Let’s speak about losers today… I will directly skip the mortifying defeat of Cagliari Calcio against Monza this week-end (superb free-kick from Daniel Madini, the son of Paolo and grand-son of Cesare) or the elimination of Inter Milan from the Champion’s league, to focus on the sector investors love to hate, or rather have learned to hate since the Great Financial Crisis. I suspect you got it: banks! Like in sports or in life, perception and reality may differ in finance, nothing is set in stone, and as a result, even losers may sometimes experience a long run of wins. With that in hands, I consider banks sector shouldn’t be dismissed, and eventually reconsidered at the light of the profound changes of the macro backdrop over the last 2-3 years, on top of the “restructuration” accomplished by major banks, especially in Europe. In this context, yesteryear losers may thus turn to be tomorrow winners.

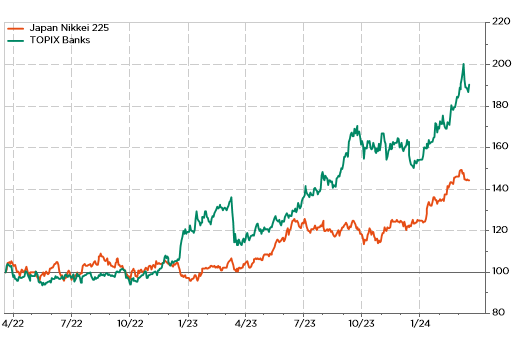

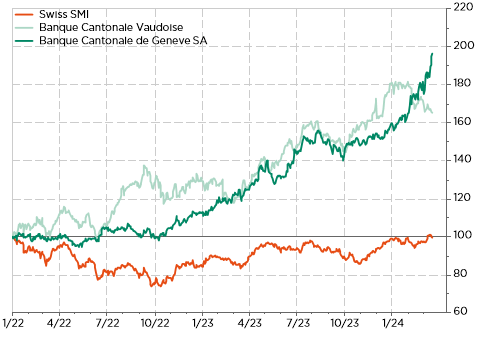

In prelude, it’s perhaps worth remembering last 3 years total returns performances or the European banking sector: +42% in 2021, +1.8% in 2022 and +31.5% in 2023 for a cumulated result of +88.2% compared to +38.7% and +31.4% for the Euro Stoxx 50 and Euro Stoxx 600 respectively. By the way, European banks have thus outperformed for 3 consecutive years. Not such a bad result for long-considered losers, is not it? And guess what, they are again outperforming YTD (+11.8% vs . +10.8% for SX5E and +5.9% for SXXP). Interestingly, they were flat/underperforming until one month ago and despite some disappointing results or guidance for major players such as BNP or ING more recently, they have been able to jump over +10% the last 4 weeks. The question is why? My answer could be “it’s interest rate, stupid” to rephrase the famous phrase from the Bill Clinton Presidential campaign. Indeed, as ECB March rate’s cut probabilities fell, European banks share price moved higher. Another way to see how banks benefit from higher rates, or just expectations of positive ones, may be found by a look at the land of the soon rising sun-rates.

And the winner is (so far)… Japan TOPIX Banks benefitting from the abandon of the YCC and expectations of positive BoJ policy rates

Last but not the least, Swiss regional banks record results last year made the headline of the Agefi (Swiss French newspaper on economy and financial markets) last week: “For many cantonal banks, 2023 was a record year. In almost all cases, interest income, boosted by rising interest rates, made the biggest contribution. In some cases, income from this business almost doubled…”. So, forget about mortgage activity slowing, an inverted yield curve or undemanding context for investment banking activities! For most banks, interest income has been the main results driver, especially in countries like in Euro zone, Japan or Switzerland where rates were close to zero for a long time.

Y a pas le feu au lac… but these 2 banks stocks from the Leman region have been hot recently !

That’s obviously less the case in the US, where interest rates were somewhat higher in the past, business competition is fierce, financial markets attraction through direct investing is a direct rival to basic saving accounts, and, last but not the least, consolidation, restructuring and regulation work of the thousands of US regional banks has still to be made!

For sure, the easy part is probably behind us because as the great Wayne Gretzky said: you should “skate where the puck is going to be, not where it has been”. Furthermore, there are obviously downside risks. In primis if a severe recession lies ahead or if the US office crisis and the pressure on broader real estate valuations lead to greater concerns regarding bank exposures (despite some well-flagged areas of weakness, the non-US banks CRE debt sustainability remains “healthy” overall). However, assuming a macro scenario with no significant changes on both inflation and growth forecasts, where central bankers may continue to feel reluctant to start easing their monetary policy this year, or revising higher their hypothetical neutral rates (r-star), non-US banks may outperform again in 2024. At this point, I was somewhat surprised by the discussions and meetings I had last week with clients and prospects in Lugano and Milano: it seems that the scenario of “current rates level for longer” can’t be ruled anymore and even appear for some less unlikely that Cagliari staying in Serie A…

As a result, some exposure to non-US banks stocks still make sense in equity portfolios for those who don’t expect a recession soon and rapid policy rate cuts (as they may at least prove more resilient than other sectors). Within fixed income portfolio, it seems obvious that European banks sector should be clearly overweight, favoring well-capitalized national champions, as both senior and subordinated debt spreads (relative to other senior corporate debt or HY respectively) continue to reflect more past troubles’ bad memory than a more probable better context going forward. Yesteryear losers may thus eventually become winners this year. Again.

