The chaos over US tariffs that Donald Trump and his administration unleashed since their infamous “Liberation Days” has raised fundamental questions about the risk premium on US assets, especially on US Treasuries, and the role of the US dollar within the global economy and international financial system. The continuous ascent of gold is among the best evidence of the loss of confidence/trust in the US in general and the USD by reflexivity (US politics, economy, monetary policy, companies,…). It’s basically US exceptionalism reversing on a fast and furious way: “everything, everywhere all at once”… out of the US!

As GS Chief Economist Jan Hatzius explains in a recent FT article, the dollar has further to fall. We fully agree. The USD is overvalued, positioning is overcrowded, US growth is now slowing more than the rest of the world, US inflation will likely remain stickier, US Treasuries safe-haven status is challenged and US equities may continue to underperform. For all these reasons, either international investors will continue increasing their fx hedge ratio or/and rotating outside US assets (repatriation or diversification).

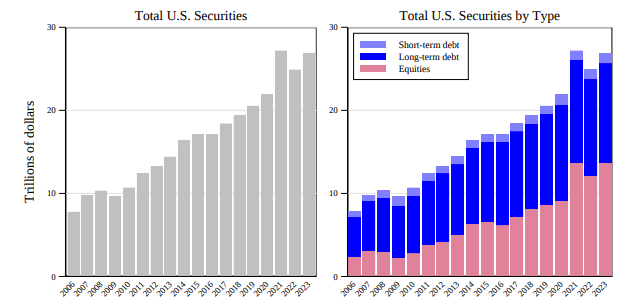

As you can see here below, the foreign holding of US securities has more than doubled over the last 15 years to reach close to $30 trillion, with most of the increase due to equities. Let’s assume a quite possible scenario where

- US equities don’t perform as well as the prior decade, or, even worse, underperform relative to other markets.

- US Treasuries safe-haven status continue to be challenged because of concerns about Fed independence and/or US government debt ballooning and/or stickier inflation

- USD-equity correlation becomes “less negative”. In other words, USD doesn’t get stronger when equities markets fall (as it has already happened in the past such as in 2000-2003).

In this context, USD may enter into a self-fulling vicious circle, which will be the exact opposite of the virtuous one experienced over the last 15 years.

Foreign Portfolio Holdings of US Securities by Broad Security Type

Source: Department of the Treasury, Federal Reserve Bank of New York, Foreign Portfolio Holding of US Securities as of June 30, 2023

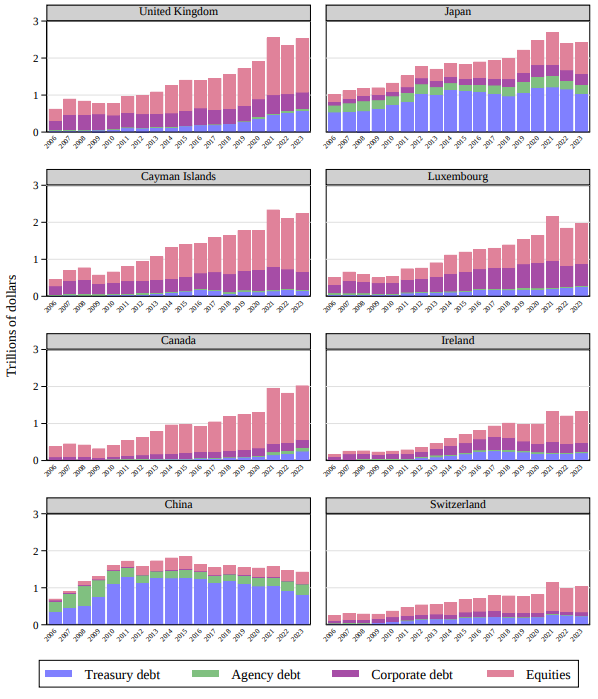

Top 8 countries

This will be a medium-long term process as far as Trump’s erratic policies continue to reduce the attractiveness of US, similar to the greenback depreciation at the turn of 2000 (due to the underperformance of US equities/TMT bubble bursting, central banks diversification into EUR, growing current account balance). Obviously, it won’t be a straight-line down and the speed won’t be as fast as recently. However, it’s key to be prepared and adjust accordingly your portfolios.

The breakdown of the top 8 foreign holders of US assets is also informative: Japan and China US assets holdings are mainly tilted towards US Treasuries, while Europe and HFs (Cayman Islands) holdings are more tilted towards US equities. Japan is America’s largest overseas credit with over $1 trillion worth of Treasuries and it seems, according to BofA Global Research, that Japanese investors (banks, pension funds, life insurance companies) have been net sellers of foreign bonds since February… especially as their domestic bond’s market offers again some attractive yield on top of one of the steepest yield curve.

