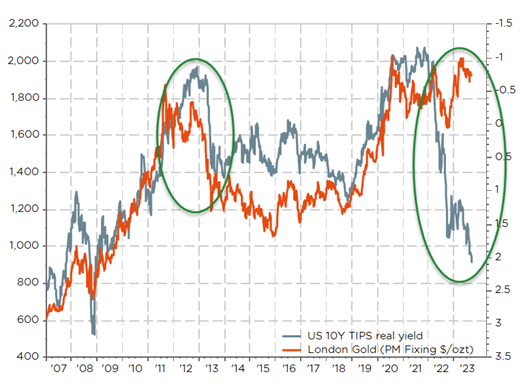

Considering the increase in US long rates (both nominal and real ones) over the last few weeks, the ongoing disinflation process and the renewed strength of the greenback lately, gold prices in USD have proved more resilient than expected so far this year.

Especially if you remember what happened during the tapper tantrum in 2013… when gold fell from $1’800 to $1’200 per ounce in just a few weeks.

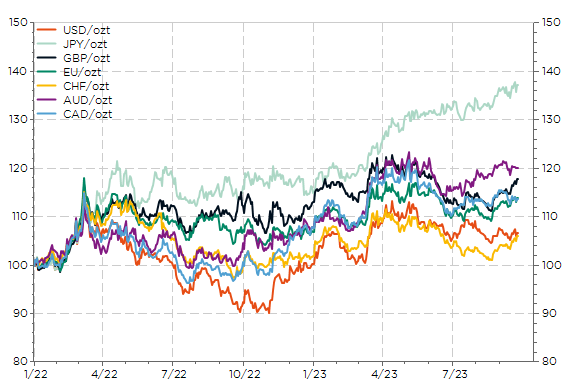

In fact, while many investors may have complained about gold lackluster performances in this unusually high inflation environment compared to the previous decades, I think it has done quite a good job when you compare its performance in relative terms vs. equities or bonds, or when you convert it back into your own base currency…

In USD, gold has delivered a high single digit return since the beginning of 2022 (when Fed/investors took notice that inflation was eventually getting out of control). That’s not really spectacular but it has outperformed both the S&P500 and US IG Broad Bond indices with total returns of -7% & -13% respectively, in this highly volatile and challenging times for most assets. Furthermore, for non-USD based investors, gold absolute and relative performances measured in other currencies are even better, outperforming clearly the respective domestic equity and bond markets during the same time frame! So, not so disappointing after all, is not it?

Gold price evolution in selected currencies since 2022

So, the question is why gold has been so resilient this year. Inflation is perhaps not completely under control (renewed rally in oil is pushing inflation expectations up), or investors doubt about central bank’s credibility/ability to bring inflation down to their 2% inflation target (many investors think the Fed will soon adopt a 3% target, more or less explicitly), or the barbaric relic has benefitted from the mounting concerns about the geopolitical/socio-economic fragmentation, or perhaps something else, even worse, is brewing… namely a mistrust towards US Treasuries and government bonds overall, especially as the “purest” or “best” safe haven asset.

