I think I have had another calling, like in the Netflix series “Manifest” (see my weekly letter of August 22nd, 2022), as I was feeling and I have thus argued that something was changing or has changed for some time now… Actually, it all started at the end of last year when I did a presentation in Milano about the economic and market outlook for 2023, with the title of “Something is Changing”. This gut feeling has proved quite prescient, and thus useful to read across markets actions so far this year, even if it wasn’t really crystal-clear back at that time.

In the meantime, I also visited Romania and Bucharest recently and, as a result, I immersed myself into the year 1989 (I was 17 years old) with the fall of the Berlin Wall, the last speech of Ceausescu and the trial and execution of the couple a few days later on the Christmas Day. Something big was also happening at that time: the end of the Cold War and the subsequent victory of democracy, liberalism and capitalism. A fresh and euphoric wind of freedom and new hope was blowing. By the way, when speaking with Romanians about recent history, they always make a difference between “Before” & “After” Ceausescu…

Fast forward back to present! More recently, I wrote a small piece on what could be the consequences of ageing population and overall demographics trends, which have also evolved and are now different compared to the last few decades. And then, I gave an interview last week to Allnews where I spoke about… the several changes -compared to the previous decades “Before Covid Pandemics”- we are now facing when assessing and defining investment strategies.

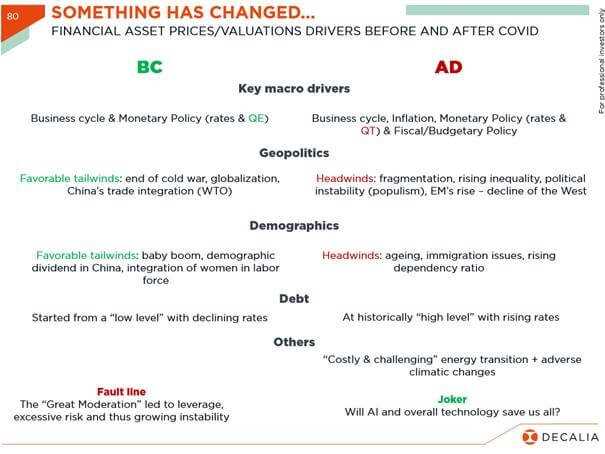

Thinking about asset prices/valuations drivers… before & after Covid

Following this interview, I also prepared the slide here above last week in order to gather my thoughts and try to share them with my colleagues, our clients and you, my faithful readers. Last but not least, I had just organized a business trip to Israel with some colleagues for the end of the month… And then this tragic conflict erupted on Saturday, exactly 50 years after the Yom Kippur War. Isn’t it weird all these somewhat related events? Are they just coincidences? Don’t you also feel that something has changed? It now seems quite clear, in my views, that we may forget about The World is Flat (Thomas L. Friedman), The End of History and the Last Man (Francis Fukuyama), as well as the many structurally favorable tailwinds financial markets and investors have benefitted “Before Covid”.

I suspect French President Macron had also some callings last year when he said “we’re experiencing the end of abundance and care free” after Ukraine was invaded by Russia. The pragmatic & basic conclusion is that all these developments call for overall caution, the reappraisal of balanced portfolio construction and nimble portfolio management (read my interview for more pragmatic investment insights). In the meantime, let’s hope my callings will finally prove wrong and pray for all the innocent victims of war, terrorism, natural disaster or whatever human calamity…

Economic Calendar

Geopolitics will likely take centerstage over the next few days (at least) after Hamas surprise and most deadly attack against Israel since Yom Kippur War, and the subsequent Israel’s retaliation. Investors will try to guess what could be the “indirect” implications of this potentially long and difficult conflict, while embedding another geopolitical and overall uncertainties risk premium into financial assets valuation.

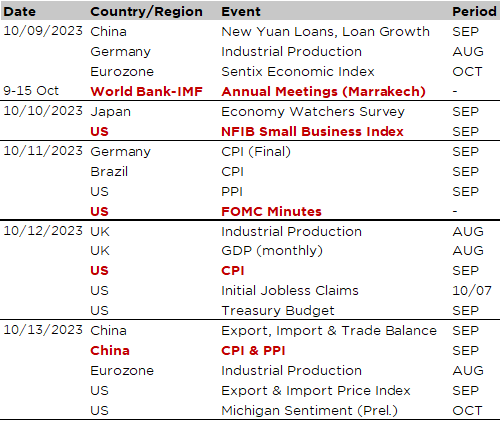

Turning back to the economy, all eyes will be on the US September CPI report this Thursday. After the unexpected strong gain in payrolls (+336k in September vs. +170k expected and, in addition, prior months were revised up by +119k), US inflation will undoubtedly be the key event this week in order to assess the odds of a (last?) additional rate hike by the Fed when members will meet on November 1st. The consensus expects +0.3% monthly gains for both headline and core index, which would lead to a slight decline yoy to +3.6% and + 4.1% respectively. The jury is still out about an additional Fed’s hike (place your bets!), but it has obviously come back on the table following the unexpected stellar payrolls report. Note however that unemployment rate ticked up to 3.8% and avg hourly earnings slowed to +0.2% MoM in September (+4.2% yoy). In other words, strong payrolls momentum hasn’t impeded progress on inflation fight as wages growth is slowing and economic activity will likely experience a pothole in Q4 (reinstallation of student debt payment, government shutdown, base effect after strong Q3, monetary policy tightening, higher energy prices, etc…). So, I will tend to place my bet on “no additional hike”… until year-end at least. Other minor gauges are also due this week, such as NFIB small business sentiment (tomorrow), PPI and last FMOC minutes (Wednesday) or the preliminary reading of University of Michigan Consumer Sentiment for October (Friday).

As far as the other major economies are concerned, notable economic releases include China September CPI (& PPI) on Friday, German industrial production this morning, which was again below expectations (yoy growth falling to -2.0% vs -1.5% expected) or Japan Economic Watchers Survey tomorrow. More interestingly, the annual World Bank-IMF meetings will take place in Marrakech during the next few days, from where several central bankers will give speeches and interviews, while the IMF’s latest economic outlook will be released tomorrow.

Finally, micro is back too as the Q3 earnings season will officially kick off on Friday with results from several US large banks such as JPM, Citi and Wells Fargo.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.