Top 8 countries

Source: Department of the Treasury, Federal Reserve Bank of New York, Foreign Portfolio Holding of US Securities as of June 30, 2023

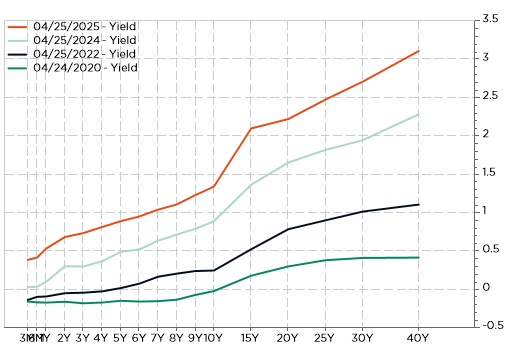

JGB’s yield curve at different points in time

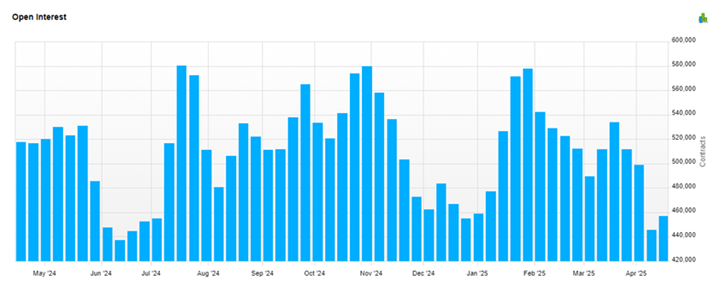

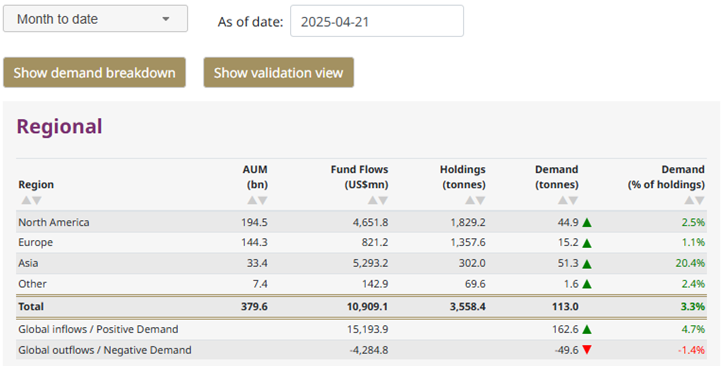

All that brings us to gold as it seems to have caught the bid that the greenback and Treasuries have lost. Thus, it is perhaps not just a coincidence if most of the recent gold prices increases have happened during my sleep (i.e. Asian trading hours) rather than during my usual working day. The few graphs and tables here below seem to confirm this trend.

- Open interest contracts on gold are close to 1y low => it’s not related to “speculation” but rather to “real” physical or investment demand

- The increase in gold ETFs has been relatively more important in Asia than in America lately

- Same for overall gold demand month-to-date: +51.3 tons in Asia (+20% of holdings) vs. +44.9 tons in the America (only +2.5% of holdings)

Gold Contracts Open Interest: hovering at the lowest level over the last 12M

Source: FactSet

MTD Gold Demand Breakdown by Region: booming in Asia

Source: World Gold Council

The continuous ascent of gold illustrates the impaired confidence on the greenback and US Treasuries, with still significant downside risks on the former over the medium to long term as possible risks of overshoot can’t be ruled out if you remember 2001-2008… My concerns are that both US companies and households can’t do much about that (they are price “takers”), while the rest of the world is waking up and organizing itself to cope with a more isolated than ever US economy. As a result, it makes me think about a Brexit in disguise with the consequences we have seen on its currency, rates, deficit trajectory, inflation and overall economic malaises becoming more frequent and acute.

These reputational damages on US assets will now take a long time before to heal. In these circumstances, I don’t believe (foreign) investors will soon reverse these trends to celebrate the passage from a moribund US Dollar to an exceptional lively one (again). However, let’s hope in these days that bond vigilantes will at least force economic reason’s victory over short term populism sin.

