expected start of the year, growth will likely continue to get softer as the year progresses with the soft vs. hard landing (mild vs. severe recession) debate intensifying. On Friday, the PCE deflator, which will be released with the personal income, spending and saving rate for US households, should confirm that gradual disinflation continued in March, but with the core index remaining anyway higher than the Fed’s target. Core PCE inflation is indeed expected to increase +0.3% MoM in March, which will push down the YoY to “only” 4.5%. We will also get March new home sales and the house prices index tomorrow.

Turning to Europe, most of the actions will take place on Friday with the 1st estimates of Q1 GDP growth for the major economies of the Euro Area and the flash CPI for April in Germany and France. Feeble but positive growth of circa +0.1%-0.2% is expected, which remains a great achievement given the expectations at the end of last year concerning growth prospects in Europe. The focus will also be on flash inflation releases for April ahead of the ECB meeting next week. The Ifo business climate (today) should remain rather stable in April.

Over in Asia, all eyes will be on Japan in the very early Friday’s morning with both the BoJ decision and several key data including the unemployment rate, retail sales and industrial production. That will be the 1st BoJ meeting under the Presidency of Governor Ueda. I suspect he would like to avoid shocking/surprising the market by tweaking or removing the YCC for his inaugural Presidency’s meeting, but he could prepare the markets for the termination of YCC later this year by delivering an indication of the start of a policy review for example.

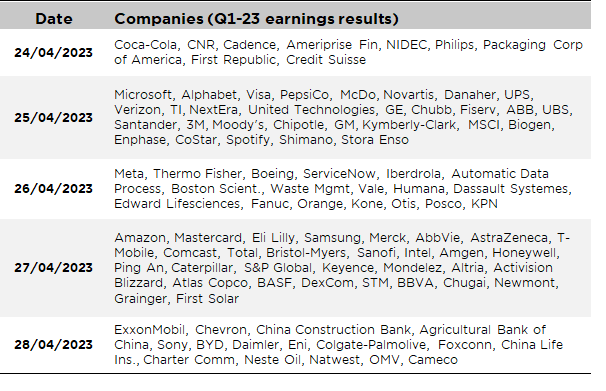

Let’s conclude with the earnings season. It is too early but the very low bars are being cleared with 88 S&P500 companies having already reported so far (18% of S&P500 market cap). We now enter in the most significant week with 42% of S&P500’s market cap reporting, including the Big Tech (Microsoft, Alphabet, Meta, Amazon: these 4 stocks account for 14% of SP500 cap), consumers-related companies (Coca-Cola, McDo, Chipotle, PepsiCo, Mondelez,…) or some pharma & energy global heavyweights (Novartis, Sanofi, AstraZeneca, Eli Lilly, Bristol-Myers, Merck, Exxon, Chevron, Eni, Total,…) among others. Other noticeable companies reporting this week include Credit Suisse and First Republic (both today), UBS (tomorrow), as well as several large Chinese banks.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.