The case for european venture debt

- The tech sector is not broken, valuations are going through readjustment

- A new scenario has emerged leading to increased cost of the equity vs debt

- Market shift from « growth at all costs » businesses to profitability model

Since our latest publication, the European tech private market continues to evolve in light of the public market dynamics and broader forces. Whilst there are undoubtedly negatives to the volatility, it has given rise to a unique opportunity for specialized European lending players, especially those who enter at this time with significant dry powder.

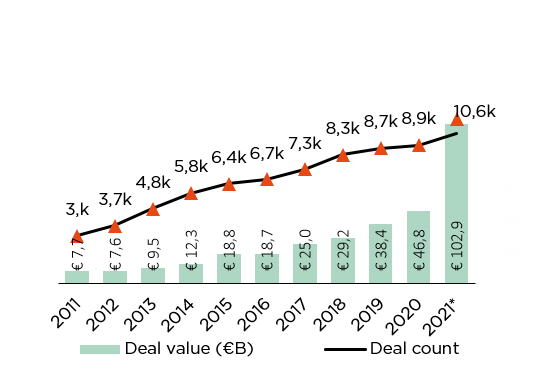

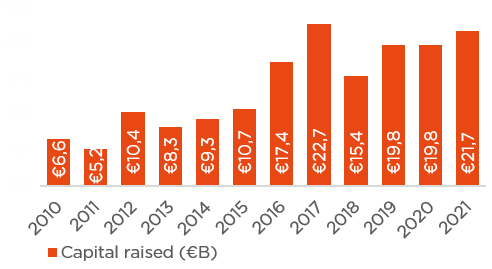

With the European tech investing opportunity set becoming larger and larger: the VC market having registered an all-time record high in 2021, in terms of capital raised (€21.7 bn), deal value (€102.9bn) and number of deals (10.6k), the supply of venture debt is not seeing a marked development, consequently leaving the market in a supply-demand imbalance status.

By adopting a model that has been proven in the US, where the growth lending market accounts for 15-20% of the total growth capital, European players can leverage the growth in their local market and limited competition, to provide downside-protected senior secured loans to “scale-up” tech businesses, at low LTV. These companies have fully developed products with a high rate of consumer uptake, seeking flexible financing options to extend the runways between equity rounds and optimize their capital structure.

2022 : Leveraging on the New Normal

The beginning of 2022 has been characterized by increased volatility in the tech sector. This new scenario, driven by the correction of the public markets, monetary policy changes, coupled with increased volatility caused by Russia’s invasion of Ukraine, and the double-digit increase in inflation, has fostered a more conservative investment sentiment in the tech sector.

While many investors argue that we are witnessing the end of an era for technology as an attractive asset class, the repricing of equity provides a markedly different scenario for growth debt lenders who are at the beginning of their investment periods. The main reason is that the technology sector is not fundamentally broken, but valuations of tech businesses have undergone a sharp correction from previous years.

The “New Normal” scenario that has emerged lays the groundwork for a long-term net benefit to growth lenders. The increased cost of equity has resulted in the increased attractiveness of growth debt instruments for IP-rich and market-proven companies now viewing debt through new lenses.

This is creating an environment that will swing in favour of lenders, both regarding the pool of assets available and, allowing asset managers access to opportunities previously unavailable when equity was cheap.

In addition, the new investment sentiment is progressively cleaning up the market away from “growth at all costs” and poor economics in favour of sound business models – ones that continue to be supported, although at lower valuations than in 2021.

Looking at some of the most recent tech transactions in Europe we can already see this shift, with a large pool of strong assets seeking alternatives to equity financing to optimise their capital structures allowing them to postpone their next equity rounds or defer their IPO beyond 2024. For instance, Finn, the Munich-based car subscription platform raised $110m in equity, $720m in debt in a Series B at a $500m valuation, led by Korelya. In Italy, Scalapay, the buy –now-pay-later startup secured $524m in its Series B led by Tencent & Willoughby Capital, including $284m of debt. In the UK, Paddle, the payments infra startup for SaaS companies raised $200m in Series D equity and debt funding at a $1.4bn valuation, led by KKR.

Encouraging signals come also from the other side of the Atlantic, where Hercules Capital, one of the largest group active in the venture debt market, has recently reported a promising start of the year driven by record commitments. At the end of Q1 2022, the group reached $615m of commitments, reporting a +16% increase versus prior year. Hercules team expects this positive momentum on origination to continue during Q2, with commitments that should exceed $1.5bn at the end of H1 2022.

Navigating the New Normal

To safely navigate this “New Normal” environment, discipline is crucial, and the structural advantages of the instrument remain key to the success of the strategy. The instruments’ senior secured position provides control to debt funds, board observer rights provide visibility to navigate any issues ahead of time.

Whilst the above provides downside protection, thanks to the solid term structuring, growth debt offers stable income streams paired with options/equity kickers, which have the ability to reprice in the event of a down-round post-investment.

Conclusion

The new scenario that is characterizing the European tech investment landscape, opens up new opportunities for growth debt lenders who are at the beginning of their investment period and are able to quickly adapt their underwriting approach.

These managers are well positioned to navigate the new environment and leverage the attractive new entry point and limited competition in EU to access unique investment opportunities.

As we were taught by Darwin, “it is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”