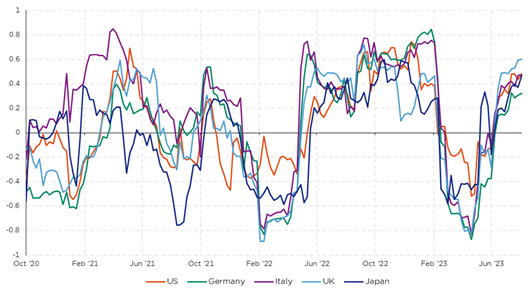

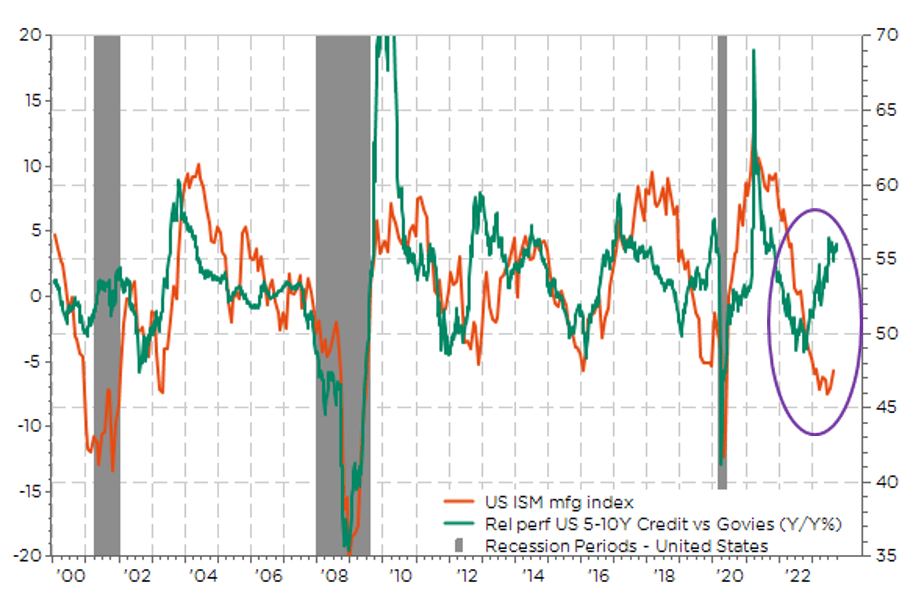

Worse, they could even be the primary sources of the troubles ahead considering the large net and gross supply of government bonds that will come to the markets in the coming months (note that corporates have done a much better job than governments by extending their debt maturities profile when rates were abnormally low) at a time when global central banks demand is decreasing and inflation risk premium is no longer stuck around 0%. That would explain most of the increase in global long rates over the last few weeks on top of resilient economic activity and sticky inflation, why bond-equities correlation has turned again positive lately, the resilience of gold, the outperformance of credit within the fixed income universe… as well as the growing interest surrounding fiscal dominance theory. For the non-initiated, fiscal dominance refers to the possibility that the accumulation of government debt and continuing government deficits can produce increases in inflation that « dominate » central bank intentions to keep inflation low. In other words, the Rubicon of (government) debt sustainability has been crossed in this case and DM government bonds will thus lose their “n°1 safe haven privilege status” (i.e. think about EM local currency government bonds). Isabel Schnabel (ECB) has been very vocal about fiscal policy playing against monetary policy since the end of last year and the Federal Reserve Bank of Saint-Louis even published an article on the on this fiscal dominance topic recently.

Equities – Bonds 3M rolling correlation (weekly data)

Rel performance of US credit vs Treasuries & US ISM mfg index

In the light of this year surprisingly large US fiscal impulse, the resilience of US growth seems suddenly less surprising. With the bond market now calling into question the sustainability of this policy, it may be time for investors to be ready for potential disappointment on growth going forward. As far as fixed income portfolios are concerned, the smartest way is certainly to add duration with US long bonds exhibiting positive convexity and thus requiring minimum capital allocation as (1) yield curve is still deeply inverted, (2) it may get worse for long bonds before it eventually gets better, and (3) you take less currency risk or you diminish the hedging costs for non-USD portfolios.

If Jerome Powell plays like Paul Volcker, meaning he is really ready to keep raising rates and constrain liquidity enough to either bring jobs and energy demand further down to meet their “structurally constrained” supplies and/or seriously counter seriously fiscal dominance risks, bond prices should eventually rebound at some point. And gold prices tank… as well as the deemed risk-on assets, such as equities and high yield, which have done so well so far this year.

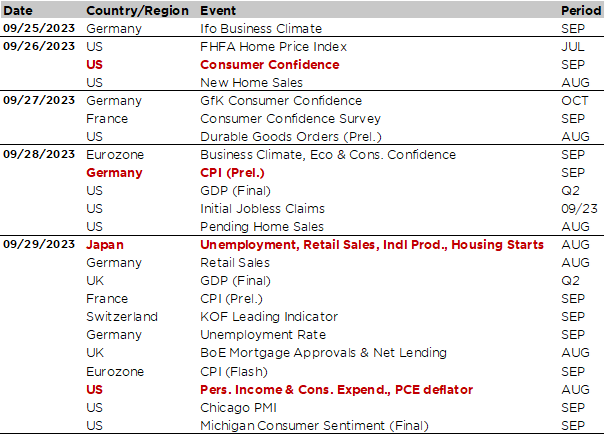

Economic Calendar

With last week central banks marathon behind us now, investors will now focus back on growth and inflation trajectories this week. In this context, the US personal consumption and expenditure report for August, which include the PCE deflator (Fed’s favorite inflation gauge), will likely be the main highlight of the week, as well as the flash September CPIs and a few growth indicators for the euro area.

Starting with the US, August personal income and spending data as well as the saving rate and the PCE deflator (both headline and core) will be released on Friday. The consensus expects both income and spending to have increased by +0.4% last month, marking a slight acceleration for income (+0.2% in July) but a slowdown in consumption growth (+0.8% the prior month), while core PCE deflator yoy change should moderate further from 4.2% to 3.9%. As far as current consumer confidence and sentiment are concerned, we will have some clues through both the Conference Board Survey (tomorrow) and the final reading of University of Michigan Consumer Sentiment (Friday). Other notable US data releases include August new home sales (tomorrow), durable goods orders (Wednesday) and initial jobless claims (Thursday), which have remained abnormally low so far (close to 200k) and are this still pointing to a quite tight labor market. In other words, an increase in these claims, as long as it is contained/gradual, may be welcomed by both the Fed … and markets.

Turning to the Euro Area, all eyes will be on the flash September CPI prints for Germany on Thursday and the whole Euro Zone on Friday. The consensus expects monthly changes to be broadly unchanged overall compared to the prior month, leading to a sharp decline of annual headline German inflation from 6.1% to 4.5% due to base effects, while the decrease should be more contained in the euro area, especially for the core index (+4.8% expected vs. +5.3% last month). In addition, we will also get some growth indicators such as the German IFO (today), which was basically unchanged compared to the prior month, or the Eurozone business and consumer confidence on Thursday.

Concluding with Asia, Japan will steal the show on Friday with several reports (unemployment rate, retail sales, industrial production, housing starts among others), especially as there won’t be any scheduled releases from China this week.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.