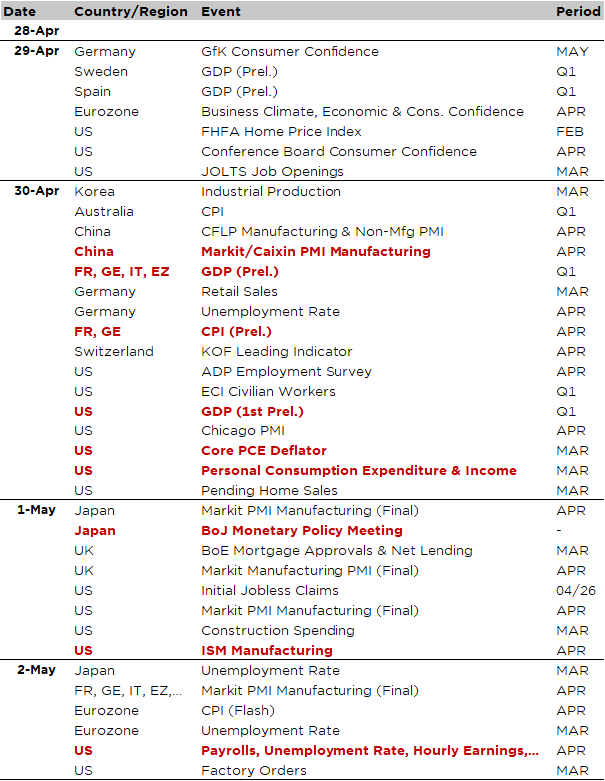

Economic Calendar

Welcome to May… a good time to sell (and go away) according to seasonality traders! At least, there will likely be plenty of action and highlights on markets given the many key economic data releases and earnings results due this week. This includes the US jobs report, ISM manufacturing and PCE inflation as well as the flash CPIs in the Euro Area. We will also get the first estimates of Q1 GDP in both the US and Euro Area, the BoJ meeting and the April PMI manufacturing indices across the major economies. Finally, Apple, Microsoft, Amazon and Meta will stand out in the avalanche of corporate earnings results scheduled over the week. So, it’s fair to say that tariffs headlines may eventually move in the background for a few days.

Starting with the data-packed week in the US, the Bloomberg consensus expects:

- Q1 GDP (Wednesday) growth to be flattish (+0.3% a.r.), slowing down significantly therefore compared to the end of last year (+ 2.4% a.r. in Q4-2024) due to the surge in imports ahead of the tariffs’ announcement and to a moderation in consumption/investment to a lesser extent.

- The PCE deflator, along with the personal income and spending for March (Wednesday) to be reassuring with MoM growth close to 0 for the Fed’s preferred inflation gauge (+0.1% for the core index) and solid monthly gains for households’ revenues and expenditures … before to assess the less favorable impact of tariffs on consumption and prices in the next few months.

- ISM manufacturing (Thursday) to tick down to 48 in April from 49 the previous month

- Payrolls to increase by +125k in April, down from +228k in March, with both the unemployment rate (4.2%) and average hourly earnings MoM growth (+0.3%) unchanged. Ahead of the US jobs report (Friday), the JOLTS report and ADP survey are also due on Tuesday and Wednesday respectively.

In Europe, several important indicators will be out as well, including Q1 GDP prints for the main economies and the whole Euro Zone on Wednesday, as well as flash April CPIs for Germany and France on the same day. Disinflation progress is expected, opening the door for further easing from the ECB. Several sentiment indicators will also be released such as the final PMI manufacturing readings for April (Friday), Germany consumer confidence or the Euro Area Business Climate Indicator (Tuesday).

Moving to Asia, the focus will be on the BoJ meeting (Thursday), where the consensus expects the current policy rate (0.5%) and monetary policy stance (cautiously behind the curve) to be maintained. The next BoJ hike is foreseen in July assuming that the downside risks on growth don’t materialize. As a result, in case of a “surprise” hike this week, it could be somewhat reminiscent of the temporary turbulences experienced last August, especially if US payrolls fell short of expectations the day after… In China, the official April PMIs as well as the Caixin manufacturing index, both due on Wednesday, will be scrutinized to detect the impact of tariffs, if any at this stage.

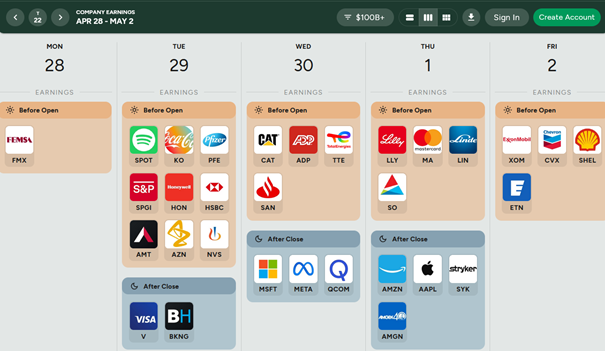

Concluding with the earnings season, almost 40% of the S&P500 by market cap will be reporting results this week. Among the heavyweights, all eyes will be on Microsoft and Meta on Wednesday and Apple and Amazon on Thursday. Among other big US names releasing their Q1 results, let’s mention Qualcomm, Pfizer, Eli Lilly, S&P Global, Visa, Mastercard, UPS, Caterpillar, Coca-Cola, McDonald’s, Exxon Mobil or Chevron. In Europe, the focus will be on healthcare (Novartis, AstraZeneca and GSK), energy (Shell, TotalEnergies, BP), automakers (Volkswagen and Mercedes-Benz), while in Asia, we will get Samsung results.

Non-exhaustive list of major earnings releases over the week (market cap > $100bn)

Source: https://earningshub.com/earnings-calendar/week-of/2025-04-28

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.