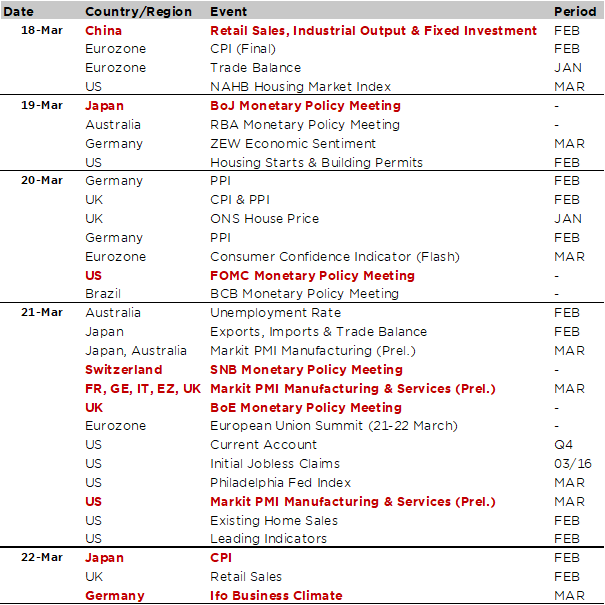

Economic Calendar

A busy macro week is in front of us with policy decisions from the RBA & BoJ (tomorrow), UK CPI & FOMC meeting (Wednesday), global flash PMIs for February and SNB & BoE monetary policy meetings (Thursday) and, finally, Japan CPI & German Ifo index (Friday). Once this potentially landmark week will be digested, you will then be able to catch your breath and enjoy the first week-end of the Spring.

In the meantime, we already got this morning the China retail sales, industrial production and fixed investment for February. A mixed bag overall with some encouraging signs of improvement as industrial production and fixed asset investments beat expectations, while retail sales were in line and property investments & sales fell again short of already depressed expectations. Furthermore, the jobless rate ticked up to 5.3% in February to 5.1%. Thanks to the ongoing government policy support, there are some tentative signs of recovery, but achieving the “around 5%” government target still looks challenging, especially without a rebound in consumer and business confidence, as well as in the housing sector. As a result, Chinese economy should continue to muddle through due to the economy’s underlying structural challenges (ageing population, correction in property sector, eroded confidence in a brighter economic and financial future).

Turning back to the key highlight of the week, i.e. the monetary policy meeting from the Fed on Wednesday, investors will be focused on the messaging around Fed’s rate cuts timing and extent. As a result, the latest summary of economic projections (SEP) and the dot plot will be closely scrutinized to get the latest insights about policy rate trajectory over the next few months… and years. Not only there are growing odds of that the first rate’s cut could be delayed further (odds for a cut in June have now decreased to 55%…) and/or the number of cuts foreseen by the Fed members median in 2024 and beyond may be less than previously thought/expected. In other words, with sticky inflation and resilient economy, we may heading into a gradual increase in the “r-star” neutral rate (exactly the opposite trend we experienced in the previous 2 decades when it fell gradually on the back of lower potential growth, persistent deflation risks, favorable demographic trends, globalization and much less accommodative budgetary policies) requiring therefore less policy easing. Concerning QT, investors aren’t expecting any news or updated guidance at this stage.

The BoJ decision tonight/tomorrow morning is another highly important event. Given recent wage negotiations signals (+5.3%, significantly higher than expected), markets now expect the Japanese central bank to finally cross the Rubicon by revising its policy and abandon both NIRP (setting rates at 0.1% on banks excess reserves) and the YCC, as well as its inflation-overshooting commitment. In this context, the BoJ will likely also update or give some indications about the (reduced) pace of its JGB purchases going forward. Note that there are still some odds that the BoJ could wait further before acting… In the case it does, this would be a historical landmark as Japan have experienced negative policy rates for 8 years now (longest run ever seen for any economy) and haven’t seen any interest rates hikes… since the mid-2000. I hope BoJ didn’t get rid of the “hike” lever in the meantime.

The SNB and BoE will round off the week among major central banks with their decisions due on Thursday. As far as the SNB is concerned, I highly doubt they will hike as ECB and the Fed aren’t yet completely ready to follow… in 3 months’ time, Swiss inflation may pick up back towards (but remaining below) the 2% target in the next few months due to technical/base effect reasons and the CHF has already depreciated somewhat since the beginning of the year. For the UK and BoE, the overall picture remains more challenging with higher inflation than in Europe or the US (UK headline and core inflation was running at 4% and 5.1% respectively in January) and an economy that is now losing steam rapidly. Consensus expects the policy rate to remain unchanged this week with a first rate cut foreseen in May, but the release of the UK CPI and PPI reports the day before may influence their stance going forward. Due to this challenging context, UK rates and GBP currency may continue to exhibit a greater volatility among the G7 economies.

Apart the monetary policy meetings marathon, the most important economic releases this week will be global flash PMIs for major economies on Thursday to gauge economic growth momentum, especially in the European manufacturing sector, which is showing tentative signs of bottoming out. In this context, Germany Ifo index (Friday) may also set the tone about hopes of a recovery or further disappointments from the sick man of Europe. Note also that there will be the European Union summit on March 21-22.

Finally, the few notable releases of companies’ earnings this week include Nike, FedEx, Tencent and BMW.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.