While money never sleeps on Wall Street, there are also special times, when every action can pay off. You are getting close to the final outcome, the stakes are uncertain, your hands get sweaty and the pressure is on. It’s in moments like these that great players reveal themselves and take responsibility, when every action is worth its weight in gold and when legends are written forever (or not) in our collective memory… That’s the money time!

And this is clearly the case in as far as NBA playoffs are concerned, with incredibly epic games last night between the Knicks and the 76ers or the Mavericks and Clippers, or for the Lausanne Hockey Club, which will have a chance to win the Swiss championship in a final game 7 on Tuesday evening in Zurich, without forgetting obviously the Cagliari Calcio in its last efforts to stay in Serie A (it will play tonight against the Genoa). Developed markets monetary policies, and especially the Fed, are also entering into money time with investors waiting for a clutch play from Jay Powell: will he cut rates with the right timing and the perfect touch, or too late (or not enough), heading the US economy into a recession, or too soon (and too much), letting inflation spiral out of control?

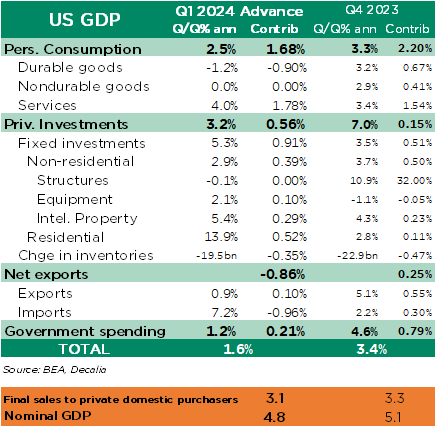

In the meantime, the clock is running and the latest economic data still points to a highly uncertain outcome. Let’s take the US Q1 GDP advance figures released last week: it surprised on the downside, coming below consensus expectations at +1.6% annualized rate (a.r.) vs. 2.5% expected and +3.4% in Q4-2023. However, the weakness was driven by noisy components such as net trade and inventories, which may be revised quite significantly in the next updated GDP releases over the next 2 months, as well as less government spending than the previous quarters, while growth in the core area of consumer spending and private investment remained robust as final sales to private domestic purchasers grew 3.1% a.r. in real terms.

US GDP Q1-2024 (1st preliminary reading) breakdown: not so weak after all

Subcomponent contributions to GDP

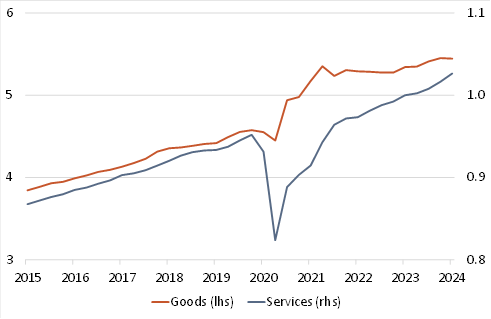

On the positive side, note also the strong rebound and positive contribution of residential investment of a magnitude (+0.5%) not seen since the second half of 2020. It’s true however that consumption was a touch softer (+2.5% v.s +3.0% expected and 3.3% prior quarter), especially on goods (durable goods consumption contracted actually), but, in the same time, services consumption accelerated further. This point is perhaps not so anecdotal because the main inflation risks are embedded in services nowadays (Fed is currently focused on “supercore” inflation, i.e. core service prices excluding housing), while there is a clearer (read uncontested) disinflation trend in durable goods or in shelter component, but it’s slower and lagging.

$Selected US inflation components

That’s the tricky part for both the Fed and investors because if the share of services consumption is growing at the expense of durable and non-durable goods … inflation may thus also prove stickier in the next few months. As a result, the quarterly core PCE rose from +2.0% in Q4-2023 to +3.7% in Q1-2024, while the consensus was expecting +3.4%, delaying further the rate cuts runway clearance.

US real consumer spending breakdown between goods and services

Source: Berenberg

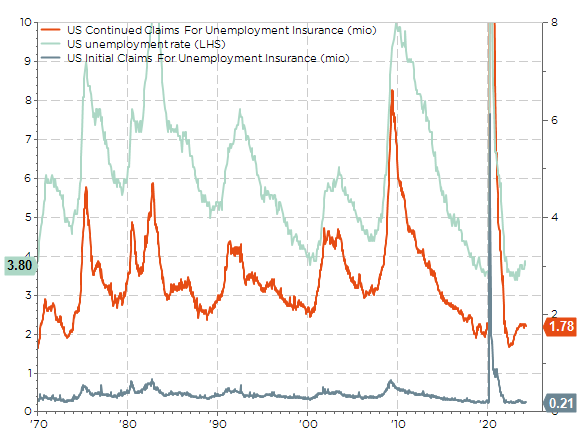

Add to that weekly initial jobless claims being stuck at a historical low level of 200k and continuing claims decreasing back below 1’800k pointing to a still tight labour market and Jay and his Fed’s team mates are likely feeling the pressure mounting on…

US weekly initial and continuing jobless claims and US unemployment rate: still close to historical lows

As money time is now also approaching for US monetary policy mandarins, this week’s main highlight for investors will be FOMC meeting on Wednesday evening, and especially the press conference of Jerome Powell following the recent streak of strong inflation prints and the subsequent repricing of Fed’s rate cut expectations in order to gauge what and when the clutch play will be delivered. For those who believe, like me, this meeting will likely be a non-event, you can certainly console yourself as well as buy some time by enjoying spectacular NBA actions, experiencing joyful relief or just going through a historic moment for the LHC fans.

