“Eppur, si muove”… Who would have thought it? Despite an increase of 525bps in the US Fed funds rate over the last 18 months, the US economic growth continues to defy rates gravity, as well as most pundits, showing resilience -to say the least-. Even more striking, financial conditions still remain broadly accommodative…, which is also reflected by the overall performances of risk-on assets such as US equities, which have fared quite well so far this year (even if the equally-weighted S&P500 is up just about 2%) with still well contained volatility, or credit (spreads tightened year-to-date and are now below their last decade average).

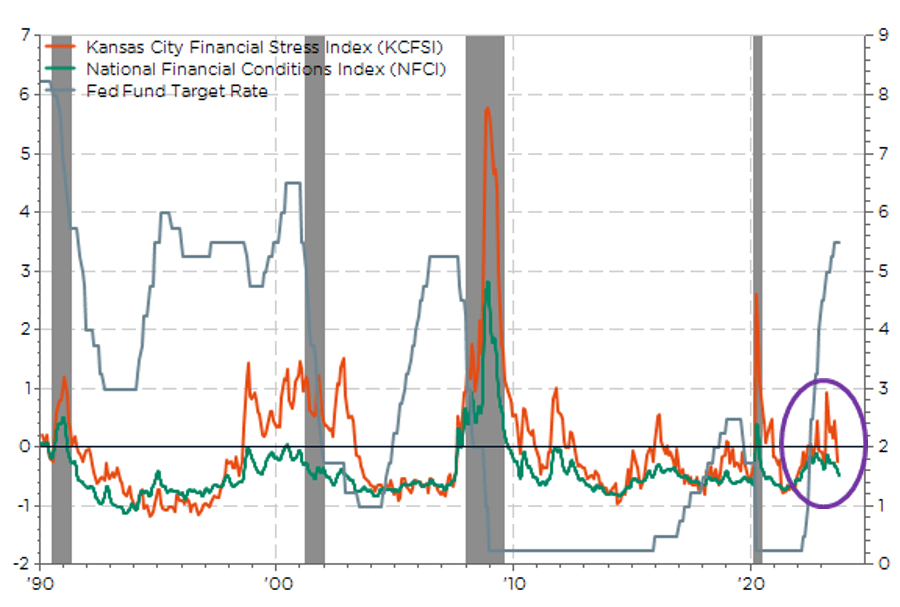

Selected US Financial Conditions Indices (LHS) & Fed Fund rates (RHS): take it easy?

One explanation may be that, after all, monetary policy hasn’t been (yet) so restrictive given the macro backdrop. Think about it… this time, we have experienced (1) an upward shift in the inflation regime, while (2) most of existing companies or households’ debt has been fixed at extremely favorable conditions over the last few years, with the rear-view mirror of a context of higher inflation and rates nowadays and, in addition, (3) they are holding some unusual excess savings/amount of cash post-covid thanks to US government support.

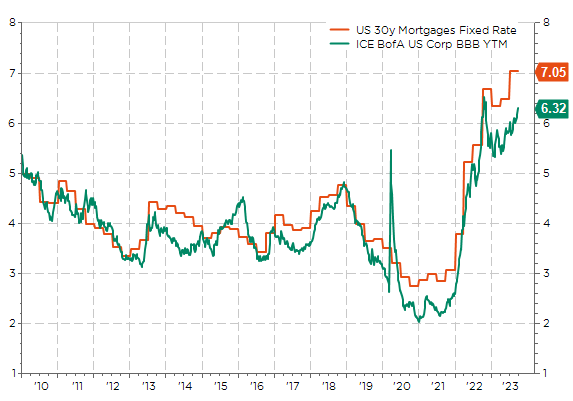

Here are a few figures, charts and facts to sustain my thesis: US CPI index was 260.47 as of December 2020, it is now 307.02 (as of end of August). Take your calculator: inflation has run at an annualized pace of 6.4% since 2021… So, I pretend that whoever has (over)loaded some debt before 2021 with ridiculous low coupon has likely done a rather a good deal so far. And assuming inflation don’t fall back easily or immediately below 2% and there aren’t any refinancing needs in the foreseeable future, the outlook has potentially brightened for these debtors over the last 2 years. As you can see here below the average rates for US 30y mortgage (households) or the BBB corporate debt YTM has been around 4% since 2010, and even way below in 2020-21… compared to 6.4% inflation since then. Note also that the average maturity of US BBB corporate bonds has oscillated between 10 and 12 years since 2010.

In other words, the first impact of both higher inflation and rates has likely been favorable so far for most economic agents (including governments), as their debt has been eroded by inflation and they don’t face immediate large refinancing needs. For private companies (or households) exhibiting strong balance sheets, it may even look like a jackpot as their cash holding is now remunerated at a rate which is higher than current inflation rate (which has almost never been the case in the past when financial repression was the norm with rates at 0% but inflation somewhat higher). Take Google and Apple with close to $90bn and more than $50bn of net cash respectively. Staying with the latter, it has also $110bn of debt split on 67 bonds. None of them has a price at or above the par currently. On these $110bn, the vast majority (53 bonds for a total of $93bn) has been issued in USD with an average coupon and maturity of 2.93 and 13.3 years respectively. Not really a worrying worm in the fruit if you assume average inflation remaining around 3% over the next decade.

Ah I also forgot to mention that one of the fastest ever increase in policy rates has happened at a time when central banks’ balance sheets have never been so high thanks to a decade of almost uninterrupted QE (Fed’s balance sheet still represent $8tn), which means… Large commercial banks have huge cash reserves (credit from central bank to conduct its QE), which are now remunerated at 5.4% in the US (interest rate on reserve balances or IORB rate) if they are not used to give credit to small and mid-size companies or households. It also explains why banks are currently reluctant to lend and/or borrowers face much higher borrowing costs than in the past as banks will obviously request a significant credit spread on top of this 5.4% risk-free rate to compensate for the incurring risk. That’s how restrictive monetary policy should work or has worked in the past when bank reserves weren’t as huge! And inflation hasn’t jumped so suddenly starting from close-to-irrelevant for more than a decade.

To make a long story short, the US monetary policy hasn’t been (yet) as restrictive as expected for all the somewhat special or unusual circumstances I tried to explain here above. As a result, the US economy has also prove more resilient than most pundits’ expectations because this time was somewhat different indeed. But don’t misunderstand me, I am not a naïve fool! When I look forward I am quite concerned because excess saving is running down, inflation is now trending lower than the previous 2-3 years, the economy is slowing and thus refinancing needs will come back at some time when both economic backdrop and financial conditions won’t therefore be so easy. At this point, US monetary policy will bite, potentially quite severely. So, beware of the delayed not-so-cool second-round “kiss-cool effect” (and its subsequent consequences).

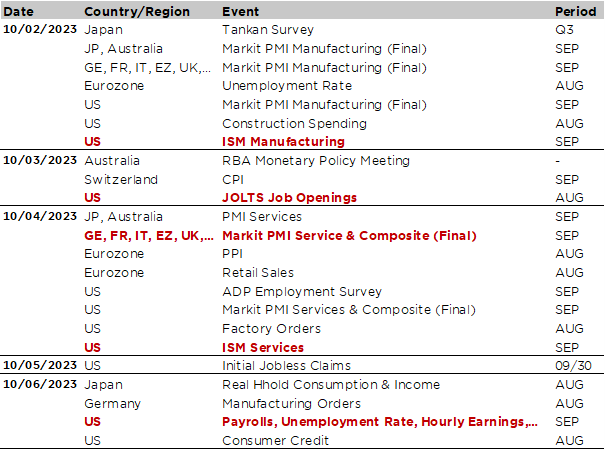

Economic Calendar

Welcome to October! We are entering in the last quarter of a year which can already be defined as memorable as far as financial markets trajectories are concerned so far. Just think about the home run of the “magnificent seven”, the never-ending rise in rates, the relegation of China’s equity market in the bottom of the ranking, or the once-again outrageous dominance of the greenback. So, beware of a few additional incredible or rather unexpected action plays over the last three months of 2023! As Yogi Berra would have said… “It ain’t over till it’s over!”. Speaking about top plays, we experienced an unusually swift action at the Capitol in the very last seconds of the 3rd quarter from both Democrats and Republicans as US politicians averted finally a disruptive (and potentially costly too) shutdown of federal activities. Like a “Hail Mary” pass in American football (a very long forward pass made in desperation, with an exceptionally small chance of achieving a completion), Congress passed just before the deadline on Saturday evening a compromise funding package to keep the government running until mid-November. This unlikely touchdown buys Democrats and Republicans time to negotiate longer-term federal funding, and, as a result, economists and the Fed won’t fly blind in the meantime. However, we aren’t yet completely out of the woods as this issue may come back sooner than later as long as negotiators don’t pass something more long standing.

In this context, the US jobs report on Friday will be the key highlight of the week. Consensus expects payrolls to grow by +165k, a slight decrease compared to +187k the prior month, with unemployment rate ticking down to 3.7% in September from 3.8% in August and average hourly earnings gaining +0.3% (+0.2% in August). Ahead of this much-awaited US jobs report on Friday, we will get additional insights about the current trends and strength in US labor market through the JOLTS report tomorrow (jobs opening and quits rate), the ADP data on Wednesday and US ISM employment components.

In addition to that, global economic growth momentum will also be gauged via the releases of the PMI indices, as well as the ISM ones for the US more specifically, including manufacturing today and services on Wednesday. Basically, consensus doesn’t expect major changes with manufacturing activity in slight contraction according to these indices (i.e. below 50) and services losing momentum but remaining above 50 (i.e. close to standstill) in most major economies.

As Germany was the notable underperformer in the manufacturing activity over the last two months according to its PMI readings, which have been below 40, it may be worth keeping an eye on some German indicators over the next few days (factory orders, industrial production and trade balance) in order to see if clouds are clearing, or not, over the German economy.

Turning to Asia, Japanese key data releases include the quarterly Tankan survey (today), which is a very useful and detailed survey by type of activity, size of companies, etc. about how they perceive business, employment, investment, export or prices trends among others (headline readings were above expectations as they pointed to an additional improvement in business sentiment for large companies, probably somewhat boosted by JPY weakness); and the August households’ real income and spending (Friday). In China, there won’t be any meaningful releases as PMI indices have been released over the weekend. Data were basically mixed as official China PMI were slightly better than expected (manufacturing up to 50.2 from 49.7 in August, while services also rose to 51.7 from 51.0), whereas the private Caixin equivalents decreased somewhat and came below consensus expectations).

Finally, on monetary policy outlook, a vast array of central bankers will deliver speeches and interviews this week, including Fed’s Chairman Jerome Powell tonight and ECB President Christine Lagarde on Wednesday, while the RBA will meet on Tuesday.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.