Fingers crossed and best of the luck to all of you for this week and the following on the markets as I will be off next Monday. My letter will thus be back on your mailbox on Monday 12 May.

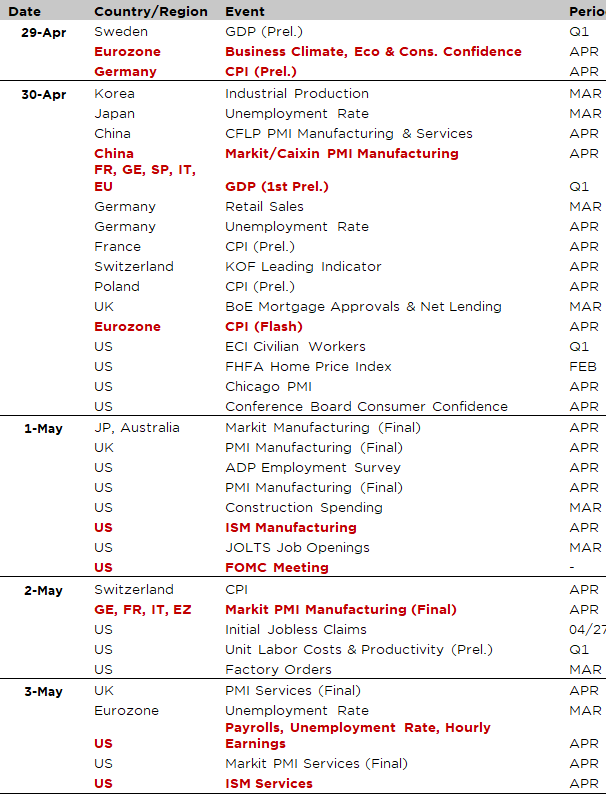

Economic Calendar

Welcome to May… but don’t go away yet if you don’t want to miss the Fed meeting on Wednesday, as well as the US ISM indices for April, and then the US jobs report on Friday. In Europe too, there will be key data releases on both growth and inflation with the Q1 GDP reports across the Euro Area tomorrow, the manufacturing PMI indices on Thursday and the April CPI prints (Germany today, France and Euro Area Tuesday). Finally, will also get important Q1 earnings results over the week from several big cap stocks.

Among the main highlights, investors will be focused on Fed’s decision Wednesday evening following the recent streak of strong inflation prints and the subsequent repricing of Fed’s rate cut expectations. The consensus expects obviously no rate cut this week and now foresees less than 2 rate cuts this year with less than 50% probability of a first move before September. Apart from the Fed, investors will be paying attention to the ISM indices, which aren’t expected to deviate much from the prior month (manufacturing stable around 50, while our model forecasts a slight improvement above 51, and services ticking up to 52 from 51), as well as to the several labor market indicators released during the week. The jobs report on Friday will obviously be the key highlight: the consensus foresees +250k in April, down from +303k in March, with stable unemployment rate (3.8%) and hourly earnings growth (+0.3% MoM, +4.0% YoY). Before that, we will get both the ADP and JOLTS reports on Wednesday.

Turning to Europe, the consensus expects another evidence of decreasing inflationary pressures with Euro Area headline and core inflation falling closer to 2% in April (sitting respectively at 2.4% and 3.0% in March), while Q1 GDP and PMI indices are expected to confirm the (slight) improvement in growth trajectory and prospects for this year. Moving to Asia, the focus will likely be on China’s PMIs tomorrow with the same idea of looking for a confirmation of growth prospects stabilization/bottoming out.

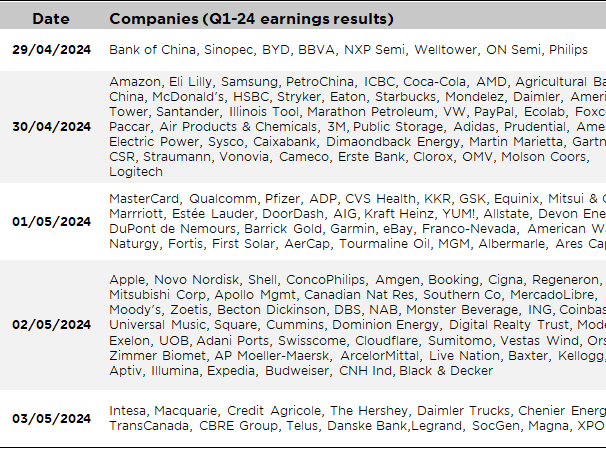

Finally, will also get important Q1 earnings results over the week from the tech sector (Apple, Amazon, AMD, Samsung and Qualcomm), Healthcare (Novo Nordisk, Eli Lilly or Pfizer), Energy (Shell and ConocoPhillips) and Consumer-related firms (Coca-Cola, McDonald’s, Starbucks, Volkswagen and Adidas).

Non-exhaustive list of major Q1-2024 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.